What Percentage Of Us Families Are Single Parent

In 2020 nearly 19 million children, amounting to 25 percent of all children in the U.S., were living in single-parent families. That percentage is nearly three times the level in 1960 of 9 percent. Americas proportion of children living with a single parent is more than three times the worldwide level of 7 percent.

Finding A Plus Loan Lender

All new federal education loans, including the PLUS loan, are made through the Direct Loan program. To obtain a Parent PLUS loan, contact the colleges financial aid office.

The PLUS loan borrower will need to sign a Master Promissory Note , which covers a period of continuous enrollment. Annual borrowing is capped at the cost of attendance minus other aid. The college will draw down the funds from the Common Origination and Disbursement system and deposit them into the students account. After the funds are applied to tuition and fees , any remaining funds will be disbursed to the student to pay for textbooks and other college-related costs.

Parents who are considering a PLUS loan also often consider a home equity loan or an alternative loan. Have questions? Learn more about qualifying for a Parent PLUS Loan: Questions about Qualifying for the Parent PLUS Loan

What Are Parent Plus Loans

Parent PLUS loans are offered by the Department of Education. They are loans that are taken out by a parent to help pay for their childs education. Only the biological or adoptive parents of a student can take out a PLUS loan for them. PLUS loans are taken out in the parents name, therefore the parent is responsible for repayment of the debt.

Parents can take out a PLUS loan for up to the schools cost of attendance.

Also see: Parent PLUS Loans: Pros and Cons

Recommended Reading: Stilt Loan Calculator

Ways To Get Your Parent Plus Loans Forgiven

You have a few options if you want to have part or even all of your Parent PLUS Loans canceled even if you dont work for a nonprofit or government organization.

Apply for Public Service Loan Forgiveness

- Have your loan balance erased after 10 years of qualifying repayments.

- The application is especially complicated for parents and most get rejected.

Public Service Loan Forgiveness was designed to encourage recent graduates with high debt loads to enter public service, but you can qualify as a parent borrower too. It involves making 120 repayments on an income-driven repayment plan while working at an eligible public service job. If you qualify, you can have the remaining balance of your loans canceled.

But 99% of the initial round of applicants were rejected, mainly due to misinformation about the eligibility requirements and process. As a Parent PLUS borrower, you have an even harder time qualifying because you first have to consolidate your loans with a Direct Consolidation Loan to make qualifying repayments on an income-driven repayment plan. And the only plan youre eligible for the Income-Contingent Repayment Plan comes with the highest monthly cost of all the IDR plans.

Look into private options

- Many have fewer service requirements than PSLF.

- Prepare for lower forgiveness amounts.

These typically only require between two and five years of service. But you might not get your entire loan balance forgiven.

Find a job that offers forgiveness as a benefit

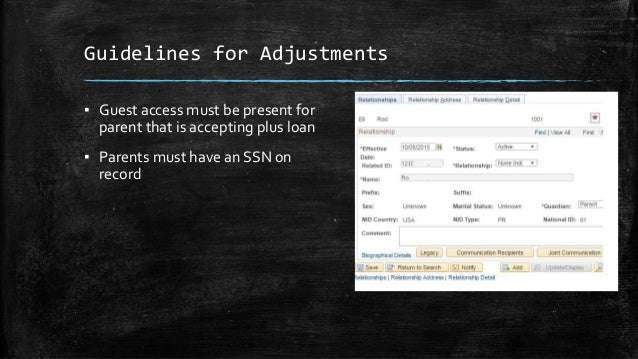

How To Apply For A Parent Plus Loan

Are you still thinking about applying for one of these monsters? Hopefully not. But maybe you enjoy horror stories . . . or rubbernecking fender-benders! If so, lets go over the steps to apply for a Parent PLUS Loan.

