How Does Credit Score Impact Your Va Home Loan

According to the guidelines defined by the VA, having an outstanding credit score is not mandatory to qualify for a VA loan. However, it is a general rule that most lenders expect you to have a minimum score of 620.

Moreover, you could qualify for additional benefits with a fair credit score, like lower interest rates and more flexible guidelines. Having a good credit score can simplify the eligibility process and help you get a loan with lower monthly payments.

Is Earnest Money Different From A Down Payment

Yes, your earnest money is different from your down payment. Earnest money is a good faith deposit you make into an escrow account after your offer is accepted to show the seller your commitment to buy. A down payment is a portion of the total purchase price you pay at closing when youre using a mortgage loan to finance the home purchase.

The average earnest money deposit is between 1% and 3% of the sale price. In highly competitive markets, you may see earnest money deposits as high as 10%. Down payment amounts will vary depending on how much youre comfortable paying upfront for a home and how much your lender requires you to put down to qualify for financing. Usually the amount is between 3% and 20% of the purchase price.

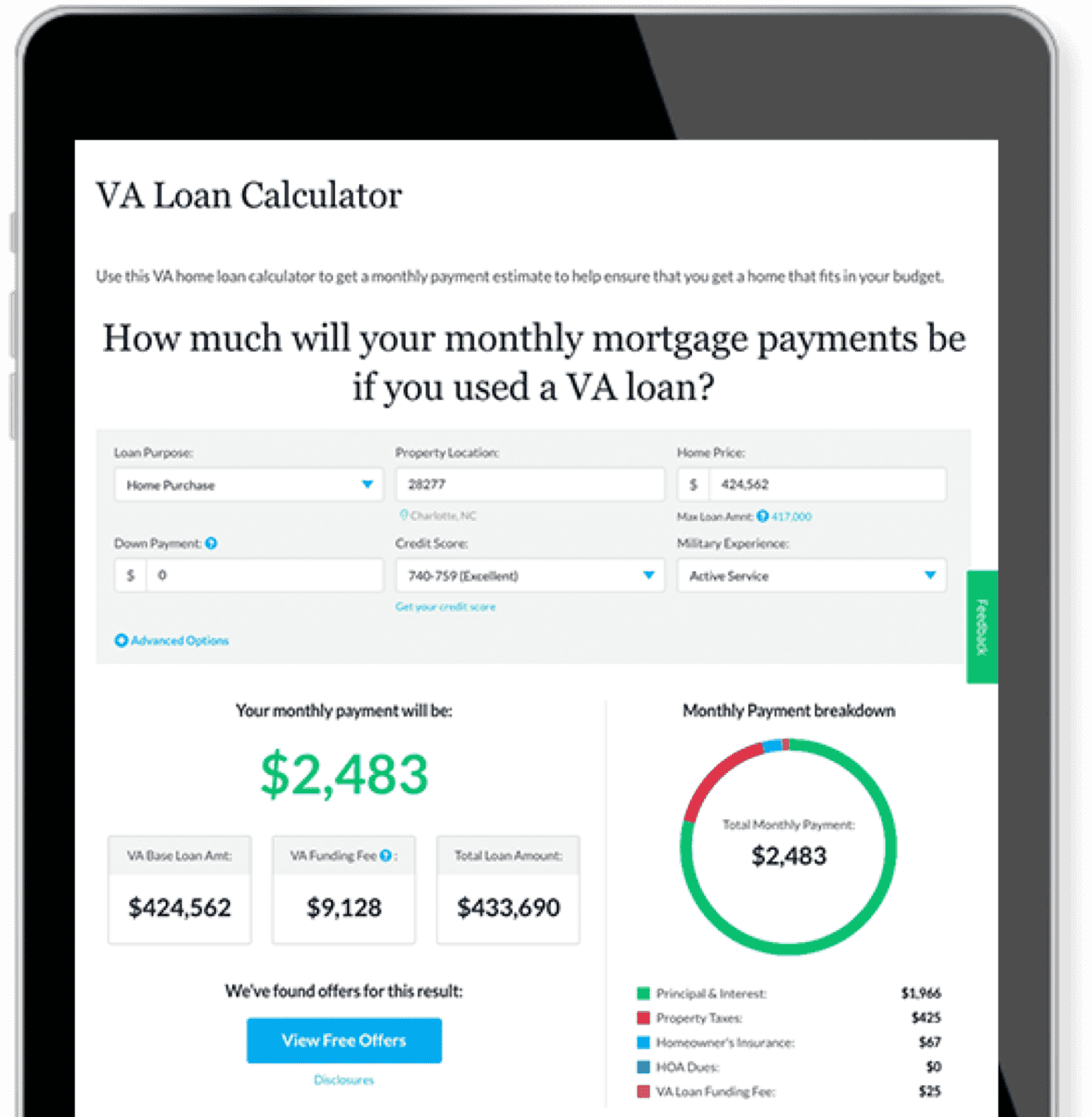

A Look At The Va Loan Calculator’s Inputs

| Input | |

|---|---|

| Home value is the potential purchase price of the home, not including a down payment. | |

