Check Your Mortgage Eligibility

Estimating your DTI can help you figure out whether youll qualify for a mortgage and how much home you might be able to afford.

But any number you come up with on your own is just an estimate. Your mortgage lender gets the final say on your DTI and home buying budget.

When youre ready to get serious about shopping for a new home, youll need a mortgage pre-approval to verify your eligibility and budget. You can get started right here.

Popular Articles

What Is A Good Dti Ratio

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

How Much Should Your Debt

Whether you are taking out a mortgage for the first time or refinancing a loan you already have, lenders examine your DTI to assess the level of risk they will incur by lending to you. Typically, the higher your DTI the riskier you are to lenders, because it indicates you may be less financially able to make your mortgage payments. In turn, this can affect how much lenders are willing to let you borrow and at what interest rate.

Lenders usually prefer conventional loan borrowers to have a debt-to-income ratio of 36% or below meaning roughly a third of your gross monthly income goes toward fixed debt payments and the rest is yours to spend on remaining wants and needs. Depending on the state of your financial health in other aspects, like your , you may qualify for a loan with a DTI up to a maximum of 50%. Loans backed by the government, like FHA loans, typically accept borrowers with DTI ratios up to 43% and may go up to 57% in certain cases.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How To Qualify With A High Dti

If you have a DTI above 43%, you may find it more difficult to qualify for a mortgage loan. And if you are approved, your loan may be subject to additional underwriting that can result in a longer closing time.

Overall, higher DTI ratios are considered a greater risk when an underwriter reviews a mortgage loan for approval.

In some cases, if the DTI is deemed too high, the lender will require other compensating factors to approve the loan, explains DiBugnara.

He says compensating factors can include:

- Additional savings or reserves

- Proof of on-time payment history on utility bills or rent

- A letter of explanation to show how an applicant will be able to make payments

A higher credit score or bigger down payment could also help you qualify.

Cook notes that, for conventional, FHA, and VA loans, your DTI ratio is basically a pass/fail test that shouldnt affect the interest rate you qualify for.

But if you are making a down payment of less than 20 percent with a conventional loan, which will require you to pay mortgage insurance, your DTI ratio can affect the cost of that mortgage insurance, adds Cook.

In other words, the higher your DTI, the higher your private mortgage insurance rates.

