Student Loan Debt Forgiveness In Canada

There are over 100 universities and colleges in Canada for students to pursue higher education. These educational institutions offer over 15,000 different programs of study for undergraduate, graduate, doctorate degrees, and certificates and diplomas. But, post-secondary school tuition isnt cheap.

Many Canadians take out student loans from the federal government, provincial governments, private lenders, and banks to cover tuition fees. Unfortunately, many student loan borrowers still struggle to pay off their debt, even years after graduation. COVID-19 enhanced those struggles, with the 355,000 jobs lost in Canada last year and disproportionate financial effects of COVID-19 for younger Canadians.

Here well discuss everything you need to know about student loan debt, including the cost of education in Canada, student loan debt compared to other forms of debt, student loan debt forgiveness, and more.

Are you struggling with student loan debt? Call us today to learn how to get out of debt.

Deferment Does Not Help

Student loan forbearance or deferment helps borrowers to stop repayment for several months. If you apply for forbearance, you do not make payments, but the interest continues to accumulate. Another disadvantage of such a non-repayment period is that these months will not count for 120 qualifying payment requirements. Hence, you will achieve Public Service Loan Forgiveness in more than ten years.

So, we have two recommendations for you. First, if you struggle with repayment, contact your loan servicer. Income-driven repayment plans are extremely affordable. However, its Income-based repayment option can be more suitable. Hence, ask your lender if a different type of Income-driven plan can be more affordable for you.

Second, even if deferment is available, such as when you are still in graduate studies, you can ask to waive this benefit. In this way, you can make payments and progress toward the PSLF.

Keep in mind that current loan forbearance due to COVID-19 is an exception. You are not required to make payments till 2022, but these months still count for PSLF. So, you do not need to worry about losing time.

We Do Not Make Loan Payments On Your Behalf And Loans Remain In Your Name

We assist in identifying appropriate government loan repayment programs and assist in document preparation to apply for the programs. Any fees that you pay to us are for its services and you are responsible for repaying your loan separately.

Do it yourself without a fee all programs are freely available for enrollment through the Department of Education.

While you could research and apply for the repayment programs on your own through the Department of Education, we find that a significant number of borrowers either dont have the time or are too anxious to go through the process on their own and simply want someone with more experience to hold their hand. One could think of it like preparing and filing tax returns. While we are all permitted to do so on our own, most taxpayers get help from third parties that they pay to assist them.

Also Check: Will I Qualify For Fha Loan

How To Spot And Avoid Scams

The best way to keep yourself from being scammed is prevention, according to Evans. Because of the current environment, people should have a high degree of skepticism, she said.

There are a few key things that people should be on the lookout for if they get a phone call or letter about student loan forgiveness.

For example, just because someone has information about your student loans, such as the total balance, doesn’t mean they are from a legit operation, according to Evans.

“We know that scammers have obtained credit reports illegally and then use that information,” she said.

Look for the name of the program that is being offered to you some scams purport that they’re part of “Biden loan forgiveness” or “CARES Act loan forgiveness,” two programs that do not exist, said Evans.

It’s kind of a prime moment for scams because I think they’re capitalizing on the confusion that surrounds what is happening with student loan policy and potential forgiveness.Bridget HaileHead of borrower success at Summer

If you’ve gotten a suspicious email, check to make sure that it’s being sent from an email address that ends in “.gov.”

Remember that federal programs do not require extra payment for loan forgiveness, so if someone is talking about charging you, it should be an immediate red flag, said Haile.

If you think something may be a scam or have any doubts, the best course of action is to contact your servicer directly, both Haile and Evans said.

Drawbacks Of Student Loan Forgiveness And Repayment Plans

Income-based repayment can also have a downside. More interest will accrue on your loan because the repayment is stretched over a longer period of time. “Loan payments under IBR and PAYE can be negatively amortized, digging the borrower into a deeper hole,” Kantrowitz notes. “Borrowers who expect to have a significant increase in their income a few years into repayment should perhaps prefer a repayment plan like extended repayment or graduated repayment, where the monthly payment will be at least as much as the new interest that accrues, and the loan balance will not increase.”

