A Longer Loan Payment

While a longer loan will make the monthly payments affordable, it also means that you will have to pay more over time. Furthermore, as cars become more expensive, dealerships are offering long-term loans to make them affordable to most buyers.

Unfortunately, a longer loan term makes it impossible to keep up with depreciation. Although it is possible to buy an SUV with affordable monthly payments over eight years, the payments will not keep up with the depreciation. Always opt for the shortest loan you can afford.

Use Cash Windfalls Responsibly

Every now and then, we benefit from unexpected financial fortune. A spot bonus for going the extra mile at work. A generous cash gift from a relative for a birthday present. An unexpected tax return. While you cant necessarily predict our next monetary windfall, you can be prepared to use it responsibly.

If you have negative equity in your car and you happen to receive a little extra cash, consider using it to pay down your loan.

Beware Of Rising Interest Rates

As you can see, both consumers and dealers are coming up with highly creative ways to deal with this growing issue. The biggest danger is that rising interest rates even increases as small as one percent could equate to an increase of several hundred, or even a few thousand dollars over the life of the loan. With some loans being financed for terms as long as 96 months , the effect of rising interest rates and the practice of rolling-over an existing loan into a new one could result in an unfortunate situation that would negatively affect your personal financial health. And all for a new car.

Read Also: How To Find Your Student Loan Number

How Soon Can You Trade In A Financed Car

You can trade in a financed car any time, but you may want to wait a year or more especially if you bought a new car. Cars depreciate over time. A brand-new car can decrease in value by 20% or more within the first year of ownership, then loses value more slowly in the following years. Depending on the size of the down payment you made on your loan and how quickly your car has lost value, you may find that you have negative equity in the vehicle almost immediately.

Using A Car With Negative Equity As Trade

You can fill in the rest of that ad with the name of just about any car and just about any dealership in the U.S. and the promise will be as empty as your bank account because it promises negative equity.

The ad plays on every station in every market in America and you have to admit its enticing enough to make you stop and think about doing it. Someone else bails you out of a bad loan situation and puts you into a new car with no out-of-pocket expense. Whats not to like about that?

Heres a word of advice from car-buying experts: DONT EVEN CONSIDER IT!

Trading in a car with negative equity to take on another car loan with even more negative equity is like throwing gas on a fire because its the only liquid you had handy. You just increased the chances for a serious financial meltdown and here is an example of why.

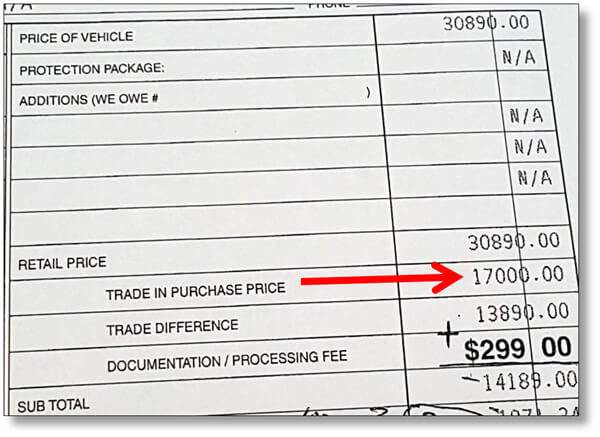

Lets say you owe still owe $10,000 on a car that is only worth $5,000. The dealer will pay off the $5,000 difference, but then roll that amount into the loan on your next car. So, if you needed to borrow $20,000 for the new car, the dealer rolls another $5,000 into the loan to cover the cost of paying off your previous loan and now youre borrowing $25,000.

Not only will your monthly payments be higher , but you likely will be paying higher interest on the loan.

And, dont forget, youre going to add more negative equity to your situation when you calculate the 20% depreciation in value the new car will lose when you drive it off the lot.

You May Like: Does Va Loan Work For Manufactured Homes

Calculate The Negative Equity

Your first step should be to determine exactly how far below the surface you are. Its pretty simple to calculate the exact amount of your negative equity. Just subtract the estimated market value of your vehicle from the current amount you owe on the auto loan.

Not sure of your cars actual value? Well, you can always check legitimate online resources such as CARFAX Canada. As theres no single ultimate authority on used car evaluations, checking from multiple resources can help you gain a better idea of what your vehicle is actually worth.

Once you have determined the amount you have in negative equity, youll probably consider refinancing or selling. But before you do either, assess your finances to see if its possible to pay off the amount in full. If its within your means, wed advise you to pay off the amount in full rather than taking on additional debt and placing your other assets in jeopardy.

