What Is A Good Interest Rate For A Car Loan

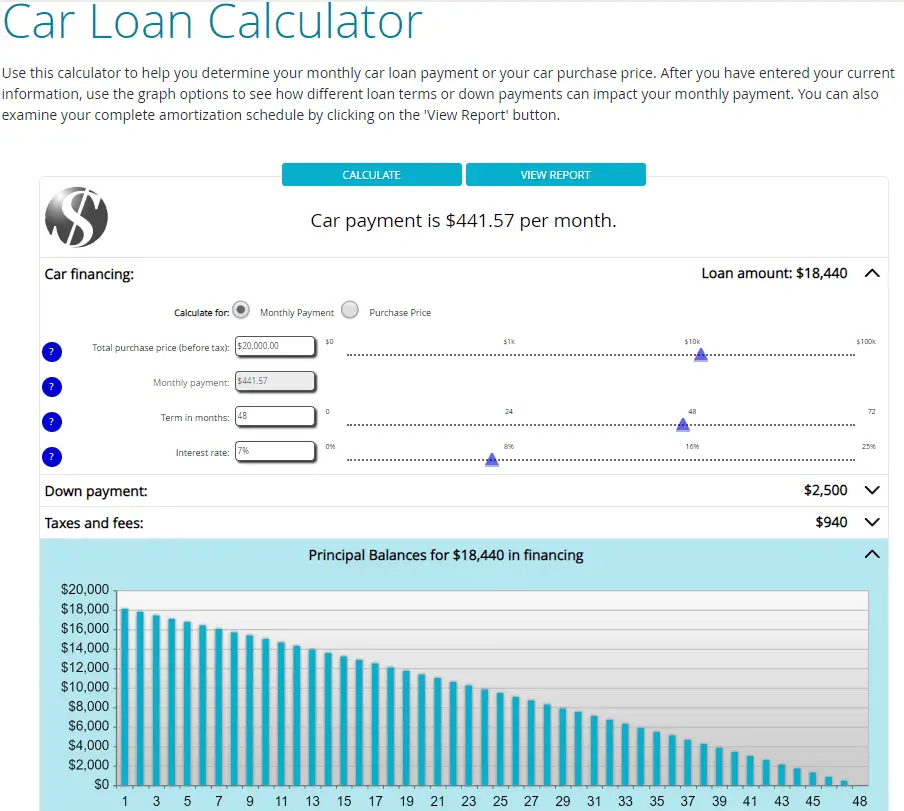

Interest rates vary depending on your credit score. The best rates are typically reserved for highly qualified applicants applicants with damaged credit receive higher rates. A good interest rate for a car loan, though, is one that allows you to finance a car with manageable monthly payments for your budget.

Here are interest rates you can expect for each credit score tier, according to Experian.

| Average loan rate for a new car | Average loan rate for a used car |

|---|---|

| Deep subprime | 14.39% |

| 4.29% |

What Credit Score Do You Need For Navy Federal Mortgage

620 or betterMinimum borrower requirements Navy Federal Credit Union generally follows Fannie Maes underwriting guidelines for conventional mortgages. That means youll typically need a credit score of 620 or better, a down payment of at least 5 percent and a debt-to-income ratio of no more than 43 percent.

Donât Miss: When Does Usaa Report To Credit Bureaus

Im Purchasing My Vehicle From A Private Third

Check with your state DMV to confirm taxes, fees and documentation needed to register and record Navy Federal as first lien holder on your vehicle title. In general, DMVs will require the title signed over to you by the seller, a Bill of Sale documenting the transaction and a copy of your promissory note .

You May Like: How To Pay Off Affirm Loan Early

How Navy Federal Auto Loans Work

Navy Federal offers financing for new and used cars, and it has options for refinancing your car. Apply on Navy Federal’s website, over the phone, or in person at a branch. In most cases, you’ll receive a decision on your application instantly.

Unlike many other lenders, you need to be a member of Navy Federal to apply for and receive an auto loan. You’re only eligible if you are an active military member or veteran, as well as an employee or retiree of the Department of Defense. Family members of any of the aforementioned groups also qualify.

