Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

Bmw Launches The X3 M Suv In India

German automaker BMW has recently launched the BMW X3 M SUV in India. The price tag that the car comes with is Rs.99.90 lakh .

This is the first time that the automaker has brought a high performance M version of the SUV in the country. The company claims that the BWM X3 M comes with the most powerful straight-six engine ever which has been put under the hood of a BMW M series car. The car comes with a host of features and safety fitments such as adaptive LED headlamps, rain sensing wipers, parking assistant, powered tail gate, head-up display, tyre pressure monitor, vehicle immobiliser, ABS with brake assist, EBD, and so on. The engine powering the car is a Twin Power Turbo, 3.0-litre, inline six cylinder engine that churns out 480 hp of max power and 600 Nm of peak torque. It is capable of clocking 0 to 100 kmph in 4.2 seconds and can hit a top speed of 250 kmph.

3 November 2020

How Do You Lower Your Apr On Your Car Loan

Since interest rates make up a big portion of your total APR, everything mentioned above to help lower interest rates can help lower your APR. But there are other things to consider as well, like negotiating any prepaid fees the lender might charge. Shopping around for the best APR deals is another great way to find a lower APR. Some dealerships may offer special deals on newer vehicles like 0 percent APR to incentivize buyers.

When shopping for a vehicle, keep your mind open to the ways in which you can save on both interest rates and APR you may have more control over what youll pay than you think.

To learn more about interest rates and APRs, go to the Chase Auto site.

Read Also: Average Motorcycle Apr

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

Recommended Reading: Usaa Auto Loan Pre Approval

Class 1b National Insurance: Paye Settlement Agreements

You pay Class 1B National Insurance if you have a PSA. This allows you to make one annual payment to cover all the tax and National Insurance due on small or irregular taxable expenses or benefits for your employees.

The National Insurance class 1B rate for 2022 to 2023 is 15.05%

Pay Class 1B National Insurance.

Best Online Auto Loan: Lightstream

LightStream

- 2.49% to 10.99%

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. It’s also strong on customer service, receiving the top score in the J.D. Power 2020 U.S. Consumer Lending Satisfaction Study for personal loans.

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is the online lending arm of SunTrust Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 2.49%, which includes a 0.5%-point discount for autopay. The maximum APR on an auto loan is 10.99%.

Also Check: Can You Refinance An Fha Loan

Best Overall: Penfed Credit Union

PenFed Credit Union

- As low as 0.99%

- Minimum loan amount: $500

PenFed Credit Union provides some of the best rates available. It also has flexible loan amounts and a number of auto loan options for members. Even though membership is required, a disadvantage for some, PenFed makes the requirements to join fairly straightforward.

-

Offers new, used, and refinance loans

-

Loan amounts from $500 to $100,000

-

Provides rate discounts for using its car buying service

-

Borrow up to 125% on new and used vehicles

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Our top pick for auto loan rates, PenFed Credit Union, offers some of the lowest rates available.