Find Out How Much You Still Owe On Your Current Loan

One thing you should always do when youre considering trading in a car you havent yet paid off is find out for sure exactly how much you still owe on the loan. You need to know this in order to see how the trade-in offer at a dealership compares to what you still owe. In an ideal scenario, what you still owe would be less than the trade-in offers you receive, but it also might not work out that way, which is a common situation well deal with a bit further on in this article. Finding out how much you still owe on a vehicle is easy to do you just have to call up your lender and ask. However, the figure youre looking for isnt necessarily as simple as the remaining outstanding balance on your loan, which is something you could easily look up online or from your last loan statement. The reason for this is because the interest charges on your loan keep accruing on a daily basis, so what you want to get is a 10-day pay-off amount, which lets you know exactly how much you still owe that includes all the interest that will accrue for the next 10 days. After those 10 days, youd want to get a new pay-off amount since it keeps changing.

Read Also: What Car Loan Can I Afford Calculator

Make Sure You Understand The Trade

Also keep in mind that you dont have to settle for the first trade-in offer you receive from the first dealership you visit. Do yourself a favor and shop around! You may get a much better offer at one dealership than another. Yes, this takes time, but its worth it if it helps address a negative equity situation.

Another thing to keep in mind is to negotiate the price of the new car you want and the value of your trade-in separately. If the dealership is offering lots of great incentives, this could help you deal with negative equity and/or better stomach a low trade-in offer.

How Can I Pay Off My Car Loan Faster

There are several ways you can work to pay off your car loan more quickly. You can start making payments every two weeks instead of once a month, for example, or increase the amount of principal you’re paying each month. If you get a large tax refund, you can make a one-time payment to lower your balance. Any of these methods will shorten the life of your loan and lower your total interest paid.

Don’t Miss: How Much To Loan Officers Make

Can You Trade In A Car Thats Not Paid Off

You certainly can. However, how much you get for the car is a different story and its not uncommon for many car buyers to get less money than they should for their trade-in. For those not in the know, if the car that you have is worth less than what you still owe on it, then thats called negative equity. But if its worth more than what you still owe, then thats referred to as positive equity.

For example, lets say that you have a Honda Accord that you still owe $15,000 on and youve checked Kelley Blue Book, which told you that the car is worth $12,000 as far as its trade-in value. But when you get the car appraised at the dealership that youre working with, they might offer you $10,000 for it. If thats the case, then you have a few options.

RELATED: 1 of the Most Outrageous Dealer Scams Happens at the End of the Sale

Negative Equity On An Auto Loan: All You Need To Know

Negative equity occurs when the value of the vehicle falls below the amount you owe on your current auto loan. For instance, if the remaining payments on your auto loan amount to $20,000 and your vehicles market value is $15,000, you have a negative equity of $5,000. This sticky situation is also referred to as being upside down on your car loan.

Negative equity can also affect youre your ability to sell off your vehicle or trade it in for a new one. Over the course of this blog, well tell you all you need to know about negative equity and how you can get yourself out of this sticky financial situation.

Recommended Reading: Does Va Loan Work For Manufactured Homes

How To Deal With An Out

If the lender is not local, youll need to bring the bill of sale on the car to your state Department of Motor Vehicles. Youll want to obtain a temporary operating permit for the buyer. This will allow you to transfer the vehicle to the buyer, and then to deliver clear title to the buyer once the loan has been paid.

Obviously, you will not have the title until the loan is paid off in full, so there will be a delay of several days while that process is completed. You may have to pay a fee to your lender to expedite the title, a process that ordinarily takes several weeks. The risk of this delay will be a problem primarily for the buyer, since he or she will have a vehicle without having the legal title. However, there is no easier way to complete the sale, unless you have the personal funds to pay off the car loan prior to the sale of the car.

Trading In A Financed Car With Equity

If you find that your car payments are unaffordable and you want to purchase a cheaper vehicle, having equity in your car makes a big difference. As long as your vehicle is worth as much or more than what you owe on its loan, you should be in good shape.

For example, let’s say that you want to trade in a vehicle that has a current value of $30,000, and your loan balance is $25,000. In this case, it’s easy for a dealer to take the vehicle as a trade-in. They can simply pay off the loan and apply the $5,000 of equity to the purchase of the cheaper car.