“Remember, payments change annually based on income. When your income rises, your payment can, too,” notes Reyna Gobel, author of CliffsNotes Graduation Debt: How to Manage Student Loans and Live Your Life.

Even if you succeed in lowering monthly payments, don’t go on a spending spree with the newly available funds, she adds. If you’re currently racking up more debt because you expect these plans in the future: Stop! You never know what will or won’t exist for graduates if the law changes in the future. Ask yourself, ‘Could I afford to repay this on a regular Extended Repayment Plan?’ If not, you could be getting yourself into very high debt and a difficult situation.”

If you choose to participate in any loan-forgiveness program, be sure to obtain written verification of the amount that will be forgiven and under what circumstances.

Recommended Reading: What Bank Has The Lowest Home Equity Loan Rates

How Can You Become Eligible

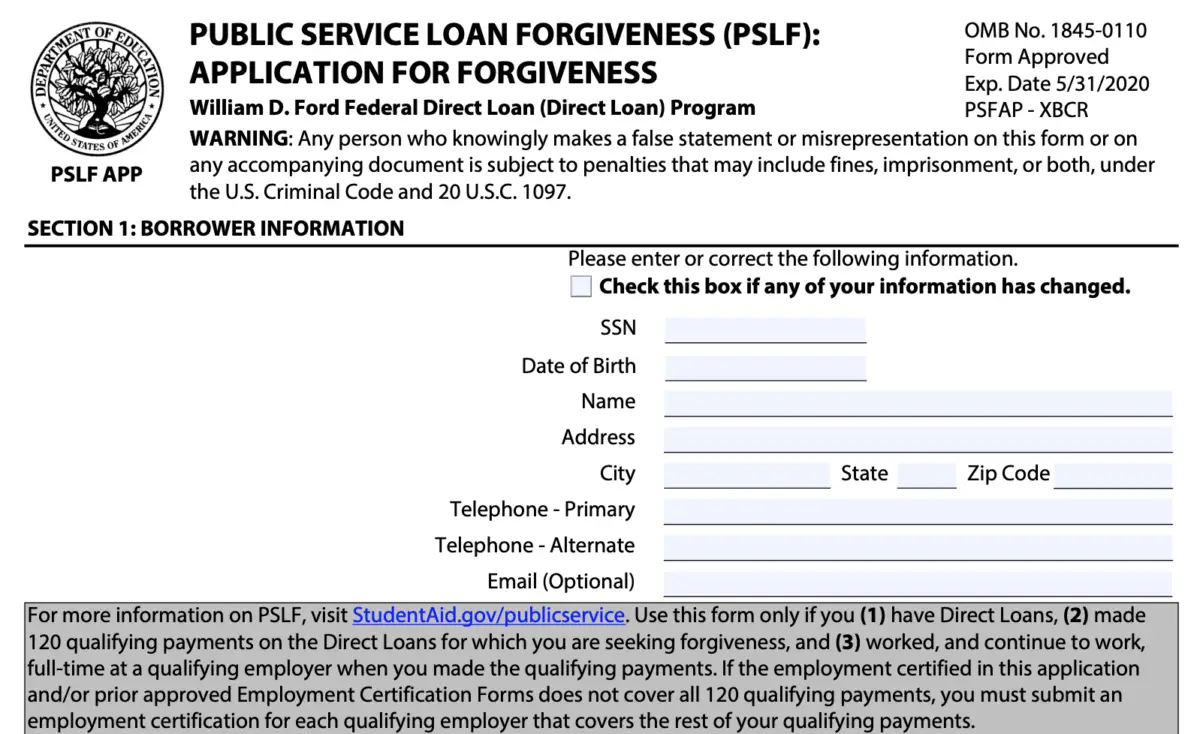

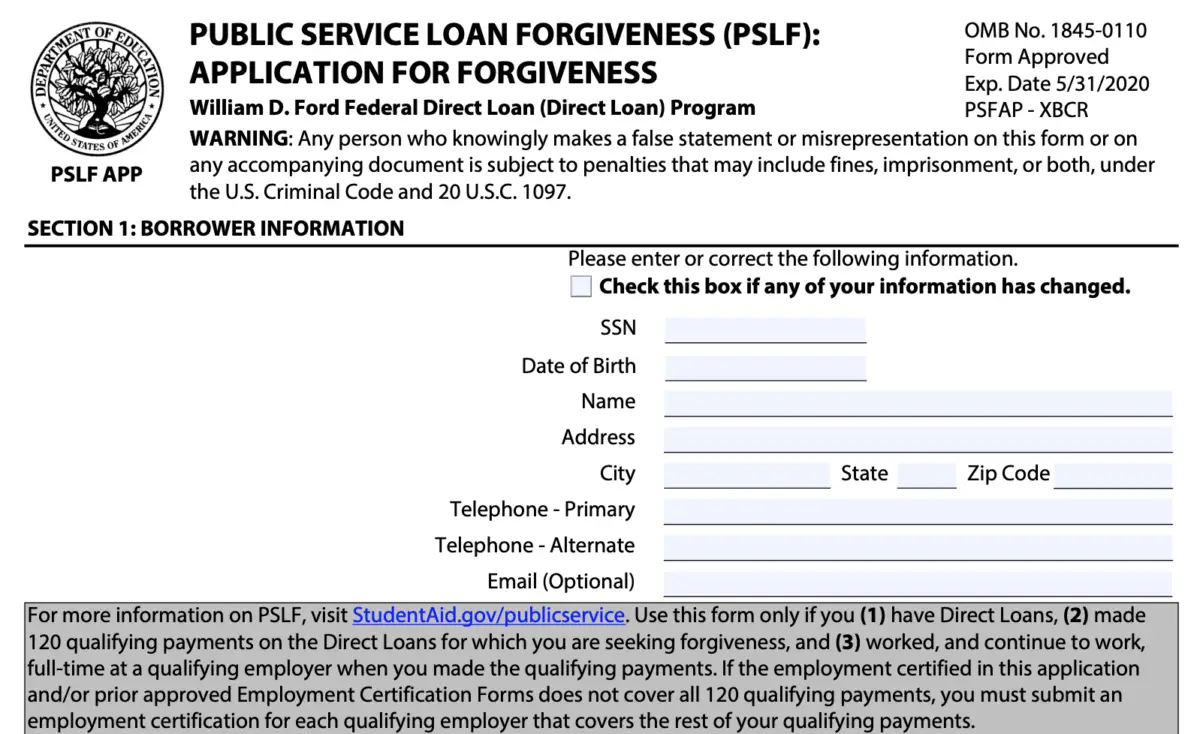

To make sure youre eligible for PSLF, submit the Employment Certification for Public Service Loan Forgiveness form. The program requires this form for every year of service, so submitting it on an annual basis will help ensure youre on track for PSLF.

Another important step is switching to an income-driven repayment plan. Youll lower your monthly payments while extending your term to 20 or 25 years. If you stay on the standard plan, you wont have any balance left to forgive after 10 years of payments.

Finally, consider consolidating your student loans into a direct consolidation loan. This step is helpful if you have Perkins or FFEL loans. Plus, it simplifies your monthly payments, so youll only have one loan to pay each month. You can estimate your possible forgiveness through our PSLF calculator.

+ Student Loan Forgiveness Programs That Discharge Loans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Help for current students: Emergency COVID-19 relief for students

Student loan forgiveness might seem too good to be true, but there are legitimate ways to get it through free government programs.

The following options are available only to borrowers with federal student loans. Some programs have very specific requirements that make them difficult to qualify for, but income-driven repayment plans are open to most borrowers.