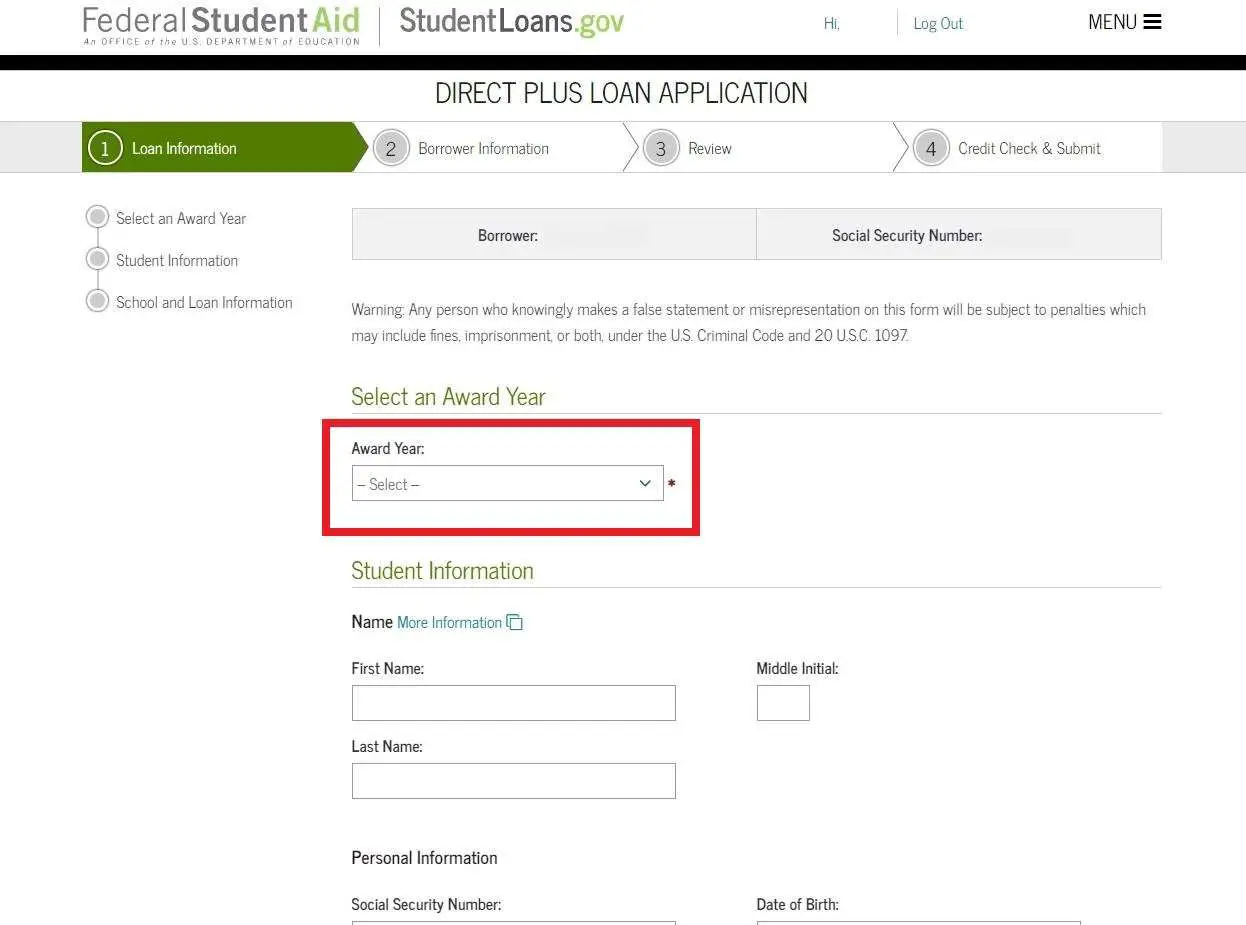

Step 1. Have your student complete a FAFSA. If you dont know, thats the Free Application for Federal Student Aid. Its found on the Federal Student Aid website. This is a good thing to do even if you and your child arent applying for any loans, because its necessary for receiving any form of financial aid, including scholarships and grants.

Step 2. Complete the Application. The exact title is the Direct PLUS Loan Application for Parents. Thats also found on the Federal Student Aid site. This is also where you decide how much you want to borrowwhich is obviously zero. If you were going to pull the trigger here , you would need to authorize a credit check.

At that point, the Department of Education will be in touch if you have adverse credit. Thats because they really want you to get this loan! Theyll tell you how you can appeal an adverse credit finding, or go find a cosigner. But we know youre too smart for that.

Step 3. Sign the Master Promissory Note. Thats the terms and conditions for paying back your loan. Youll see it there on the same government website as the application. We really hope you havent reached this step because once you sign, you will be locked in for at least 10 years of loan payments, and who knows how much in interest.

You May Like: Usaa Car Loan Bad Credit

Refinance With A Private Lender

âParent PLUS Loans often have interest rates 1-3% more than other federal student loans. Refinancing parent loans with a private lender could allow you to get a lower interest rate, which will help you get a lower monthly payment and pay the loans off faster.

To qualify, youâll need a good credit score and enough income to cover your monthly bills and other payments for education loans. Since there is an income requirement, explore refinancing Parent PLUS Loans before you retire and your income decreases.

Note: If you refinance with a private lender, youâll lose access to federal benefits like deferment, forbearance, and student loan forgiveness programs

Retiring With Parent Plus Loan Debt Lets Talk

Youâre not the only parent wondering how youâll afford Parent PLUS Loans once you retire. Iâve helped parents and student loan borrowers devise strategies to keep them out of default, preserve their credit scores, and leave room in their budgets so they can live. Schedule a free 10-minute call to see how I can help you.

