About Our Car Loan Calculator

Use our auto loan calculator to estimate your monthly car payment based upon the price of the car, your down payment and trade-in allowance, taxes and fees, and the interest rate and term of your auto loan. See how changing one factor will affect your down payment.

The auto loan calculator will also show you the total interest paid if you hold your car loan for the full term. Dont overlook this number! Even though you pay the interest over many years, this is real money that gets added to the total purchase price of the car. If you want to save money, look at ways you can reduce the interest you pay: Buy a less expensive car, put more money down, and/or get a shorter loan with larger monthly payments .

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, car insurance can be a significant expense. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Estimate your monthly payments with our handy Auto Loan Calculator.

What Determines Your Interest Rate On A Car Loan

Interest rates are not the same for every person and are determined based on several factors. Here are some of the things that may affect your interest rate when financing your vehicle:

Typically, the higher your credit score, the lower your interest rate will be. Thats because a high credit score indicates that you have a good history of paying off your debts on time, so youre a less risky borrower. If youd like to check your credit score, you can use Chase Credit Journey to find your score for free without hurting your credit.

The vehicle

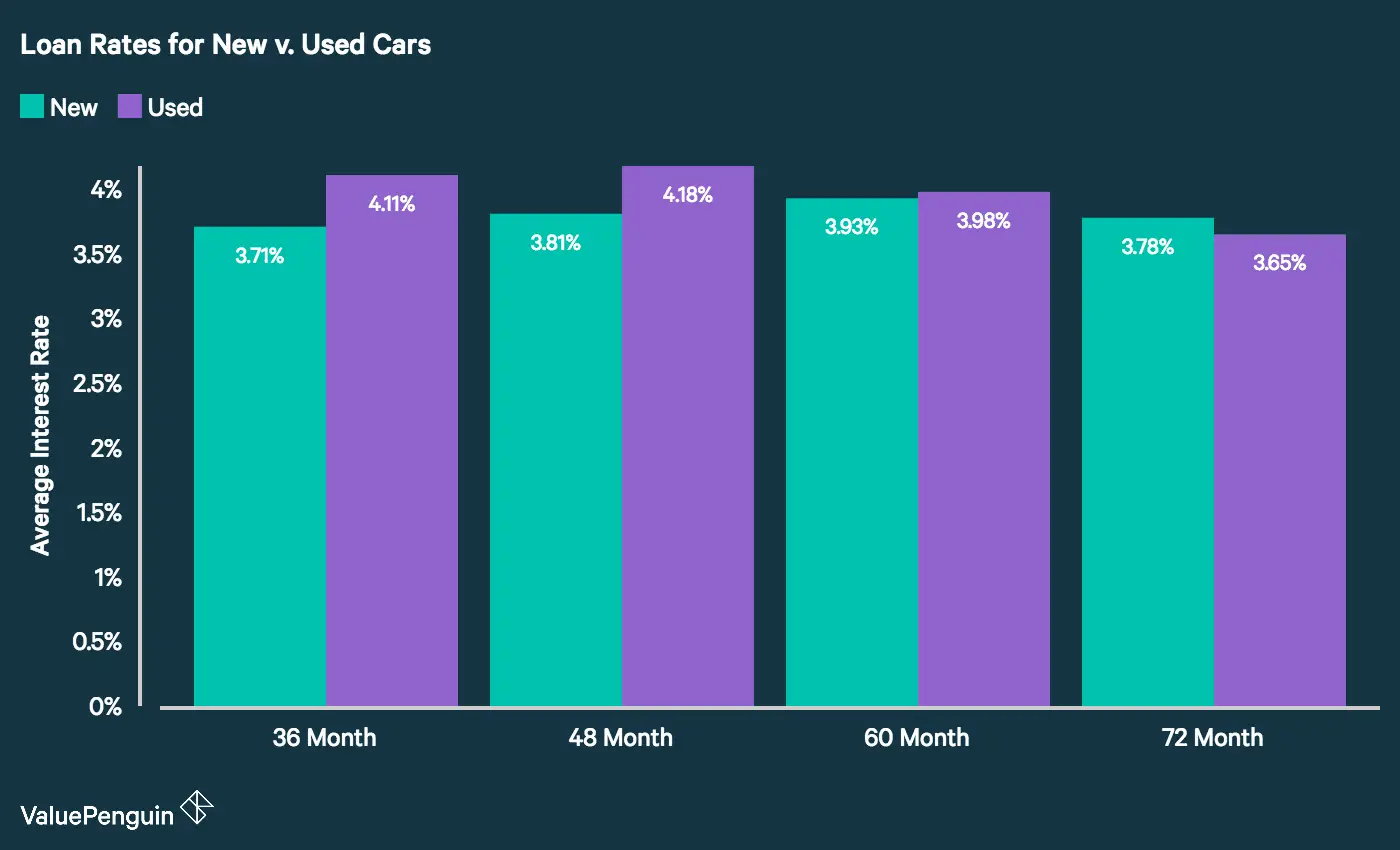

The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles usually have a higher interest rate.

Loan term

Longer loan terms tend to have higher interest rates than short-term loans. So, while you will have to pay a higher amount each month on the principal, with a short-term loan , you may save a lot of money on interest.

Lender

Interest rates vary. You should compare interest rates from several lenders to see which ones offer the best prices. You can also finance your vehicle through the vehicle manufacturer whose rates may be different.

