Is Student Loan Forgiveness Tax

SAN JOSE, Calif., Oct. 19, 2021 /PRNewswire/ — There’s been a lot of discussion lately about student loan forgiveness. One popular resolution, for example, calls for President Biden to use executive action to cancel up to $50,000 of student debt for all U.S. student loan borrowers.

It’s still unclear how the Biden Administration will respond to the pressures to introduce a new student loan cancellation policy. But whether borrowers receive a loan discharge through new legislation or through an existing program, here’s what to consider with how the forgiveness could impact tax liability, from myFICO.

For more loan and credit education, visit myFICO’s blog at

Receiving $50,000 of student loan cancellation might sound wonderful on the surface. But if those forgiven dollars are considered taxable income by the federal government, you could find that you suddenly owe an extra $10,000 or more to the IRS on your next tax return.

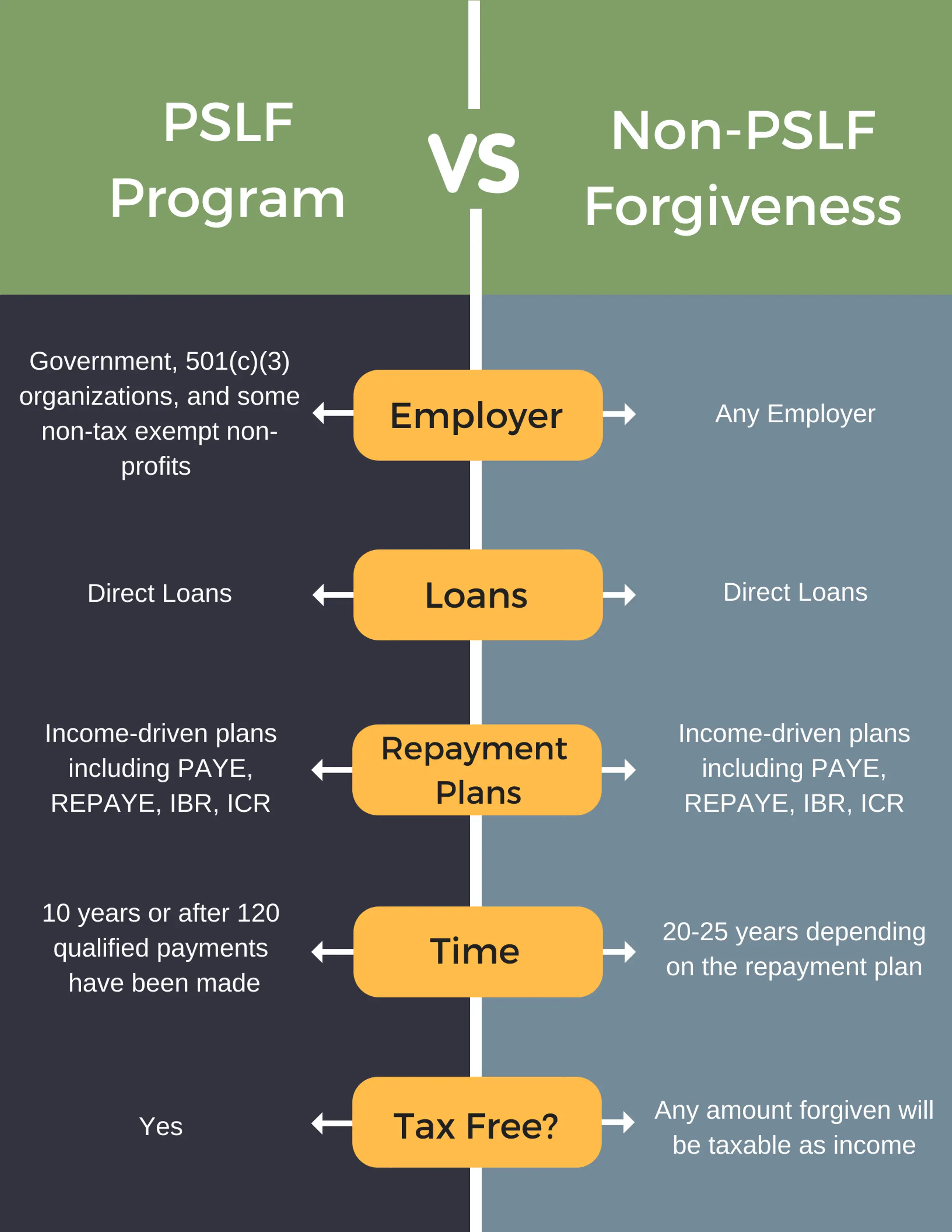

Whether or not student loan forgiveness is tax-free usually depends on the type of forgiveness that you receive. But recent legislation from Congress has temporarily expanded the availability of tax-free student loan forgiveness. Here’s what you need to know.

What Types of Student Loan Forgiveness Are Always Tax-Free?

When Can Student Loan Forgiveness Be Considered Taxable Income?

-

Pay As You Earn

-

Revised Pay As You Earn

-

Income-Based Repayment

-

Income-Contingent Repayment

The Bottom Line

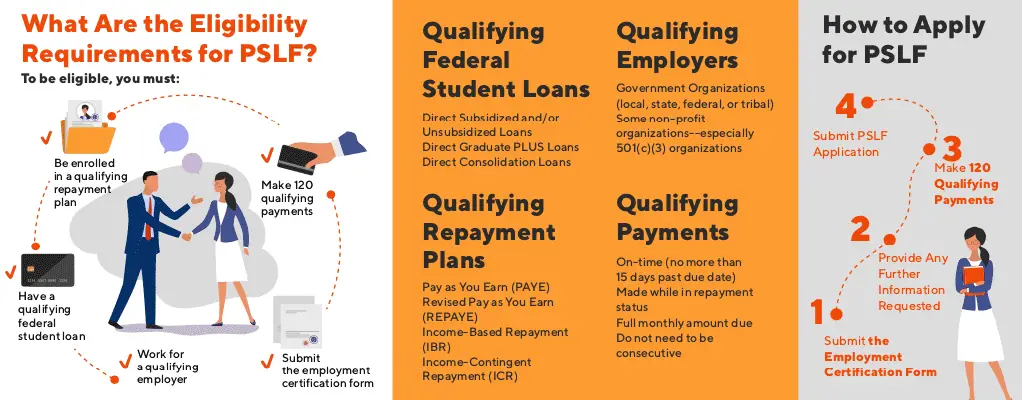

How To Get Public Service Loan Forgiveness

