You Are Trading Assets In For Debt

Getting a home equity loan means turning assets into debt because you are effectively taking the part of your home that you own and tying it up in another loan. Although this may be worth it in some scenarios as it prevents you from having to withdraw money from existing investments, there are also implications to having higher debt that you must consider.

How Home Equity Loan Payments Are Calculated

The calculator on this page tells you how much you may be able to borrow, but it’s not a home equity loan payment calculator that figures monthly payments on a loan.

A home equity loan has equal payments every month. The monthly payments depend on three factors:

-

Loan amount.;

-

Loan term. The term is the number of years it will take to pay off the loan. For a given amount and interest rate, a longer term will have lower monthly payments, but will charge more total interest over the life of the loan.

-

Interest rate. Usually, a longer loan term has a higher interest rate.

Are Home Equity Loans A Good Idea

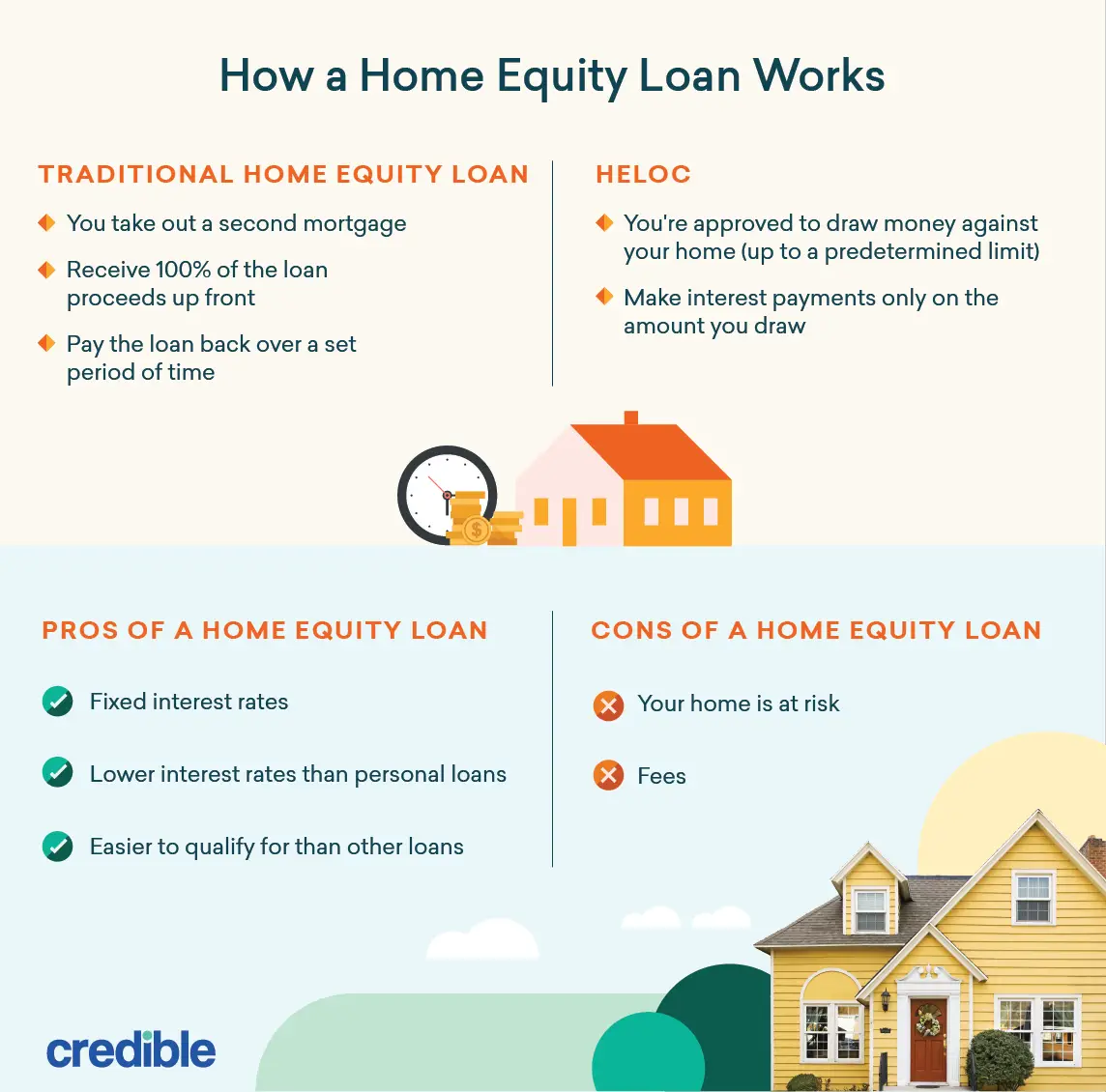

Whether a home equity loan is a good idea or not depends on your financial situation and what you plan to do with the money. Using your home as collateral carries substantial risk, so it’s worth the time to weigh the pros and cons of a home equity loan.