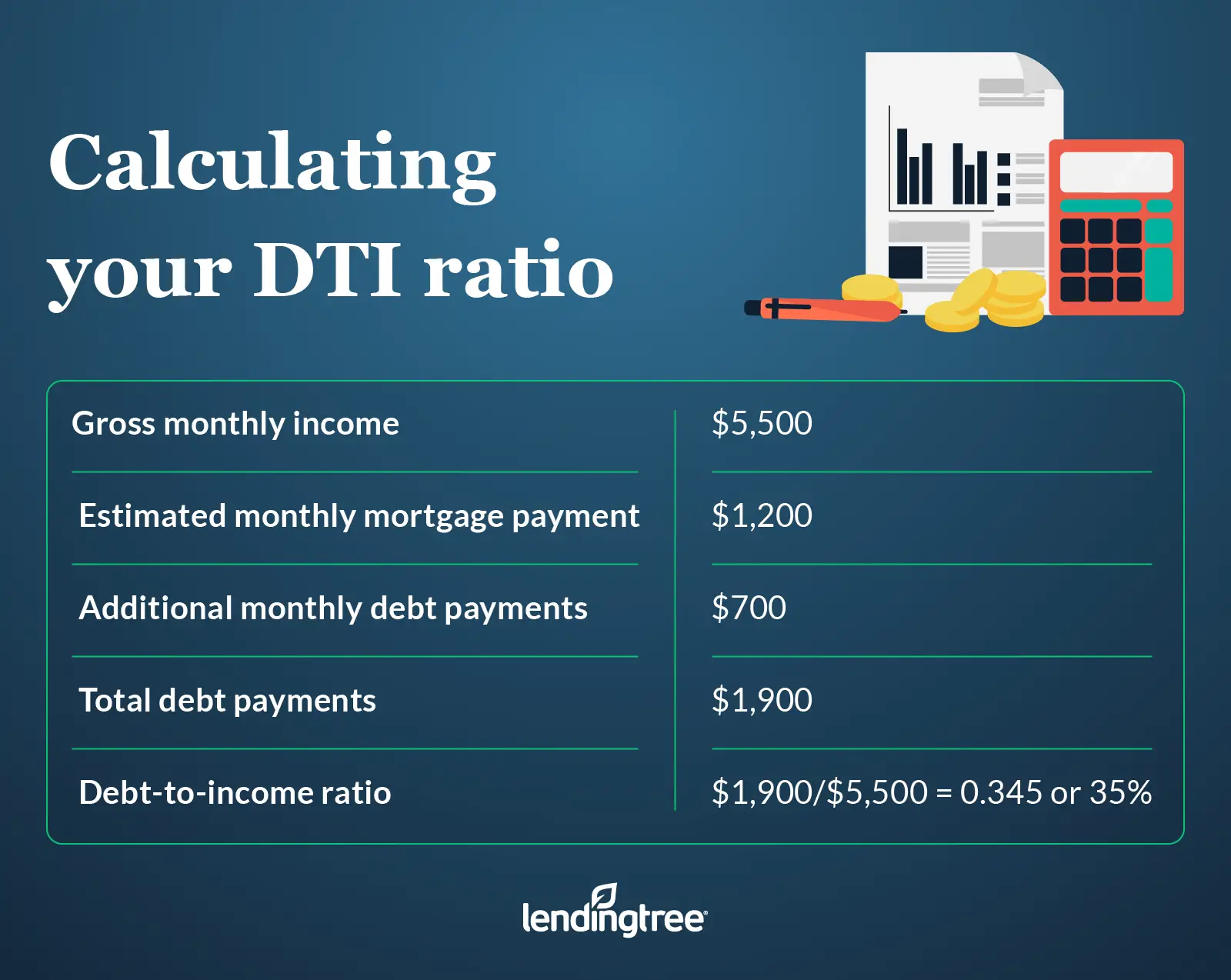

Convert Your Answer To A Percentage

The final result is your debt-to-income ratio.

Lets work through an example. Assume you pay rent at a monthly rate of $1,000, a car payment of $400 and a minimum credit card payment of $150. Lets also assume that you have a gross monthly income of $5,000. Your debt-to-income ratio is $1,550 divided by $5,000, which equals .31 . Lenders consider those with a lower DTI to present a lower credit risk. Not only will you more likely be preapproved, youll also likely qualify for a lower interest rate. The lower your DTI, the less credit risk you are to lenders.

Don’t Miss: Fha Loan Limits Texas

Make A Plan To Reduce Your Debt

Once youve identified those savings, make a plan to reduce your debt. There are a variety of popular approaches to this, and two of the most popular trends involve snowballs and avalanches. The snowball method suggests paying off your smallest debt first and working your way up to your largest. The avalanche method posits that it is better to tackle your highest-interest debt first. Either way, the result is the same. Your debt gets paid off more quickly, and you save money and lower your DTI.

% Cutoff For Mortgage Loans

When you do apply for a loan, most lenders today typically use 43% as a cutoff. Anything higher and you automatically cant get a qualified mortgage. You can figure out how much of your income is 43% by performing a simple equation.

Take your monthly pre-tax income figure and multiply it by 0.43. The number you get is the maximum amount of debt obligations you may have in order to qualify for a mortgage.

If you want to be more conservative, multiply your monthly earnings by 0.36. This is especially true if youre in a higher tax bracket because youll lose more of your money to taxes before paying your bills.

Lets take a look at these calculations with a real-life example. Well use the same scenario as before: your monthly income is $4,000 before taxes are taken out. For a 36% DTI ratio, your credit cards and loan obligations should total no more than $1,440 each month.