Don’t Miss: Usaa Rv Loan Calculator

Average Interest Rates For Car Loans

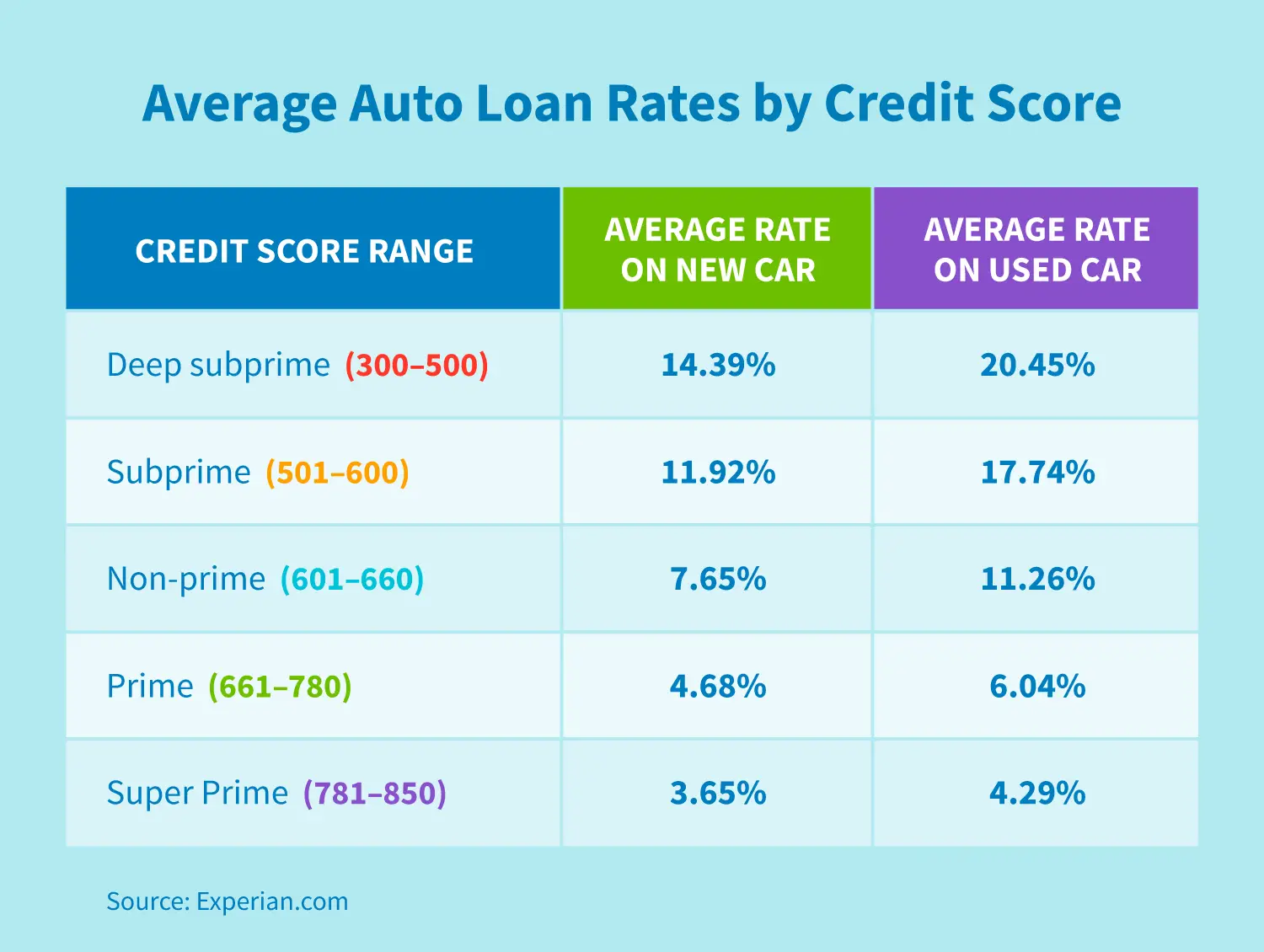

The average APR on a new-car loan with a 60-month term was 4.96% in the first quarter of 2021, according to the Federal Reserve. But as mentioned above, your credit scores and other factors can affect the interest rate youre offered.

|

Loan type |

Note: Experian doesnt specify which credit-scoring model it uses in this report.

The table above isnt a guarantee of the rate you may be offered on an auto loan. Instead, it can help you estimate an interest rate to enter into the auto loan calculator, based on the average rates people with various credit scores received on auto loans in the first quarter of 2021.

Keep in mind that there are different and that various lenders use may different ones. For example, auto lenders may look at your FICO® Auto Scores. And available interest rates and APRs can vary by lender, so be sure to shop around and compare both across your loan offers.

How Interest Rates Vary By Lender

Where you decide to get financing can impact the rates youll pay for a car loan.

Your options include:

Bank loans. Banks are favourable for individuals who have great credit scores. You could be eligible for 0% financing through your bank.

Credit unions can provide reasonable rates on car loans for newcomers to Canada who may have a limited Canadian credit history.

Online auto lenders. Online lenders may offer 0% financing but youre more likely to pay higher rates if you have less than perfect credit. Online lenders can offer car loan rates up to 30% or higher for borrowers who have poor credit history.

Dealership financing. Rates at dealerships mostly depend on the dealer. If a dealership works with an outside bank, your interest rate may be higher than what you might pay at a bank, credit union or online lender.

At Birchwood Credit, we do credit finance differentlywe lend our own money. This means quicker approval, better repayment terms and better rates for you, even if you dont have a perfect credit score. While banks or other lenders may deny you solely based on your credit score, we look at your entire financial situation and help you get the best rate available.

Also Check: Used Car Loan Usaa

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

Recommended Reading: How Far Back Do Underwriters Look At Bank Statements

Average Auto Loan Rates By Credit Score

Consumers with high credit scores, 760 or above, are considered to be prime loan applicants and can be approved for interest rates as low as 3%, while those with lower scores are riskier investments for lenders and generally pay higher interest rates, as high as 20%. Scores below 580 are indicative of a consumers poor financial history, which can include late monthly payments, debt defaults, or bankruptcy.

Consumers with excellent credit profiles typically pay interest rates below the 60 month average of 4.21%, while those with credit profiles in need of improvement should expect to pay much higher rates. The median credit score for consumers who obtain auto loans is 711. Consumers in this range should expect to pay rates close to the 5.27% mean.