» MORE:What are the odds Ill get student loan forgiveness?

The information below is about existing student loan forgiveness programs. Learn more about the potential for Biden Student Loan Forgiveness.

Youre not eligible for federal student loan forgiveness programs if you have private loans, but there are other strategies for managing private loan debt.

Don’t Miss: How To Be Eligible For Fha Loan

Navy Student Loan Repayment Program

The Navy Student Loan Repayment Program is one of several Navy enlistment education incentive programs designed to pay federally guaranteed student loans through three annual payments during a Sailor’s first three years of service.

You must sign up for this program when you enlist, and your recruiter must include this program in your recruiting paperwork.

You can learn more about this program here.

Student Loan Repayment Assistance Programs For Nurses

In addition to national programs, many states offer loan repayment assistance to nurses. The Illinois Nurse Educator Program, for example, awards up to $5,000 per year for four years to qualifying nurses and nurse educators in Illinois.

Browse through the available LRAPs for nurses. You can search by state, occupation or award amount. There are plenty more loan forgiveness options for nurses.

Recommended Reading: How Much Credit Score Required For Car Loan

Temporary Expanded Public Service Loan Forgiveness Program

Federal student loan borrowers are eligible for loan forgiveness under the TEPSLF Program if:

- you’re ineligible for PSLF because not all of your payments were made under a qualifying repayment plan and

- you have at least 10-years of qualifying employment in the public service.

A qualifying monthly payment is a payment that you made:

- after October 1, 2007

- for the full amount due as shown on your bill

- no later than 15 days after your due date and

- while employed full-time by a qualifying employer.

Borrower Defense To Repayment

If you believe that the school you attended misled you or engaged in misconduct in violation of certain laws, the federal student loans you obtained to attend that school may be eligible for forgiveness, called Borrower Defense to Repayment. Learn more about the process, eligibility requirements and how you can apply.

Also Check: What Credit Score Do You Need For An Fha Loan

Military Student Loan Forgiveness And Assistance

Not only does the military offer loan forgiveness for Army and Navy doctors, but it also helps armed forces members and veterans. The Army, Navy, Air Force and National Guard all offer loan repayment assistance programs.

- The Armys College Loan Repayment Program pays one-third of your loans every year for three years. In total, you could get up to $65,000 in aid.

- The Navy program also awards up to $65,000.

- The National Guard LRAP contributes up to $50,000.

There are plenty of other programs for military student loan forgiveness, so make sure you know what you qualify for.

Student Loan Forgiveness In Canada

Categories

According to a Canada Student Loans Program Statistical Review, 625,000 students received student loans during the 2018 2019 school year. Plus, the average loan amount was somewhere in the $5,700 range, while the average loan balance was over $13,300 by the time students completed their education.

Statistics also showed that around 330,000 students entered the Repayment Assistance Plan because they couldnt afford their loan payments . Are you a Canadian student struggling to pay off student loan debt? If so, you may be able to resolve the situation by getting loan forgiveness.

Don’t Miss: What Are Assets For Home Loan

Registering For Student Credit Forgiveness Via Pslf

To be able to register for the forgiveness of student credit via PSLF, you should have fulfilled 120 remittances. It is not mandatory to make those payments consecutively. Once you have met this requirement, you must upload the official Public Service Loan Forgiveness Form. At the time of submission, you should still be a part of a suitable organization. So do not resign from your job in the governmental division right away. Then, when you finish filling the Public Service Loan Forgiveness form, share it with FedLoan Servicing. FedLoan servicing is the formal credit servicer of the PSLF program. Lastly, you have three choices while presenting student loan forgiveness applications. These include mail, fax, and website.

State Lrap Programs For Doctors And Other Health Care Professionals

While many programs are available nationally, you might also find loan assistance from your state. There are a variety of state LRAPs across the country.

The Massachusetts Loan Repayment Program, for instance, awards up to $50,000 to health professionals working in shortage areas. You might find other repayment assistance options in your state.