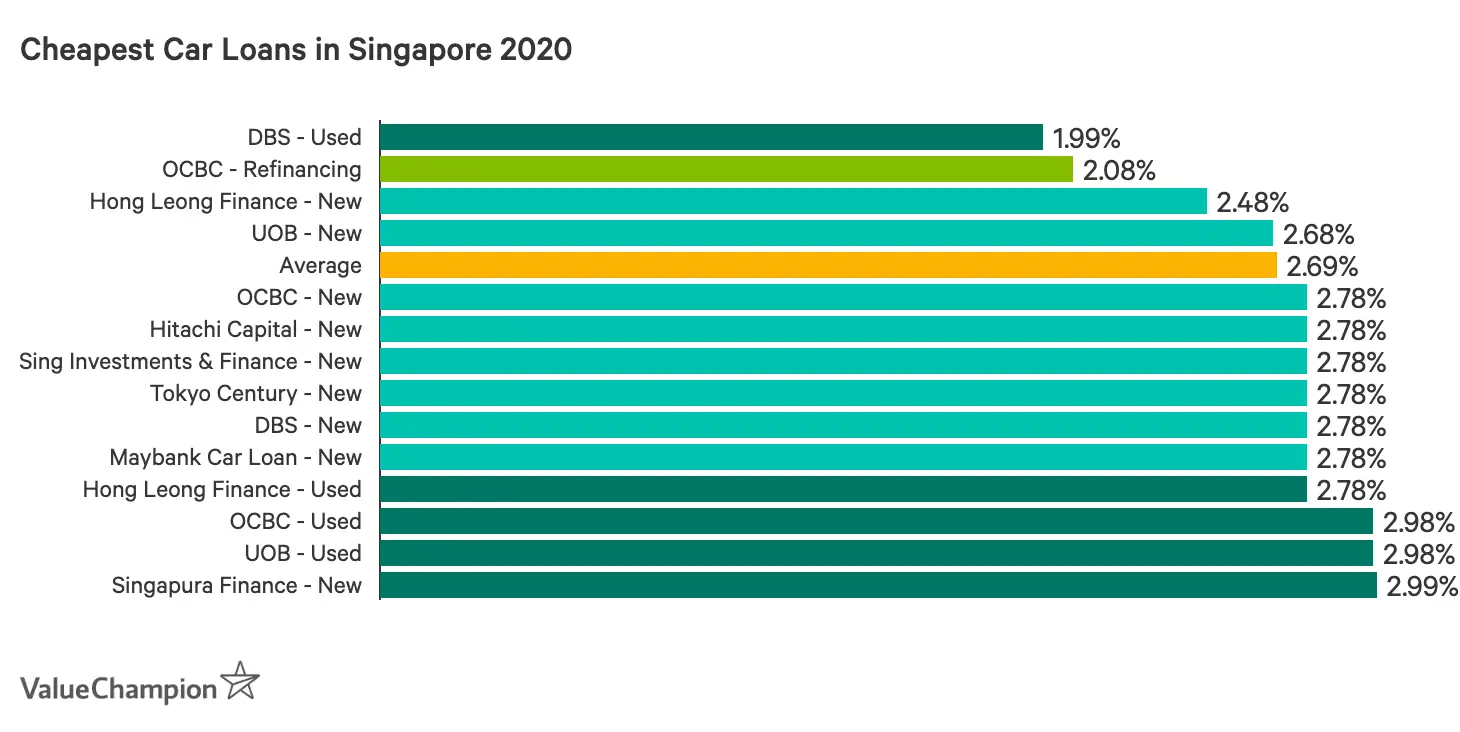

At PenFed, rates for 36-month refinance loans start as low as 1.79%. Deep discounts are available for members who use the credit union’s car buying service, with rates starting as low as 0.99% annual percentage rate for a new car and 1.99% APR for a used vehicle.

You’ll have to become a member of the credit union, but the requirements to join are fairly easy to meet. Car loans from PenFed start as low as $500 and move up to $100,000, a wide range that beats out many of the lenders we surveyed.

