What Is A Student Loan Servicer

A student loan servicer provides you with the tools and resources you need to successfully manage your loanfrom the point your first loan amount is disbursed through your school, to the point you’ve entirely paid off your loans. At Great Lakes, our servicing role includes:

- Keeping you up-to-date with information about your student loans.

- Monitoring your school enrollment and status while you’re in school.

- Assisting you as you pay back your loans.

- Helping you find the best repayment plan for your budget.

- If consolidation is right for you, guiding you to complete the application where you’ll be asked to choose one of the U.S. Department of Education’s consolidation servicers, of which, Great Lakes is one of them.

to share your thoughts with us. Your input helps us make changes to mygreatlakes.org that will benefit you and all of our customers.

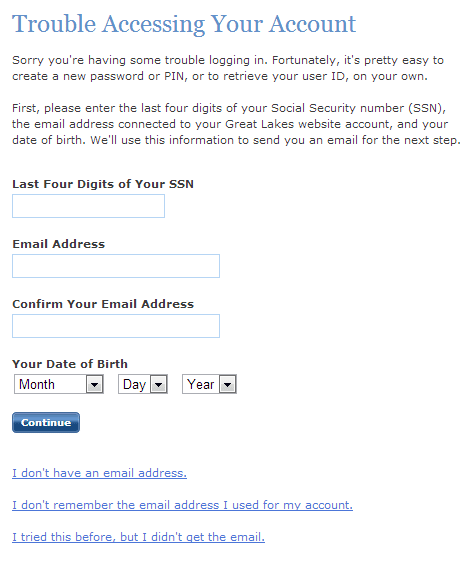

What Do I Do If I Can’t Get My Federal Student Aid Id To Work

There may be several reasons why your Federal Student Aid ID isn’t working.

You may be entering something incorrectly. To use your FSA ID, you must enter your user name and password exactly as you entered them when you created your ID.

The U.S. Department of Education may not have completed their match with the Social Security Administration . Your FSA ID is considered to be conditional until your information is verified with the SSA. You may use your FSA ID to:

Sign an initial Free Application for Federal Student Aid , and

Participate in the Internal Revenue Service data retrieval and transfer process.

Once they complete verification with the SSA , you’ll be able to use your FSA ID to access your personal information on Federal Student Aid websites.

Their records show that the SSN, name, and date of birth you provided on your FSA ID application do not match the information on file with the SSA.

Apply for an FSA ID again if you believe you entered incorrect information when you applied the first time.

Contact the SSA if you believe their information is incorrect.

You haven’t created your FSA ID yet. If you previously used your FSA Personal Identification Number to access information on FSA websites, you’ll need to create an FSA ID. To create an FSA ID, select Create Account

Learn more about IDR recertification requirements and what happens if you don’t recertify.

Financial Aid Representatives: Login

A sophisticated set of tools and resources, as well as specialized Great Lakes staff, can assist financial aid personnel at schools in making the most of their time.

Login Instructions for Financial Aid Representatives are provided below.

Step 1: You go to this website:.

Step 2: After that, you enter your User ID, Password, and Security Code. When finished, click Log in.

You May Like: Can You Use Va Loan For Renovations

Why Was An Adjustment Made To My Loan Amount

If your school’s financial aid office has adjusted your loan amount, it may be because they have learned that you are receiving additional aid from outside sources , which has affected your loan eligibility. While your school has the discretion to make adjustments to your aid offer, you are encouraged to contact them if you have questions about the amounts and types of aid you are eligible for.

Why Do I Have To Submit Annual Documentation For The Recalculation Of My Monthly Payment Amount

The monthly payment amounts for income-driven repayment plans are based on changing variables like your income, family size, and the state you live in. Submitting documentation every year is necessary to recalculate your monthly payment amount and ensures you maintain the lowest monthly payment available to you. Learn more aboutincome-driven repayment andhow to apply in our Knowledge Center.

