Warning Signs That Someone Used Your Name For A Ppp Loan Or Eidl Fraud

by Carrie | Nov 2, 2022

Note: of May 31, 2021, the SBA has stopped the PPP application process.

As of January 1, 2022, they have stopped taking EIDL applications as well.

If you are still receiving letters/emails regarding pre-approved lines of credit for a PPP accountread to learn more.

Have you recently received a letter from the SBA regarding your Paycheck Protection Program PPP, or Economic Injury Disaster Loan EIDL? If you did and never applied for either one of these, you could be a victim of PPP or EIDL identity fraud.

First off, dont throw it away. Some people that received these letters thought it was junk mail or a scam and tossed it just like any other spam letter. It was actually a warning sign that a fraudulent loan was taken out using their identity, either personal or business.

Details About The Data

In an 18-page report, the SBA and Treasury revealed that 86.5% of PPP loans were for less than $150,000. Those loans, however, accounted for only 27.2% of the $521.5 billion in loans approved.

The average loan size was $107,000. More than 3.5 million loans were for $50,000 or less, while about 82,600 loans were for more than $1 million.

Other highlights in the report include:

- PPP loans are supporting about 51.1 million jobs, as much as 84% of all small business employees, based on U.S. Census calculations that small businesses employ around 59.9 million workers in the United States.

- Across the 50 states, PPP loans covered 72% to 96% of estimated small business payroll. The state with the highest percentage of loan support is Florida, while Virginia has the lowest percentage of loans covered.

- Lenders with less than $10 billion in assets were responsible for $231 billion in loans or about 44% of the total. Banks with more than $50 billion in assets accounted for 36% of the value of the loans about $190 billion.

- Among industries, health care received the most money $67.4 billion while professional, scientific, and technical services received the largest number of loans, 638,221. The construction, manufacturing, accommodation and food services, and retail sectors each received more than $40 billion in loans.

- Banks accounted for about $497 billion in loans, followed by credit unions , small business lending companies , and fintech .

A De Facto Honor System

These flagged loans were not always adequately scrutinized, according to an auditors report. Last fall, the auditor found that SBA failed to ensure loans were completely and accurately reviewed to address their respective eligibility flags.

There was a rush to close out flags. In late 2020, the SBA had a contractor develop a tool to expedite the manual review process by grouping flagged loans in bulk as requiring no further action, according to the Pandemic Response Accountability Committee. The auditors report found that the SBA trusted without checking a key contractors review of the flagged loans and didnt examine the loans the contractor determined were fine.

Compounding the oversight shortfalls, only a limited number of PPP forgiveness applications were actually reviewed by the SBA, according to the auditor, and $49 billion was paid to lenders for forgiveness of PPP loan guarantees that were still being reviewed to address alerts and flags indicative of eligibility concerns. The SBA disagreed with the auditors assessment in the fall of 2021 regarding the severity of the problem.

The data obtained by POGO provides more details on mass close-outs of flags shortly before the second round of the program in mid-January 2021, further fueling concerns that they were not adequately reviewed. Businesses with uncleared flags were unable to access second-round PPP funds.

Don’t Miss: How To Change Name On Auto Loan

Applications Under Fake Businesses

Due to data security breaches and data aggregators amassing billions of peoples personal information, there is a good chance your name is waiting to be picked out of the hat when it comes to being a victim of fraud.

With only names, socials, and birthdays, the bad guys completed loan applications simply by creating a fictitious business and providing fake financial documents. In many of the cases we are aware of, the bad guys used the victims first or last name followed by Farms as the business name.

Since the victims SSN was used, as opposed to a business FEIN, if the victims credit was good, the loan was likely to be approved.

Many of the loans were for $48,900 or less.

As far as proof of ID, the bad guys applied online with the virtual banks. Most, if not all, require very little information or no information for proof of identity. If a drivers license was required, bad guys can easily make a fake one. The banks do not confirm the photo on the ID matches the photo in the states DMV database.

Ppp Recipients That Laid Off Workers

Even though the purpose of the Paycheck Protection Program was to keep workers on the payrolls of businesses, some PPP loan recipients laid off employees. Businesses with 100 or more employees are legally required to send notices to employees in advance of layoffs of 50 or more under the Worker Adjustment and Retraining Notification Act.

The SBA flagged 388 businesses for issuing COVID-related WARN notices.

A loan worth more than $5 million to a recipient in Clark County, Nevada, was flagged for issuing a WARN notice.

Out of the 388 loans flagged for this reason, a disproportionate number 306 went to entities in New York state. This raises questions about whether the SBA was consistent in its assessment across the nation of recipients compliance with the terms of the PPP loans, which were intended to preserve jobs, or if there is some other explanation such as the fact that New York state was the nations pandemic epicenter when the PPP began. An SBA spokesperson had no comment.

