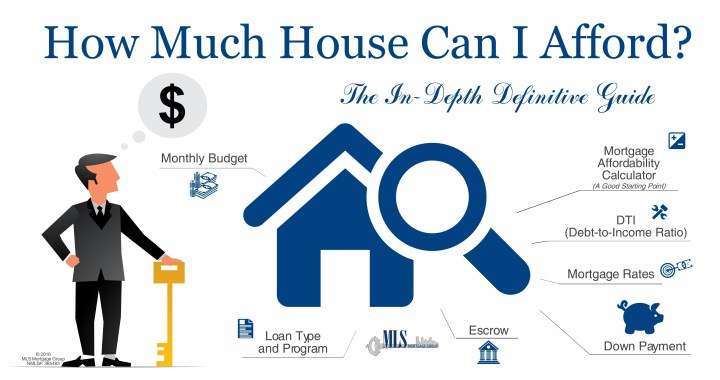

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

How The Interest Rate And Loan Term Can Impact Your Borrowing Power

Changing the interest rate and loan term can have a significant impact on your borrowing power.

The lower the interest rate, the higher your borrowing capacity as the total amount of interest applicable to the entire life of the loan will be lower assuming interest rates do not change.

If the loan term is shortened, this will decrease the amount of interest you will be charged over the entire life of the loan. This means your monthly repayments will predominantly pay down the principal amount of the loan, however the monthly repayments will be substantially higher as a result.

Its important to note the calculator assumes a fixed rate for the entire life of the loan. The calculator also doesn’t factor in interest rate fluctuations.

How Do I Find Out My Car Loan Amortization Schedule With Extra Payments

You can get an idea of your amortization schedule when you use our auto loan early payment calculator. You will be shown just how much you’ll be owing at any period in the life of the loan for both regular payments and accelerated payment plans that use extra payment.

Is there a ‘remaining car loan payoff calculator’?

Yes, there is a remaining car loan payoff calculator. This auto loan early payment calculator provides you with accurate information about how much money you still have to pay off on a car loan. You will, however, need to supply details on the loan amount, period, and extra payment.

How to pay off car loan calculator faster?

An auto loan early payment calculator helps you save money by making extra monthly payments. It works when you supply details of the loan term, loan amount, additional monthly payment intended, current payment, and interest rates. You then get a report on how much you save in terms of money and time on the loan.

Also Check: Usaa Student Loan Refinancing

Do You Want A Loan Or Line Of Credit

Let us walk you through each step in the calculator with helpful tips and definitions.

1 Displayed rate does not represent the actual rate you may receive.

* The calculation is based on the information you provide and is for illustrative and general information purposes only and should not be relied upon as specific financial or other advice. Actual results and loan or line of credit payment amounts and repayment schedules may vary. Calculator assumes a constant rate of interest.

** Creditor Insurance for CIBC Personal Lines of Credit, underwritten by The Canada Life Assurance Company , can help pay off or reduce your balance in the event of death or cover payments in the event of a disability. Choose insurance that meets your needs for your CIBC Personal Lines of Credit to help financially protect against disability or death.

What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. That’s why it’s so important to establish and maintain the highest rating possible.

You May Like: Credit Score For Usaa Auto Loan

How Banks Use Foir

Lets try to understand this with the help of an example. Ashish earns Rs 50,000 per month and pays an existing home loan EMI of Rs 10,000. He wants to apply for a personal loan. How much can he get? Lets assume the bank will have a threshold FOIR of 50% for Ashish. This means that the bank will give Ashish the loan amount such that his total loan EMIs dont exceed Rs 25,000 . His existing EMI is Rs 10,000. Therefore, the additional EMI that Ashish can afford is Rs 15,000 . With this number, you can work backwards to calculate the maximum loan amount. Of course, you need the rate of interest and loan tenure too. For an interest rate of 10% p.a. and loan tenure of 5 years, the maximum loan amount an EMI of Rs 15,000 can service is Rs 7.05 lacs.

Your loan eligibility will increase with:

| 120 | 32,96,859 |

For a given EMI , rate of interest and loan tenure, you can determine how much loan you can afford using ourLoan Calculator too. Various bank and NBFC website have their own calculators on the websites.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Read Also: Usaa Auto Loan Application

Mortgage Calculator: How Much Can I Borrow

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Considering Paying Off Your Auto Loan Early

Most auto loan lenders allow borrowers to prepay on the principal balance of their loan without a prepayment penalty. .

