Do I Have To Pay An Origination Fee

For lenders that charge origination fees, that cost is a required loan expense though you may be able to negotiate a lower rate. However, origination fees are not always a deal-breaker. For instance, origination fees on a loan could mean a lower overall interest rate because lenders with no origination fees may raise their interest rates to make up the difference.

With that said, youll need to keep in mind that in many cases, the origination fee will be taken out of your loan proceeds, meaning you may not receive your full loan amount.

Fixed Or Variable Interest Rates

A personal loan may have a fixed interest rate, meaning that your monthly payments remain constant during the repayment period. It can also have a variable interest rate, increasing or decreasing your monthly payments according to the prevailing market rates. If you take out a $20,000 personal loan at a 6% fixed annual interest rate, this comes to $1,200 in interest, which is $100 per month.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Also Check: Can You Use Fha Loan If You Already Own House

How To Better Understand A Loan Origination Fee

The origination fee definition is straightforward it covers the costs of the loan process, which makes it easier for all parties involved. When you ask for a mortgage loan, you might use a calculator to add up all the costs. For example, if you have a 30-year fix on a long-term loan, the calculator makes it easier to plan months and years in advance. You should also include interest rates when you perform these calculations with a lender.

Be mindful not to fall for junk fees, which are unnecessary add-ons. They might enclose these fees right before a mortgage closure, which makes it difficult to go back on the deal. Its not a pleasant situation to be in, especially with out-of-nowhere fees. Make sure your lender lets you know everything upfront.

Whats Included In Origination Charges

This category includes lender fees for underwriting and processing your loan. Every lender is slightly different in how they label their fees in this section, so the names you might see in this section are:

- Underwriting fee

- Application fee

Some lenders combine all of these into one single fee, and some break them out.

One thing all lenders will show consistently here is whether theyre charging a percentage of the loan amount as an additional fee on top of the fees noted above. These fees are also known as points, and should be labeled as points on the Loan Estimate and Closing Disclosure.

Points are an extra fee you pay for a lower rate. You arent required to pay points, so ask your lender to explain the rate difference between points and no-points options, and also ask them to tell you how long it will take the rate savings from paying points to repay the cost of the points.

Don’t Miss: How To Negotiate Home Loan Interest Rate

Are Personal Loan Origination Fees Regulated By The Government

In many respects, yes. The Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency require compliance with the Truth in Lending Act. This regulatory control came after the 2008 Financial Crisis. The regulations do not tell lenders how much they may charge for an origination fee, but they require lenders to disclose all fees that the borrower must pay, in writing, and provide the APR, so consumers can have transparency and compare loan offerings apples to apples.

Types Of Business Loan Fees

Most lenders, whether they are banks or alternative lenders, will charge a variety of fees in addition to interest on a loan. We’ve compiled a list of the major types of fees associated with business loan and financing products.

Origination fee: This is a fee charged for processing the loan application and approval, including verifying a borrowers information. Origination fees may be charged as a flat fee or a percentage of the loan amount. If its charged as a percentage-based fee, it will typically be between 1% and 6% of the loan amount. Sometimes the origination fee is included in the total loan amount, meaning the borrower is essentially borrowing the fee and repaying it with interest.

Service or processing fees: Over the lifetime of a loan, your lender will perform a variety of activities, such as customer service or billing, to manage and administrate the loan. A service or processing fee is used to cover the cost of these expenses. Service fees are frequently billed monthly or according to the loan repayment schedule, but some lenders may only charge a one-time service fee. Service fees are usually charged as a percentage of payment amount or of the total loan amount .

Late payment fee: This fee is self-explanatoryits charged when a loan payment is made past its due date. A late payment fee may be either a flat fee, frequently around $10 to $35, or a percentage of the payment amount or outstanding balance .

Recommended Reading: What Do You Need For Va Loan

Can Or Not Its Financed Into The Mortgage Loan

We have answered three vital questions up up to now. Whats a mortgage origination price? How a lot do they price? And are they negotiable? This is one other widespread query we obtain: Can this price be rolled into my loan and paid over time? Most often, the reply is not any.

Lenders cost origination charges with a view to cowl their up-front prices and make an up-front revenue on the loan. They cannot obtain both of those targets in the event that they roll the price into the loan. They might agree to cut back the price in alternate for charging a better rate of interest, as talked about above. However that is about it. Exceptions could be made for VA loans, so long as the full loan quantity doesnt exceed VA limits for the county the place you are shopping for.

Mortgage Lenders That Dont Charge An Origination Fee

As noted, not all lenders charge origination fees. Ive listed several above, but its just a sample.