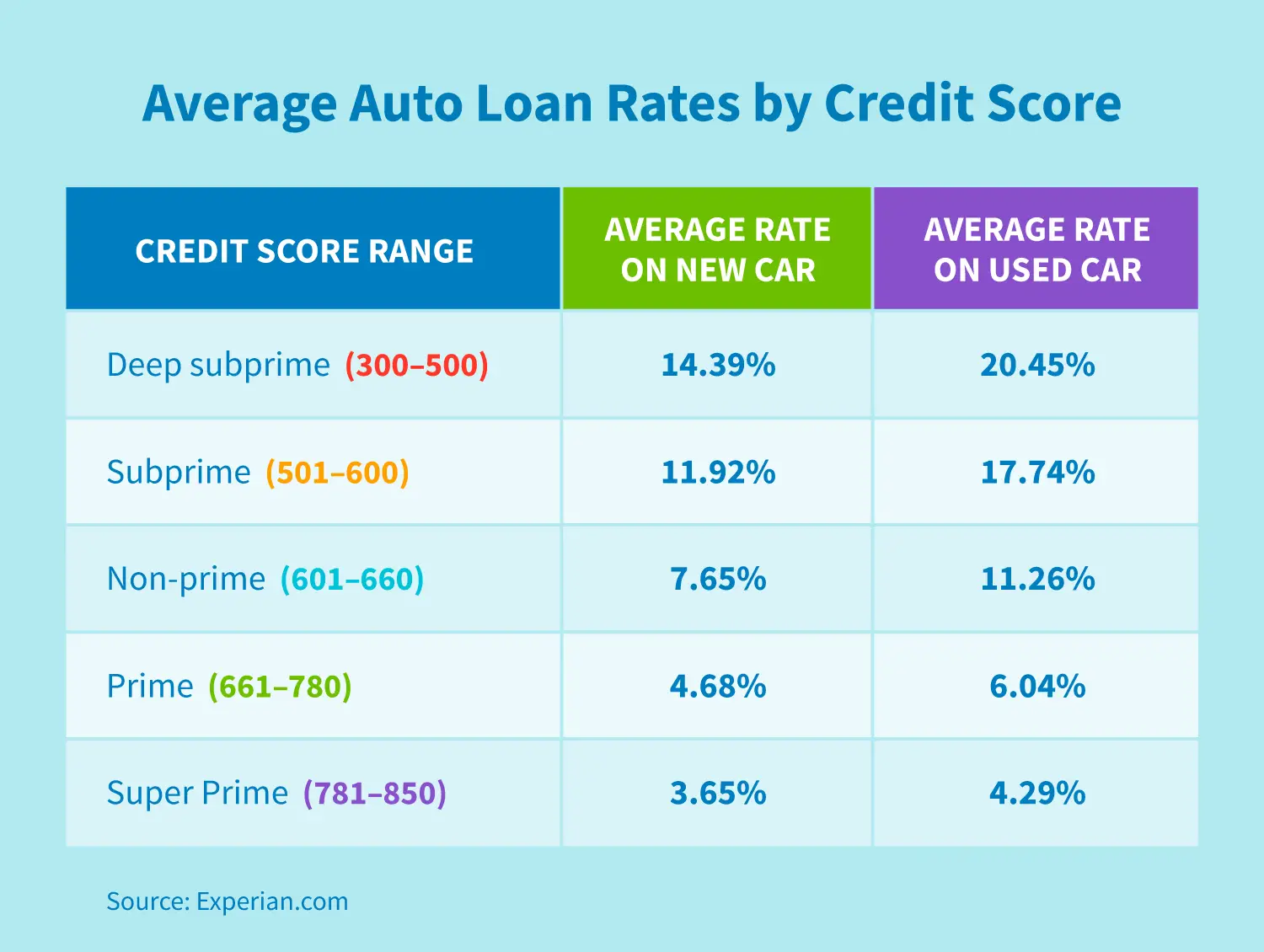

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

Read Also: Nslds.ed.gov Legit

What Are Car Loans And How Do They Work

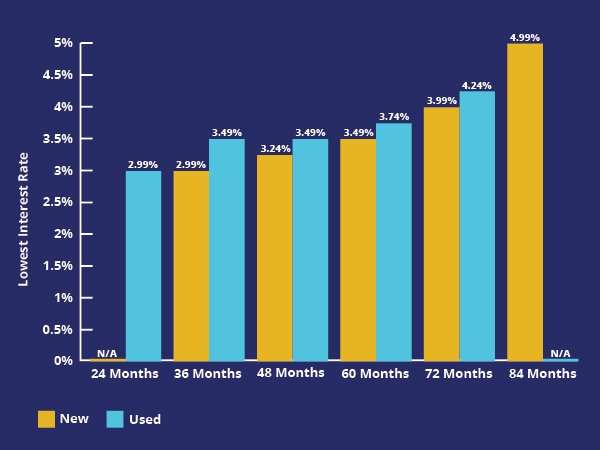

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. As of October 6, 2021, the average APRs according to a Bankrate study are the following.