Recommended Reading: How To Get An Aer Loan

What Should I Do After Negotiations

Many people work up to negotiating the fairest price for their new vehicle and trade-in. While these steps are important, your responsibilities don’t stop there. Complete each of these steps in order for a successful trade-in:

Cons Of Trading In A Car

There is one major downside to trading in your car, though: You probably wont make as much money as you would if you sold the vehicle yourself. The car dealership wants to make a profit by reselling your used car to another driver, so youll miss out on that extra chunk of money.

Trading your car in might also limit your options when it comes to buying your next car. If youre planning to use the value of your old vehicle as the down payment on a new one, youll have to purchase your next car from a dealer willing to buy the old one.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Option 2 Refinance Your Car Loan

To remove a lenders encumbrance, or debt, tied to your car before you put it up for sale, one option could be to refinance your car loan.

Refinancing your loan, or replacing an existing debt with another debt under new terms, may help boost your savings and give you greater flexibility and control over your car loan. For you this could mean refinancing to a loan with a lower interest rate, longer loan term or from a secured to unsecured car loan . Bear in mind that unsecured car loans often attract higher interest rates than loans secured by a car or other asset, so its important to consider your options carefully.

If you do decide to refinance your car loan, its worth checking that any fees or higher interest rates do not offset potential savings or convenience watch out for things like any early exit fees or application fees lenders may charge you for switching to a new loan.

When Youre Looking To Get A New Set Of Wheels You May Be Anxious To Get Rid Of Your Old Car Even If You Still Owe Money On It

But trading in a car with a loan could cost you if you have negative equity, meaning you owe more on your loan than your car is worth. Lets take a look at your potential options whether you have positive or negative equity and how to trade in a car with a loan balance.

Also Check: How Do I Find Out My Auto Loan Account Number

Take A Look At Your Bank Account

Trading a car in involves more than assessing the vehicle. Youll also need to evaluate the state of your finances to know what you can afford on the other side of the trade.

If youre trading in a car with a loan, determine whether the trade-in value will be enough to pay off the rest of the loan. While the dealer might offer to pay your loan off, youll wind up adding that amount to a new loan on your next vehicle.

Does My Car Loan Disappear If I Trade In My Car

Your car loan doesn’t disappear if you trade in your car. However, the trade-in value of your car becomes credit towards your loan. This credit might cover the whole balance. If it doesn’t, your dealer will roll over your loan, combining the deficit with the amount owing on your new car. Consolidating what you owe into a single new loan helps you manage your payments better.

You May Like: Caliber Home Loans 1098 Form

How To Avoid Negative Equity On Your Car

The best way to avoid going upside down on your auto loan is to do your research and assess your finances before you make a buying decision. If you want help with your auto loan in Canada, get in touch with us at MyRide! Our wide range of services include guiding first time buyers through the car financing process and helping car buyers repair bad credit with the right car loan.

How Can I Sell Upside Down Car To Carmax A Comprehensive Guide

As car dealerships find innovative ways to make more people buy their new cars, it is now becoming more common to find people with negative equity. Factors like small or no down payment, high-interest rate, roll over and longer loan terms are some of the things that can make people have negative equity.

You will have negative equity if the loan balance is bigger than your cars resale value. Negative equity also goes with other terms like upside-down or underwater.

Being upside down is not a big issue unless the vehicle is declared a total loss by insurance, stolen or you want to replace it. You should review your auto loan balance and the resale value before you can start shopping for a new car, as the state of your equity will affect how you can sell your car.

Selling an upside down car to Carmax is a popular way you can dispose of your car with negative equity. This article will help you understand upside down and how you can sell an upside-down car to Carmax.

You May Like: Va Loan Manufactured Home With Land

How To Trade In A Car With A Loan

If your are ready for a new car, it is possible to trade in your existing car — even if it still has a loan. The dealership will pay off the car loan when you trade in your car for a new one. The biggest roadblock will be if your current car is worth less as a trade in than the loan balance. This is called being “upside down” in your current car.

Reasons For Returning A Vehicle

There are a number of reasons why you may need to return a financed vehicle. Returning a car could make sense in any of the following scenarios:

- You can no longer afford the monthly payments and want to avoid repossession.

- You purchase a new or used car only to realize shortly after that it’s a lemon.

- You believe you overpaid for the vehicle and would like to look elsewhere for a car.

- You move to a new city and no longer need the vehicle.

- You simply changed your mind about the purchase.

Trading the vehicle in for a less expensive car is something to consider if you still need a car but can’t afford the one you have. You’d still have a car loan payment. But if the vehicle is less expensive, the new payment may be more affordable for your budget than the previous one.

Read Also: What Happens If You Default On Sba Loan