Although the waivers are limited, the Education Department said that it is looking to make these changes to PSLF permanent. Nonetheless, even if the department does take that step, many of the current requirements will remain in place. And in addition, parent PLUS borrowers looking to qualify for forgiveness under PSLF will need to follow the current qualifications.

Student Loan Forgiveness Questions

Can a defaulted student loan be forgiven? Student loans in default are eligible for loan forgiveness if you are totally and permanently disabled, your school closed, or your school made fraudulent misrepresentations. However, defaulted student loans are not eligible for the Public Service Loan Forgiveness Program or income-based student loan forgiveness. Read this guide to defaulted student loan forgiveness for more information.

Can student loans be forgiven after 10 years? A federal student loan can be forgiven after 10 years under the Public Service Loan Forgiveness Program. To qualify, public service workers must make 120 monthly payments under an IDR Plan for loans made under the Direct Loan Program.

Is the IRS forgiving student loans? The Department of Education, not the IRS, forgives student loan debt. However, in some instances, the IRS treats student loan forgiveness as taxable income. In early 2021, the Biden Administration passed a coronavirus relief package that makes all student loan forgiveness tax-free through 2026.

Read Also: How Long Does It Take Prosper To Approve A Loan

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Are There Downsides To The Student Loan Forgiveness Programs

Each student loan forgiveness program has drawbacks, and it’s important to understand them before you start the process.