If youâre interested in more expert student loan knowledge, for student loan repayment and forgiveness tips and updates. After managing over 400 million in student loans, I promise to give you the best information out there.

Also Check: Usaa Auto Loan Credit Score

General Eligibility & Citizenship Status Requirements For A Direct Plus Loan

All PLUS applicants, including the dependent student in the case of a Parent PLUS Loan, must be a U.S. citizen or eligible noncitizen, must not be in default on any federal education loans or owe a repayment on a federal education grant, and must meet other general eligibility requirements for Federal Student Aid programs. You can find more information about these requirements including a list of eligible noncitizen statuses Federal Student Aid.

Recommended Reading: How To Get Loan Officer License In California

How To Consolidate Parent Plus Loans

Post-secondary tuition has been steadily increasing over the last several decades. In fact, tuition costs for the 1987-1988 school year came to $3,190 in inflation-adjusted dollars. Just 30 years later, tuition costs have risen nearly 215%, with the average yearly tuition cost coming in at $9,970.

To combat these ever-increasing tuition costs, parents have begun to take out loans to help fund their children’s education.

Also Check: Usaa Classic Car Loan

Parent Plus Loan Eligibility Denials And Limits

Many parents want to help fund their childs college education. One common way to do this is through the Federal Parent PLUS Loan. Like with other student loans, the Parent PLUS Loan offers advantages to private student loans, including safer repayment terms and the option to enroll in repayment programs. As the name suggests, this loan goes to the parent of a dependent college student and limits how much debt the student will have to take on. But, parents with bad credit may not qualify. Parents should be aware of Parent PLUS Loan eligibility requirements, because a denial can impact their childs ability to finish college and can create more debt for the child. Parents and students also need to evaluate the cost of higher education carefully, because PLUS Loan amounts can be dangerously high at some schools.

Could Be Hard To Qualify

For one, it could be hard to qualify for refinancing. Unlike the federal government, private lenders check your credit and income before approving you for a loan.

They want reassurance that youll be able to pay the loan back, and they look at your credit and income to get it. Although few advertise a specific cutoff, most want to see a credit score of 650 or higher.

If you cant qualify now, youll need to take steps to build your credit .

Read Also: Usaa New Car Loan Rates

Are Parent Plus Loans Worth It

Parent PLUS loans can be useful if your child has maxed out their student aid and has no other alternative to lower the cost of their education . However, parent PLUS loans can derail your own life goals, like saving for retirement, paying off your mortgage or living the lifestyle youve always imagined for yourself. Before taking out a loan, understand the extra cost youll pay in interest and make a plan for repayment so youre not taken by surprise.

Can I Include A Parent Plus Loan In A Chapter 13 Bankruptcy

- Posted on Oct 11, 2012

If you found my answer useful, please check it as âhelpfulâ here on Avvo. Answers to questions on Avvo are for general informational purposes only. Proper preparation of a bankruptcy case involves many factors and variables, and may lead to a different answer than that given here when all the facts are taken into consideration. The fact that a general question was answered on Avvo does not establish an attorney-client relationship that only happens when both you and I sign a formal contract and a retainer is paid and collected.

- on Oct 11, 2012

Present law makes this result, as your attorney and my colleague has reported.Unless you can squeeze out some payments from your budget after the plan payment is made, you are stuck.Congress would have to change the law, currently unsecured creditors enjoy a preference to your paying back a student loan.If your plan is a 100% dividend return to unsecured creditors, any extra income you have can be used to pay student loans, or to anything else you want.

General legal advice is offered for educational purposes only. A consultation with a qualified attorney is required to determine specific legal advice as to your situation and applicable law. We are a debt relief agency and we help people file for relief under the bankruptcy laws.

Recommended Reading: Usaa Auto Lease Calculator

Discharge Options For Parent Plus Loans

The terms forgiveness and discharge have the same essential meaning, but theyre used to refer to different conditions for loan cancellation.

When your loans are erased because you work in a certain type of job, the government refers to that as forgiveness, while the situations below are considered circumstances for discharge. In both cases, youre no longer required to make loan payments and your repayment is considered complete. Here are the cases when parent PLUS loans are eligible for discharge.

- Discharge due to death. If the parent PLUS borrower or the child for whom they took out a loan dies, the loan is forgiven. To receive the discharge, documentation verifying the death must be provided to the student loan servicer.

- Total and permanent disability discharge. If the parent borrower becomes totally and permanently disabled, their loans may be discharged. The government reaches out to eligible Social Security recipients with student loans to let them know TPD is available to them, but others can apply proactively through the federal website DisabilityDischarge.com.