PROS:

-

Fixed rates provide predictable payments, which makes budgeting easier.

-

You may get a lower interest rate than with a personal loan or credit card.

-

If your current mortgage rate is low, you dont have to give that up.

-

If you use the loan for home improvements or renovation, the interest may be deductible.

CONS:

-

Less flexibility than a home equity line of credit.

-

Youll pay interest on the entire loan amount, even if youre using it incrementally, such as for an ongoing remodeling project.

-

As with any loan secured by your house, missed or late payments can put your home in jeopardy.

-

If you decide to sell your home before you’ve finished paying back the loan, the balance of your home equity loan will be due.

» MORE: The best home equity loan lenders

Recommended Reading: Is Student Loan Refinancing Worth It

You Could Have Three Mortgages For Only Two Homes

A home equity loan is often taken out in the form of a second mortgage. Combine this with the financing you will need for your second home, and its likely you will end up with three mortgages for only two properties.

Although this is important to remember, its not necessarily a deal breaker, as its no worse than having two mortgages and another loan which would likely have higher interest rates.

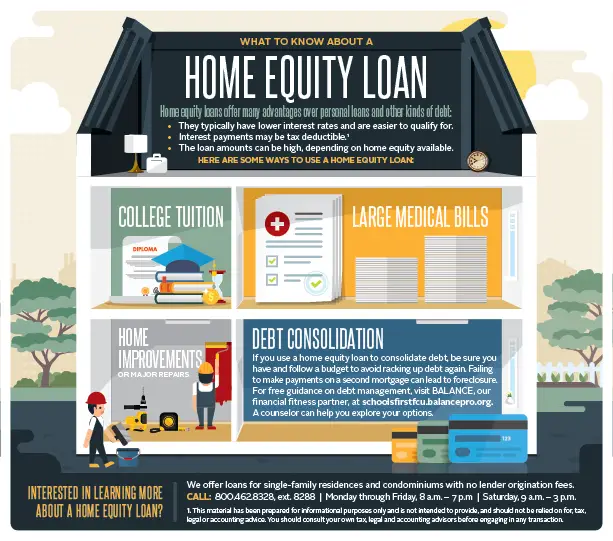

Investing In Higher Education

At some point in your career, you may decide that you could benefit from additional education. This could mean college or trade school classes, specialized courses or certain designations within your discipline.

You might consider using a home equity loan to pay for that education, which is an investment in your future. Not all careers will benefit enough from higher education to warrant the cost, though. Be sure to look into whats realistic for your job and whether theres enough return on investment.

You should also consider the rate you could get on a traditional federal student loan before pulling from your homes equity. If you finance your education with a federal loan, youre not only getting access to potentially lower interest rates, but also flexible repayment plans if you cant afford your payments down the line. By contrast, if youre struggling with repaying a home equity loan, you could lose your home to foreclosure.

Recommended Reading: What Is Fha And Conventional Loan

What To Use A Home Equity Loan For

A home equity loan is something to consider if you need a large sum of cash up front, like if youre paying for a large home renovation project or debt consolidation.;

If someone wants to consolidate debt they may choose the home equity loan because its going to pay off all the debt that they want to consolidate in one loan in one fell swoop, says McBride.

While its important to consider the ramifications of debt consolidation that trades unsecured debt for a new secured home equity loan , it could make sense if you can get a much lower interest rate that allows you to pay it off faster.

What Is A Second Mortgage

A home equity loan can be considered a second mortgage if the home equity loan is in second position. That means that you have a primary mortgage that would be paid out first in the event of a sale or foreclosure and an additional mortgage that would be paid out in second priority. The amount you can borrow will depend on the amount of your homes equity. Some second mortgages require the loan to be paid off over a set period of time, with payments that include both principal and interest. Others only charge interest during the term, with the principal remaining the same. Home equity loan requirements for a second mortgage can be lenient in certain circumstances and people with bruised credit and low or no income may be able to qualify.

In short, is a home equity loan considered a second mortgage? Answer: it depends. Now lets take a look at another type of home equity loan in Canada: the HELOC.

