How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

What Determines Your Interest Rate On A Car Loan

Interest rates are not the same for every person and are determined based on several factors. Here are some of the things that may affect your interest rate when financing your vehicle:

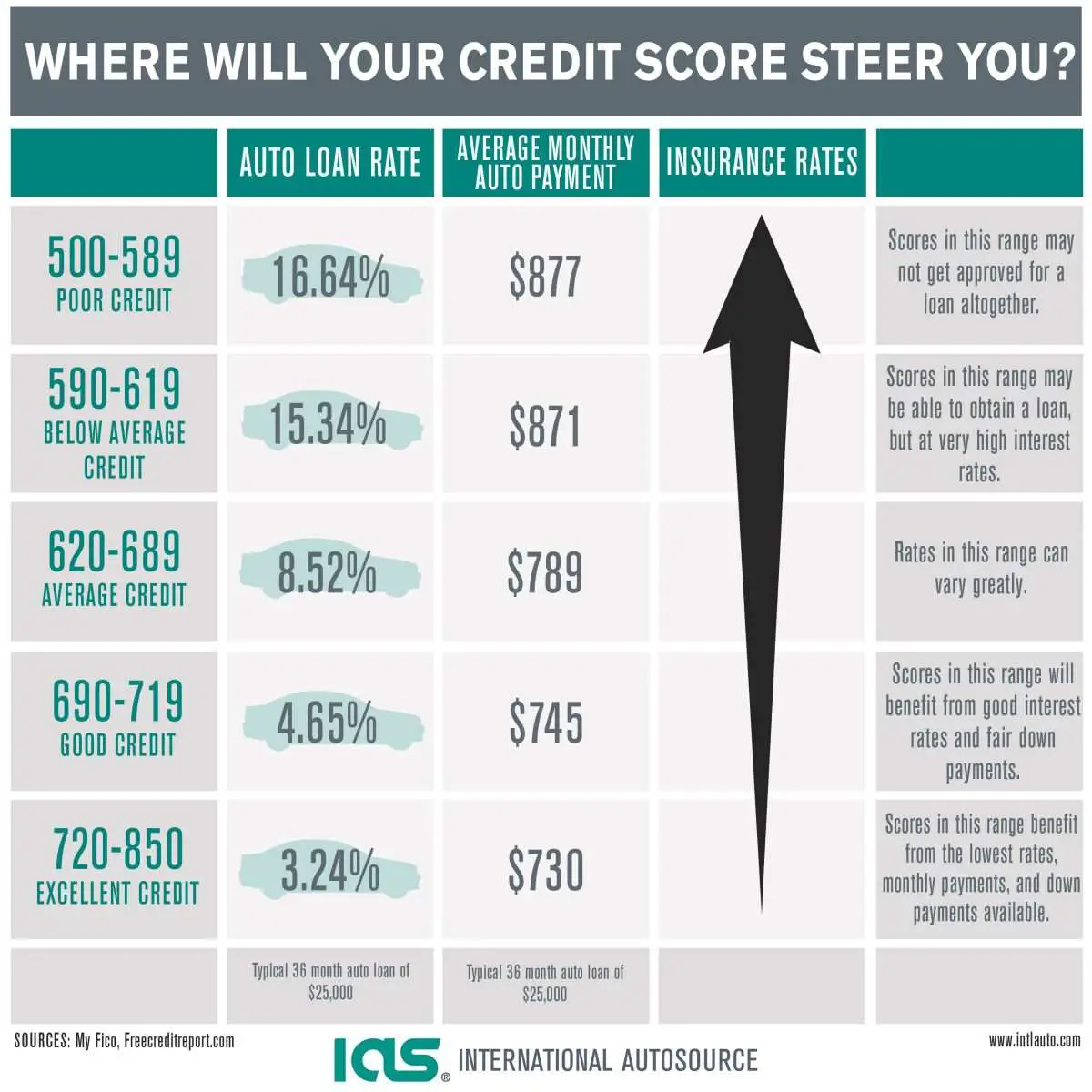

Typically, the higher your credit score, the lower your interest rate will be. Thats because a high credit score indicates that you have a good history of paying off your debts on time, so youre a less risky borrower. If youd like to check your credit score, you can use Chase Credit Journey to find your score for free without hurting your credit.

