Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Private Undergraduate Student Loans

Private student loans for undergraduate students function similarly to other types of private loans in that a credit and income review will be required to determine your ability to repay the loan. This review can also affect the interest rate on your loan. Since most undergraduate students have not yet established a credit history or have a steady income, it is often necessary to apply with a cosigner.

Learn more about .

Should I Take Out Federal Or Private Student Loans

As you consider how to pay for college, its wise to take advantage of any grant or scholarship opportunities available to you before you start to look at financing options. If you do have to borrow money, its almost always best to start with federal loans. These loans come with many benefits unique to the federal government, like income-driven repayment plans, long forbearance and deferment periods and loan forgiveness options.

If grants, scholarships and federal loans dont cover your costs, you may need to stack on private student loans to finance the remaining balance. While these should typically be a last resort, you may qualify for low interest rates if you have good credit.

Don’t Miss: What Car Can I Afford Based On Salary

The Amount Youll Pay In Interest

As the names suggest, subsidized loans are subsidized by the US government, meaning that the department of education covers the interest you owe on the loan until youve graduated, as long as you are enrolled at least half time. With unsubsidized loans, interest begins accruing immediately after disbursement, and even during the 6 month grace period you have after graduating before your full payments begin.

What Are The Fees For A Subsidized Loan

Subsidized loans are subject to the same origination fees as unsubsidized loans, currently 1.059%. Origination fees can change from year to year and are deducted from the disbursement.

For example, a first year student who borrows $3,500 with a subsidized loan would receive a disbursement $3,462.93 after the origination fee of 1.059% is deducted.

Interest accrues on the full $3,500 borrowed even though less than that amount can be used to pay for school expenses.

Don’t Miss: Usaa Auto Loan Rates Credit Score

Interest On Subsidized And Unsubsidized Loans

Federal loans are known for having some of the lowest interest rates available, especially compared to private lenders that may charge borrowers a double-digit annual percentage rate :

- For loans disbursed on or after July 1, 2021, and before the July 1, 2022, school year, direct subsidized and unsubsidized loans carry a 3.73% APR for undergraduate students.

- The APR on unsubsidized loans for graduate and professional students is 5.28%. And unlike some private student loans, those rates are fixed, meaning they dont change over the life of the loan.

There’s also one other thing to note about the interest. While the federal government pays the interest on direct subsidized loans for the first six months after you leave school and during deferment periods, youre responsible for the interest if you defer an unsubsidized loan or if you put either type of loan into forbearance.

Income-driven repayment plans can mean lower monthly payments, but you might still be making them 25 years from now.

How Much Can I Borrow With Unsubsidized Student Loans

Borrowing limits are higher for unsubsidized loans than for subsidized loans but still vary according to which year of your studies you’re in currently.

The amount you can borrow is also affected by whether you are a dependent or independent for tax purposes, with students who are independent eligible for higher borrowing limits.

The table below gives an overview of borrowing limits for unsubsidized loans. If you have any subsidized loans, the amount available for unsubsidized loans may be reduced. In total, dependent students can borrow no more than $31,000 in combined subsidized and unsubsidized loans.

Independent undergraduate students may qualify for up to $57,500 in combined subsidized and unsubsidized loans.

| Year | |

| are considered independent | $ 20,500 |

Graduate and professional students can qualify for up to $138,500 in combined Subsidized and unsubsidized loans with the aggregate limit including loans received during undergraduate years.

Higher borrowing limits may be available if your parents are ineligible for a Direct PLUS Loan.

