Best Car Loan Rates: Conclusion

You can find the best auto loan rates for you through banks, credit unions, online lenders, and dealers. There are also a variety of factors that affect your interest rates and many methods for you to get the lowest rates possible. We encourage you to look around and compare your options to find the best auto loan for you.

The Bankrate Guide To Choosing The Best Auto Loan

Auto loans let you borrow the money you need to purchase a car. Since car loans are typically secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan, or financing, is secured does put your car at risk of repossession if you dont repay the loan, but having collateral often helps you qualify for lower interest rates and better auto loan terms.

Auto loans usually come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

How to choose the best auto loan lender

1. Approval requirements. 2. Annual percentage rate.3. Loan terms.

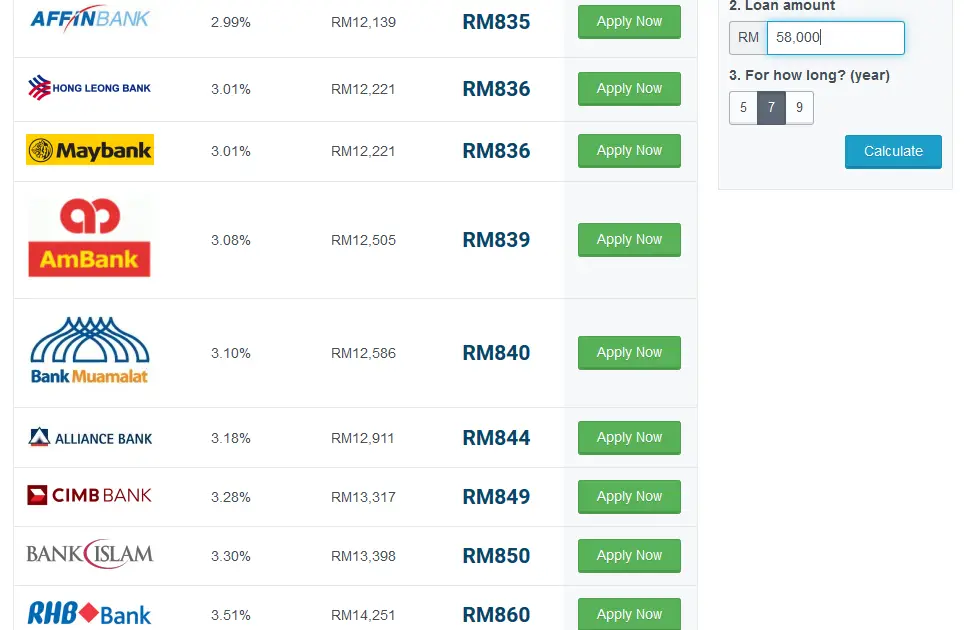

What Is A Good Auto Loan Interest Rate

A good auto loan interest rate is usually 4% or lower, but typically the best auto loan rates are for new cars. According to the 2022 report from the National Credit Union Administration , the average 60-month new car loan from a credit union has an interest rate of 2.78%. From a bank, the average rate is 4.69%. So, if you find these rates or lower, you know youre getting a fair rate on your car loan.

Recommended Reading: How To Apply For Student Loan Deferment

Choosing The Right Car Loan

The following table explains the dos and donts when choosing the right car loan:

| Dos | Donts |

|---|---|

| Compare – BankBazaar.com can help you compare the various car loan options available to you. | Eligibility – Do not apply for a loan amount that exceeds your eligibility, as this will result in the rejection of your loan application. |

| Whats the Interest? Choose a loan that offers you the best interest rate along with the loan amount you need. | Multiple Applications – Do not apply with multiple banks as this will have a negative impact on your credit score. |

| Keep it Simple Choose the car before applying for the loan and make sure the cost of the car fits your budget. | If your application is rejected, dont continue to keep apply at different banks. Chances of rejection will rise. |

| Hidden Fees and Charges – Sometimes what appears as obvious will have a hidden component. Be aware of the hidden fees and charges concerning the car loan. | Relying on the Dealership for loans – The loan that the dealer offers may not have the best interest rate. So, check the other options. |

| Special offers There could be special offers available when you are applying for your loan. Make sure you take advantage of them | Dont pick a car with a high service cost because you already have the EMI and the insurance premiums to pay. |

| Insurance Check the insurance premium for the car as this is a recurring cost. |

In case of bad credit, is a long-term car loan a better option?