When combined with other factors relevant to an applicants auto loan request, including liquid capital, the cost of the car, and the overall ability to repay the loan amount, credit scores indicate to lenders the riskiness of extending a loan to an applicant. Ranging from 300 to 850, FICO credit scores are computed by assessing credit payment history, outstanding debt, and the length of time which an individual has maintained a credit line.

What Factors Influence Car Loan Rates

There are several things lenders look at when deciding car loan interest rates:

- Your credit score and credit history

- Your income and where it comes from

- Employment history

- Loan term length

- Down payment amount

These factors all have the potential to affect your interest rate. So does The Bank of Canadas interest rate policyif interest rates are rising, you could expect to pay a higher rate for a car loan. Conversely, when rates are lowered, car loan rates may drop as well.

Getting out of debt takes time and dedication. You can learn more about managing your debt problems with our 9 steps.

Recommended Reading: Can Mortgage Lenders Verify Bank Statements

Uncontrollable Economic Factors That Affect Interest Rate

There are many factors that affect what interest rates people get on their mortgages and auto loans. Although these largely cannot be controlled, having knowledge of these factors may still be helpful.

Economic Policy and Inflation

In most developed countries today, interest rates fluctuate mainly due to monetary policy set by central banks. The control of inflation is the major subject of monetary policies. Inflation is defined as the general increase in the price of goods and services and the fall in the purchasing power of money. It is closely related to interest rates on a macroeconomic level, and large-scale changes in either will have an effect on the other. In the U.S., the Federal Reserve can change the rate at most up to eight times a year during the Federal Open Market Committee meetings. In general, one of their main goals is to maintain steady inflation .

Economic Activity

Unemployment Rate

When the unemployment rate is high, consumers spend less money, and economic growth slows. However, when the unemployment rate is too low, it may lead to rampant inflation, a fast wage increase, and a high cost of doing business. As a result, interest rates and unemployment rates are normally inversely related that is, when unemployment is high, interest rates are artificially lowered, usually in order to spur consumer spending. Conversely, when unemployment within an economy is low and there is a lot of consumer activity, interest rates will go up.

Supply and Demand

Best Credit Union For Auto Loans: Consumers Credit Union

Consumers Credit Union

- As low as 2.24%

- Minimum loan amount: None

-

No minimum or maximum loan amount

-

Offers new, used, and refinance loans

-

Offers transparent rates and terms

-

Lowest rates require excellent credit

-

Membership in credit union is required

Consumers Credit Union offers auto loan rates to its members as low as 2.24% for new car loans up to 60 months. Like other credit unions, it requires membership, but it’s easy to join. You can become a member by paying a one-time $5 membership fee. There are no geographic or employer requirements.

CCU doesn’t have a minimum or maximum loan amount. Your loan is approved based on your credit score, credit report, and vehicle information. There’s also no minimum loan termyou submit a request based on what you need.

Generally, borrowers with excellent credit will qualify for the lowest rates from Consumers Credit Union. But even members who have less than excellent credit have access to discounts. There’s a 0.5% discount available for those who autopay from a CCU account. The discount falls to 0.25% for those who make automatic payments from an outside financial institution.

Read Also: Capital One Auto Finance Approval

How Much Is The Car Payment Really Costing Me

Its just $350 a month.

Everyone has a car payment.

Sound familiar?

See, on the surface, $350 or even $500 a month seems innocent. But then, your dog needs surgery. Or your almost-teenager needs braces. Ordang ityou just need more room in your monthly budget for life.

Wheres your margin? Oh yeah, its going to the bank for five more years.

On a practical level, your monthly car payment is costing you, well, money. And lots of it.

But even if you could squeeze out that monthly payment without too much stress, think about the extra youre paying in interest. Thousands of dollars. And oh yeaha new car with a loan will jack up your auto insurance.