With PSLF, for instance, you may be giving up a higher income you might have earned in the private sector by choosing to work for a government agency or nonprofit. You could run into the same issue with the Teacher Loan Forgiveness program if a school in a low-income area pays teachers less than other schools in the area. So in chasing after forgiveness, you could be leaving more money on the table in other ways.

Also, the PSLF program requires you to make 120 qualifying monthly payments, which means it’ll take you at least 10 years to qualify. The income-driven repayment plans are even more demanding, requiring you to make payments for 20 or 25 years.

Finally, if you pick an income-driven repayment plan, your forgiven balance will be taxable, which could cause problems with the IRS if you can’t afford to pay the bill.

You May Like: When Can You Refinance An Fha Loan

What Repayment Plan Is Not Available On Federal Student Loans

Income-Based Repayment is offered on FFELP Loans and Direct Loans not eligible for Pay As You Earn. Parent Plus Loans, Federal Consolidated Loans with underlying Parent Plus Loans, and private loans are not eligible for Pay As You Earn, Revised Pay as You Earn, or Income-Based Repayment.

Pslf Limited Waiver Opportunity

Under the regular PSLF rules, only payments made on Direct Loans counted toward the 120-payment minimum. Payments made towards FFEL and Perkins Loans didnât count. Nor did late payments or payments made under the wrong repayment plan.

On October 6, 2021, the Dept. of Education announced it was temporarily relaxing those eligibility requirements. For a limited period of timeâspecifically, until October 31, 2022âborrowers may receive credit for any past student loan payments, regardless if it was made for the wrong loan, under the wrong repayment plan, or was tardy, or was made for less than the full amount. The rule changes will also allow military members to count time on active duty toward the 10 years â even if they put a pause on making their payments during that time.

Read Also: Capitalone Autoloans.com

Are Federal Student Loans Forgiven After 10 Years

The Public Service Loan Forgiveness program discharges any remaining debt after 10 years of full-time employment in public service. Term: The forgiveness occurs after 120 monthly payments made on an eligible Federal Direct Loan. Periods of deferment and forbearance are not counted toward the 120 payments.

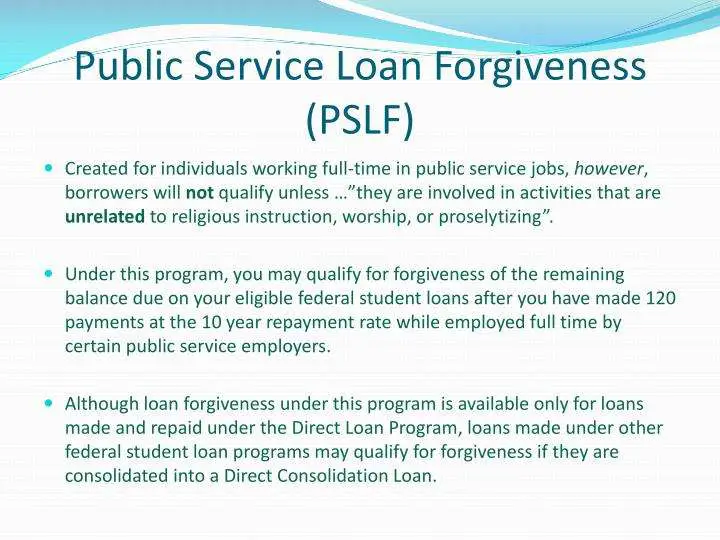

Public Service Loan Forgiveness

The Public Service Loan Forgiveness program is designed to help college graduates who work for a government agency or eligible nonprofit organization. To qualify, you must:

- Get on an income-driven repayment plan and make 120 qualifying monthly payments.

- Work full time for a U.S. federal, state, local or tribal government or an eligible nonprofit.

- Have federal direct loans .

Once you meet all of the requirements for PSLF, the remaining balance of your loans will be fully forgiven. What’s more, the canceled amount won’t be considered taxable income, which isn’t a guarantee with all forgiveness programs.