| Down Payment | The down payment is an upfront amount paid towards the principal. VA loans do not require a down payment, and most VA borrowers choose $0 down. However, if you decide to put money down, it can reduce the VA funding fee – if required – and your overall monthly payment. |

| Interest Rate | The interest rate is the cost of borrowing. Interest rates in the calculator include APR, which estimates closing costs and fees and is the actual cost of borrowing. Interest rates in the calculator are for educational purposes only, and your interest rate may differ. You can view current VA mortgage rates here. |

| Loan Term | Loan term is the length you wish to borrow – typically 15 or 30 years. |

| Interest rates typically vary based on several factors, including credit score. Estimate your credit score for a more accurate VA loan payment. | |

| Loan Type | VA loans provide both purchase and refinance options. Calculations for loan types differ due to the VA funding fee. While this calculator works for refinancing, we also have a specific VA refinance calculator for cash-out and IRRRLs here. |

| VA Specifics | VA specifics relate to the VA funding fee. VA buyers exempt from the VA funding fee include those with a disability rating greater than 10%, those who’ve received a Purple Heart and surviving spouses. Borrowers who aren’t exempt and have used a VA loan before are subject to a slightly higher VA funding fee. |

Read Also: Greater Lakes Student Loans Login

How Do Interest Rates Impact Affordability

Interest rates have a direct impact on VA loan affordability. Mortgage rates reflect the cost of borrowing money, and they can vary depending on the lender, the borrowers credit profile and more.

VA borrowers benefit from having the industrys lowest average interest rates.

More:See today’s VA loan interest rates

Tips For Using Our Va Home Loan Calculator

Our VA Home Loan Calculator is here to help you estimate monthly payments on a VA home loan.

To get started follow these steps:

Enter:

Also Check: What Is Chfa Loan Colorado

A Brief History Of Va Loans

The G.I. Bill of 1944 is where the VA Loan Guaranty Program originated. This sweeping bill made several provisions for returning veterans of World War II. Its ultimate goal was to thank those individuals for their service to their country, and to help them get on with their lives. Considering that their lives were put on hold in many ways due to their military service, the bill was designed to give them a helping hand. The VA Loan Guaranty Program aimed to make housing affordable for returning GIs.

Through the VA Loan Guaranty Program, veterans and active military personnel were able to qualify for home loans through qualified lenders. The U.S. government backed up a certain portion of those loans, guaranteeing them and, essentially, vouching for those who took them out. One of the most important aspects of how the government achieved that was by insuring the property that was being financed on the GIs’ behalves. For that reason, there was no need for those who qualified for VA loans to take out private mortgage insurance – a benefit that would add up to significant savings down the line.

Down Payment Assistance Grant

Down payment assistance

What you need to know

This is perhaps the most meaningful benefit offered by Virginia Housing. Qualified first-time buyers can receive up to 2.5% of a homes purchase price to apply to a down payment no repayment required. The grant is combined with a Virginia Housing loan, and household income limits are considered.

Also Check: How To Find My Student Loan Account Number For Irs

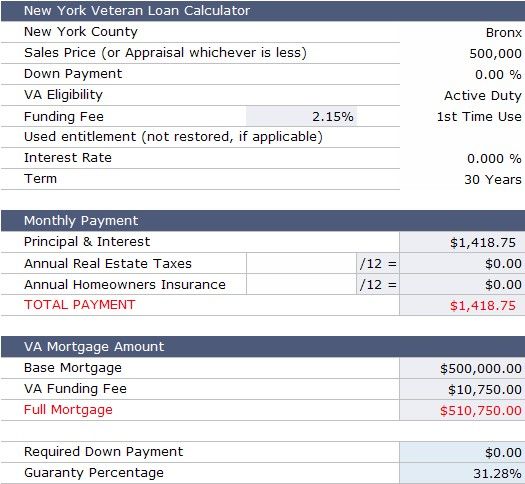

Enter Your Military Status To Get The Most Accurate Results Possible

The fifth section of the calculator contains multiple important variables for veterans. Namely it lists VA status, loan use & if the funding fee is financed in the loan. By default these are set to active duty/retired military, first time use & funding fee financed.

Military Status

If you are a reservist or a member of the guard, please change this variable to reflect your funding fee.

