% Cutoff For Mortgage Loans

When you do apply for a loan, most lenders today typically use 43% as a cutoff. Anything higher and you automatically cant get a qualified mortgage. You can figure out how much of your income is 43% by performing a simple equation.

Take your monthly pre-tax income figure and multiply it by 0.43. The number you get is the maximum amount of debt obligations you may have in order to qualify for a mortgage.

If you want to be more conservative, multiply your monthly earnings by 0.36. This is especially true if youre in a higher tax bracket because youll lose more of your money to taxes before paying your bills.

Lets take a look at these calculations with a real-life example. Well use the same scenario as before: your monthly income is $4,000 before taxes are taken out. For a 36% DTI ratio, your credit cards and loan obligations should total no more than $1,440 each month.

To qualify for a mortgage with a maximum 43% DTI and the same monthly income, your mortgage and other debt shouldnt exceed $1,720 each month. Try the math using your own financial information and see where you fall.

How To Calculate Your Debt To Income Ratio

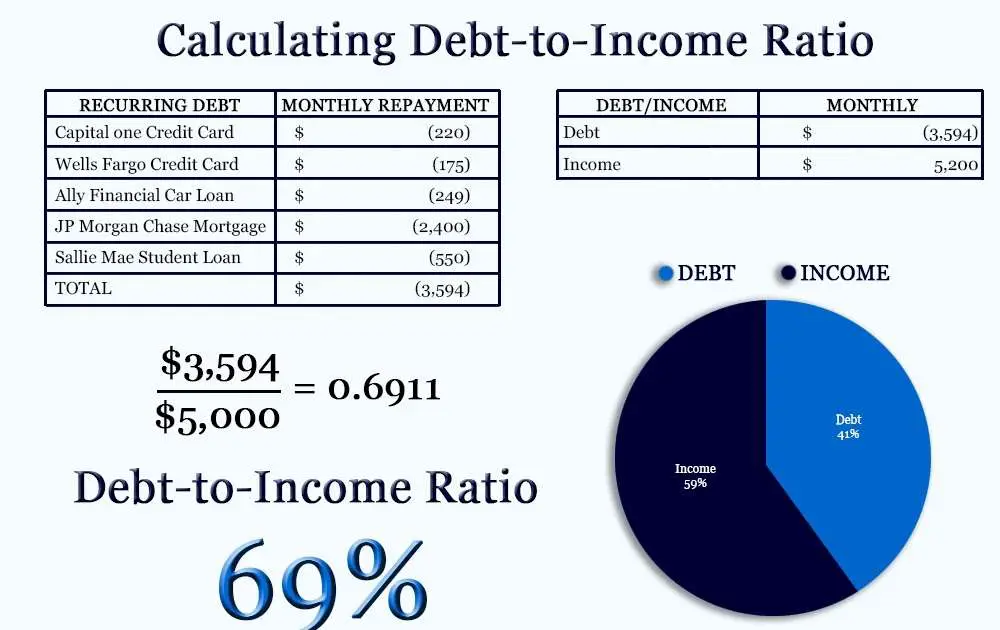

To help you prepare your debt to income ratio to get a mortgage, here is an equation to calculate your debt to income ratio.

Debt to Income Ratio =

To determine your debt to income ratio, simply divide the amount you pay each month in debt by your total gross monthly income. The sum will be a decimal, so multiply the total by 100 to convert your DTI into a percentage.

Calculating your debt to income ratio in advance can help you understand how mortgage lenders will view your loan application.

If you have specific questions regarding your debt to income ratio to get a mortgage, consult your financial advisor, mortgage lender, or real estate agent.

For more helpful homebuyers tips and information, explore more articles on the RealEstateAgents.com Blog.

