Who Is My Student Loan Servicer

Your student loan servicer is the company that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When you make a payment toward your student loan, it is managed by your loan servicer.

Student loan servicers work with borrowers to help manage their student loan repayment. If borrowers would like to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer first.

Borrowers do not choose their loan servicer, but rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Education.

Below are nine loan servicers that currently manage federal loans, plus an additional loan servicer that deals with default resolution though be aware that this list may soon change.

Originally, the Department of Education had planned to change its roster of servicers in 2020, but while some new contracts have been announced, the only change as of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be one of the companies on the list above. Note also that your loan servicer can change during the life of your loan, so make sure to check your student loan accounts for the most current information.

Find Out How Much You Owe Even If You Forgot Your Lenders

It can be easy to lose track of all of your student loans and your total balance, especially when you’re busy in college. Many students receive multiple small loans per semester, which can be a mixture of federal student loanssuch as Perkins, Stafford, and PLUSand private student loans. While your school financial aid office may be able to help you find some basic facts and figures, there are other effective ways to find out your total student loan balance.

How Do I Register For A Nelnetcom Account

You May Like: Usaa Auto Refinance Phone Number

Explore Your Student Loan Repayment Options

You will receive a package in the mail from the National Student Loans Service Centre that details how much you owe, your proposed monthly payment, and the confirmed interest rate on your loan. It is your responsibility to set up a repayment schedule. Otherwise, your loan repayments will be automatically withdrawn from the account in which your loan was deposited.

Supports For Students Affected By Wildfires

Are you affected by the current wildfire situation? Do you need help with your student loan payments?

- If you have Canada loans, or Canada and Alberta loans, contact the National Student Loans Service Centre to fast track your application for the Repayment Assistance Plan.

- For Alberta Student Loans, call 1-855-606-2096

Currently in School

If your studies have been disrupted as a result of the wildfires, and you have:

- Extended your study period

- Withdrawn from studies, or

- Your financial circumstances have changed.

Notify the Alberta Student Aid Service Centre, or login to your Student Aid Account and submit a Request for Reconsideration. Eligible students may receive up to $7,500 in Alberta Student loan funding to help cover unexpected costs relating to the wildfire. Supporting documentation may be required to verify the costs.

Don’t Miss: How To Transfer A Car Loan

Do Parents With Parent Plus Loans Get A Grace Period

Although Parent PLUS Loans dont have a grace period, borrowers with PLUS Loans disbursed on or after July 1, 2008, might be eligible to postpone payments while the parent or student is in school and up to six months after graduation or when they drop below half-time enrollment status. For more information about Parent PLUS Loans, including the option to postpone payments, see Stages of a Student Loan.

What Is A Grace Period

This is a six-month period of time after youve left school before youre required to start making payments on your Direct Subsidized and Unsubsidized loans. For graduate and professional students with Grad PLUS loans, you have a similar six-month deferment period after leaving school before you begin repayment. For more information about grace and other stages in a student loan life cycle, see Stages of a Student Loan.

Recommended Reading: Va Manufactured Home Loans

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through September 30, 2021.