First or Subsequent Use

If this is an additional use rather than first time use then reset that field to reflect the higher funding fee for subsequent uses.

Roll Funding Fee Into Loan

If you do not want to finance the funding fee, then set the financing option to No.

Injured in Service

If you were 10% or more disabled while in service, your funding fee can be waived. Set “finance the funding fee” to No and deduct that number from your cash due at closing to get your actual closing costs.

Can You Obtain Va Loans Above Conforming Loan Limits

New Law Starting January 2020

Military veterans and activy duty military members can now obtain VA loans with no money down for homes exceeding the conforming loan limit:

In January, Mr. Colletti and his wife, Rachel Ewing Colletti, closed with no money down on a $965,000 house.

The new rules also affect refinances. Evan Banning, president of California Housing and Lending, a real-estate brokerage and mortgage firm in San Diego, said he refinanced a loan for a vet and active reservist in mid-January. The client had purchased a house for $1.7 million a few years earlier with 10% down, but didnât use a VA loan. Under the prior VA rules, refinancing would have required his client to boost his home equity. Instead, Mr. Banning provided a refinance of $1.62 million with no additional money down. He lowered the rate from 4.125% to 3.25%, he said.

Law Before 2020

Before the new law came into being, if you purchase a home valued above the local conforming mortgage limit then you will need to cover the downpayment for the portion of the loan which is above the local limit. For example, if you lived in a county where the maximum conforming loan limit is $636,150 and wanted to buy a house which cost more than this, then you would need to make a down payment of 25% of the amount beyond the limit. If you were to buy a house for $836,150 with a VA loan then you would need to cover 25% of the loan amount above the local limit.

- $836,150 – $636,150 = $200,000

- $200,000 / 4 = $50,000

Also Check: How Much Do You Put Down With An Fha Loan

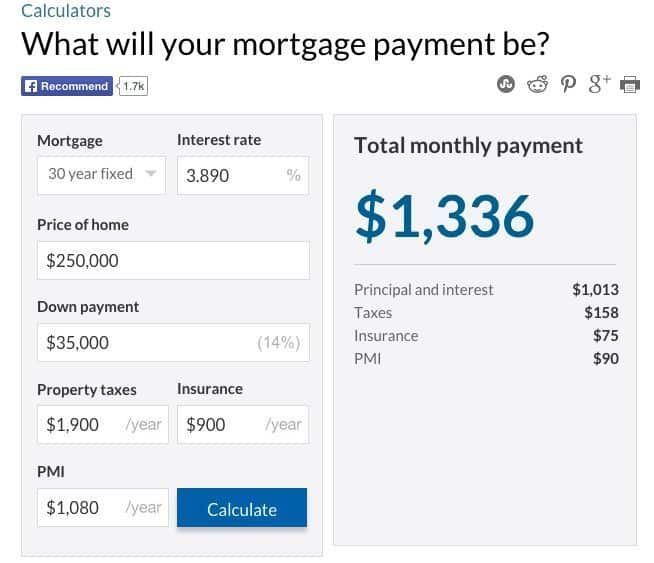

How To Use Credit Karmas Mortgage Calculator For A Va Loan

If youre in the market for a new home, Credit Karmas VA mortgage calculator can help you estimate your monthly mortgage payments. Below is a list of the information you must provide to get an estimate.

Keep in mind these may not be all the costs you have to pay when buying a home. You may be responsible for additional expenses, including discount points, origination and lender fees, and closing costs for things like appraisals and title insurance.

How To Qualify For A Va Home Loan

As stated above, to qualify for a VA loan, you must get your Certificate of Eligibility , meet the lenders requirements, and ensure that the house meets all the MPRs.

Here is what you can do to qualify for a VA loan.

- Choose a home that meets all of the MPRs.

- Improve your credit score before applying.

- Get your COE to validate your eligibility.

Read Also: When Does Student Loan Come In

S To Acquiring A Va Home Loan

Acquiring a VA home loan involves a relatively straightforward, simple process. Before going ahead with it, though, you should familiarize yourself with what you’re going to be expected to do. Below, the basic steps for acquiring a VA home loan are outlined for your convenience. Although everyone’s experience is going to vary slightly, you can expect yours to go in roughly the following order:

Qualify – First, you need to make sure that you are actually qualified to receive a VA home loan. Look over the eligibility requirements as outlined in the previous section. If you are still unsure about whether or not you qualify, you should use the Veteran Affairs Eligibility Center to see what they have to say. Covering this base is important if you want to proceed with obtaining a VA home loan.

Apply For A COE – Next, you’re going to need to apply for a COE, or Certificate of Eligibility. You will need this certificate when you approach a VA-approved lender for a home loan.