What Is My Debt

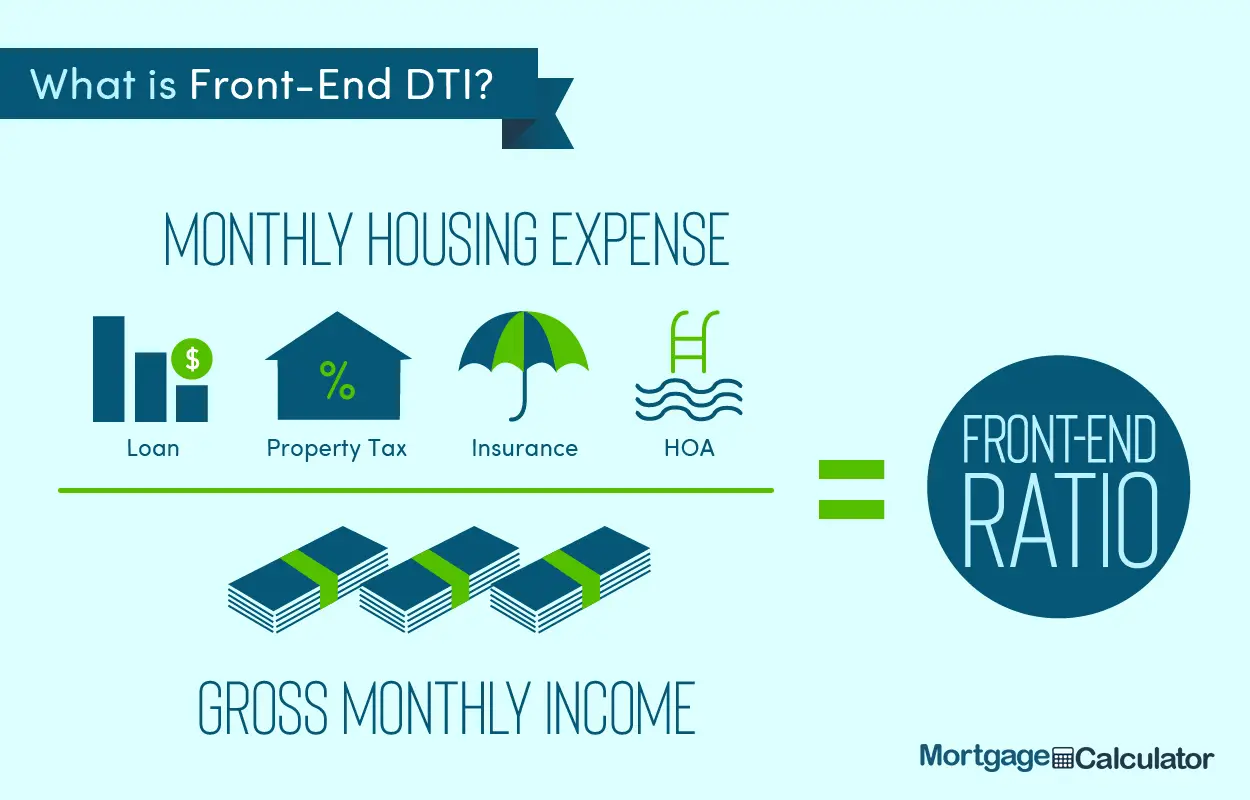

You may hear two terms related to the debt-to-income calculation for mortgages: front-end DTI and back-end DTI.

Heres what they mean:

- Front-end DTI: Your mortgage payment divided by your gross income.

- Back-end DTI: Your total monthly debt payments, including your new mortgage payment, divided by your gross income .

Also Check: Va Partial Entitlement Worksheet

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

How Do You Lower Your Dti Ratio For A Va Mortgage Loan

If you have a high DTI, dont fret, there are ways you can lower your ratio. Here are some strategies for getting your DTI in an acceptable range.

- Eliminate monthly payments:Paying off small debts will decrease your DTI. For example, if you pay off your outstanding credit card balance or student loan debt, your DTI will drop.

- Increase your income: Some ideas for boosting your income include freelancing, developing a side hustle, working a seasonal job, or asking for a raise. Note what guidelines lenders have for proving that income is regular and stable. Depending on your situation, you may also need authorization from your chain of command to obtain a second job.

- Add another borrower to the loan: Another borrower, such as your spouse, on your loan application may help you qualify for a VA mortgage loan. While adding another borrower to your loan may lower your DTI, it can also increase it depending on the finances of the other borrower. For example, if the other borrower has a significant amount of debt and little income, including a co-signer may not make sense.

- Wait a few months before applying: If these take you some time, you may want to hold off applying for a loan. This will give you time to get all of your financial documents in order, pay off debt, and increase your income.

Read Also: Usaa Refinance Car Loan

What Can I Do As A Borrower

To prepare for your home loan application, its usually best you cut out or at least reduce unused debt facilities.

For example, if you have a $2,000 limit on your credit card but find that you rarely use this amount per month, consider cancelling it.

Another example is expenses that arent vital and can be easily cut from your spending such as entertainment subscriptions, going to the pub, gym memberships, going to music festivals or sporting events, or simply eating take-away on a regular basis.

Please call us on 1300 889 743 or fill in our and we can weigh up your home loan options.

There are lenders out there that dont apply debt to income ratios caps.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Read Also: Capitalone Autoloans.com

Why Is Your Dti Ratio Important

A DTI is often used when you apply for a home loan. Even if youre not currently looking to buy a house, knowing your DTI is still important.

First, your DTI is a reflection of your financial health. This percentage can give you an idea of where you are financially, and where you would like to go. It is a valuable tool for calculating your most comfortable debt levels and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If youre interested in applying for a credit card or an auto loan, lenders may use your DTI to determine if lending you money is worth the risk. If you have too much debt, you might not be approved.

Recommended Reading: Genisys Credit Union Auto Loan Calculator

How Do You Calculate Dti For A Va Loan

Now that you understand the importance of your DTI for a VA loan approval, youll want to understand how to calculate it. Heres how.