The vehicle

The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles usually have a higher interest rate.

Loan term

Longer loan terms tend to have higher interest rates than short-term loans. So, while you will have to pay a higher amount each month on the principal, with a short-term loan , you may save a lot of money on interest.

Lender

Interest rates vary. You should compare interest rates from several lenders to see which ones offer the best prices. You can also finance your vehicle through the vehicle manufacturer whose rates may be different.

Buying Used Could Mean Higher Interest Rates

Buying a new car may be more expensive, all in all, than buying used. But, new and used auto loan interest rates are significantly different, no matter your credit score. Based on Experian data, Insider calculated the difference between new and used interest rates. On average, used car financing costs about four percentage points more than new financing.

| Super Prime | 1.31% |

The gap between how much more a used car costs to finance shrinks as credit scores increase, but even for the best credit scores, a used car will cost over 1% more to finance than a new car.

Used cars are more expensive to finance because they’re a higher risk. Used cars often have lower values, plus a higher chance that they could be totaled in an accident and the financing company could lose money. That risk gets passed on in the form of higher interest rates, no matter the borrower’s credit score.

Recommended Reading: Wells Fargo Auto Loan Application

Penfed Credit Union Reviews

PenFed is not accredited by the Better Business Bureau and is not currently rated by the organization.

Customer ratings for PenFed Credit Union are among the highest in our research. The organization has an impressive 4.6-star rating out of 5.0 on Trustpilot. Customer ratings are considerably lower on the BBB website, however, where reviewers give PenFed nearly 1.2 out of 5.0 stars.

Positive reviews consistently mention a smooth and easy loan application process and low rates. Customers reporting negative experiences tend to mention slow processing times for loan applications.

Our team reached out to PenFed Credit Union for a comment on these reviews but did not receive a response.

Consider An Extended Warranty

On a related note, if you purchase an extended auto warranty through a dealership, the cost can often be rolled into your monthly car payment. However, that will increase your loan amount and the total interest you pay. It can be a better idea to purchase a standalone vehicle service contract a bit later on if you want to save money and keep your car protected.

Also Check: How To Qualify For Fha Loan In Ga

How Do I Get A Car Loan

The idea of getting a used car rates loan can be somewhat intimidating, especially to first-time buyers. However, you can easily start the process online by researching different lenders and credit unions products and services. To apply for an auto loan, you need the following documents and information:

- drivers license or ID

- social security number

- 5 years – 4.37%

- 6 years – 4.45%.

Obviously, over time, the external market value of a used car will gradually decrease, so you risk overpaying to the lender more than half of the price of your purchase.

Final Thoughts On Auto Loans

Whenever you need a vehicle but cant afford to pay in cash at the dealership, an auto loan may be a move in the right direction.

Both financial responsibility and the trustworthiness of the borrower are highly valued by lenders when it comes to securing auto loans, so understand whats at stake when signing the paperwork.

While reading over the fine print, make sure what youre signing only entails negotiated terms you agreed to. This is a foolproof way to avoid any unforeseen costs when you least expect it.

Once you compare quotes from different lenders, understand the major factors affecting auto loan approval, and recognize other associated costs, you can confidently approach the dealership lot.

If youre still not sure if an auto loan is right for you, determining your debt-to-income ratio and current credit standing is a good place to start.

Read Also: How To Check Credit Score For Home Loan

You Are Leaving Summit Credit Union

Please read the following before proceeding to:

The website you are about to visit is solely the responsibility of the merchant or other party providing the site. The content of this third-party site, including materials and information, is solely the responsibility of the provider of the site. The Credit Union is not responsible for any such third-party content. Any transactions that you enter into with a vendor, merchant or other party that you access through this third-party site are solely between you and that vendor, merchant or other party. The Credit Union does not endorse the content contained in this third-party site, nor the organization publishing the site, and hereby disclaims any responsibility for such content. The Credit Union Privacy Policy does not apply to this third-party site, and for further information you should consult the privacy disclosures of the third-party site.