Don’t Miss: Usaa Car Loan Refinance Rates

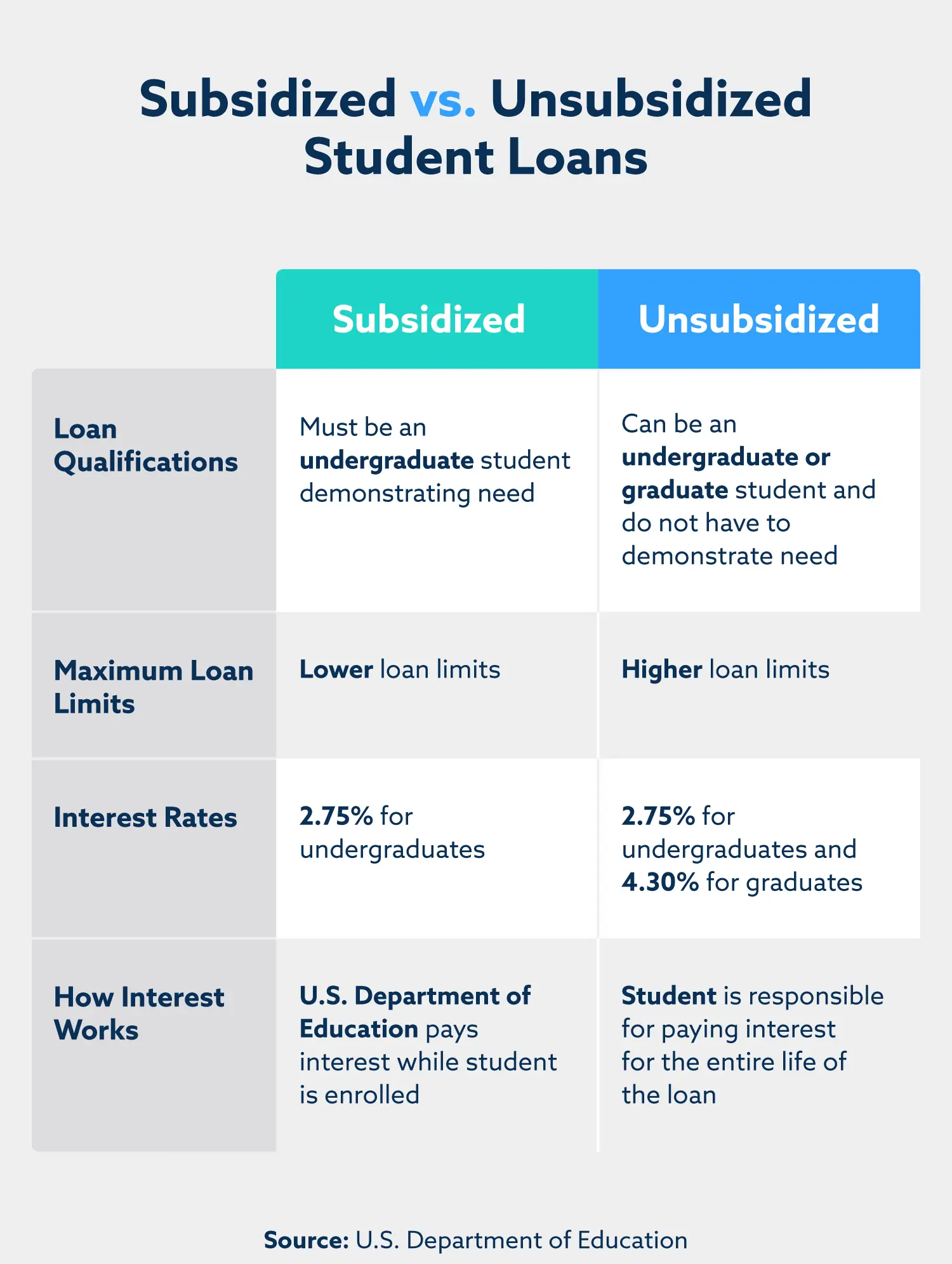

Subsidized And Unsubsidized Loan: Meaning

Subsidized loans are available only to undergraduates. The objective of subsidized loans is to support students who need more financial backing. And, this is why students applying for this loan have to demonstrate financial need. No interest accrues on such loans during the period the student is in school. Also, no interest accrues during the deferment period.

However, unsubsidized student loans are available for all, whether they are pursuing graduate or undergraduate programs or a professional degree. The interest on these loans starts accruing immediately on disbursement. Moreover, the interest that remains unpaid prior to the grace or loan deferment period is capitalized. Further, students applying for this loan do not need to demonstrate any financial need as well.