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Also Check: Usaa Boat Loan Credit Score

How Much Would You Like To Borrow:

Please review and adjust your amounts for down payment, trade-in and cash incentive. Their current total is equal to orexceeds the vehicle purchase price.

Reminderthe minimum borrowing amount is $7,500. Therefore the total price of the vehicle less any down payment, trade-in, and cash incentive cannot be below this amount.

Interest Rate

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

Also Check: Rv Loan Rates Usaa

Can You Negotiate Apr On A Car

Yes, you can negotiate APR the same way you negotiate the cars price by showing the dealer that your own lender gave you a lower rate. You can also ask the dealer what it would take to get a tier bump. Dealers sort borrowers into tiers by credit score the higher the tier, the lower your APR. They may say that you need to put more money down or get a cosigner in order to reach a higher tier.

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

You May Like: Sss Loan Eligibility

Car Loans For Bad Credit

Whether youre just starting out and have no credit history, or have simply made some credit mistakes along the way, its still possible to get an auto loan. Many lenders provide car loans for bad credit. If youd like to improve your chances of being approved or possibly get a lower rate now, consider adding a cosigner, making a large down payment or both.

A no-haggle, online experience could be extremely stress relieving. Read our full Carvana review.

WHERE IT MAY FALL SHORTYou cannot use a loan offer you got through Carvana to purchase a vehicle from any other seller.

Loyalty Programme Introduced By Hyundai For New Customers

A new loyalty programme known as Hyundai Mobility Membership has been launched by Hyundai. Individuals who buy a car on or before 13 August 2020 will be eligible to avail the membership. However, according to Hyundai, all existing customers will also be eligible for the membership in the next phase. The steps that are involved to enrol for the programme are installing the Hyundai Mobility Membership app are registration, interest selection, details of the vehicle, and completing the registration. Details such as the email ID, mobile number, and VIN are needed to complete the registration. The three categories of the programme are lifestyle, mobility, and core. Hyundai has entered into a partnership with several companies so that various benefits will be provided under the programme. Various needs of the vehicle such as tyres, oil, and accessories are provided under the programme.

18 August 2020

Recommended Reading: Classic Car Loans Usaa

Whats The Difference Between New And Used Car Interest Rates

Loans for newer cars tend to have lower interest rates than those for used cars. Lenders see newer cars as less of a risk theyre less likely to break down, and lenders can identify exactly how much theyll depreciate over time. Newer cars have more predictable resale value down the line than newer cars, and that predictability results in a lower interest rate.

Ftse 100 Live: Fed Signals Hikes Banks Rise On Interest Rate Outlook Oil Close To $90 Tesla ‘breakthrough’your Browser Indicates If You’ve Visited This Link

Shares are under pressure again after the US Federal Reserve put investors on standby for a series of interestrate rises starting in March. Wall Street was hit by selling pressure after the meeting but the FTSE 100 index held on to yesterday’s big gains thanks to progress by banking and defensive leaning stocks.

Yahoo

Don’t Miss: Usaa Auto Loan Credit Requirements

Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

No negotiation

-

Excellent credit borrowers get the lowest rates

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvana’s most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

What Determines Your Apr On A Car Loan

APR accounts for both your car loan interest rate and the cost of any financing fees and prepaid expenses. The Truth In Lending Act , a federal law, requires lenders to disclose the APR on your vehicle purchase before signing a loan agreement. An example of a prepaid expense would be an origination fee.

Interest rate

Your interest rate usually makes up the biggest part of the total APR on your vehicle. Because of this, lowering your interest rate can help you get the best APR on your car loan.

Origination fees

A loan origination fee is the amount of money youll pay upfront to cover the cost of processing your loan. These fees can be a small percentage of your loan amount or a flat fee.

You May Like: Usaa Loans Auto

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.