If you can manage to either increase your payments, or apply a lump sum toward the principal balance, you can consider doing so by using this calculator by crunching some numbers. Paying off the auto loan early or adding a prepayment amount each month, shortens the period of time that the loan is in place and also decreases the total amount of interest that you will pay on the loan in the long run. While it may be difficult to part with a larger sum up front, or adding an additional amount each month to your payment, paying off your loan early can potentially save you thousands of dollars overall.

- FAQ: An auto loan early payoff calculator like this one can help you figure out how much.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Also Check: Is Bayview Loan Servicing Legitimate

There Is No Standard Threshold Foir

The threshold ratio may vary across banks and may not even be disclosed. As I understand, not many banks would be comfortable once the FOIR breaches 50%. However, it is possible that banks may make exceptions for very high income or high net worth individuals. And I can see reasons for the same.

Lets consider an example. Ashish earns Rs 50,000 per month and Ramesh earns Rs 5 lacs per month. Neither has any loan. You can expect fixed expenses to be a fairly high portion of Ashishs monthly income. The same cannot be said for Ramesh. At such high level of income, he may be saving much more . Therefore, it is possible that the bank may restrict Ashish to a FOIR of 40% while it may go up to 60% for Ramesh.

A similar argument can be extended to High Net-worth individuals. Note that this is a conjecture. Banks have different policies for determining loan eligibility.

Find Out How Much Mortgage You Can Afford

Weâll help you figure out what home price you may be able to afford.

Ready to start looking for your dream home? Donât just dream about it â let the TD Mortgage Affordability Calculator help you begin your search. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach.

Step 1 of 6

Recommended Reading: Drb Vs Sofi

Interest Rates And Fees If You Borrow On Amounts You Prepaid

You pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term.

Fees vary between lenders. Make sure to ask your lender what fees you have to pay.

You may not have to make any changes to your mortgage term.

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

Don’t Miss: When Can I Apply For Grad Plus Loan 2020-21

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How Do I Qualify For A Personal Loan

Eligibility criteria for a personal loan can vary by lender. However, there are a few common requirements youll likely come across, including:

- Good credit: Youll typically need good to excellent credit to qualify for a personal loan a good credit score is usually considered to be 700 or higher. There are also several lenders that offer personal loans for bad credit, but these loans tend to have higher interest rates compared to good credit loans.

- Verifiable income: Some lenders have a minimum income requirement while others dont but in either case, youll likely need to show proof of income.

- Low debt-to-income ratio: Your debt-to-income ratio refers to the amount you owe in monthly debt payments compared to your income. Lenders generally prefer a DTI ratio no higher than 40% for a personal loan though some lenders might require a lower ratio than this.

Tip:

A cosigner can be anyone with good credit such as a parent, other relative, or trusted friend who is willing to share responsibility for the loan. Keep in mind that this means theyll be on the hook if you cant make your payments.

Check Out: How to Get a Personal Loan With a 600 Credit Score

Maximum Lifetime Limit For Student Aid

There are lifetime limits on the number of weeks you can receive student aid. This includes interest-free periods while you are in school. Once a lifetime limit has been reached, interest starts to accumulate. You will also have to start paying back the loan 6 months after you graduate or finish your studies.

Full-time students can receive student aid for no more than 340 weeks, except:

- students enrolled in doctoral studies can receive student aid for up to 400 weeks

- students with permanent disability can receive student aid for up to 520 weeks

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

How Much House Can I Afford With An Fha Loan

With a FHA loan, your debt-to-income limits are typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirements are met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

Also Check: Excel Loan Payment

How To Determine How Much House You Can Afford

Ultimately, you will need to work with a lender to figure out exactly how much house you can afford, given your current financial situation. That being said, you can do some preliminary calculations to get a better sense of your budget. Create a mortgage affordability template using these categories to crunch the numbers on what you can afford.

How Much Can You Borrow

In addition to private loans, there are three main types of federal student loans: Direct Subsidized, Direct Unsubsidized, and Direct PLUS.

First, consider a Direct Subsidized Loan. Subsidized federal loans are simple to obtain, usually less expensive than PLUS or private loans, dont require a or cosigner, and have built-in protections and repayment options that unsubsidized, PLUS, and private loans don’t have. Subsidized federal loans are available for undergraduate students only. Unsubsidized federal loans can be taken out by both undergrads and graduate/professional students.

Don’t Miss: How To Transfer Car Loan To Another Person