Read Also: How Long Does It Take Sba To Approve Loan

You Have At Least One Federal Student Loan That Is Not A Direct Loan Such As A Ffel Loan

You will need to submit a consolidation application and a PSLF form by October 31, 2022 to ensure that payments made on loans that are not Direct Loans can be counted toward PSLF. Right now, we encourage you to consolidate before using the PSLF Help Tool to certify employment. If you want to check your employers eligibility for PSLF before you consolidate, you can do so by logging into the PSLF Help Tool, which is available at StudentAid.gov/PSLF. If you have a mix of FFEL and Direct Loans, please refer to the sections above to understand how your Direct Loans will be affected.

We are working to update the PSLF Help Tool, but it will not be configured for borrowers with non-Direct Loans to submit a PSLF form until later this year. We will provide more information when this update is done.

To find out more about loan consolidation visit StudentAid.gov/Manage-Loans/Consolidation.

Restoration Of Total And Permanent Disability Discharges

Some disabled borrowers who qualified for a Total and Permanent Disability Discharge had their repayment obligation reinstated because they failed to submit the annual earnings paperwork during the pandemic. The U.S. Department of Education will reverse the reinstatements and provide other student loan debt relief for 230,000 borrowers with Total and Permanent Disability Discharges.

Also Check: Do Lenders Verify Bank Statements

Student Loan Forgiveness In Canada

Home \ Debt \ Student Loan Forgiveness In Canada

Join millions of Canadians who have already trusted Loans Canada

According to a Canada Student Loans Program Statistical Review, 625,000 students received student loans during the 2018 2019 school year. Plus, the average loan amount was somewhere in the $5,700 range, while the average loan balance was over $13,300 by the time students completed their education.

Statistics also showed that around 330,000 students entered the Repayment Assistance Plan because they couldnt afford their loan payments . Are you a Canadian student struggling to pay off student loan debt? If so, you may be able to resolve the situation by getting loan forgiveness.

How Much Could Be Forgiven

At the moment, the main point of contention among student loan forgiveness proponents is over how much debt should be scrapped: $10,000 or $50,000?

If all federal student loan borrowers got $10,000 of their debt forgiven, the outstanding education debt in the country would fall to around $1.3 trillion, from $1.7 trillion, according to Kantrowitz. And roughly one-third of federal student loan borrowers, or 15 million people, would see their balances reset to zero.

Canceling $50,000 for all borrowers, on the other hand, would shrink the country’s outstanding student loan debt balance to $700 billion, from $1.7 trillion. Meanwhile, the debt for 80% of federal student loan borrowers, or 36 million people, would be gone entirely.

Even under that more generous plan, not everyone would be entirely happy. One-fifth of federal student loan borrowers owe more than $50,000, and around 7% of borrowers have balances over six figures.

Read Also: How To Get A Car Loan When Self Employed

Apply For The Graduated Repayment Plan

Dont like the idea of spreading out your FFEL loan payments over 25 years? The Graduated Repayment Plan allows you to lower your monthly payments in the beginning and then they increase every two years for 10 years .

The idea is that your salary will potentially increase as you work longer. The Graduated Repayment Plan is structured with that in mind, assuming you will be able to afford higher student loan monthly payments as you get further into your career.

Federal Student Loan Forgiveness By Loan Type

Direct Loan Program Loans, including Direct Consolidation Loans:

- 10 years for full-time public service employees under the PSLF Program.

- 20 years under the PAYE Plan for new borrowers only.

- 20 years under the REPAYE Plan for undergraduate loans only.

- 20 years under the IBR Plan for new borrowers only.

- 25 years under IBR and ICR Plans.

FFEL Loans/Stafford Loans, Subsidized and Unsubsidized Loans: 25 years under the IBR and ICR Plans. If you consolidate FFEL Loans into a Direct Consolidation Loan, your loans may be eligible for the REPAYE, IBR, or ICR Plans and can be forgiven after 25 years of monthly payments.

