Unduly Long Loan Terms

Contrary to what some buyers may think, loans with extended payment periods are not cheaper. That is because the longer the repayment term, the higher the interest charged. The buyer, in such a case ends up paying far more than the vehicles worth. A similar situation might also arise where a buyer goes for unnecessarily low installments which prove more expensive in the end.

Bank Of America Reviews

Bank of America has a strong standing within the industry, holding both accreditation and an A+ rating from the BBB.

When it comes to customer reviews, the company doesnt fare as well. Bank of America has almost a 1.1 out of 5.0-star rating from consumers on the BBB website and a 1.4-star rating out of 5.0 from customer reviews on Trustpilot.

However, it is important to note that reviews are for the company overall and are not specific to its auto loans division. Even though a number of Bank of America customers complain about high fees and frustrations with phone support, many also report positive experiences with the company, usually pointing to user-friendly online interfaces and supportive customer service.

Our team reached out to Bank of America for a comment on its negative reviews but did not receive a response.

Leasing Vs Buying A New Car

Comparing the two major finance choices

The choice between buying and leasing a car is often a tough call. On the one hand, buying involves higher monthly costs, but you own an assetyour vehiclein the end. On the other hand, a lease has lower monthly payments and lets you drive a vehicle that may be more expensive than you could afford to buy, but you get into a cycle in which you never stop paying for the vehicle. With more people choosing a lease over a loan than they did just a few years ago, the boom in leasing isnt stopping anytime soon.

Buying a vehicle with a conventional car loan is pretty straightforward. You borrow money from a bank, credit union, or other lending institution and make monthly payments for some number of years. A chunk of each payment is put toward paying interest on the loan and the rest is used to pay down the principal. The higher the interest rate, the higher the payment. As you repay the principal, you build equity untilby the end of the loanthe car is all yours. You can keep the car as long as you like and treat it as nicelyor poorlyas you want to. The only penalties for modification or abuse could be repair bills and a lower resale value down the road.

As car prices rise , leasing a new vehicle remains an alternative. However, according to Experian, one of the credit reporting agencies, the percentage of all new vehicles that are leased is down in the first quarter of 2022 when compared with both 2020 and 2021.

Read Also: What Does Unsubsidized Loan Mean

When I Refinance Do I Get Money Back

If your car is worth substantially more than you owe on it, some lenders allow what is known as cash-out auto refinancing. You borrow more than you owe on your current loan, pay off that lender and take the remainder in cash. Interest rates may be lower than those on a credit card or personal loan because the loan is secured by your car. But over borrowing against your car may mean you owe more than it is worth for a longer period of time.

To recap our selections…

Am I Likely To Qualify For Refinancing At A Lower Interest Rate

Your credit history will have a direct impact on the interest rate youre offered. If youve made six to 12 months of steady, on-time payments on your current loan, its likely that your credit score has improved. With a better credit score, you will probably qualify for a lower interest rate when you refinance.