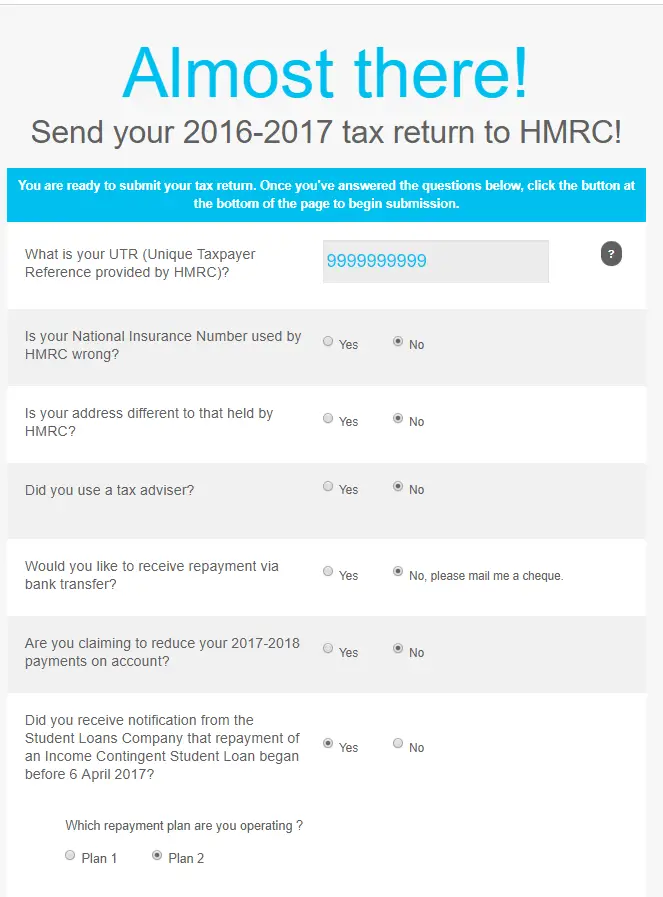

What Information Will I Need About My Student Loan To File My Federal Tax Return

To file your federal tax return, you will need the amount of interest you paid on your student loan during the prior year. You may be able to deduct some or all of your paid interest from your income, which could reduce the amount you owe in income tax. To determine how much of your paid interest may be deducted, we recommend that you contact your tax advisor refer to IRS Publication 970, Tax Benefits for Education or use the Student Loan Interest Deduction Worksheet in your Form 1040 instructions.

You can find the amount of interest you paid on your IRS Form 1098-E, on your monthly billing statement sent in January and/or February, through the automated telephone system, or by logging in to your Nelnet.com account. If you have more than one loan account, the amount of interest you paid is provided separately for each account. To determine the total amount of interest paid for all of your loans, add the amount you paid for each account.

To file your taxes, you dont need IRS Form 1098-E. If you want a copy of your student loan interest paid information for your records, see below for more information on how you can find out how much interest you paid last year.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How Do I Make A Payment Online

Just follow these steps:

I Am A Member Of The Us Military Am I Eligible For Any Special Federal Student Loan Benefits

Nelnet is grateful to those who serve or have served our country, and we recognize the sacrifices you have made. As a member of the U.S. military, youre entitled to special benefits provided by the U.S. Department of Education and the U.S. Department of Defense. To learn more about these benefits, see Resources for Servicemembers.