The 388 loan recipients flagged by the SBA is far smaller than the number identified by the nonprofit, pro-union organization Good Jobs First. In a , Good Jobs First conservatively identified 1,892 companies that received PPP loans that also sent layoff notices affecting over 190,000 workers earlier that year.

Read Also: Can I Go Back To School With Student Loan Debt

$2 To $5 Million Range

- Self-driving trucking company TuSimple plans to save 324 jobs. TechCrunch recently reported that this startup, which gained unicorn status in 2019, has hired Morgan Stanley as it seeks $250 million in new funding.

- Yeezy LLC, a company owned by Kanye West, is listed and the money will retain 106 jobs.

Applications Under Real Businesses

Not all the applications were filed under fake businesses. We received calls from a few individuals that discovered someone used their business identity to apply for a loan or multiple loans.

In many states, business records are available to the public. For example, in Florida, anyone can search for businesses registered to conduct business in the state by visiting www.sunbiz.org. The information listed for each business often includes the business address, officers, and FEIN, information required on the PPP and EIDL application.

If you want to learn more about just how easy it is for criminals to use your business for fraud, check out our main article where we go more in depth on what is business fraud.

Also Check: What Is Prime Loan Rate

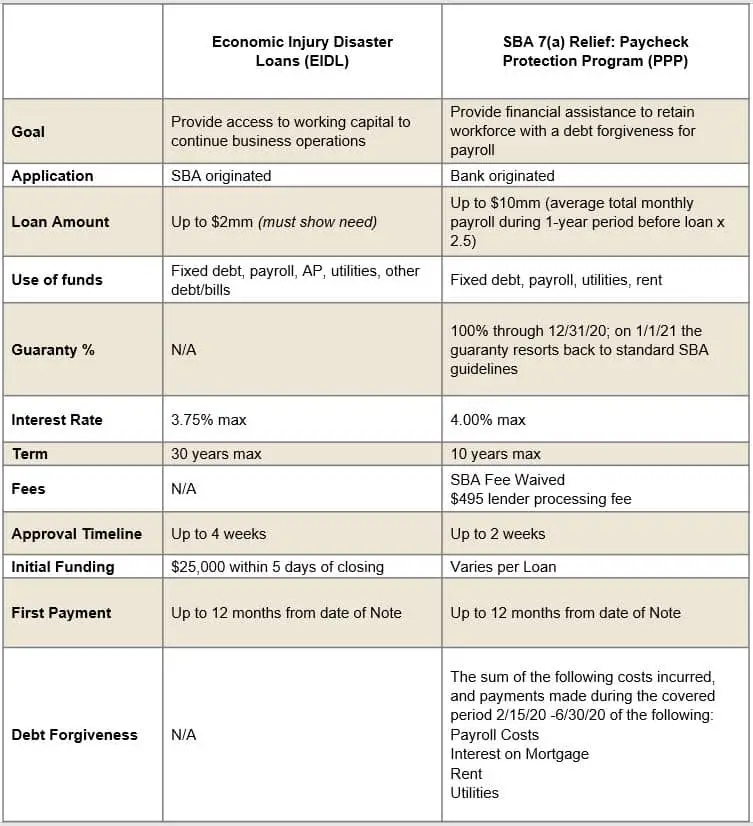

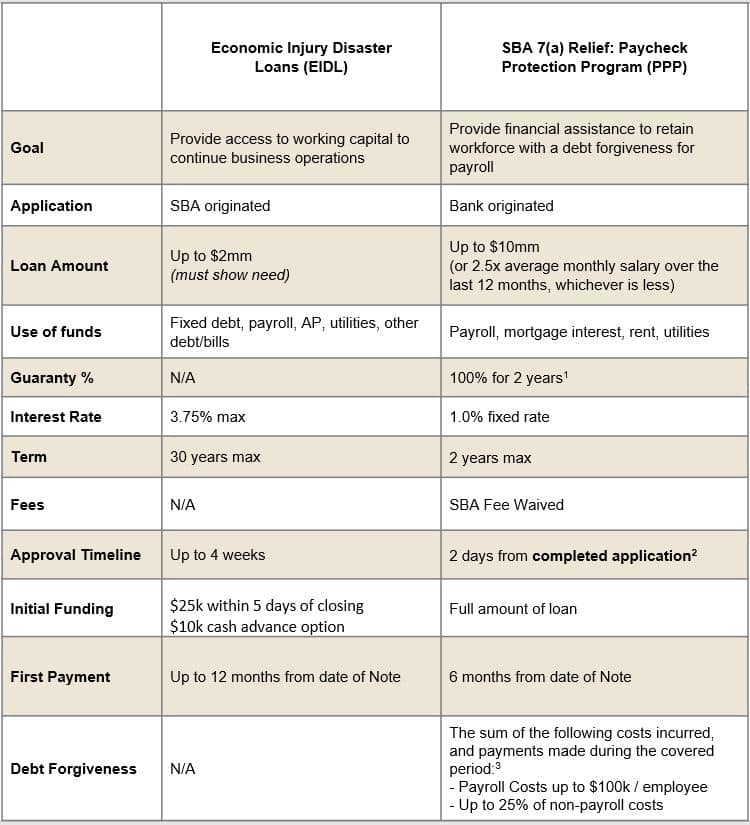

Economic Injury Disaster Loans

In response to the Coronavirus pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available following a successful application. This loan advance will not have to be repaid. If a business received an Economic Injury Disaster Loan advance in addition to a Paycheck Protection Program loan, the amount of the Economic Injury Disaster Loan advance will be deducted from the PPP loan forgiveness amount by SBA.

The SBAs Economic Injury Disaster Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic.

This program is for any small business with fewer than 500 employees , private non-profit organization or 501 veterans organizations affected by COVID-19.

Businesses in certain industries may have more than 500 employees if they meet the SBAs size standards for those industries.

The Economic Injury Disaster Loan advance funds will be made available within days of a successful application, and this loan advance will not have to be repaid.

$150000 To $350000 Range

- Stackin, which connects millennials to fintech startups, got a loan. This loan is notable because the fintech company raised a $12.6 million Series B financing in May, is listed in the loan data. CEO Scott Grimes did not immediately respond to a request for comment.

- OpenResearch, formerly named Y Combinator Research, got a loan. The nonprofit company rebranded in May, and announced that it is operating independently from Y Combinator and will no longer be affiliated with the incubator. This renaming announcement came after the nonprofit applied for a PPP grant.

Read Also: What Is Origination Charges In Loan

Ppp Loan Recipient List By State Illinois

Illinois has a total of 620,049 businesses that received Paycheck Protection Program loans from the Small Business Administration.