How Do I Get Out Of A Car Loan

Assuming that your car is worth more than the remaining balance on your car loan, the easiest way to get out of a car loan is by selling that vehicle. Then immediately use the money you receive to finish paying off your loan. Remember, until you pay off the loan, you do not own the title to the car. Most lenders will allow you to sell it under the condition that the sale covers the remainder of what you owe.

Don’t Miss: How To Access Parent Plus Loan

What Minimum Credit Score Is Required For A Car Loan

Most buyers with a score of 660 and sufficient income can easily get approved for a car loan from a traditional bank or credit union.

There is, however, no explicit rule about what score is required for a car loan. Beyond credit, lenders also evaluate loan applications on their employment history, income, the value of the car, and more. Below that 660 score threshold, alternative lenders can be an attractive option. They offer more flexible standards, albeit at less favourable rates.

Want to see what kind of car loan you can qualify for? Use the comparison tool below:

Compare current car loan interest rates!

The Kia Sonet Gtx+ Automatics Launched In India At A Price Point Of Rs1289 Lakh

The Kia Sonet was launched recently in India. However, the price tags of the top-variant models of the car were not revealed at the time of the launch. The automakers have recently revealed the prices of the petrol and diesel variants of the top-spec model.

The Kia Sonet GTX+ will be available in both petrol and diesel variants and will come with automatic transmission setups. Both the cars have been priced at Rs.12.89 lakh . As per the latest revelations of the prices, the petrol range of the car now starts at Rs.6.71 lakh and goes up to Rs.12.89 lakh and the diesel variant starts at Rs.8.05 lakh and goes up to Rs.12.89 lakh. There is a total of 17 different trims of the car on the basis of the engine, trim, and so on. The two petrol unit variants of the car churns out 83 hp and 120 hp respectively. The diesel unit is a 1.5-litre setup which churns out 100 to 115 hp of max power and 240 Nm to 250 Nm of peak torque.

30 September 2020

Read Also: Are There Student Loan Forgiveness Scams

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

Lightstream: Best Customer Rating

- New Car Loan Starting APR: 3.99%

- Used Car Loan Starting APR: 3.99%

Founded in 2013, LightStream is the online lending division of Truist Bank. According to the companys website, it has a 4.9 out of 5.0-star rating based on over 22,000 customer reviews. It also has a rating of A+ with accreditation from the BBB.

LightStream provides loans of all kinds to people with good credit or better. With auto loans, there are no restrictions on the age or mileage of the financed vehicle, which means borrowers have plenty of options. However, the starting loan amount is $5,000.

LightStream auto loans start at 3.99% for both new and used vehicle loans, and these rates include an autopay discount of 0.5%.

LightStream Pros and Cons

Weve listed out some of the pros and cons of getting an auto loan from LightStream in the table below:

| LightStream Pros | |

|---|---|

| Only accepts good to excellent credit | |

| No vehicle age or mileage limits | Higher APRs on average |

Drivers may be able to find the best auto loans from LightStream if theyre hoping to finance a high-mileage car or one with an older model year. The companys starting APRs tend to be slightly higher than other options on average.

For more details on LightStream, head to the companys website.

Read Also: How To Get Car Loan When Self Employed

What Is A Comparison Rate

A comparison rate is a rate that helps you work out the true cost of a loan. It takes the interest rate plus most fees and charges relating to a loan and combines these amounts to a single percentage figure. The comparison rate allows you to compare loans from different lenders to find out how much it will cost you.

The comparison rate is based on a secured consumer loan of $30,000 and a term of 5 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

What Is A Car Loan

A car loan is simply a loan to help purchase a new or used vehicle.

Whether it is new or just new to you, you may not have the money to buy a car or truck outright. A car loan gives you the option to pay in installments over several years. The installments can stretch from 24 to 96 months. Interest rates are lower than many other types of loans because the vehicle itself serves as collateral. The lender can repossess the car or truck if the borrower does not pay back the loan.