Parent PLUS Loans: 25 years under the ICR Plan, but only after the debt is consolidated into a Direct Consolidation Loan. You can click here to learn more about how to get rid of Parent PLUS Loans.

Federal Perkins Loans: can be forgiven, but only if the loans are consolidated into a Direct Consolidation Loan.

Note: Youâre a new borrower if you have no outstanding balance on a Direct Loan or FFEL Loan when you receive a Direct Loan or FFEL Program loan on or after

Recommended Reading: Car Loans With A 600 Credit Score

Borrowers Will Be Notified Of Eligibility By July 2022

Those receiving private loan cancellation and refunds will receive a notification from Navient concerning their balance no later than July 2022. Federal borrowers eligible for the settlement payment will receive a postcard in the mail in spring 2022 from the settlement administrator.

Private student loan borrowers impacted by the settlement do not need to take any further action at this time. Federal borrowers should update or create their Federal Student Aid account to ensure that the Education Department has the correct account information and address on file.

Direct Student Loan Forgiveness For Federal Employees

Prior to working on this article, I was actually not aware of the FSLRP program. However, the Office of Personnel Management has a very informative article on it.

The FSLRP provides direct student loan forgiveness for federal employees. The FSLRP is authorized under Section 5379 of Title 5 of the US Code. Agencies may forgive up to $10,000 in loans a year and up to $60,000 of loans total for eligible federal employees. Employees participating in this program must sign a service agreement stating that they will work for the government for 3 years.

Unless you work for one of these three agencies, you probably do not have access to student loan forgiveness directly through your agency.

The OPM website just states that federal agencies can offer this as an incentive. . However, it appears that only three agencies regularly offer this benefit: Securities and Exchange Commission, State Department, and the Department of Justice. If you think about it, employees working in these agencies could choose very lucrative private sector jobs so this benefit helps to make up for the difference.

Unless you work for one of these three agencies, you probably do not have access to student loan forgiveness directly through your agency. If you work for one of these agencies you should definitely look into whether you qualify.

You May Like: Specialized Loan Servicing Lawsuit

You Dont Know What Kind Of Federal Loans You Have

Its very common for borrowers to not know what kind of federal loans they have. You can see what loans you have by logging into your account on StudentAid.gov, going to the My Aid page , and scrolling down to the Loan Breakdown section.

There, youll see a list of each loan you have borrowed, even if you have paid the loan off or consolidated it into a new loan. Direct Loans begin with the word Direct. Federal Family Education Loans start with FFEL, and Perkins Loans include the word Perkins in the name.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Investment Property Loans For Veterans

Start Putting Together A Plan Now

Due to the pandemic, payments on most federal student loans are suspended through September 30, 2021. But the experts say you should start putting a plan together now for when student loan payments resume.

Make a plan now, because loan servicers will be overwhelmed in October, says Taylor, referring to 40 million student loan borrowers who will begin repayments at the same time.

Private student loans arent eligible for the COVID-19 suspension of payments, but there are ways to make private student loans more manageable. If youre a private student loan borrower, be sure to get ahead of any financial challenges by calling and requesting to refinance or modify your loan. With rates at historic lows, now is a great time for private student loan borrowers to refinance before rates go up again.

Here are five steps you should take when developing an action plan for your student loans:

Year Vs 25 Year Student Loan Forgiveness

All federal student loan borrowers qualify for forgiveness of any remaining loan balance after making 20 or 25 years of qualifying monthly payments. Your eligibility for forgiveness after 20 years or 25 years depends on your type of loan, repayment plan, and when you borrowed the loans.

For each of the income-driven repayment plans, a qualifying payment is a payment made under:

- the 10-Year Standard Repayment Plan

- any income-driven repayment plan

- any other repayment program, if the payment amount is at least equal to what the payment amount would be under the 10-year Standard Repayment Plan.

You also get credit for any month you are in an economic hardship deferment. However, except for the coronavirus pandemic forbearance, any month spent in any other type of forbearance or deferment doesnât count towards forgiveness.

Don’t Miss: Sss Loan Application