» MORE:Get car insurance quotes

Read Also: Loaning Signing Agent

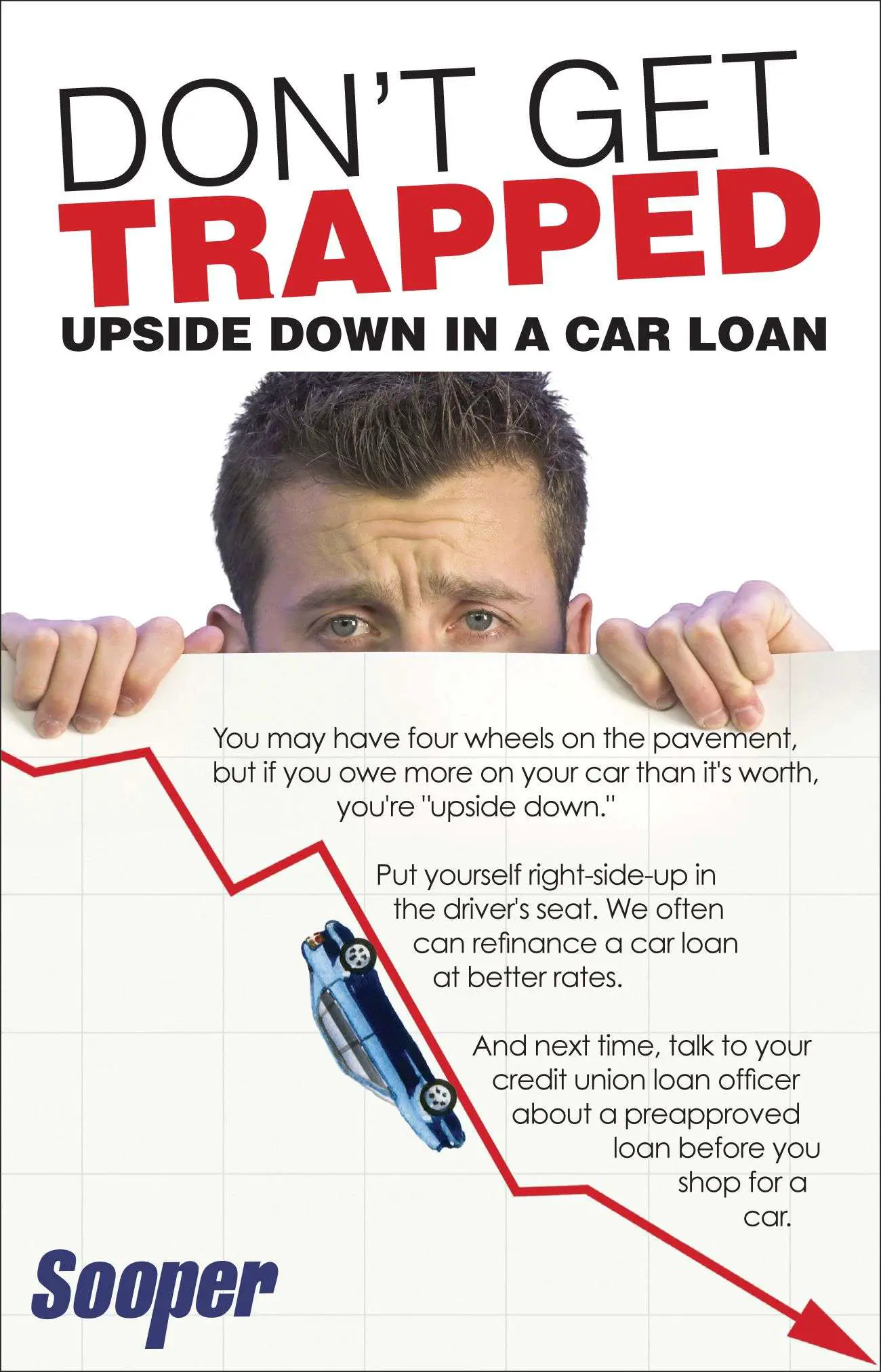

Suffering From An Upside

Whether from a car accident, financial hardship, orrefinancing gone wrong, it is all too easy for car buyers to wind up with anupside-down car loan.

Suddenly, youre swimming in a sea of debt and default carpayments, struggling to get yourself out of negative equity. What can you do?How do you pull yourself out of this financial mess?

That said, Butler car dealerships, Precision Jeep gives youthe ins and outs of upside-down car loans, from what it is to proactive stepsyou can take to decrease negative equity and get back in the green.

What exactly is anupside-down car loan? And how is it different from a standard loan?

Lets say you recently purchased a new car and, thanks topersistent negotiation, you were able to talk down the sticker price to$25,000. After you drive off the lot, the vehicles value drops considerably.

After year one, without much wear and tear, your vehicle depreciates20% from its original value .

Because of depreciation, not to mention a T-bone caraccident and low down payment, you end up owing more than what the car is worth:$20,000 on a now-$16,000-dollar car. In other words, you have an upside-downcar loan.

Unlike regular car loans, an upside-down loan has negativeequitythe difference between the amount owed and the value of the carwhich increases every time youre unable to make a car payment. However,while uncomfortable, being upside down on a loan is not automatic financialdoom.

4 Ways to Recoverfrom an Upside-Down Car Loan

Summary:

Getting Your Car Loan Right

Being upside down on your auto loan isnt always the easiest situation to get out of, but it certainly is possible. With a little research and a plan, you can take the necessary steps to not only keep your car, but also save your credit and bank account.

Ready to refinance your car loan?

Also Check: Upstart Early Payoff Penalty

When Should You Refinance Your Car Loan

Refinancing an auto loan makes sense in many conditions. You should consider applying for a refinance loan if:

- Youve improved your credit score from when you originally financed the vehicle

- Your current interest rate is above todays average rates

- Youre unhappy for any reason with your current lender

- You want to lower your monthly payment by reducing your APR or lengthening your repayment period

- You want to borrow money via cash-out refinancing

- You owe $7,500 or more on your current loan

Refinancing your loan may not make sense if youve paid off most of your existing loan, or if your vehicle is older and has a lot of miles on it. You may also have trouble refinancing if you owe more than what your car is worth, as we explain in the next question.