Also Check: How To Get Out Of Car Loan Early

I Need Technical Help

WARNING

This system may contain government information, which is restricted to authorized users ONLY.Unauthorized access, use, misuse, or modification of this computer system or of the data contained hereinor in transit to/from this system constitutes a violation of Title 18, United States Code, Section 1030,and may subject the individual to civil and criminal penalties. This system and equipment are subject tomonitoring to ensure proper performance of applicable security features or procedures. Such monitoring mayresult in the acquisition, recording, and analysis of all data being communicated, transmitted, processed,or stored in this system by a user. If monitoring reveals possible evidence of criminal activity, suchevidence may be provided to law enforcement personnel.

ANYONE USING THIS SYSTEM EXPRESSLY CONSENTS TO SUCH MONITORING.

To Login To Your Great Lakes Student Loan Account Go To This Page Https: //wwwmygreatlakesorg

- To login to your Great Lakes student loan account, go to this page https://www.mygreatlakes.org

- You will need your account number, social security number and date of birth. You will also need a username and password. If you dont have an account yet, sign up!

- You can access your account anytime by going to the link above or searching for it on Google by typing Great Lakes Student Loans Login.

To login to your account, you will need your Great Lakes Student Loans account number, social security number and date of birth. Alternatively, you can use your usernam*You can log in to the Great Lakes student loans login page with your username and password. If you dont already have an account, click Create Account on the welcome screen. Once you have created your account, enter the requested information including name , date of birth, address , city state zip code./e

You May Like: What Is The Average Motorcycle Loan Interest Rate

How Do I Sign Up For Account Access On Mygreatlakesorg

Setting up your login information is fast, easy, and can be completed in a few simple steps. Click at the top of any page to get started. Account access on mygreatlakes.org is available to anyone with a student loan serviced or guaranteed by Great Lakes.

Once you’ve completed the signup process, you can log in anytime to view information about your loans and therepayment options available to you.

Access Your Student Loan Wherever You Are

We’re available wherever you need us, allowing you to access your student loan information 24/7. You can download our mobile app to get payment notifications, sign up for text alerts, and access our website from your mobile device, tablet, or desktop. We want to give you the best user experience possible.

Read Also: How Long Should You Wait To Refinance Your Auto Loan

What Do I Need To Do To Receive A Military Deferment

If you would like to receive a military deferment during the first 12 months you are eligible, you are only required to submit a verbal request.

After the 12 months, you are required to submit documentation to enter the program. When you’re on active duty, it can be difficult to provide documentation. Having someone act as your Power of Attorney will allow them to complete necessary documentation to make the process smoother and continue your deferment without interruption.

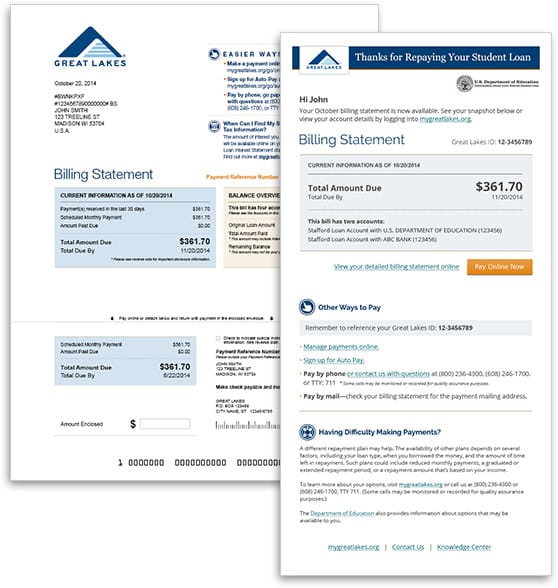

How To Make A Student Loan Payment

Any time you make a payment on your loan, it reduces what you owe in the long run. So even if you don’t have a payment due right now, making a payment is always a good idea. And if you’re in repayment, making on-time payments will help you build a solid credit history and stay on the path to successfully paying off your loan.