How Do You Pay Back Subsidized Loans

You can pay back your subsidized loan at any time. Most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation, known as the “grace period” when the government continues to pay the interest due on the loans.

When your loan enters the repayment phase, your loan servicer will place you on the Standard Repayment Plan, but you can request a different payment plan at any time. Borrowers can make their loan payments online via their loan servicer’s website in most cases.

Read Also: Alberta Student Loan Login

Receive Added Perks During Deferment

Subsidized student loans also qualify for an interest rate waiver during periods of temporary deferment. You wont owe monthly payments, and interest wont accrue because the government will pay the interest for you. The loan balance you entered deferment with is the same loan balance you leave deferment with. Unsubsidized loans do accrue interest during deferment, so deferring unsubsidized student loans can end up being quite costly.

The Difference Between Subsidized And Unsubsidized Student Loans

Learn about the differences between subsidized vs. unsubsidized student loans including who can borrow, how you qualify, amount you can borrow, and how interest works.

Miranda Marquit

May 21

For many college students, the reality is that loans are needed to cover some of the costs of schooling. When using loans to cover the college funding gap, many students find that federal loans offer a reasonable solution as a starting point. Because of the low limits presented by federal loans, private loans might also be used to fill gaps.

When starting with federal student aid, however, understanding the difference between subsidized and unsubsidized loans is an important part of the process. The type of loan you get determines how much you owe after graduation. For those who qualify, subsidized loans can mean owing less in interest.

Heres what you need to know.

Don’t Miss: Usaa Refinance Car Loan

Subsidized Vs Unsubsidized Loans

The rising cost of a college degree has more students than ever borrowing to cover their expenses. While some students opt for loans from private lenders, an estimated 42.8 million borrowers have Federal Direct Loans, as of Q3 2021.

Federal Direct Loans may be subsidized or unsubsidized. Both types of loans offer numerous benefits, including flexible repayment options, low-interest rates, the option to consolidate loans, and forbearance and deferment programs. But how do subsidized and unsubsidized loans compare? We focus on the key aspects of each type of loan so you can decide what’s right for you.

How Interest Accrues On Subsidized And Unsubsidized Loans

Subsidized: Interest is paid by the Education Department while you’re enrolled at least half time in college.

Unsubsidized: Interest begins accruing as soon as the loan is disbursed, including while students are enrolled in school.

» MORE: Current student loan interest rates and how they work

Subsidized: No payments are due in the first six months after you leave school. The Education Department will continue to pay interest during this time.

Unsubsidized: Loan payments are not due in the first six months after you leave school, but interest will continue to build. It will then capitalize, meaning its added to the original amount borrowed. That increases the total amount you have to repay, and youll pay more in interest over time.

Subsidized: Interest is paid by the Education Department during deferment, which lets you temporarily pause payments.

Unsubsidized: Interest continues to collect during deferment and will be added to your principal loan amount.

Recommended Reading: Usaa Auto Loan Rates Today

Which Loan Is Better

After all these discussions, you might wonder, which is better: subsidized vs unsubsidized loan?. Unfortunately, there is no exact rule which can help you identify the best loan type. Instead, the answer depends on your qualifications. For example, if you are an undergraduate student, you can apply both. However, for Subsidized loans, you need to prove financial need. If you face financial difficulties, you can qualify for a Subsidized loan. Meanwhile, graduate or professional students can only apply to Unsubsidized loans.

Even if you like the requirements for a Subsidized one, you have no chance to apply for it. To sum up, the subsidized vs unsubsidized loan topic, if you want to find the best student aid type, you can contact third-party debt specialists, like those in Student Loans Resolved. Debt experts can analyze your qualifications and determine which loan type suits you better. In this way, you will not struggle with loan repayment in the future.