Loan amounts range from $250 to $500,000 on new and used cars. The minimum you can borrow to refinance is $5,000, and Navy Federal doesn’t list a maximum.

Loan terms start at 12 months and maximum term lengths vary depending on the type of car you’re looking to finance. Your loan term for a new vehicle can be as long as 96 months, while used vehicles have a limit of 72 months. Keep in mind that the longer your loan term, the more likely you are to go upside down on your loan, meaning you owe more on your car than it’s worth.

Navy Federal’s rates vary depending on your term length, the model year of your car, and the number of miles on the vehicle.

The credit union has a mobile app in the and Apple Stores if you want to manage your loan on the go.

Schoolsfirst Federal Credit Union

SchoolsFirst Federal Credit union has partnered with companies like Autoland and Enterprise to bring customers exclusive savings. To become a member, you must be a current or retired school employee or part of their family.

Why it stands out: Along with all the different ways to save, SchoolsFirst also gives borrowers the option of requesting an auto convenience check, which will allow you to write a check for the vehicle at the dealer up to the approved loan amount. It also offers Guaranteed Asset Protection insurance with deductible assistance and options for no payments for 90 days.

Pros:

- Offers a school employees auto loan with Summers Off, which allows qualifying members to defer one or two consecutive auto loan payments during the summer

- Allows you to finance a car from a private seller

- Make no payments for the first 90 days

Cons:

- Summers Off program is only available on auto loans with original terms of 60 months or less

- Membership is restricted to members of educational communities

What to look for: SchoolsFirst Credit Union offers new and used auto loans from 36 to 84 months. APRs for new cars start at 2.49% and APRs for used cars start at 2.64%. Maximum loan amount is 100% of the MSRP or Kelley Blue Book Suggested Retail Value.

Don’t Miss: Can You Have More Than One Loan With Onemain Financial

How Do You Determine The Interest Rate On My Auto Loan

Your auto loan rate is based on your:

- length of the loan

- cars model year

| Collateral Titled in KY, MD, MN, MT, NY, & OK | Security Interest Filing or Copy of Title |

| Vessel/Boat Registered with U.S. Coast Guard | Copy of Preferred Ship Mortgage or Abstract of Title |

| Collateral Registered but Not Titled Due to State Regulation | Copy of State-Issued Registration or Copy of Bill of Sale |

| Aircraft | Copy of FAA Registration |

For a new or used vehicle or collateral located overseas, Navy Federal requires one of the following:

- Copy of Manufacturer’s Statement of Origin

- Copy of Military or Foreign Registration

- Copy of Bill of Sale

Bottom Line On Navy Federal Credit Union

A Navy Federal Credit Union auto loan or auto refinance loan can be a good choice for those who qualify for membership. Credit union members can take advantage of low APRs and lengthy loan terms. If youre not in the armed services or part of a military family, youll need to look elsewhere for a loan to finance your vehicle purchase.

Recommended Reading: What Can An Fha 203k Loan Be Used For

Conventional Fixed Mortgage Rates 6

Special Update for Mortgage Applicants: Due to a high volume of applications, it may take us longer than normal to respond. Were working to process applications to the best of our ability. Thanks for your patience.

| Term |

|---|

Rates as of Sep 16, 2022 ET.

Rates subject to change.

Rates are based on an evaluation of credit history, so your rate may differ. All Conforming and Jumbo HomeBuyers Choice rates quoted above require a 1.00% loan origination fee. The origination fee may be waived for a 0.25% increase in the interest rate. All Conforming and Jumbo HomeBuyers Choice loans are subject to a funding fee of 1.75% of the loan amount. This funding fee can be financed into the loan up to a maximum of 101.75% LTV, or the fee can be waived for a 0.375% increase in the interest rate. Purchase loans require no down payment. LTV restrictions apply to refinance loans.

Purchase loans require no down payment. LTV restrictions apply to refinance loans. Rates displayed are the “as low as” rates for purchase loans and refinances.

Navy Federal Refinance Rates & Fees

Navy Federal Credit Unions fixed rates are between 3.44% and 11.28%. Variable rates are between 3.23% and 10.61%. Note that the lowest rates always include the 0.25% interest reduction for enrolling in autopay.