Auto Loan Ontario Is The One Stop Auto Loan Company With Solutions For All Credit Situations

Once you complete ouronline credit application, you’ll get personal attention from our Ontario financial experts so that they can understand your individual personal situation and work hard to get you the lowest interest rate available and ensure that you can have a comfortable and affordable monthly payment for the vehicle you want!Let Auto Loan Ontario, the automotive financing experts easily walk you through the vehicle loan process and all the options available to you for your next automobile purchase so that you make an informed educated decision. We know how to get you the most money and the best interest rates. We’ve helped people with:

| Ontario No Credit Car Loans |

| Bad Credit Vehicle Loans |

Read Also: What Is My Auto Loan Credit Score

How We Chose Our Picks

We examined closed LendingTree auto loans from H1 2022. We wanted to know: 1) which lenders consumers chose most often, and 2) which ones offered the lowest average APR. We also looked at the advertised starting car loan rates of large, national lenders to compare.

To find the best rates for those with military connections, we looked at rates offered by USAA Bank, Navy Federal Credit Union, Pentagon Federal Credit Union and Randolph-Brooks Federal Credit Union, and chose the one with the lowest advertised APR for a traditional new car loan not including any other discounts that may be available, such as breaks for using a car-buying service.

Auto Loan Ontario Provides Canadian Bad Credit Car Loans

If you need a car loan or truck loan in Ontario you have found the best loan company in Ontario! Why go to a car dealer and try to get approved? Get Pre-Approved for your Ontario car loan before you ever leave your home or office. This gives you the power to choose the vehicle of your choice that is affordable for your budget and suits your needs and lifestyle.

Stop spending money on frustrating expensive vehicle repairs fixing that old car or truck you may be driving…you are wasting your money. Don’t let past credit issues hold you back from upgrading your old tired automobile to a new or newer vehicle. Now you can get approved for a car loan in Ontario from the comfort of your home or office with your privacy assured. Don’t settle for less just because you have bad credit, have a bad credit rating, no credit, bankruptcy or collections. No application denied!!

Recommended Reading: How To Private Sale Car With Loan

Get Your Own Financing

If paying cash for a new or used car isn’t an option, then skip the dealership financing and shop around for your own car loan. That way, you can take your time to find the best rate — not just what the dealer offers — and you can be clearer about the terms and cost of your financing.

Also, take some time to understand what your car loan interest rates will be like so you can be ready for the expense.

How Can I Get The Best Auto Loan Rate

To get the best auto loan rate you should:

- Shop around for rates and compare your credit union with what the dealer is offering.

- Pay your bills on time.

- Have consistent employment with a low debt-to-income ratio.

- Price shop cars some vehicles that dealers want to get rid of will come with a special rate.

Recommended Reading: Low Interest Rate Student Loans

Analyze The Total Loan Amount

While sifting through miles and miles of auto loan quotes, its important to look at the big picture. In this case, the total loan amount youll be responsible for.

Yes, youll more than likely handle the loan through monthly payments, but the total loan amount determines the length of time youll pay installments.

The longer you stretch out your monthly payments, the lower rate youll experience. But, there is a small price to pay for lower rates inflated interest in the long term.

With longer monthly debt payments, your fiscal resources will steadily deplete, making it harder to save for retirement or supplement an emergency cash fund. Choose your battles wisely.

Best Auto Loan Companies

Below is a breakdown of the best auto loan companies with the lowest rates. PenFed Credit Union tops the list with the best new car loan rates, but if you are looking for used car loans or refinancing, other companies may suit you better. To help you find the best auto loan rates for you, we have outlined new and used car loan APRs, pros and cons, and details about each companys loan services.

Read Also: What Is The Best Student Loan Servicer

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You will need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you will use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Lowest Auto Loan Rates

| $7,500 to $100,000 | Not specified |

Be aware that the lowest rates are available for borrowers with the best credit. In other words, the minimum credit score is the minimum needed to qualify for auto financing from a lender, not to get the lowest interest rate. Also, interest rates change frequently. The information presented here is current as of the time of publication.