You May Like: How To Find Student Loan Number

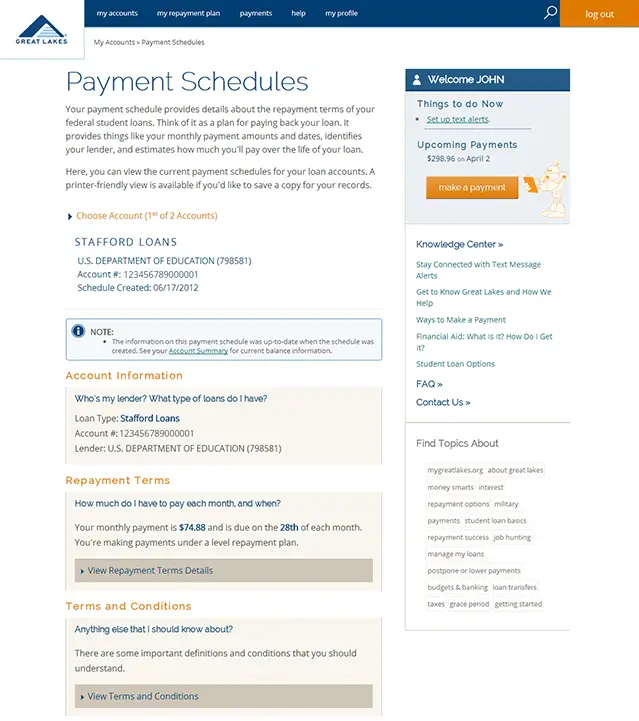

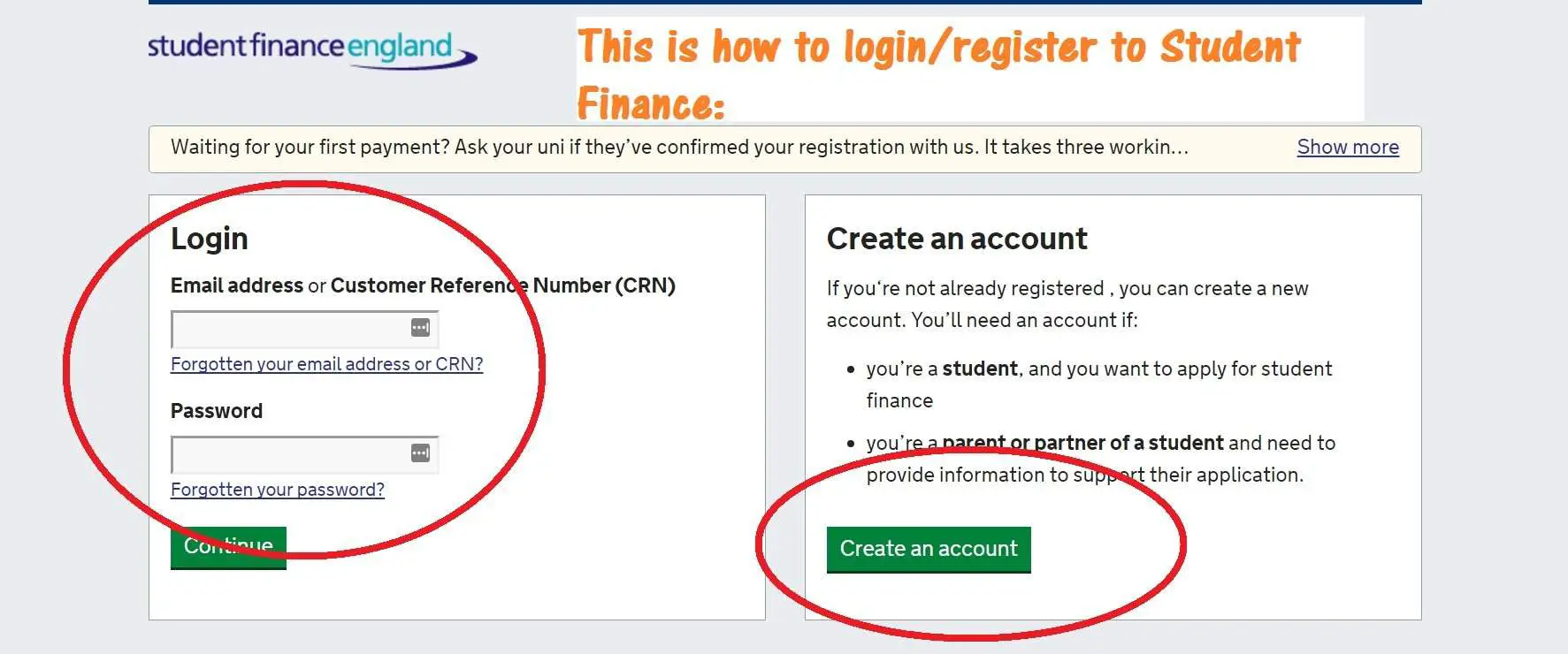

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.

Resolve Student Loan Disputes

If you and your loan servicer disagree about the balance or status of your loan, follow these steps to resolve your disputes:

1. Talk with your loan servicer

You may be able to solve a dispute by simply contacting your loan servicer and discussing the issue. Get tips on working through an issue with your loan servicer to resolve the dispute.

2. Request help from the FSA Ombudsman Group

If you have followed the guide and still cannot resolve your issue, as a last resort, contact the Federal Student Aid Ombudsman Group. The FSA Ombudsman works with student loan borrowers to informally resolve loan disputes and problems. Use FSA’s checklist to gather information youll need to discuss the dispute with them.

Recommended Reading: Aer Allotment

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, you’ll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

Will The Total Amount I Have To Repay Stay The Same If I Change Repayment Plans

In most cases, choosing a different repayment plan will change the amount of your monthly payment. The amount you repay each month determines how quickly you pay down your principal balance. Interest accrues based on the principal balance of your loan. Lowering your monthly payment by choosing a repayment plan that offers a longer term will increase the amount of interest you accrue, costing you more money in the long run. For more information, see How Is Student Loan Interest Calculated?.