Instead, that money could be beefing up your savings account. Oryou could even haveenough to buy a reliable used car in straight-up cash. Then you could get the right auto insurance at the right price and keep your costs down.

Lets say you bought a used car with cash, and instead of wasting $500 a month on a car payment, you invested that money in a Roth IRA instead. After a 40-year period, that investment will be worth $4.3 million dollars.

So, back to our original questionhow much is a car payment really costing you? More than 4 million dollars over the course of your life. Thats how much.

Ways To Lower Insurance Costs

No matter if the buyer purchases new or used, the car will need to be insured. Unless the purchaser pays cash for the vehicle, they will be required to carry a full coverage policy in order to protect the lenders interests in the case of a collision, weather damage or if the vehicle is stolen or vandalized. If the buyer purchases with cash and no portion of the purchase price is financed, the new owner may carry liability only insurance. In most states, at least a liability policy is required. However, depending on the vehicle age, buyers who pay in full upfront may still want to consider full coverage. In at fault states, liability covers only the other driver and vehicle in case of an accident. In no fault states, liability will cover only the minimum required for the policy for property damage and bodily injury. If the car is five years old or newer, the driver probably needs to carry full coverage insurance to make sure they are able to cover the cost of repairs in case of an accident or damage.

You May Like: Fha Land Loan

Shop Around For Your Loan

Credit Unions generally offer car loans at 1% to 1.5% lower than banks. So if you dont belong to one, its a good time to think about joining. Get pre-approved for the loan before you start shopping. This gives you more choices. You will already know what rate your credit union offers, so when the salesman begins talking about financing, you will immediately know if he is giving you a good deal or not. Walking into the dealership without being pre-approved, gives the salesman the opportunity to charge you a higher rate since you will be uninformed and will have no ammunition with which to negotiate.

Dont Miss: How Much Commission Does A Car Salesman Get

Where To Get A Car Loan

If youre looking to take out a loan to finance your auto purchase, you have plenty of options to choose from. When it comes to financing your vehicle, you should be sure to come prepared in order to ensure that your negotiation with a car dealership is successful and you dont wind up paying more than you bargained for.

Online rates comparison tools like can help you to learn more about what rates you qualify for. Monevo lets you compare loan offers from different lenders for free. If you see a loan that meets your needs, you can apply quickly and easily online, and have the funds available to you in as little as one business day.

Read Also: Va Home Loan Investment Property

Myautoloan: Best For Shopping For Multiple Loan Offers

Overview: If you want to compare multiple loan offers but you dont want to spend a lot of time doing it, myAutoLoan is a great option. This platform lets you enter your information once and receive multiple loan offers in one place.

Perks: After filling out a single online loan application, youll be given up to four quotes from different lenders. To qualify, you must be at least 18 years old, have an annual income of $21,000, have a FICO score of 575 or greater and be purchasing a car with less than 125,000 miles and that is 10 years old or newer. By comparing multiple auto loan offers at once, you can pick the one with the interest rate, loan term and conditions that work for you and your budget without having to shop around.

What to watch out for: If you have poor credit, your interest rate could be on the higher side. Also note that you can use this platform if you live in most states, but not in Alaska or Hawaii.

| Lender |

|---|

Pay Off Your Loan In 4 Years Or Less

You pay interest on each car payment you make, so the longer your loan term, the more interest youll pay. The faster you can pay off your loan, the less interest youll pay. 4 years is a good benchmark to budget for.

Another thing to consider is some lenders may require you to pay a higher insurance premium while youre paying your vehicle off . Youd likely have a higher monthly charge and it would be an added cost to budget for. This varies by lender so its always a good idea to ask.

You May Like: Cost To Get Car Painted

You May Like: Specialized Loan Servicing Lawsuit

How Much Is Too Much For A Car Payment

When its time to buy a car, youll probably want to know: How much car can I afford? Financial experts answer this question by using a simple rule of thumb: Car buyers should spend no more than 10% of their take-home pay on a car loan payment and no more than 20% for total car expenses, which also includes things