Find A Lender – Not all lenders offer VA home loans. You should check around to see what your available options are. Lenders must be approved by the U.S. government, so double check that the one you’re interested in working with does participate. Otherwise, you will end up wasting a lot of time.

How Can I Prepare To Buy A Home With A Va Mortgage Loan

- Check your credit. People with higher credit scores typically qualify for more competitive interest rates than people with lower scores. If your credit needs work, consider improving it before applying for a loan.

- Calculate your debt-to-income ratio. Your debt-to-income ratio is your total monthly debt payments compared to your gross monthly income.

- Save for a down payment. Though most VA loans dont require a down payment, having one can help you qualify for a lower interest rate and reduce the VA Loan funding fee you may have to pay.

- Create a budget. Buying a home will affect your finances for years. Its important to create a budget that wont stretch you too thin and stick to it when house hunting.

You May Like: When Do Student Loans Resume

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Other Common Fees Paid At Closing

Aside from the VA funding fee, borrowers will most likely need to pay some closing fees:

- Loan Origination FeeUsed to cover administrative costs for processing of VA loans.

- Loan Discount PointsCharged in order to receive interest rates lower than current market rates. Two discount points , or less, is considered to be reasonable. Discount points may be paid by either the buyer or seller.

- Appraisal FeeAppraisals are formal statements of property value to determine maximum loan amounts obtained without a down payment. Non-refundable even if loan never closes.

- Hazard Insurance and Real Estate TaxesNecessary to insure payment of taxes and insurance during the first year.

- Title InsuranceUsed to verify there are no outstanding liens against the property.

- Recording FeeUsed to record deed on county records.

Certain fees are normally not paid by buyers. These include brokerage fees, real estate commissions, and title insurance.

Read Also: What Is Draw Period On Heloc Loan

Va Loan Calculator With Service

VA loans are hands-down the best mortgage product on the market. They require no down payment, and they are lenient about credit scores and income levels.

Our VA mortgage calculator shows your buying power when you use this powerful loan product.

With zero down payment and no monthly mortgage insurance, you might be surprised how much house you can afford.

How Much Do I Need To Put Down

A down payment of 20% or more will get you the best interest rates and the most loan options. But you dont have to put 20% down to buy a house. There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs that require no money down.

Read Also: Is It Easy To Get Loan From Credit Union

Va Mortgage Calculator Terms Defined

Purchase Price

Lets break it down further. Pruchase price, the first input, is based on your income, monthly debt payment, credit score and down payment savings. A percentage you may hear when buying a home is the 36% rule. The rule states that you should aim to for a debt-to-income ratio of roughly 36% or less when applying for a mortgage loan. This ratio helps your lender understand your financial capacity to pay your mortgage each month. The higher the ratio, the less likely it is that you can afford the mortgage.

To calculate your DTI, add all your monthly debt payments, such as credit card debt, student loans, alimony or child support, auto loans and projected mortgage payments. Next, divide by your monthly, pre-tax income. To get a percentage, multiple by 100. The number youre left with is your DTI.

DTI = Total monthly debt payments ÷ gross monthly income x 100.

Down Payment

In general, a 20% down payment is what most mortgage lenders expect for a conventional loan with no private mortgage insurance . Of course, there are exceptions. For example, VA loans dont require down payments and FHA loans often allow as low as a 3% down payment . Additionally, some lenders have programs offering mortgages with down payments as low as 3% 5%. The table below shows how the size of your down payment will affect your monthly mortgage payment.

How a Larger Down Payment Impacts Monthly Payments

| Percentage | |

|---|---|

| $200,000 | $1,005 |

Interest Rate

Mortgage Term

Homeowners Insurance

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

Don’t Miss: How To Get Bank Loan For New Business

Managing Your Mortgage Payment

Your monthly payment is affected by the following factors:

- Home Price: A more expensive house results in larger monthly payments, especially if you are borrowing without making a down payment.

- Downpayment: If you decide to pay something upfront, your monthly payments can decrease at a special rate.

- Interest Rate: Generally, VA home loans are provided at highly competitive interest rates, which make for lower payments every month.

- Funding Fees: You can pay the funding fees either together during the loan closing or get it rolled up into monthly installments, which will increase your monthly payments.

Who Is Exempt From Paying The Va Funding Fee

Veterans with a disability rating of higher than 10%, Purple Heart recipients, and surviving spouses of veterans who died in the line of duty are exempt from paying the VA funding fee.

More than one-third of all VA borrowers are exempt, so ask your VA mortgage lender if you qualify for an exemption from the VA funding fee.

Read Also: What Is The Sba 7a Loan Program