- Closed school discharge. Parents may also be eligible for discharge if their childs school closed before the child could complete their degree program. Contact your student loan servicer to identify whether youre a candidate.

Should You Refinance Parent Plus Loans

You should weigh your decision to refinance parent PLUS loans based on your needs and financial situation. Student loan refinancing may be right for you if you can qualify for an interest rate lower than the federal rate. Private lenders generally base interest rates for borrowers on income and credit score youll need a credit score thats at least in the high 600s.

However, refinancing also means losing access to federal student loan benefits, such as deferment or forbearance, income-driven repayment plans, and student loan forgiveness programs like Public Service Loan Forgiveness . If you qualify for or need these programs, refinancing may not be the best solution for you.

You May Like: Refinance Auto Loan Calculator Usaa

Youre Helping Your Child Pay For Grad School

Maybe your student is headed for graduate school, med school, law school or another professional program. If you want to help them pay for graduate school, private student loans will be your only option to do so.

The federal parent PLUS loan is available only to parents of undergraduate students. If you want to borrow to help pay for your childs advanced degree, private student loans are the way to go.

Like undergraduate students, however, graduate students might have access to federal aid and student loans that are a better deal. Talk through all the borrowing options with your graduate student to find the best and most affordable way to finance their degree.

What Is A Parent Plus Loan

A parent PLUS loan is a federal student loan, specifically a Direct PLUS loan, thats offered to parents of undergrads. It offers flexible borrowing limits that let parents borrow up to their students full cost of attendance, covering gaps between offered student aid and costs.

The borrowing parent must have non-adverse credit to qualify, and they will own and repay these loans.

Grandparents and legal guardians arent eligible for parent PLUS loans, even if they have had primary responsibility for raising the student, unless they have legally adopted the young person.

Read Also: Usaa Car Loan Credit Score

Bankruptcy Could Be A Problem

Even after your child has obtained everything he or she can with student loans and grants, you may still need to bridge the gap. This is best done with a federal Parent PLUS loan. Unfortunately, these are credit based, and as suchmay be beyond your reach.

You cannot have an âadverse credit history.â This means that you are more than 90 days delinquent on any debt , or in the past 5 years defaulted on a debt, obtained a bankruptcy discharge, foreclosure, repossession, tax lien,wage garnishment, or write-off of a federal student loan.

Donât Miss: What Is Epiq Bankruptcy Solutions Llc

Who Is Eligible To Apply For A Parent Plus Loan

The parent is the borrower for the Parent PLUS Loan, and the loan will not transfer to the student. Only parents of undergraduate students considereddependent for federal aid purposes can apply for this loan. The application is subject to a credit check.

Students must also be meetingsatisfactory academic progress standards for financial aid eligibility to receive the loan.

The application usually becomes available in late March or early April for the upcoming academic year.

Recommended Reading: Usaa Auto Loan Credit Score Requirements

How To Apply For Federal Plus Loans

To obtain a Federal PLUS Loan, talk to the colleges financial aid office. The Federal PLUS Loan is disbursed through the college financial aid office, so they administer the application process and determine the maximum amount you can borrow. They will ask you to complete a PLUS loan application at the Studentaid.gov web site. You may be required to complete entrance counseling.

PLUS Loan borrowers will also have to sign a Master Promissory Note at Studentaid.gov to obtain a Federal PLUS Loan. The Master Promissory Note is good for a continuous period of enrollment at a specific college for a period of up to 10 years.

Also Check: Bayview Loan Servicing Foreclosure Listings

Two Versions Of The Federal Plus Loan

There are two versions of the Federal PLUS Loan: the Federal Parent PLUS Loan and the Federal Grad PLUS Loan.

Other than the differences in the borrower, the purpose of the loan and some discharge provisions, the Parent PLUS and Grad PLUS loans are nearly identical. The Federal Grad PLUS Loan first became available on July 1, 2006, through an amendment to the Federal Parent PLUS Loan.

You May Like: Can You Refinance An Fha Loan

You May Like: Restoring Va Entitlement After Foreclosure

Gather Your Documentation And Apply

Once youve shopped around for the best rates, your next step is to choose an offer and apply. This application will be a little more extensive, as it will ask for your personal information, as well as loan statements and proof of employment, such as pay stubs or an offer letter.

You can typically apply online and will get an answer from the lender in a few days. You can also call the lenders customer service line if you have any questions or need help along the way.

Most refinancing providers are able to process your application and get your new loan up and running in a matter of weeks. If refinancing is the right move for you, the sooner you apply, the sooner you could start saving on interest.

Note that checking your rates and applying for refinancing is free. You should never have to pay to refinance student loans, and the best lenders dont charge an application or origination.