Alternatives To Fixing A Bad Deal At The Dealership

If you dont want to refinance, there are a few other options to consider.

Trade-in your car: If youre going this route, go for a less expensive vehicle. This downgrade will help reduce your overall auto debt.

Sell your car, private party: This may require more effort and time on your part, as there are a few more steps involved when selling your vehicle without your title , including:

- Asking your lender for the payoff balance

- Obtaining the value of your caryou can do this through Kelly Blue Book or Edmunds

- Paying off the vehicle so the lender can release the title to the new owner

Theres a possibility that you may also end up upside down on your loan, which means your cars value is less than your loans payoff amount. For example, if your car is worth $20,000 but you still owe $25,000 on the loan, you may have a tough time finding a private buyer who would be willing to pay you $25,000 for the vehicle.

You May Like: Fha Max Loan Amount Texas

Key Takeaways On How To Get Out Of An Upside Down Car Loan

Being underwater is never fun. If you have an upside down car loan, its important to act fast, so you dont fall further into debt. While your car begins to depreciate, your loan and its interest rate will still be there. From refinancing your car to selling it, these tips on how to get out of an upside down car loan will help you stay afloat and build equity in your vehicle.

What Is An Upside Down Car Loan

When youre underwater on your car loan, it means the value of your car loan is greater than the actual value of your car. For example, if you have an auto loan for $12,000, and your car is only worth $9,000, youre upside down. That $3,000 difference is considered negative equity, and is what brings you underwater.

As previously stated, cars depreciate at an alarming rate, which can make catching up on your upside down loan difficult because as your cars value continues to plummet, youre stuck with expensive loan payments.

Read Also: Refinance Avant

Recommended Reading: How Long Does The Sba Loan Take

Trading In Your Upside

If you have the flexibility to work remotely or you can rely on other forms of transportation, you might be able to do without your car. Perhaps you can share a vehicle with your spouse or significant other. Regardless, one way to offload an upside-down car is to trade it into a dealership.

Negative equity means youre in the hole so, if you trade in an upside-down car, youre on the hook for the negative amount of equity. In other words, youll still owe money to the dealer.

For example, lets assume your car loans outstanding balance is $20,000 but your car is only valued at $17,000. To trade in your car, youll have to pay the dealer the difference: $3,000. If you have the liquidity to afford it and you dont need a vehicle this can be a good option for getting out of debt.

More Debt Is Not A Good Fix For Negative Equity

If youre really scrambling, you might be tempted to take out a personal loan or open a credit card with a temporary zero-interest promotion and use it to pay off some of your auto loan. While this technically reduces your negative equity, it doesnt fix your debt situation. Taking this route is more likely to hurt you later on, so focus on the other alternative weve outlined instead.

Ready to refinance your car loan? Find a Better Loan Now

You May Like: Refinance Auto Usaa

Auto Approve: Top Choice For Refinancing

Starting APR:2.25%Loan amounts: $5,000 to $85,000Loan terms: 12 to 84 monthsAvailability:50 statesMinimum credit score:580

Unlike the other lenders on this list, Auto Approve doesnt finance new car purchases. Instead, the company specializes in refinancing auto loans. However, when it comes to the type of vehicle you can refinance, Auto Approve offers much more flexibility. The company works with a network of lenders to offer refinancing for motorcycles, ATVs, boats and RVs in addition to the standard cars, trucks and SUVs.

Auto Approves auto loan refinancing rates begin at 2.25% APR, which is toward the lower end of the rates we saw in our research, but note that only the most qualified borrowers will likely get a rate this low. The company doesnt charge an application fee or a prepayment penalty.

Borrowers can select terms of 12 to 84 months to refinance their vehicles. Auto Approve is also accessible to those who dont have the best credit history since it has a minimum credit score of only 580. However, borrowers with lower credit scores should expect to pay higher rates than the minimum APR featured here.

Apply For Your Auto Refinance Loan

There are a few steps youll need to take to apply for an auto refinance loan. Once youve decided on a lender, youll need to gather all required documents before applying. This can include information about yourself, like your name, address, and social security number, as well as information about your vehicle and your previous loan.