This is especially true with the newer breed of fintech mortgage lenders, many of which charge no lender fees whatsoever.

Some of these companies dont even use commissioned loan officers, and they rely a lot on technology, so its easier for them to waive the fees.

However, you may still have to pay third-party fees, such as title/escrow, appraisal, and prepaid items like interest, property taxes, homeowners insurance, etc.

Be sure to compare the origination charges, all lender fees, AND your interest rate among different banks and lenders to get the complete picture.

Looking at just one or two of these figures wont provide an accurate assessment as to whether its a good deal or not.

If you take the time to shop around, you may be able to avoid the loan origination fee altogether and get that low rate youre after!

Also Check: What Are The Qualifications For First Time Home Buyers Loan

How Much Is A Personal Loan Origination Fee

As stated above, personal loan origination fees will vary. There is no one standard rate that you can expect across all lenders.

There are, however, some basic guidelines that can help you prepare.

Origination loans tend to be percentage-based. Rather than a flat fee, the fees will change depending on the amount you take out.

The percentage rates vary from lender to lender, but they generally stay between 1% and 8% of the loan amount.

The only way to truly know what to expect is to get an actual offer from a lender.

Breaking Down The Loan Origination Fee

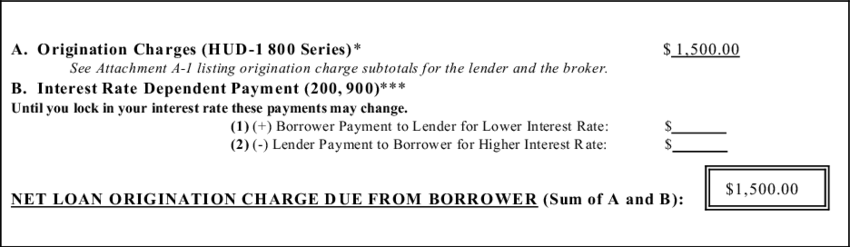

This is a screenshot of an actual Good Faith Estimate , which displays the adjusted origination costs.

In the example above, the loan origination charge is $1,840 on a $348,000 loan amount, which makes the fee roughly half a percentage point .

This particular broker charged a $250 origination charge, a $695 processing fee, and an $895 underwriting fee, which combined make up the $1,840 total.

Note that these fees are represented as one lump sum on the Good Faith Estimate, so ask for a breakdown to see what youre actually being charged. Or refer to your Fees Worksheet.

The corresponding Fees Worksheet pictured above breaks down the origination charges so you can better understand what youre being charged and why.

Although not pictured here, lenders typically display a percentage on the same line as the Loan Origination Fee, such as 1.000%, if applicable. This will give you a better idea as to what youre actually being charged.

Now lets refer to the top screenshot again. Our borrower also received a lender credit of $3,076.32, which offset the entire origination charge and more, resulting in an adjusted origination charge of -$1,236.32.

This amount was put toward other closing costs, reducing the borrowers out-of-pocket expenses.

Recommended Reading: Can I Refinance My Parent Plus Loan

How Does An Origination Fee Work

An origination fee is charged based on a percentage of the loan amount. Typically, this range is anywhere between 0.5% 1%. For example, on a $200,000 loan, an origination fee of 1% would be $2,000.

One important thing to note is that in the same area where you’ll see the origination fee, you may also see a charge for mortgage discount points. One prepaid interest point is equal to 1% of the loan amount, but these can be bought in increments down to 0.125%. These points are paid in exchange for a lower interest rate.

The points, together with any origination fee, will be included on the Origination Charges section of your Loan Estimate.

You may see a loan advertised as having no origination fee. However, if youve been around the block at all, you understand that theres no such thing as a free ride.

The lender makes its money by charging a slightly higher interest rate, which can fetch more money when the loan is sold to mortgage investors. Making money off a higher interest rate is referred to as having a bigger yield spread premium.

With a no-origination fee loan, youll pay less upfront in closing costs, but youll pay more in interest over the lifetime of the loan. It comes down to whats important to you.

Assuming you do end up with an origination fee, its paid at closing along with other fees such as your down payment and title costs. Its important that you budget for these items early on.

Cost Of Origination Fees

Most of the time, origination fees are a percentage of the loan amount. Its usually 0.5% 1% for U.S. mortgage loans. This is before accounting for discount points.

For lenders that split up underwriting and processing fees, add the percentages together to be sure youre comparing apples to apples.

Additionally, this is just one component in your overall closing costs. In order to get a better idea of the fees being charged by lenders for comparison purposes, be aware that lenders always have to publish two rates: the base interest rate and the annual percentage rate.