- Add up your minimum monthly payments

- First, find the total of your debt payments for the month. Youll use the minimum payment for each monthly debt. In other words, if your account balance is higher than it usually is, use the amount you typically pay each month. Some examples of debt payments can include:

- Rent

DTI ratio

0.3899, or 38.99%

According to VA loan guidelines, the borrower in the example above would qualify for a VA loan since their DTI is less than 41%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: Usaa Certified Dealers List

Whats The Debt To Income Ratio To Get A Mortgage

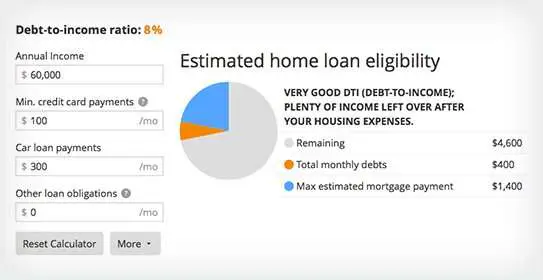

While 43% is typically the maximum debt to income ratio to get a mortgage, lenders prefer a 36% debt to income ratio or lower to qualify for loan benefits.

When you apply for a loan to purchase your home, lenders will be analyzing if you have the appropriate debt to income ratio to get a mortgage. Debt to income ratio, also called a DTI, is one of the ways that lenders determine a buyers .

If youre going to be financing your home purchase, gaining a better understanding of the debt to income ratio to get a mortgage can help you prepare for your loan application by improving your borrowing outlook.

What Is The 28/36 Rule Of Thumb For Mortgages

When mortgage lenders are trying to determine how much theyll let you borrow, your debt-to-income ratio is a standard barometer. The 28/36 rule is a common rule of thumb for DTI.

The 28/36 rule simply states that a mortgage borrower/household should not use more than 28% of their gross monthly income toward housing expenses and no more than 36% of gross monthly income for all debt service, including housing, Marc Edelstein, a senior loan officer at Ross Mortgage Corporation in Detroit, told The Balance via email.

It’s important to understand what housing expenses entail because they include more than just the raw number that makes up your monthly mortgage payment. Your housing expenses could include the principal and interest you pay on your mortgage, homeowners insurance, housing association fees, and more.

Read Also: Usaa Pre Approval For Mortgage

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Whats A Good Debttoincome Ratio

As a rule of thumb, a good debttoincome ratio is 40% or less when youre applying for a mortgage. That means your combined debts and housing costs dont exceed 40% of your pretax income each month. That said, a lower debttoincome ratio is always better. The lower your debttoincome ratio is, the better mortgage rate youll get and the more youll be able to afford when buying a home.

Also Check: Refinancing With Usaa

S To Calculate Your Dti Ratio

Now that you have a handle on what to consider, learning your DTI ratio is possible in three easy steps:

1. Add up all of your debts that are listed under debts to usually consider above. Make sure you dont include anything in the payments usually not considered list.

2. Add the expected monthly cost of your home equity loan to the total. If you have a desired loan amount in mind, use Discover Home Loans monthly payment calculator to get an estimate for your monthly payment and APR.

3. Divide your total from step 2 by your pre-tax income. This will give you a percentage, which is your DTI ratio.

Lets see it in action. Assume you make $6,000 each month before taxes. Now, lets assume that your monthly debts and the monthly cost of your HEL would be $2,160. Divide $2,160 by $6,000 and you will get 36%. This means your DTI ratio would be 36%.

Now, its time to learn which DTIs are the best.

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

You May Like: Avant Vs Upstart

Learn More About Saving And Buying A Home

After getting your finances in order, you may be in a strong position to start shopping for a home. Congrats on all that hard work! Theres a lot to learn about each phase of the home-purchasing process, so take the time to educate yourself. Our first-time home-buyers guide can help educate you on what youll need to know.

While youre making strides towards that big purchase, remember to get in touch with your American Family Insurance agent. Theyre your trusted resource that can help you get the coverage your new home needs. And with an easy-to-understand plan in place, youll know youve got the coverage you need to protect everything that matters most.

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Don’t Miss: Loan Originator License California

What Is An Acceptable Debt

Although each lender will weigh your debt-to-income ratio a bit differently, they all generally deny mortgages whose ratios exceed a given limit. Anyone that lands above it will typically not be qualified for a mortgage. Some lenders may be willing to extend that threshold, or the total allowable limit beyond 43 percent though this is done with strings attached. Lenders may approve the mortgage, but terms and restrictions can apply. Check with your lender to learn about their internal lending requirements.

Even if youve got a debt-to-income ratio thats below 43 percent, theres no guarantee that youll qualify for a mortgage. Many other factors are in play like your credit rating, work history and other indicators that can make or break the deal.

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Read Also: Usaa Used Car Loan Restrictions

How Does Dti Ratio Differ From Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100.In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: Carmax Loan Approval

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.

Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

What Does This Mean

The higher your debt to income ratio is, the worse off you look to creditors. Having a high debt to income ratio could mean that you are living beyond your means. If your credit utilization ratio is high, you are quite possibly using credit to make the majority of your purchases, and without the credit, you would not be able to make ends meet.

A high debt to income ratio is a red flag for any lending company. If they see you have too many debts, the company is most likely not going to give you more credit. And if they do, theyre going to charge you a higher than normal interest rate.

To avoid overpaying with high interest rates, Ill show you how to improve your Debt To Income score.

You May Like: Www.capital One.com/autopreapproval