Also Check: Can I Loan Money To My S Corp

Quebec Loan Remission Program

Under the Quebec Loan Forgiveness Program, you can get up to 15% of your provincial student loan forgiven if you finish your studies within a specified period or youve received a bursary from the Loans and Bursaries Program for each year of your studies.

The specified period of study is normally:

- 27 months for a college-level technical program

- 24 months for an undergraduate university program, over a 3-year period

- 32 months for an undergraduate university program, over a 4-year period

- 16 months for a masters program without a thesis

- 20 months for a masters program with a thesis

- 32 months for a doctorate program

Eligibility Requirements For The Quebec Loan Remission Program

To qualify for this provincial loan forgiveness program, you must:

- Have been granted a bursary under the Loans and Bursaries during each award year of your studies

- And, have finished an education program that results in an undergraduate degree within the specified study period. Loan remission may also be possible for past college studies, as long as they pass requirements.

- Or, have finished a college-level training program that results in a Diploma of College Studies within the specified study period.

Check out how your student loans can affect your credit.

Army College Loan Repayment Program

The Army College Loan Repayment program is the most generous of all the branches, but it does have some big “catches” that you need to be aware of.

First, this program will forgive up to $65,000 of your student loan debt for highly qualified individuals who enlist in one of the Armys critical military occupational specialties .

However, to qualify, you must have this written into your enlistment contract, AND you must give up your Post 9/11 GI Bill. So, if you’re thinking about going back to college, this might not be a good deal.

You can learn more about this program here.

Recommended Reading: When To Apply For Ppp Loan Forgiveness

How To Apply For Joe Bidens Student Loan Relief 2021

Use the Search Button below for more details.

President Joe Biden extended student loan relief until January 31, 2022, based on Bidens executive action, your federal student loans arent due again until as early as February 1, 2022.

According to Forbes, student loan borrowers will get $110 billion of student loan cancellation

Federal Perkins Loan Cancellation

If you took out a federal Perkins loan to pay for school, you could qualify for loan cancellation in a variety of ways. The Perkins loan cancellation and discharge program typically forgives a certain percentage of student loan debt after every year of service. Over time, you could get up to 100% of your Perkins loan canceled.

Recommended Reading: Can Closing Costs Be Included In Refinance Loan

How To Get Your Student Loans Forgiven: Three Paths

Cancelling student loan debt is a popular subject in todays climate, but its been a popular topic for more than 20 years and 45 million people still owe $1.7 trillion.

That could change if Biden and Congress reach some sort of compromise on how much to cancel and qualifying requirements.

In the meantime, option No. 1 for student loan forgiveness is having a job that serves the public good. If youre a teacher or police officer or firefighter or social worker or health care worker or government employee who kept up with payments for 10 straight years, youve got a good shot. If you are a sign spinner or pet psychic, forget it.

Option No. 2 is through a repayment plan that is based on your income. You will still have to pay a large chunk of your debt over a long period, but under the current laws, a portion will be forgiven at the end.

Those options are available for federal student loans.

Option No. 3 is called a discharge and its available for federal or private loans, but you probably dont want to go there. A discharge is when you cant repay the loan for a variety of reasons, like death, disability, fraud, identity theft or bankruptcy.

Other Options For Managing Student Loan Debt

As with any loan, making payments to avoid piling interest is the way to financial health. Setting up a plan, such as a budget that sets aside a certain amount of money every month and directs it into a separate savings account not linked to your main banking accounts, can help build up the funds necessary to finally pay off the student debt you owe.

Also Check: How Much Business Loan Can I Get

You Have Options If You Were Denied Pslf

If your application for PSLF was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

This TEPSLF opportunity is temporary, has limited funding, and will be provided on a first come, first served basis. Once all funds are used, the TEPSLF opportunity will end.

Visit StudentAid.gov for detailed information on how to be reconsidered for loan forgiveness.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Do Mortgage Loan Officers Do