If youre interested in applying for an auto refinance loan, its a good idea to wait to apply until your finances are in order. For example, if your credit score is near a threshold, you might want to take steps to raise your score before applying to qualify for lower rates. Once your application is accepted, youll need to begin repaying your new loan. Its a good idea to set up automatic payments each month to make sure you never miss a payment.

Also Check: Usaa Personal Loan Approval Odds

Inclusion Of Unnecessary Add

Wise buyers tend to be wary of what is included in the car purchase. That includes the question of whether the car shall have any fancy gadgets and whether the price is inclusive of the same. When fancy add-ons pop up in the written contract and increase the price of the vehicle to an amount higher that what the buyer had planned for, there is a higher likelihood of it turning into an underwater car loan.

Figure Out The Value Of Your Car

There are several websites that let you type in your vehicle information to get an approximate value, but the three most common are:

There are several types of valuations for new and used cars: wholesale, retail, trade-in, residual, loan, private party, etc. The two you should look at closely are the retail and trade-in values.

Retail value:Trade-in value:Residual value:

The trade-in value will be lower than the retail value. Most lenders will use the retail value of your vehicle when it comes to auto loans, but its best to ask your lender which one they use, just in case. Residual value is also important, but well get to that below.

Read Also: Usaa Approved Car Dealerships

Figure Out Where You Stand On Your Loan

Restoring the equity in your loan begins with figuring out how deep underwater you are. Start by subtracting the current balance of your car loan from the current value of the car. For example, you find your car is worth $10,000 today, but you still owe $15,000 on the loan. The result: You are upside down by $5,000.

Next, contact your lender directly to get the payoff balance. That quote is typically good for a specific period of time, so you can investigate ways to improve your situation.

Start by finding the current value of your car. Credit Union members have access to the National Automobile Dealers Association car values by logging in to Member Connect. Other resources such as Kelley Blue Book and Edmunds can also help you find your cars value. Remember, there are actions you can take to try to reverse negative equity.

Auto Loan Refinance Upside Down

Nicholas Hinrichsen – Published: January 15, 2022

- Check if you bought GAP insurance or a Service contract. Often you can cancel these contracts which removes them from the loan

- If you’re still negative equity you can potentially get “2 loans” such that you payoff 80% of your loan with an auto refinance loan at a lower interest rate, and then also receive a personal loan to make up the remaining balance. Your combined payment can still be lower than your existing loan

- Your last option is to wait a little bit and make bigger payments each month on your current loan to get to positive equity. If you make an additional $50 payment monthly, that money goes directly towards the principal in the loan. This helps you get to positive equity sooner

Consumer Solutions

You May Like: How Long Does It Take Sba To Approve Loan

Latest News In Auto Refinance

Two recent reports by ConsumerReports and the Consumer Finance Protection Bureau found that the lack of federal interest rate limits in the auto loan industry has left many consumers, particularly those with poor credit scores, prey to inflated interest rates. To find out more, check out Auto Lenders May Offer High Rates Based on ‘What They Think They Can Get Away With’, New Study Says.

One of the best ways to get a better deal on your refinance is to improve your credit score. Our article on How to Build Credit Fast can get you started.

We mentioned above that some lenders or marketplaces require hard credit pulls or soft credit pulls but whats the difference? If youre not sure what each one does (and how each affects your credit, read our article Hard vs. Soft Credit Check: What’s the Difference, and What Do They Mean for Your Credit Score?

Before starting the application process, shop around and compare offers from different lenders. When you settle on the best one, submit a formal application and wait for the lender’s formal offer. If accepted, you can finalize the document, settle the previous loan, and start your loan payments with the new lender.

Advantages Of Auto Refinancing

The biggest advantage of refinancing an existing auto loan is that you can lower your monthly payment by choosing a refinance loan with a lower APR than your current one or a longer payoff period. In some cases, you can lower the overall cost of your vehicle loan.

Just remember that extending your repayment window can lower your monthly payment, but add several months of interest charges that make the overall loan cost greater.

Some lenders, such as RoadLoans.com, offer cash back refinancing options that allow you to tap into your current auto loans equity and borrow your cars full Blue Book value. That means that you can use part of the refinance loan to pay off your existing debt and use the remainder of the loan in any way you choose.

Before you pick a loan and lender especially one that touts that it can save you money check for any processing costs or closing fees that can make the loan as expensive than your current loan.

Read Also: What Credit Bureau Does Usaa Use