In 2022, Navy Federals lowest available fixed rate for new loans has increased 15.1% while its highest fixed rate has declined 8.1% . The lowest available variable rate is up 100.6% and the highest starting variable rate has increased just 1.3% .

| 5.36% 10.61% |

Additional information about Navy Federal refinance rates:

- Checking your rate with Navy Federal will affect your credit score. They will conduct a hard, not soft, credit inquiry .

- Variable rates are based on the 90-day SOFR as published by the Federal Reserve Bank of New York two business days before the quarterly adjustment date.

- Variable rates are capped at 18.00%.

Don’t Miss: How To Trade In Car With Existing Loan

How Do Auto Loans Work From Credit Unions

Most credit unions that offer auto loans require loan applicants to have at least one stable career with the company they work for. By definition, this means that you have worked for a certain company for at least 12 months. Credit unions with gross monthly income are also exploring the possibility of hiring a loan applicant.

Donât Miss: Does Barclaycard Report To Credit Bureaus

Carfax Is A Registered Trademark Of Carfax Inc

Liberty Mutual Insurance is made available through the TruStage® Auto & Home Insurance Program. TruStage Auto & Home Insurance Program is made available by TruStage Insurance Agency, LLC. Coverage provided and underwritten by Liberty Mutual Insurance Company or its subsidiaries or affiliates, 175 Berkeley Street, Boston, MA 02116 USA.

To the degree allowed by regulation, candidates are separately endorsed not all candidates might qualify. A shopper report from a purchaser revealing office or potentially engine vehicle report will be gotten on all drivers recorded on your strategy where state regulations and guidelines permit.

Kindly counsel your approach for explicit inclusions and impediments. The protection offered isnt a store, and isnt governmentally safeguarded, sold, or ensured by Navy Federal Credit Union. Naval force Federal Credit Union empowers this protection program to be offered and is qualified for remuneration from TruStage Insurance Agency, LLC.

Naval force Federal Credit Union is not the slightest bit answerable for any items or administrations gave by or through TruStage, Liberty Mutual, or their members, auxiliaries, and insurance agency accomplices.

TrueCar works with the Navy Federal Car Buying Service. Naval force Federal isnt answerable for any buy, rent, or administration gave by or through the Navy Federal Car Buying Service.

Also Check: How To Obtain Home Improvement Loan

How To Apply For An Auto Loan

Follow these general steps to apply for an auto loan:

How Can I Send My Signed Promissory Note

Please sign the enclosed Promissory Note and return to Navy Federal via one of the following options:

- Email the document as a PDF attachment to . Include your name and Access Number in the subject line. Also provide your contact phone number and any additional comments you might have. You may send as an image from your smartphone but it may take longer to process.

- Send attachment through digital banking by signing into your account and selecting Messages, then choose Send us a message and select your loan number, or select New/Recent Application, then Vehicles and Other Loans.

- Drop off at any of our branches.

- Use the Secure Document Upload as an option for submitting any Consumer Loan documents. Visit , then complete the fields and submit the document. Youll receive a confirmation email that the document was received.

Recommended Reading: How Difficult Is It To Get An Sba Loan

Recommendations For Auto Loans

While Navy Federal Credit Union can be a solid choice for borrowers, its membership limits who can apply for an auto loan or refinancing. Shopping around for auto loan and refinance rates will allow you to find the best APR for your new or used vehicle. We recommend reaching out to myAutoloan and Auto Approve.

Current Promotions & Offers

Navy Federal Credit Union offers a 0.25% interest rate reduction to borrowers who enroll to make automatic payments. Members of the credit union can take advantage of special offers with Navy Federals partners, including discounts and cash bonuses from Navy Federal as well as from their partnering corporations and organizations.

Read Also: What Kind Of Loan For Home Improvement

Applying For A Loan W/ Navy Federal Credit Union

Whether youâre applying for an auto, mortgage, or personal loan, Navy Federal Credit Union has extremely competitive rates. The problem? You need great credit to get those loan terms . Your first step to determine if youâre eligible for top-tier rates is to pull your Credit Report.

You can review your Credit Report and find every inaccurate , or contact a Credit Repair company, like Credit Glory, to walk you through that entire process.