There are lots of ways you can quickly and easily make your paymentsfind the method that works best for you!

Don’t Miss: How To Repay Parent Plus Loan

Website Reviews From Mygreatlakesorg

Millions of happy customers have left positive reviews on My Great Lakes. Customers leave comments such as:

Great Lakes assisted me in effectively managing my student loan for my degree and setting my interest rate to manage. I was very concerned about student loan management because I was naive about all of these types of loans and did not even know how Education Loan works.

Another customer was pleased with his experience with My Great Lakes Student Loans. Heres what he has to say about it:

My initial reaction was, Oh no!!! when I learned that my loans could be transferred to another loan officer. No one cares about me as much as she does! Great Lakes has been taking out my loans for almost five years and has always been helpful and pleasant in dealing with the numerous changes I make in my work. Customer service representatives are patient and explain each step and option so that I can choose the best one.

Understand Your Repayment Options

After you know who and how much you owe, and have a sense of your personal budget,it’s time to learn about your repayment options. Your repayment plan determines how much you pay each month, including what you may pay in interest,over the life of your loan.

This means that choosing a repayment plan is usually about paying as much as you can afford each month ,but not more than you can afford .

Also Check: Can I Pay Off My Lightstream Loan Early

Use Tools To Compare Your Options

One of the best things you can do to ensure success is to stay informed about all of your options. Federal student loans allow you to lower your payment amount, postpone your payments, or sometimes have your loan forgiven, and it’s never too early to start learning about all of your options. If you’re in repayment, it’s easy to check your current plan and explore the available repayment options, including plans based on your income. This is important whether you’re having trouble making your payments or you just want to get a jump start on repayment while you’re still in school.

Can I Change The Day That Auto Pay Withdraws Money From My Account

We withdraw money from the checking or savings account you select on your payment due date. You canselect a new payment due date for eligible Great Lakes accounts. If your loans don’t have a payment due, you can select which day of the month you want Great Lakes to withdraw money from your checking or savings account.

Also Check: How Hard Is It To Get An Sba Loan

Why Does Most Or All Of My Student Loan Payment Go To Interest

Payments must be applied first to interest, then to loan unpaid balance. This means that only the amount that exceeds interest owed is applied to the unpaid balance. There are common situations in which all, or most, of your payments will be applied to interest. For example, when you’re on a Graduated repayment plan, if you’ve missed or skipped a few payments and then make a payment, if you’re on an income-driven repayment plan, or if you don’t make a payment within 30 days of entering repayment. Find out more about how payments are applied.

I Need Help What Do I Do

We all need help sometimes. It’s a fact of life Great Lakes understands. We want you to know that we’re here to provide support and answer all your student loan questions, big or small, at every stage of the process.

We realize getting information about your student loans can be overwhelming, and it can sometimes seem difficult to find the information that’s relevant to you. That’s why we provide a variety of ways for you to find answers and stay informed. We believe getting the information you need should be a comfortable, worry-free experience that’s based on your needs and preferences.

Recommended Reading: How Long To Wait Between Loan Applications

What Is A Student Loan Guarantor

A student loan guarantor’s primary mission is to manage the Federal Family Education Loan Program on behalf of the federal government. Duties range from enforcing federal student loan rules and regulations to counseling student loan borrowers who may be unable to make their payments. This guarantee allows lenders to be reimbursed for loans that may default.

Is Great Lakes My Student Loan Servicer

A student loan servicer such as Great Lakes collects and manages your student loan payments. For federal student loans, the U.S. Department of Education assigns you a student loan servicer. That means that you cannot choose your student loan servicer, unless you choose to refinance your student loans. If you think AES may be your student loan servicer, or if youre not sure whos your student loan servicer, then you can verify your student loans with these simple options.