To qualify for a mortgage with a maximum 43% DTI and the same monthly income, your mortgage and other debt shouldnt exceed $1,720 each month. Try the math using your own financial information and see where you fall.

You May Like: Va Loan For Modular Home And Land

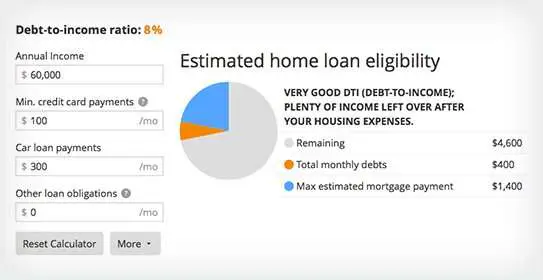

How To Calculate Your Dti Ratio

total monthly debt payments divided by monthly income = debt-to-income ratio

1. Take your annual income and divide it by 12 to get your monthly income.

2. Add up your reoccurring monthly expenses such as:

- Minimum monthly payments on credit cards

- Auto loans

Note: To find your back-end DTI ratio add your monthly mortgage payment

3. Divide your monthly debt obligations by your monthly income to get your DTI ratio

For example: If your yearly income is $60,000 and your total monthly debt payments come to $1,000

$60,000 divided by 12 = $5,000

$1,000 divided by $5,000 = .2

= 20% debt-to-income ratio

Get Clarity On Your Dti With A Pre

At Better, we want you to be as prepared for buying a home and the mortgage process as possible.

Applying for a pre-approval takes as little as 3 minutes and will provide you with a clear picture of how much you can afford. Youll undergo a soft credit check that allows our underwriters to look at your debts, income, and credit in detail to obtain a more accurate picture of your DTI.

Although your DTI ratio is just one important factor to consider when buying a home, carrying less debt relative to your income will make it easier to get a mortgage and help ensure youll be able to afford your home for years to come.

Better Mortgage can help you understand your DTI and the financing options available to you. Start your pre-approval process today.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