This table shows the top 5 industries in Illinois by number of loans awarded, with average loan amounts and number of jobs reported.

The tool below can be used to search all publicly released PPP recipients in IL. Filter the list or search for specific companies.

| Top Industries |

|---|

| No Results Found – Please Modify Your Search! |

| } |

FederalPay’s PPP Information Policy

Paycheck Protection Loan data has been made public by the Small Business Administration for all private companies that received a PPP loan.

All information displayed on this page is publicly available information under PPP loan guidelines, in compliance with 5 U.S.C. § 552 and 5 U.S.C. § 552a and is published unmodified, as provided by the SBA. FederalPay does not modify the data and makes no claims regarding its accuracy.

Any corrections or modifications to this data can only be made via the SBA. For more information, please see the .

Allegedly Dead Or Debarred

Even setting those criminal record flags aside, there is still a large universe of questionable Paycheck Protection Program loans that merit closer scrutiny by resource-strapped federal watchdogs even as most PPP loans have already been forgiven by the SBA.

And, although they represent a tiny fraction of the flagged loans in the database, many have already led to federal indictments. One example is a Riverside County, California, recipient of a loan exceeding $5 million with 10 flags that appears to be Road Doctor California LLC. Its owner, Oumar Sissoko, was convicted in April 2022 for misappropriating some of the money.

Another basis for denying PPP loans is appearing on the federal governments list of entities that have been debarred from winning contracts, grants, or loans. A broader dataset managed by the Treasury Department is called the Do Not Pay list. It contains information on debarred entities, plus data on dead persons and borrowers with delinquent or defaulted federal loans.

The SBA data shows that 4,663 loans were flagged with Do Not Pay Death Sources. One example is the previously mentioned loan worth between $2 million and $5 million to a recipient in Dallas County, Texas, that received 13 flags, including the death source flag.

The SBA flagged 926 loans as Do Not Pay SAM. SAM is a reference to a federal database of companies and persons excluded from doing business with the government.

Recommended Reading: Which Student Loan Is Better Subsidized Or Unsubsidized

Sba Releases List Of Businesses That Benefited From Ppp Loans

More than 23,000 South Dakota businesses took advantage of the federal Paycheck Protection Program, according to data released by the SBA and Treasury Department.

It showed 1,943 businesses in the state received more than $150,000 in PPP loans. The loans, which can be forgiven, were offered during the early weeks of the COVID-19 pandemic to help cover payroll costs along with other expenses such as lease, mortgage and utility payments.

Data was released by loan amount ranges:

- $150,000 to $350,000

- $1 million to $2 million

- $2 million to $5 million

- $5 million to $10 million

These categories account for nearly 75 percent of the loan dollars approved. For all loans below $150,000, the SBA is releasing data including loan amounts, lenders, ZIP codes where the businesses are located and the number of jobs retained but not business names or addresses.