Financing is available from diverse sources, including dealerships, traditional banks, and online lenders.

| What type of lender is best? | Pros |

|---|---|

|

Compare the best car loans interest rates in Canada and save money on your vehicle purchase.

Also Check: How To File Bankruptcy On Car Loan

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. They function as a grade for your borrowing history ranging from 300 to 850, and include your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be.

A lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.40% | $656 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $656 a month, while a person with a score in the lowest category would pay $831 a month, or $175 more for per month for the same car.

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Also Check: Where To Get Loan With Collateral

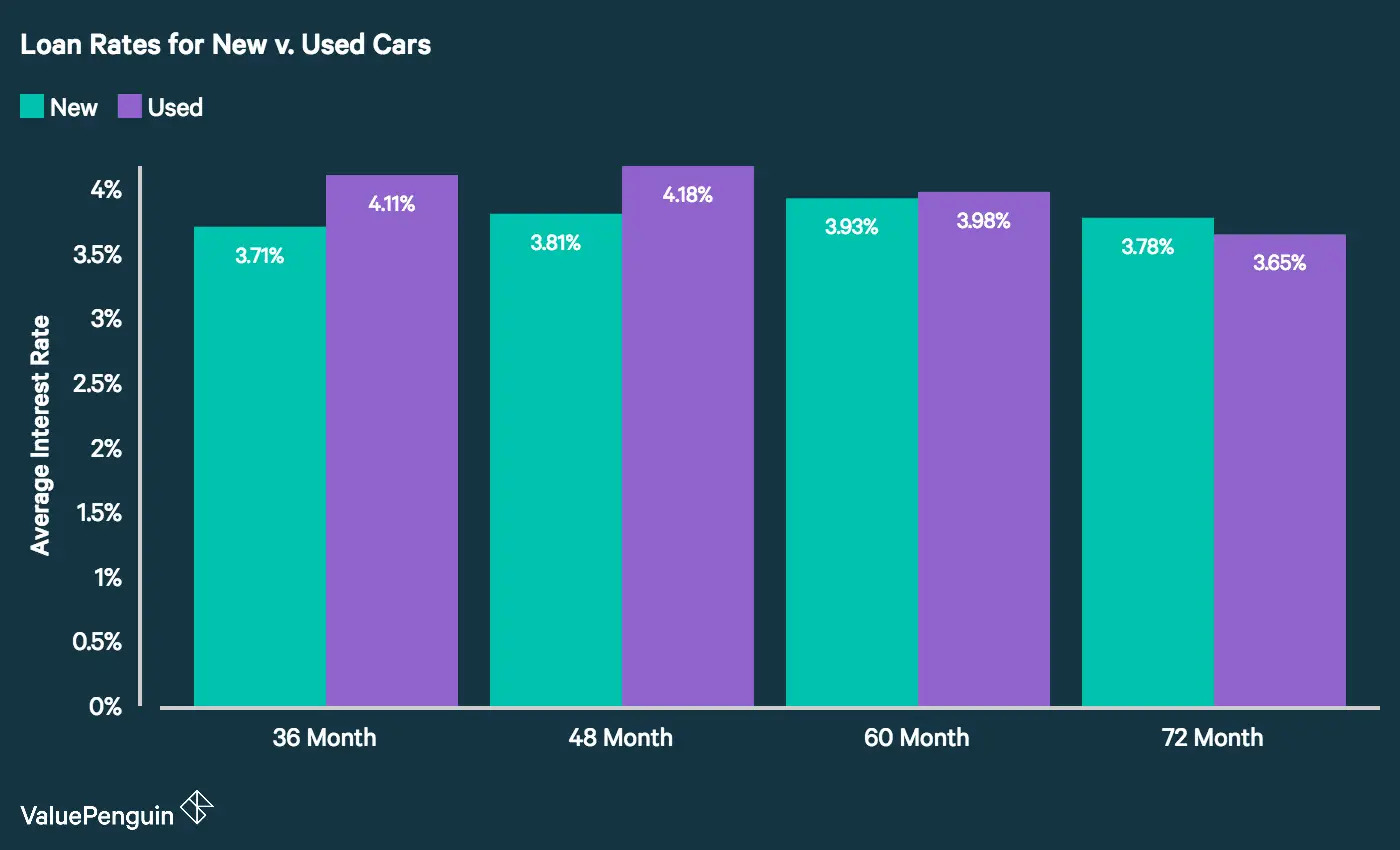

Loans Under 60 Months Have Lower Interest Rates For New Cars

Loan terms can impact on your interest rate. In general, the longer your term, the higher your interest rate is.