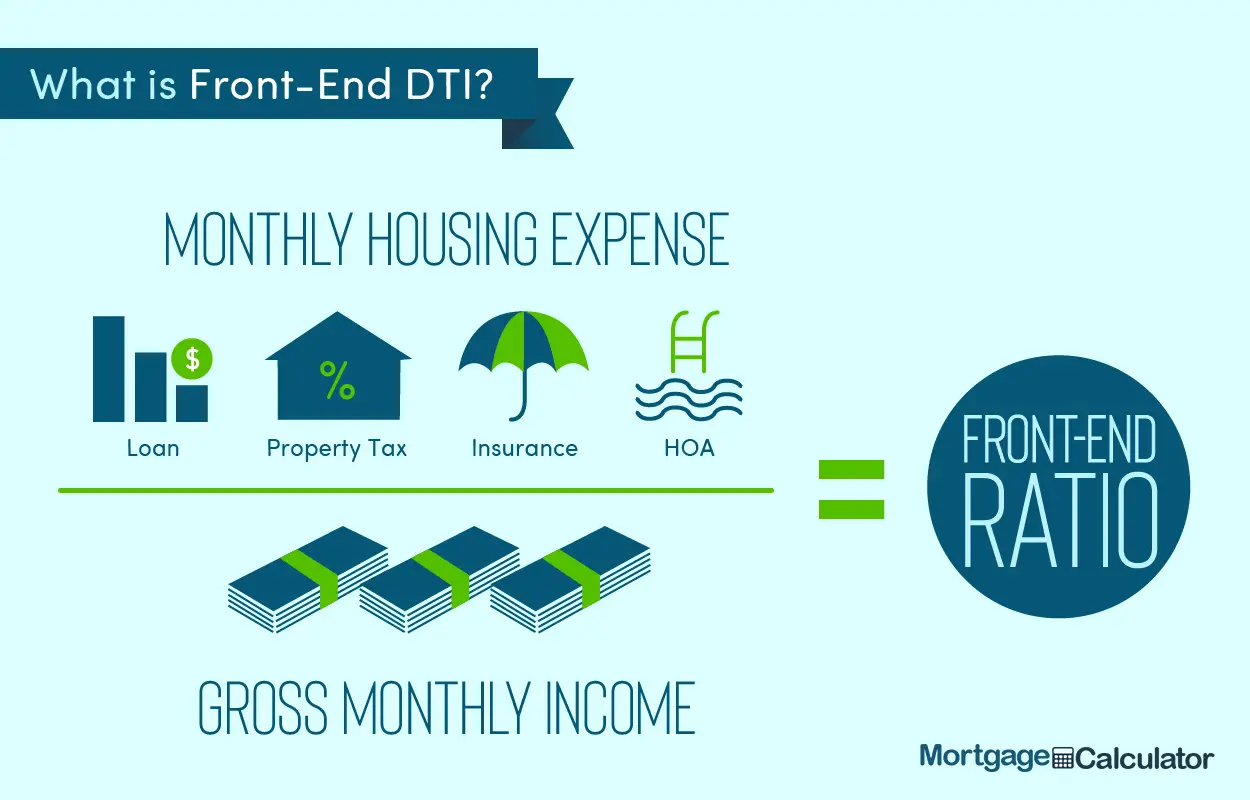

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

Recommended Reading: How To Get An Aer Loan

The Debt Ratio Isnt The Only Issue

Dont focus solely on your debt ratio, though. Yes, its a big deal, but not the only one. The lender looks at the big picture. Think of your credit score and your employment history. You could have the best debt ratio but the worst credit score. You wouldnt qualify in this case. You could also have the best debt ratio but not have consistent employment. Each of these factors plays a role in your ability to secure a loan.

Lenders want to know that you can afford the loan, but also that you have good habits. A low credit score shows that you dont pay your bills on time. It could also mean you overextend yourself. There are many variables that play into your credit score. The key is not focusing on one factor, but looking at the big picture.

Knowing how lenders calculate the debt to income ratio can help you get a head start. If you know your debt ratio is high, you can work it down. Start paying debts off or figure out how to increase your income. Maybe you need a 2nd job for a while. Youll need it for at least 6 months before a lender can use the income. But it might be just enough to help push you into the approval zone.

Tips To Lower Your Dti

If you arent happy with your current DTI, remember it isnt a fixed number, and you can lower it by either increasing your monthly income or decreasing your existing debt. Whether youre having trouble getting approved for a loan or are facing high interest rates, trying out these tips to reduce your DTI may help.

- Compare your credit card interest rates and pay down ones with the highest rates first.

- Use the 50/30/20 rules to create a budget you can stick to, that will help you manage your spending.

- Pay all bills on time to avoid piling on late fees.

- Get a side hustle like ridesharing, tutoring online, selling clothes in the resale market, or a part-time restaurant or retail position.

Read Also: Caliber Home Loans 1098 Form

How To Lower Debt

The only way to bring your rate down is to pay down your debts or to increase your income. Having an accurately calculated ratio will help you monitor your debts and give you a better understanding of how much debt you can afford to have.

Avoid employing short-term tricks to lower your ratio, such as getting a forbearance on your student loans or applying for too many store credit cards. These solutions are temporary and only delay repaying your current debts.

How To Lower Your Dti Ratio

If youve run the numbers and youre concerned that your DTI isnt as low as youd like it to be, there are two main ways you can decrease it: reduce your debt or increase your income. Lowering your DTI can make the mortgage process go smoother, so it might be worthwhile if you have time before you apply for a new mortgage or refinance.

Here are a few DTI reduction strategies to consider:

-

Pay down or pay off your car loan before applying for your mortgage.

-

Start paying off your credit cards in full, one by one.

-

If possible, refinance or consolidate current loans to reduce your monthly payments.