Don’t Miss: What Can You Use Sba Disaster Loans For

Stick To A Strict Budget

This means simply creating a realistic budget for you and your family and dont stray from it. Lenders shouldnt work the numbers behind the scenes make the numbers work for you.

Some people like to go the old-fashioned route with pen and paper, but others prefer the convenience and reliability of an Excel sheet.

Not only should you be calculating the total loan amount, estimated monthly payments, and interest rates, but also your current debt-to-income ratio.

Your debt-to-income ratio is exactly what it sounds like the amount of monthly income you must allocate toward various debt payments, such as college debt or a mortgage.

Therefore, if you see an imbalance in this ratio, you may want to hold off on an auto loan.

Compare The Best Auto Loan Rates

| Lender | |||

|---|---|---|---|

| LightStreamBest Online Auto Loan | 3.99%* with Auto Pay & Excellent Credit | $5,000 to $100,000 | |

| Bank of AmericaBest Bank for Auto Loans | 3.59% | ||

| Consumers Credit UnionBest Credit Union for Auto Loans | 2.49% | ||

| Chase AutoBest for Used Cars | Not Advertised | ||

| myAutoloanBest for Bad Credit | 1.90% | ||

| CarvanaBest for Fair Credit | Not Advertised | Any Car They Are Selling | 36 to 72 months |

You May Like: How To Get Someone Off Your Car Loan

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Which Factors Impact Auto Loan Approval

Although more factors could be added to this list, the following are some of the most relevant you should be aware of:

- With bad credit, youre less likely to be approved for a loan in this competitive industry. Higher interest rates would also come with the territory, but every lender has specific criteria.

- Debt Load: Lenders know that if you already have mounds of debt, youll probably face some difficulty handling loan payments. Its best to tackle current debt before taking on any more.

- Loan Term: Similar to an insurance policys term, this is the amount of time borrowers are given to finalize the loan. Longer terms mean lower rates, but higher interest will catch up with you.

- Vehicle Type: A new cars shiny price tag usually equals high-interest rates. Pre-owned cars often entail lower principal, but depending on the dealer, new cars can lead to manageable interest rates.

You May Like: Where To Apply For Small Business Loan

What Is A Good Auto Loan Interest Rate

A good auto loan interest rate is usually 4% or lower, but typically the best auto loan rates are for new cars. According to the 2022 report from the National Credit Union Administration , the average 60-month new car loan from a credit union has an interest rate of 2.78%. From a bank, the average rate is 4.69%. So, if you find these rates or lower, you know youre getting a fair rate on your car loan.

Best For Bad Credit: Oportun

Oportun

-

Only available in 41 states

-

High interest rates

Having less-than-perfect credit shouldnt keep you from getting the car you need. While you shouldnt expect the low rates those with excellent credit receive, you can avoid overpaying with Oportun. Through this online lender, you can get a loan for a car that you purchase from an auto dealer or a private party. Since buying through a private party can be cheaper, this can save you big bucks over dealerships.

Oportun will lend to people with limited or no credit history. You should have proof of income to apply. Loan amounts can range from $300 to $10,000, so you can get the car you want. Best of all, Oportun does not require a hard credit check when prequalifying and checking rates. So, looking around wont hurt the score youre trying to fix. The application takes only a few minutes, is entirely online, and results in an instant decision. If you live in one of the states where Oportun is available, this is an excellent choice.

Read Also: Can I Get Student Loan Forgiveness

How Do I Apply

The most common ways to apply for a DCU Auto Loan are through our online application or in a branch. If you are already a DCU member, you can submit your application within Digital Banking under Offers. This will allow you to streamline your application, because you wont be asked for any information we may already have. Additionally, you could check to see if you are already preapproved for an auto loan.

If you have questions or need assistance submitting an application, you can contact our Consumer Loan Call Center at 800.328.8797 then select Option 3.