Read Also: Is Jumbo Loan Rates Higher

Borrow Against The Equity

You can get cash and use it to fund just about anything with a home equity loan, also known as a second mortgage. This allows you to tap into your home equity while you’re still living there. But your goal as a homeowner should be to build equity, so its wise to put that borrowed money toward a long-term investment in your future rather than just spend it.

Paying your current expenses with a home equity loan is risky because you could lose your home if you fall behind on payments and can’t catch up.

Qualifying For A Home Equity Line Of Credit

Having equity alone doesn’t guarantee you’ll be able to qualify for a home equity line of credit. You’ll also need to have decent credit most lenders want to see FICO scores of at least 660 or more, and many have even stricter requirements. But 720 or more should put you in good shape.

You also can’t be carrying too much debt your total monthly debts, including your mortgage payments and all other loans, should not exceed 45 percent of your gross monthly income.

Lenders consider all these factors together when you apply for a HELOC. For example, they may allow a lower credit score or more debt if you have a lot of home equity available.; Similarly, if you have a lower credit score they might only allow you to use 75 percent of your total home equity rather than the 90 percent they might allow someone with strong credit.

Don’t Miss: How To Calculate Amortization Schedule For Car Loan

Theres A Limit To How Much You Can Borrow

Theres also a limit to the amount you can borrow on a HELOC or home equity loan. To determine how much money youre eligible for, lenders will calculate your loan-to-value ratio, or LTV. Even if you have $300,000 in equity, the majority of lenders will not let you borrow that much money.

Lenders generally allow homeowners to borrow up to 80 percent to 85 percent of the value of their homes, minus existing mortgage balances. That number can be different from person to person, though, and depends heavily on your credit score, financial history and current income.

How To Use Home Equity

Equity is an asset, so it makes up a portion of your total net worth. You can take partial or lump sum withdrawals out of your equity if you need to, or you can save it up and pass all the wealth on to your heirs.

There are a few ways you can put your asset to work for you if you decide to use some of your home equity.

Read Also: How To Get Better Interest Rate On Car Loan

Who Should Consider A Home Equity Loan

If you need a lump sum of money for something important and are sure you can easily repay a home equity loan or second mortgage, its worth considering. The rates on a home equity loan tend to be significantly lower than rates on credit cards, so a second mortgage;can be a more economical option than paying for what you need with plastic. And sometimes the interest paid on home equity loans or second mortgages is tax deductible, so this may be an added financial bonus .

Just remember, you will get all this money in one lump sum, and you can lose your home if you dont repay the loan. So make sure that a second mortgage makes financial sense for you, rather than an option such as a home equity line of credit, where you can take out the money little by little.

Current Refinance Rates

Consider Tapping Into Your Equity

Fortunately, you dont have to sell your home to enjoy the benefits of rising home equity. Instead, you can get a home equity loan to fund an addition, give your kitchen or bathroom a facelift, or make a down payment on that beach house youve been dreaming about.;

Here are four ways to tap your home’s equity:

Don’t Miss: What Is The Max Home Loan I Can Get

Home Equity And Heloc Pros And Cons

Even if property values stay flat or rise, every new loan stretches your budget. If you lose your job, for example, itll be harder to keep current on your payments. Because a new lender has another lien on your home, theres a greater chance that you could face foreclosure if you fall behind for a long enough period.

-

Lower cost than many other types of loans

-

The ability to borrow a relatively large amount of cash

-

Potential tax breaks if you use the funds on the home

-

The safety of fixed interest rates on home equity loans

-

When you use your home as collateral, you shrink the amount of equity in your home

-

If the real estate market takes a dip, those with higher combined loan-to-value ratios run the risk of going underwater on their loan

Some Of The Advantages Of Using Your Home Equity

- You can use your equity to strengthen your homes value Since your home is an asset, you can use your equity to finance any renovations you might want to do, thus increasing your homes market value, if and when you decide to sell it.

- Interest may be deductible on your tax return If you decide to use the extra money from your second mortgage loan for investments that will produce an income, its possible to use the interest for a tax deduction.

- You can use your equity for anything you want While some homeowners choose to use their home equity for renovations or to finance other properties, others will use it to pay for their childrens or their own education, or even go on vacation. You can also use your equity to consolidate any other higher interest debts you might have on your plate.