-

Consider adding a co-borrower with a low DTI to your loan.

-

Pick up a side gig or part-time job to help pay down debt.

-

Expecting a raise or promotion in the next few months? Consider waiting to apply until it goes through.

-

Consider using some of your down payment savings to pay down debt. Just make sure youll meet down payment guidelines, which can be as little as 3% to 5%.

Also Check: What Is Chfa Loan Colorado

Tips To Keep Your Debt

Are you worried that your debt-to-income ratio will make you ineligible for a mortgage loan?

You can follow these tips to lower your DTI and improve your chances of mortgage approval:

Even if your DTI is within the good range for mortgage qualifying, it doesnt hurt to try to lower it before you apply.

The lower your existing debts, the more youll be able to spend on your mortgage.

Working to improve your debt-to-income ratio before you apply for a home loan can make you eligibile for a bigger, more expensive home.

Why Is Your Dti Ratio Important

A DTI is often used when you apply for a home loan. Even if youre not currently looking to buy a house, knowing your DTI is still important.

First, your DTI is a reflection of your financial health. This percentage can give you an idea of where you are financially, and where you would like to go. It is a valuable tool for calculating your most comfortable debt levels and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If youre interested in applying for a credit card or an auto loan, lenders may use your DTI to determine if lending you money is worth the risk. If you have too much debt, you might not be approved.

Recommended Reading: Genisys Credit Union Auto Loan Calculator

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Want To Improve Your Debt

The only way to really improve your debt to income ratio is by giving debt the bootfor good. How? Ramsey+ is your one stop shop for helpful content, tools, and the step-by-step plan to stop the cycle of debt. Theres never been a better time to improve your financial standing. Get started with your 14-day free trial today.

Also Check: How Does Paypal Business Loan Work

Mortgage Approval: Whats Behind The Numbers In Our Dti Calculator

Your debt-to-income ratio matters when buying a house. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. DTI is calculated by dividing your monthly debt obligations by your pretax, or gross, income.

In most cases, lenders want total debts to account for 36% of your monthly income or less. Nonconventional mortgages, like FHA loans, may accept higher a DTI ratio, but conventional mortgages may not be as flexible.

Lenders consider low DTI as important as having a stable job and a good credit score. When evaluating your mortgage application, DTI tells lenders how much of your income is already spoken for by other debts. If the percentage is too large, its a clue you may have trouble paying your monthly mortgage payments, and lenders will be reluctant to approve your loan.

Hate surprises? Estimating your DTI with the NerdWallet calculator before submitting your mortgage application can help you understand how much house you can afford.

How To Calculate Your Dti

To determine your debt-to-income ratio , start by adding up all your monthly debt payments.

Monthly debts for DTI include:

- Future mortgage payments on the home you want

- Auto loan payments

- Groceries

- Other non-debt expenses that dont appear on your credit report

Next, divide the sum of your debts by your unadjusted gross monthly income. This is the amount you earn every month before taxes and other deductions are taken out otherwise known as your pre-tax income.

Then, multiply that figure by 100.

* 100 = Your DTI

For example, say your monthly debt expenses equal $3,000. Assume your gross monthly income is $7,000.

$3,000 ÷ $7,000 = 0.428 x 100 = 42.8

In this case, your debt-to-income ratio is 42.8% just within the 43% limit most lender will allow.

Front-end DTI vs. back-end DTI

Note that lenders will examine your DTIs front-end ratio and back-end ratio.

Your front-end ratio simply looks at your total mortgage payment divided by your monthly gross income, says Cook.

Most lenders want to see a front-end ratio no higher than 28%. That means your housing expenses including principal, interest, property taxes, and homeowners insurance takes up no more than 28% of your gross monthly income.

But in most cases, says Cook, the front-end debt ratio is not the number that matters most in underwriting. Most loan underwriting programs today primarily look at the back-end debt ratio.

Recommended Reading: How Do I Find Out My Auto Loan Account Number