Also Check: How To Get An Aer Loan

Is There A Fee For Changing My Repayment Plan

No. There is no charge for changing your repayment plan. Please note, if your loan is on the Income-Based Repayment Plan and you wish to change your repayment plan, federal regulations require you to make one scheduled payment on the Standard Repayment Plan or in a Reduced Payment Forbearance after exiting IBR before you may change plans.

Any unpaid interest that accrued while you were on the IBR Plan will be added to your principal balance when you exit the IBR Plan. For more information about interest capitalization and its effect on your loan balance, see Interest Capitalization.

Which Teachers Qualify For The Teacher Loan Forgiveness Program

If you teach full time for five consecutive, complete academic years at certain schools and educational service agencies serving low-income families, the Teacher Loan Forgiveness Program may forgive as much as $17,500 of your federal student loan principal and interest. Qualifying loans include subsidized and unsubsidized Federal Family Education Loan Program and Direct Loans. Portions of consolidation loans may qualify. Visit StudentAid.gov for more information and to see which schools and agencies qualify.

Don’t Miss: Does Va Loan Work For Manufactured Homes

What Do I Do With My 1098

You’ll have one 1098-E for each account listed on your Account Summary.

To file your taxes, you don’t need a physical copy of your 1098-E. Check with a tax advisor to determine how much of the interest paid on your student loans in the previous year is tax deductible. If you have more than one account, you’ll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return.

If you want a physical copy of your 1098-E for your records, just print it out from our website. It’s as easy as that!

Checking Your Private Student Loan Balances

Each private student loan lender handles them differently theres no national database for private loans. If youre unsure where to start, use these tips:

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Will Changing Repayment Plans Or Postponing My Payments Using A Deferment Or Forbearance Hurt My Credit History

No. The type of repayment plan used to repay a student loan is not reported to the consumer reporting agencies. Using a deferment or forbearance for your student loan will not adversely affect your credit history. Making a late payment could impact your credit history, so let us know immediately if you have trouble making a payment we can help!

What Is A Deferment

A deferment is an authorized temporary suspension of repayment that can be granted under certain circumstances. To get a deferment, you must apply for it, meet the qualifications, and make arrangements with the servicer of your loan. Depending on your loan type, interest may continue to accrue during a deferment, and any unpaid interest will be capitalized at the end of the deferment. While not required, you can continue making payments without penalty even if no payment is due, which will reduce your total cost of borrowing and save you money in the long run.

Recommended Reading: How Much To Loan Officers Make

Why Didnt I Receive An Irs Form 1098

An IRS Form 1098-E is only mailed to borrowers who paid $600 or more in student loan interest in the previous year if they are not in a repayment status or they do not have an active Nelnet account . Borrowers in a repayment status, who paid any amount of interest in the previous year, will see their IRS 1098-E information on their monthly billing statement sent in January and/or February according to their correspondence preference in our system.

Regardless of your loan status and the amount of interest you paid, you can also obtain your IRS 1098-E information when you log in to your Nelnet.com account or through our automated phone system.

How Do I Find My Student Loan Account Number To Verify My Identity For The Irs

Check with the lender from whom you have the student loan. Wouldn’t it be on the information you use when you make your payments? Look on the loan website.

If you are trying to enter student loan interest you paid you need your 1098E.

STUDENT LOAN INTEREST

Only the person whose name is on the student loan and who is legally obligated to pay the loan can deduct the student loan interest. If you co-signed then you are legally obligated to pay if the primary borrower defaults or does not pay. If you did not sign or co-sign for the loan you cannot deduct the interest.

You cannot deduct student loan interest if you are being claimed as someone elses dependent, or if you are filing as married filing separately.

The student loan interest deduction can reduce your taxable income by up to $2500

There is a phaseout for the Student loan interest deduction, which means the amount you can deduct gets reduced when your modified adjusted gross income hits certain income levels and is even eliminated at certain income levels –

If your filing status is single, head of household, or qualifying widow, then the phaseout begins at $65,000 until $80,000, after which the deduction is eliminated entirely.

If your filing status is married filing joint, then the phaseout beings at $130,000 until $160,000, after which the deduction is eliminated entirely.

Enter the interest you paid for your student loan by going to Federal> Deductions and Credits> Education> Student Loan Interest Paid in 2020

Also Check: Does Va Loan Work For Manufactured Homes