You can schedule a free consultation with Credit Glory, or call one of their Credit Specialists, here 412-6805â³ rel=ânofollowâ> 412-6805 â).

Who Is Eligible For Navy Federal Credit Union Auto Loans

Navy Federal Credit Union members can apply online for auto loan preapproval. However, members with poor credit scores should consider adding a co-signer to their application to increase their chances of being approved for the credit unions loan products.

To apply, youll need:

- Your phone number and email address

- Current housing information

- The dealership or sellers name

Recommended Reading: Can You Get Rid Of Student Loan Debt

Best Credit Unions For Car Loans

Overall, credit unions offer better auto loan rates than banks or dealerships, which can save you money now and over time. This is because credit unions are not driven by profit like banks are and do not count on making the most off the loans they approve.

Much like banks, decide to issue loans depending on your credit, your employment history and your income. However, credit unions are often more willing to work with people who have fair or poor credit scores less than 669 when it comes to auto financing.

What Credit Score Do You Need To Buy A Car

Your credit score influences your auto loans interest rate and total cost. Learn how you can lower the rate for your next car.

Posted May. 25, 2021

For many of us, owning a car is more than getting where we need to go. Its also about relaxing on the open road, listening to our favorite tunes and seeing the sights. Maybe youve already started looking at ads and reviews and figuring out what you can afford. But, is there more you should know besides features and sticker price?

Read Also: Does Getting Married Affect Your Credit Score

Don’t Miss: Should I Refinance My Va Home Loan

Navy Federal Credit Union Share Savings Account From Navy Federal Credit Union

Deposit Details

Pros & Cons

Highlights

- Join Navy Federal Credit Union as an active military member, military veteran, Department of Defense employee/retiree, or family member of any of the aforementioned groups

- 247 branches worldwide, including on select military bases

- Interest compounded monthly, paid monthly

- You’ll pay $3/quarter if you have no other Navy Federal accounts, AND your balance is under $50, AND your account has been inactive for 12 months

- Federally insured by the NCUA

Additional Reading

| 30 days to 7 years | 3 months to 7 years |

| Minimum opening deposit | |

|

|

| Types of CDs | Standard share certificates, Jumbo share certificates |

| Next steps | Learn more |

Nasa Federal Credit Union

Members of NASA Federal Credit Union include current and retired employees of NASA Headquarters, any NASA Center or Facility or NAS, plus employees or members and their families of one of NFCUs partner companies or associations. They offer flexible terms and low rates for new and used car financing as well as for auto loan refinancing.

Why it stands out: One of its features is the ability for members to apply online and get preapproved quickly. By having financing already in place, members have the advantage at the car dealership because they can focus on negotiating the car price instead of the loan terms.

Pros:

- No payment required for the first 60 days

- Check your rate with no impact to your credit score

Cons:

- Terms only extend to 84 months

What to look for: NASA Federal offers the same rates for both new and used vehicles. Rates start at 2.89% APR for up to 36 months and 2.99% APR for rates up to 63 months. Other rates and terms are available.

Don’t Miss: What Is Loan Forgiveness Program

How Much Does It Cost

For new and eligible used vehicles, a flat enrollment fee of $399 applies. You may pay this as a lump sum or finance it by rolling the amount into your loan. Be mindful that adding the fee to your loan will increase the cost of GAP. As a comparison, many car dealers charge up to $999 for asset protection products.

Refinancing A Car Loan

Refinancing your existing car loan can be a good idea if youve improved your credit score or interest rates are significantly lower than when you initially took out the loan. Navy Federal Credit Union offers refinance auto loans for your vehicle.

To refinance your car with Navy Federal, you must take out a loan thats at least $5,000. Term limits and APRs for refinancing are the same as those for new and used auto loans.

Read Also: What Do I Need For Pre Approval Home Loan

What Should I Do If It Has Been Over 2 Months And Navy Federal Still Hasnt Received My Title

Contact your DMV , dealership or financial institution to confirm your title was sent to Navy Federal. Additionally, you can notify us of the steps youve taken to secure the title and any issues youve encountered. To contact us:

- loans in the amount of $7,500 or less with a term of 12 months or less