The annual percentage rate includes the base interest rate plus closing costs associated with your loan. The bigger the difference between the base rate and the annual rate, the more the lender is charging in closing costs and fees.

Recommended Reading: How To Get Lowest Interest Rate On Personal Loan

Read Your Loan Estimate Carefully

Once you choose a lender, be sure to read your Loan Estimate carefully. It outlines all the fees youll be expected to pay at closing, including the origination fee. Though this fee covers many services associated with your loan, theyre often negotiable. Never be afraid to ask your lender for a reduction or credit to offset your costs especially if youre a first-time home buyer.

Loan origination fees are common costs that cover your lenders work to process your loan. Origination fees are typically just one percent of your loan balance and theyre often negotiable. Talk with your mortgage lender about their origination fee and plan to pay this extra closing cost before you move in.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Receive real estate and mortgage news by email weekly. Personalized for you & your specific homebuying goals.

Homebuyer is powered by Novus Home Mortgage, a division of Ixonia Bank, NMLS #423065. Member FDIC. Equal Housing Lender

- About

If Youre Applying For A Personal Loan The Loan May Not Be All That You Have To Pay Back

Thats because some lenders charge whats called an origination fee. This upfront fee can reduce how much you receive and can be included in the loans annual percentage rate, or APR.

As you shop around for personal loans, its important to consider each options origination fee along with the other features and terms the lenders offer. An origination fee isnt always a deal breaker it could be worth it to pay a fee if the loan has a long repayment period, or if the APR still ends up lower than other loan options.

Before you do decide, read this guide to help you understand the fee and why it exists, why you should shop around and how to decide if its worth it.

Recommended Reading: How To Calculate Mortgage Loan To Value

How Are Origination Fees Collected

Different lenders will have their own policies on how they charge an origination fee. For instance, some will roll it into the loans balance. In this case, if you have a $10,000 personal loan with a 4% origination fee, your final balance with the fee added in is $10,400.

Other lenders will deduct the origination fee from the disbursed funds, so for a loan balance of $10,000 with a 4% fee, the borrower would only receive $9,600 of the funds thats because the lender takes out the $400 origination fee.

Sometimes, a borrower might be required to pay an origination fee outright, with cash, instead of adding it to the loaned amount. This is most common with a mortgage and is typically included in the homebuyers closing costs.

Loan applicants should watch out for advance-fee scams, however. These scams promise or guarantee a loan, even for bad credit, but charge high origination fees or have hidden costs.

The Federal Trade Commission warns borrowers to be diligent. Research lenders and fees to avoid advance-fee loan scams.

Are There Personal Loans With No Origination Fees

Some lenders offer payday loans with no upfront fees or guarantors, which sounds like the perfect way to save on associated charges for your loan. But the most important thing is to consider the proposed APR for your loan. Before you choose a loan, ask your lender for a prequalification. The prequalification process does not affect your credit score. So you can do it with multiple lenders at a time.

Some lenders offer no origination fees but include other specific terms and conditions for borrowers. For example, a lender may offer no origination fees but limit loan amounts or refuse co-applicants that would boost your credit.

Some lenders only allow no charges for existing customers or debt consolidation loans for high-interest credit card debts. Others give no origination fees but no prequalification option, which means they require an immediate commitment from the borrower.

Also Check: What Is Chfa Loan Colorado

How Do Personal Loan Origination Fees Work

Origination fees are charged as soon as you take out your loan. However, you will rarely have to pay the fee out of pocket.

Instead, lenders tend to just deduct the fee from your loan. In practice, this just looks like you receive slightly less than your overall loan amount.

Lets say you borrow $10,000 with an origination fee of 1%. The lender will give you $9,900, keeping the difference as payment of the origination fee.

This may seem like a bad deal, but its important to remember that origination fees are part of the overall loan agreement. There may be instances where the origination fee allows for a lower APR, meaning you pay less overall.

Helping You Earn Through Partnerships

Our top priority is to help you learn and earn. Our articles are provided free of charge, and the information found here can help you build wealth for life. We offer an independent perspective on financial services, financial markets, and good practices for personal finance. Our main goal is to help you grow your money.Wealthy Millionaire helps you earn by recommending services through our carefully vetted list of partnerships. Our research and professional insight was built through years of financial industry experience, and our recommended products are based on independent analysis of the best service providers in the market. These recommendations are objective we do not accept special payment to recommend products and services from our partners.

Also Check: Why Is My Student Loan Not On My Credit Report