You May Like: How To Pay Home Loan Faster

How To Calculate Home Equity

Now that you know what home equity is, you probably want to know how much equity you have in your own home. Knowing roughly how much equity you have is helpful if youre thinking of selling, and its also an important factor if youre considering a home equity loan or line of credit more on that later.;

Most people dont own their homes outright. According to the Zillow Group Consumer Housing Trends Report 2018, 59% of homeowners are still paying a mortgage on their homes. This means that calculating equity isnt as easy as simply assessing your homes market value.;

Things To Consider Before Taking Out A Home Equity Loan In Canada

As with most loans, you need to consider the affordability of repayments and whether the loan will improve your financial situation and lifestyle.

- Unless you are taking out a reverse mortgage, youll need to have a plan in place for paying off the loan

- If you miss HELOC or second mortgage payments, you may lose your home

- The amount of equity that you own in your home will be reduced

- You will have to budget for monthly payments unless the loan is a reverse mortgage

Read Also: How To Get Sba 7a Loan

Should You Get A Home Equity Loan

Everyones situation is different, and a home equity loan wont be the right choice for everyone. But if you have unused equity in your house or apartment and you want to tap into it without going through the hassle of refinancing your mortgage, a home equity loan is worth a look. In particular, if you intend to use the proceeds to improve your home, the potential tax deductibility of the interest on home equity loans makes them an option to strongly consider.

Best Home Equity Loans Of 2021

See how to qualify for the best home equity loan and access your homes equity for home Some mortgage options require no or low down payments.What Is a Home Equity Loan?Where Can You Get a Home Equity Loan?

You are able to leave the first mortgage in place without the expense of a refinance or losing the good interest rate you may have on that loan. The home;

Aug 24, 2021 Usually a home equity loan serves as an additional debt on top of an already existing mortgage. When you take out a home equity loan, you borrow;

Jun 11, 2020 Home equity, which refers to the difference between your mortgage balance FHA loan rules say that if you have been out of work for six;

Recommended Reading: Can You Use Fha Loan If You Already Own House

Home Equity Loans: How To Qualify

The first step in applying for a home equity loan is having enough equity in your home to qualify. Generally speaking, most home equity lenders will only let you borrow up to 85% of your homes value in total between your mortgage and a home equity loan.

For example, if your home is currently worth $400,000, you could owe a total of $340,000 on your mortgage and a home equity loan. So if you already owe $300,000 on your home, you could qualify to cash out another $40,000 with a home equity loan.

Depending on your situation, its likely youll need to have your property appraised to determine how much its worth in todays market. Your home equity lender will usually facilitate this process for you, although an appraisal fee is typically required.

Your is another factor that comes into play if you want to qualify for a home equity loan. While each lender has their own qualification criteria, youll have the best chance at approval if your FICO score is at least good meaning 670 or higher. And youre more likely to get the best rates and terms on a home equity loan if your FICO score is very good, which is generally 740 and higher.

Related: How to instantly improve your credit scores for free with Experian Boost.

Finally, a home equity lender will consider your debt-to-income ratio, which is how much debt you already have in relation to the income you bring in. Generally speaking, lenders prefer consumers with debt-to-income ratios of 43% or below.

Home Equity Loan Costs

Like other financial products, home equity loans often have fees that may not be obvious unless youre looking for them. According to the Federal Trade Commission , you could be asked to pay an application or loan processing fee, as well as an origination fee of up to 5% of your loan amount.

You will also likely need to pay for an appraisal to prove your home has enough value to support the loan, and you may also face document preparation fees, recording fees or broker fees as well. So its important to ask about fees up front and look for lenders who offer home equity loans with very limited extra fees and closing costs.

If youre considering a home equity loan, make sure to shop around and compare lenders, their rates and the fees they charge. One way to do that is through an online marketplace such as LendingTree, which offers the convenience of only having to submit your details once, and then getting offers from multiple lenders that you can compare and consider.

Also Check: What Is The Commitment Fee On Mortgage Loan

Subtract Your Loan Payoff Amount

Now youll want to factor in your remaining mortgage balance. Contact your mortgage lender to get a loan payoff amount, which is also called an estimated settlement statement.;

Note that your loan payoff is not the same as the loan balance you see on your monthly payment. A loan payoff factors in interest up to your estimated closing date, whereas your statement is only calculated once a month. Your loan payoff might also include a prepayment penalty if youre selling soon after buying. For the purposes of this exercise, well assume your closing date is today.;

If you dont have a remaining mortgage balance, your equity is equivalent to your homes current market value.;

Example: Keeping the same example as step one above, with your 20% down payment, you originally borrowed $200,000. After six years of monthly mortgage payments, your loan balance as of June 2019 is $176,472 with your 4.07% interest rate.;