After 60 months, your loan is considered higher risk, and there are even bigger spikes in the amount you’ll pay to borrow. The average 72-month auto loan rate is almost 0.3% higher than the typical 36-month loan’s interest rate for new cars. That’s because there is a correlation between longer loan terms and nonpayment lenders worry that borrowers with a long loan term ultimately won’t pay them back in full. Over the 60-month mark, interest rates jump with each year added to the loan.

Data from S& P Global for new car purchases with a $25,000 loan shows how much the average interest rate changes:

| Loan term |

| 72-month used car loan | 4.07% APR |

While there’s a direct correlation between a longer repayment term period and a higher interest rate with new cars, it’s not the case with used cars. It is unclear exactly why these rates dip with longer repayment terms.

It’s best to keep your auto loan at 60 months or fewer, not only to save on interest, but also to keep your loan from becoming worth more than your car, also called being underwater. As cars get older, they lose value. It’s not only a risk to you, but also to your lender, and that risk is reflected in your interest rate.

How To Get The Best Personal Loan Interest Rate In Canada

If you plan to apply for a personal loan in Canada, always start with a bit of research. For instance, here are some of the things you can do to find the best personal loan interest rate in Canada:

- Apply For A Secured Loan Depending on your lender, you may be able to offer an asset as collateral in exchange for a lower interest rate. An asset will give your lender something to sell, should you default on your payments.

- Get A Cosigner Like collateral, getting someone to cosign your personal loan helps reassure the lender that your payments will be made on time. If you cant afford them or default, your cosigner becomes responsible for your payments.

- Go To Your Bank Banks and credit unions tend to charge competitive interest rates, which can be lower than those of private lenders. Unfortunately, you may need excellent credit and a steady income to qualify for the best personal loan interest rates.

- Compare Lenders & Quotes Make sure your lender is a legitimate business with a good reputation and affordable loan options. They should also be able to give you a free quote that shows your approximate loan amount and interest rate.

- Improve Your Credit & Finances Overall, the best way to earn a low personal loan interest rate is by building strong credit and stable finances. Plus, you may qualify with banks and credit unions, which can be safer.

Don’t Miss: Can Personal Loan Increase Credit Score

Refinance Your Car Loan With Roadloans

When paying off your car loan, its still important to keep one eye on the market for new and improved offers from lenders across the country. Just because the interest rate you received two years ago was the best at the time doesnt mean that remains the case today. Thats where RoadLoans can help.

With a wide range of financiers counted amongst our panel, our team of friendly and dedicated consultants is here to do the hard work for you and find the best car loan for you to switch to. You can save hundreds of dollars, if not more, by locking in a lower rate and fees on your loan. Get the wheels in motion with a quick quote today.

Online and convenient process

You can apply for your next car loan from the comfort of your home with our fast and simple online application.

More choice, more savings

We count over 25 reputable lenders amongst our panel, with more options increasing your chances of finding a great deal.

Have the hard work done for you

Your consultant will compare all the top offers for you and help prepare your application to maximise your approval chances.

How Much Car Loan Can I Get On My Salary

Car Loan is usually give upto 36 times of net monthly salary and 90% of the cost of car value depending on the repaying capacity such that the overall deuctions does not exceed 65% of Gross Income .

For example: A person having gross monthly salary of Rs. 40000 and deduction of Rs. 5000 making his net monthly salary of Rs. 35000 is eligible for car loan of Rs. 1260000

Also Check: How Do You Qualify For First Time Home Buyer Loan

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make payments on the principal of the car with no interest for a number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available for certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

You May Like: Should I Refinance My Home Equity Loan

Wherever The Road Takes You Were Here To Help

Whether youâre buying your first car, ready to upgrade or looking for a new adventure, we can help you find and finance the vehicle thatâs right for you.

See How Much You Could Afford Today

Business Vehicles

Whatever the size of your business, we have the financing options that will help get your business on the road.