In South Dakota, 20,564 businesses received loans of less than $150,000.

In the Sioux Falls area, three business received loans in excess of $5 million:

- Regency Midwest Ventures, supporting approximately 500 jobs.

- Showplace Wood Products, supporting approximately 500 jobs.

- Sonifi Solutions, supporting approximately 500 jobs.

South Dakota was recognized early in the program for having a large percentage of businesses approved for the loans.

There were 4.9 million PPP loans nationwide.

| a $5-10 million |

Signs Of Implausible Businesses

The push to move PPP loans out the door as quickly as possible was motivated by an effort to protect millions of jobs. But significant sums appear to have been diverted to entities that may not be real businesses, may not have been in operation when PPP loans were sought, or could not have realistically employed the number of workers claimed.

SBA flagged 239,144 loan recipients as having an inactive business. One example is a loan worth between $1 million and $2 million that went to a recipient in Ulster County, New York, that had been flagged for nine other reasons. Twenty-six other recipients flagged for having an inactive business address also had 10 flags or more.

SBA flagged 48,427 loans because of data matches showing the recipients business addresses as currently vacant. One example is in Austin, Texas, where a loan between $350,000 and $1 million was flagged for this reason, as well as eight others.

The SBA flagged 5,811 loans because its analysis identified a large number of employees at the residential addresses provided by the PPP recipients as their place of business.

Read Also: Can You Get An Fha Loan With No Down Payment

Ppp Loan Recipient List By State Mississippi

Mississippi has a total of 138,393 businesses that received Paycheck Protection Program loans from the Small Business Administration.

This table shows the top 5 industries in Mississippi by number of loans awarded, with average loan amounts and number of jobs reported.

The tool below can be used to search all publicly released PPP recipients in MS. Filter the list or search for specific companies.

| Top Industries |

|---|

| No Results Found – Please Modify Your Search! |

| } |

FederalPay’s PPP Information Policy

Paycheck Protection Loan data has been made public by the Small Business Administration for all private companies that received a PPP loan.

All information displayed on this page is publicly available information under PPP loan guidelines, in compliance with 5 U.S.C. § 552 and 5 U.S.C. § 552a and is published unmodified, as provided by the SBA. FederalPay does not modify the data and makes no claims regarding its accuracy.

Any corrections or modifications to this data can only be made via the SBA. For more information, please see the .

Sign Up For Our Weekly Newsletter

Get a roundup of POGO’s latest work and announcements. Delivered Saturday mornings.

The agency first began retrospectively applying these flags in 2020 to help identify loans that should be more closely assessed before being forgiven. Indeed, the SBA dubbed the flags hold codes, and the codes were supposed to be cleared before the agency forgave the loans. Yet previously unreported auditor findings state that the SBA failed to ensure that all flagged loans and forgiveness applications were properly reviewed, raising the possibility that the government wrongly waived the repayment of tens of billions of dollars in PPP loans.

The data obtained by POGO appears to show mass close-outs of 2.7 million flags on two separate days near the end of the Trump administration. On a third day shortly before President Joe Bidens inauguration, the SBA cleared out 99.1% of special review flags, almost entirely assigned to the very largest PPP loans above $2 million.

The SBA has made changes to allow it to examine forgiven loans. However, the SBAs inspector general warned earlier this year that oversight failures both on the front end when the loans were approved and on the back end when they were forgiven may make it challenging to recover funds for forgiven loans later determined to be ineligible.

Government estimates of PPP fraud run as high as $100 billion.

Don’t Miss: State Farm Bank Auto Loans

Sba And Treasury Announce Release Of Paycheck Protection Program Loan Data

WASHINGTON The U.S. Small Business Administration, in consultation with the Treasury Department, today announced it was releasing detailed loan-level data regarding the loans made under the Paycheck Protection Program . This disclosure covers each of the 4.9 million PPP loans that have been made.

The PPP is providing much-needed relief to millions of American small businesses, supporting more than 51 million jobs and over 80 percent of all small business employees, who are the drivers of economic growth in our country, said Secretary Steven T. Mnuchin. We are particularly pleased that 27% of the programs reach in low and moderate income communities which is in proportion to percentage of population in these areas. The average loan size is approximately $100,000, demonstrating that the program is serving the smallest of businesses, he continued. Todays release of loan data strikes the appropriate balance of providing the American people with transparency, while protecting sensitive payroll and personal income information of small businesses, sole proprietors, and independent contractors.

Todays release includes loan-level data, including business names, addresses, NAICS codes, zip codes, business type, demographic data, non-profit information, name of lender, jobs supported, and loan amount ranges as follows:

- $150,000-350,000