Who Qualifies For Federal Direct Loans

Federal subsidized and unsubsidized loan borrowers must meet the following requirements:

- Enrollment at least half-time at a school that participates in the Federal Direct Loan program

- A U.S. citizen or eligible non-citizen

- Possession of a high school diploma or the equivalent

- No default on any existing federal loans

Direct subsidized loans are only available to undergraduates who demonstrate a financial need. Both undergraduates and graduate students can apply for direct unsubsidized loans, and theres no financial need requirement.

If you qualify for a subsidized loan, the government pays your loan interest while you’re in school at least half-time and continues to pay it during a six-month grace period after you leave school. The government will also pay your loan during a period of deferment.

To apply for either type of loan, you will need to fill out the Free Application for Federal Student Aid . This form asks for information about your income and assets and those of your parents. Your school uses your FAFSA to determine which types of loans you qualify for and how much youre eligible to borrow.

Recommended Reading: Usaa Auto Loan Payment Calculator

Subsidized Vs Unsubsidized Student Loans: Know The Difference

Subsidized Loans can save you money over your repayment term. But there are also situations where you might choose Unsubsidized Loans, like if youve hit your subsidized loan limits.

Edited byAshley HarrisonUpdated February 17, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When you apply for federal financial aid to pay for college, you might be offered Direct Subsidized or Direct Unsubsidized Loans in your financial aid award letter.

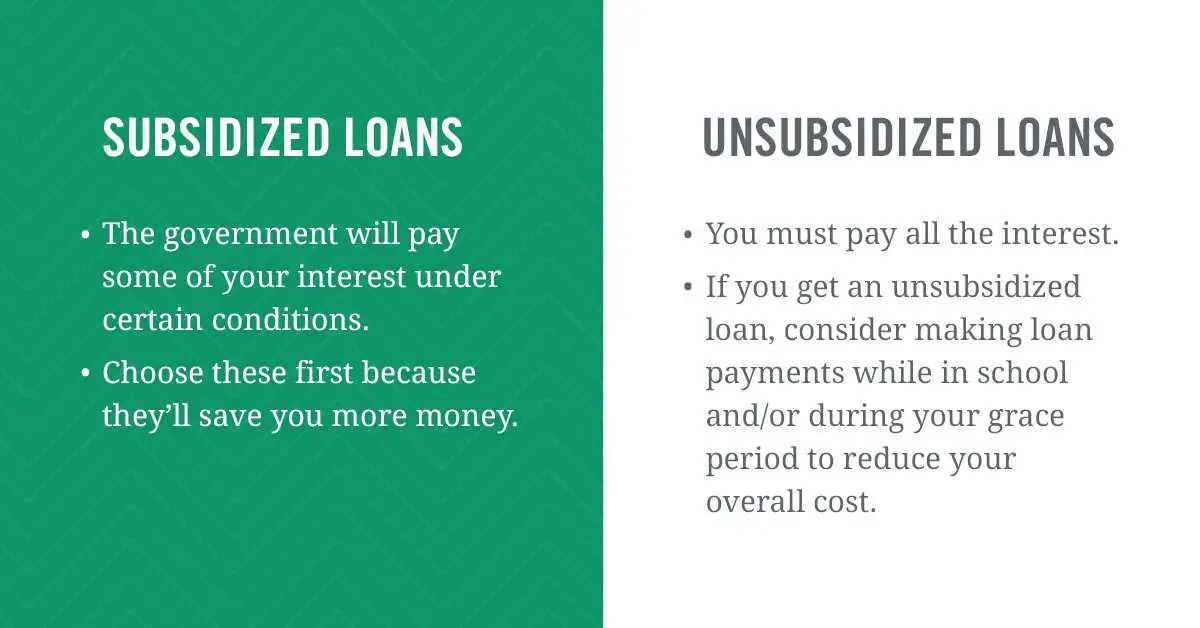

- With Direct Subsidized Loans, the U.S. Department of Education covers the interest that accrues while youre in school, during your grace period after graduation, and during loan deferments.

- With unsubsidized loans, youre responsible for all interest that accrues.

Subsidized loans can save you thousands of dollars in interest charges in the long run. But you might need to rely on unsubsidized loans if you dont qualify for subsidized loans or have met the subsidized loan limit.