- Log into the National Student Loan Data System : The NSLDS database includes all information about your student loans, including balances, history and student loan servicers. You can login with your Federal Student Aid ID.

- Check your credit report: Your credit report will also tell you whether Great Lakes is your student loan servicer. You can order a free credit report for all major credit bureaus from AnnualCreditReport.com.

- Contact Great Lakes: You can contact Great Lakes directly to verify if Great Lakes if your student loan servicer. The phone number for Great Lakes is 1-800-236-4300.

Read Also: What Are Some Good Loan Companies For Bad Credit

How Can I Get The Information I Need To Submit My Taxes

Your student loan interest information is available on mygreatlakes.org. Your 1098-E statement for the previous tax year is first available in January. Select My Accounts > Tax Filing Statements& nbsp to access it.

You’ll also receive an email notification when new student loan interest information is available.

Payments Made Via The Internet

You can easily make payments online if you are a federal borrower designated Great Lakes as your service provider. Youll need to register for mygreatlakes.org and create an account on the online portal. You will be asked for personal information such as your name, date of birth, social security number, etc. After that, you can get information about your loan. You will be given an account and given a username and password to log in to mygreatlakes.org. You can download the mobile application and use your debit card to organize payments. There is no way to pay with a credit card.

Also Check: How To Calculate Dti For Conventional Loan

Is Mygreatlakes A Scam Or A Legit Site

To begin with, you have reservations about the Great Lakes student loan and the widespread belief that it is a rip-off. Its also possible that youve heard about how legitimate Great Lakes Student Loan is. Its critical to understand that My Great Lakes is a federal government-registered study service provider program. MygreatLakes.org 2021 collaborates with federal loans to provide students with loans with reasonable terms and flexible payment options that are tailored to their specific needs.

As a result, the Great Lakes student loan rumor is false. My Great Lakes is a significant institution that contributes significantly to the student loan industry. My Great Lakes, unlike private lenders, provides loans to the federal government, removing the risk of high-interest rates. Because he keeps his customers on federal loans, where Congress sets the interest rates, the risk of an excessive interest rate is reduced, if not eliminated entirely, and irrational in the case of student loans.

What If There Isn’t Enough Money In My Checking Or Savings Account On My Due Date Or Withdrawal Date

If there’s not enough money in your account to cover your automatic payment, we’ll attempt to withdraw the money twice, just like we would if it were a returned check.

Your financial institution may apply overdraft fees if you don’t have enough money in your account on your due date or withdrawal date. We are not responsible for any overdraft fees assessed by your financial institution. If you have three consecutive failed payment attempts, we’ll automatically deactivate your Auto Pay. If you’re receiving an interest rate reduction for using Auto Pay, you’ll lose the incentive. Depending on the type of loan you have, you may be able to regain this benefit by re-enrolling in Auto Pay.

Don’t Miss: How To Get Out Of Loan Debt

Don’t Have A Security Code

Great Lakes uses Symantec Validation and ID Protection for two-factor authentication, for safe and secure access.

You can get your security code by having one of the following:

VIP Security Token

If you have a VIP Security Token, you already have what you need and can register it for use with our website.

VIP Access Application

If you do not have a VIP Security Token, you may download the VIP Access application to generate your long-term security code.

Great Lakes Customer Service: Overview And How To Contact

Editorial Note: This content is based solely on the author’s opinions and is not provided, approved, endorsed or reviewed by any financial institution or partner.

Great Lakes is a leading student loan servicer for millions of student loan service borrowers. Great Lakes is now part of Nelnet, but operates independently as a student loan servicer.

Great Lakes is one of the four main student loan servicers of federal student loans. The other three are Navient, Nelnet and American Education Services .

Heres what you should know about Great Lakes to maximize your customer service experience, if Great Lakes is your student loan servicer. In this guide, we will discuss:

Recommended Reading: Are Student Loan Forgiveness Calls Legit