Heres what you need to know when choosing between subsidized vs. unsubsidized loans:

What Is A Direct Plus Loan

If both options seem not suitable for your needs, a Direct PLUS loan can be helpful. Direct PLUS loan covers the portion of educational expenses not funded by other financial aid programs. There exist two types of PLUS loans. First, Graduate PLUS loans are available to graduate and professional students. Next, Parent PLUS loans are available to parents of undergraduate students.

Different from Subsidized or Unsubsidized loans, a check can be essential for PLUS loans. Hence, you need to have a good credit history to become eligible.

The interest rate for a Direct PLUS loan is 6.28%, both for parents and students.

Also Check: Capitol One Autoloans

To Receive Your Subsidized Or Unsubsidized Loan:

Qualify For Federal Student Loan Forgiveness Programs

You can even have your unsubsidized federal student loans forgiven. Borrowers working in the public sector for the government or an eligible non-profit can qualify for Public Service Loan Forgiveness after 10 years of eligible payments. Other borrowers can qualify for forgiveness after 20 to 25 years on an income-driven repayment plan.

You May Like: How Much Does An Auto Loan Affect Credit Score

What Is Subsidized Loan

This is a big benefit of subsidized loans over unsubsidized student loans and any other type of education borrowing. Subsidized student loans are need-based, meaning that you must have a demonstrated financial need in order to obtain one. Your school determines the amount of subsidized student loans you can take out, …

Repaying Subsidized And Unsubsidized Loans

Youll have various decisions accessible when it comes time to begin out repaying your loans. Unless you ask your lender for a particular selection, youll robotically be enrolled inside the Standard Repayment Plan. This plan items your compensation time interval at as a lot as 10 years, with equal funds each month.

Don’t Miss: Usaa Credit Score Requirements

How Much Can You Borrow

The borrowing power of student loans is likely one of your major concerns when budgeting for your education. You should be aware of some specific details about these particular loan programs.

With direct subsidized student loans, $3,500 is the maximum you can receive for your first year. The loan amount cannot exceed the financial need identified via your FAFSA. If you’re also receiving an unsubsidized student loan, the total can’t exceed $5,500.

For independent students and those dependent on parents who do not qualify for federal PLUS loans, the maximum amounts are $9,500 and $33,500, respectively.

If you’re receiving an unsubsidized student loan, your maximum loan amount is $5,500 for the first year.

Maximum loan amounts increase with each subsequent year of school as follows:

- Second year of undergraduate education: You have a $6,500 combined loan maximum, with a maximum of $4,500 allowed to be subsidized.

- Third year of undergraduate education and beyond: You have a $7,500 combined loan maximum, with a maximum of $5,500 allowed to be subsidized.

- The aggregate allowed maximum is $31,000 with $23,000 subsidized.

- For graduate and professional degree students , the maximum aggregate amount of unsubsidized loans is $138,500, of which $65,500 can be subsidized.

Is It Better To Get Subsidized Or Unsubsidized Loans

As you can see, subsidized student loans have some key advantages over their unsubsidized counterparts. However, both varieties of federal direct student loans have some pretty important benefits when compared with other methods of borrowing money such as personal loans or private student loans. Here are some of the most important examples:

- Neither type of federal direct student loan has any credit requirements. Private loans and personal loans typically have minimum credit standards or require a cosigner.

- Federal direct student loans are eligible for income-driven repayment plans such as Pay As You Earn and Income-Based Repayment. These limit your monthly student loan payments to a certain percentage of your discretionary income and forgive any remaining balance after a certain repayment period .

- Federal direct loans may be eligible for Public Service Loan Forgiveness and/or Teacher Loan Forgiveness if the borrower’s employment and repayment plan meet the program’s standards. On the other hand, private student loans never qualify for these programs.

- You have the ability to obtain a deferment or forbearance on federal student loans, which can allow you to temporarily stop making payments during tough financial times. Some private loans have their own forbearance programs, but the federal options are generally far superior.

Don’t Miss: Used Car Loan Usaa