If I Decline An Unsubsidized Loan Can I Change My Mind

Your school’s financial aid office gives you the chance to decline any portion of your financial aid award that you do not want. One of the most common awards to decline is an unsubsidized loan, which is money on which you have to pay interest from the moment you borrow it. If, at a later time, you realize that you need the unsubsidized loan after all, you can reinstate it in most cases.

Tip

If you have declined an unsubsidized loan, then later decide that you need it, you can generally reinstate it.

How To Ask For More Financial Aid For College

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

How To Become Eligible For The Pell Grant

The financial aid office at your college or career school will determine how much financial aid you are eligible to receive. The office uses the information you supplied in your Free Application for Federal Student Aid to determine how much need based and non-need based aid you can receive. Federal student loans have annual loan limits, so you are not able to ask for more money than the loan limit provides for. It is important to review your financial aid package to decide if your dream school is an affordable option for you.

Recommended Reading: Does Refinancing Car Loan Hurt Credit

If Your Situation Has Changed:

It is important to note that most information on your application cannot be updated because it must be accurate as of the day you originally signed your FAFSA form. For example, if you spent some of your savings after filing the FAFSA form, you may not update your information to show a change in that amount.

However, you should speak to the financial aid office at the school you plan to attend if:

there will be a significant change in your or your parents income for the present year;

if your family has other circumstances that cannot be reported on the FAFSA form.

It is important that you reach out to your schools financial aid office as soon as you are aware of these changes.

Student Living Allowances For School Year 2018 To 2019

Actual monthly allowance by province/territory

These are the monthly amounts a student receives based on the cost of shelter, food, miscellaneous expenses and public transportation in their province or territory.

| LIVING SITUATION | |

|---|---|

| SINGLE STUDENT AWAY FROM HOME | |

| Shelter | 495 |

| Miscellaneous | 234 |

| SINGLE PARENT | |

| Shelter | 818 |

| Miscellaneous | 234 |

| Shelter | 989 |

| Miscellaneous | 467 |

| Miscellaneous | 104 |

| SINGLE STUDENT LIVING AT HOME | |

| Shelter | |

| Miscellaneous | 201 |

Note: Provinces and territories determine their monthly ceiling .

Don’t Miss: How To Apply Loan In Sss

Alternatives To Using Loans For Living Expenses

While student loans are one way to pay for living expenses, they arent your only option. Here are a couple of other alternatives to consider:

- Apply for scholarships and grants: Because college scholarships and grants dont have to be repaid, they can help keep your costs low while paying for living expenses. You might qualify for federal grants or school-based scholarships after filling out the FAFSA. There are also many private scholarships and grants available from nonprofit organizations, local and national businesses, and professional associations in your field.

- Get a job. Working a part-time job during college can help you earn extra money for living expenses while also building your resume. You could also consider applying for a job through a work-study program.

Other ways to potentially lower your costs overall include:

- Buying used textbooks or renting them

- Living off-campus and getting a roommate

- Carpooling with a friend that has a similar schedule to you

Check Out: Tuition & Room and Board: On-Campus vs. Off-Campus Costs

Taking Out Federal Student Loans

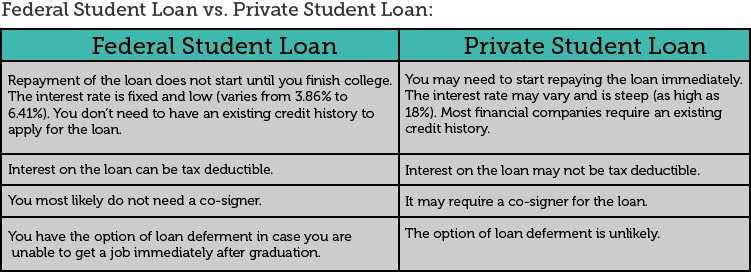

If you still need more funds to fill the tuition gap, taking out additional student loans may still be an option. Its likely that if you filled out the FAFSA® and received a federal financial aid package, you may have already been awarded federal student loans.

However, it might be worth considering whether you can take out additional federal loans, because they offer fixed interest rates and more flexible repayment terms than most private lenders. In most cases, student loans from the federal government dont require a credit check or a cosigner, which can be especially helpful if you havent had time to build up a credit history.

As an undergraduate, you can take out two different types of loans under the William D. Ford Federal Direct Loan program . One of these being the Direct Subsidized Loan, which is awarded based on financial need. If you qualify for this loan, you will not be responsible for the interest while youre in school or for six months after you graduate.

You can also take out a Direct Unsubsidized Loan, which does not depend on financial need. Interest on this loan will accrue while youre in school and during the six-month grace period, though you will not be responsible for paying that interest until your repayment period begins. And you dont have to start repaying subsidized or unsubsidized federal loans until you graduate or drop below half-time enrollment .

Don’t Miss: What’s Better Refinance Or Home Equity Loan

Private Or Alternative Loans

Some private institutions offer education loans that do not require the FAFSA form. While we recommend federal aid first, we realize it does not always cover the cost, especially for pricier schools. Private loans will almost always require a cosigner and may have higher fees or interest rates depending on your credit.

I encourage you to first ask your financial aid office if they have a list of lenders for you to consider, but not all schools maintain such a list. If not, you can search for lenders on your own, but compare products before making your choice: look at interest rates, fees, repayment terms, creditworthiness requirements, satisfactory academic progress requirements, etc. Students and parents are free to choose whichever lender best fits their needseven if it is not on a schools preferred lender list.

Before making any final decisions on how to fill the gap between your aid and your costs, it is always recommended that you meet with a representative in your financial aid office to determine what campus resources might be available before going out on your own. It might also be possible that you still have the time to change some of your choices before the semester begins: Can you change the type of meal plan you chose? The type of housing? The number of classes in which you are enrolled? Check with campus officials to see if you still have time to select a different, more affordable option.

Continue the conversation on or .

How To Get Your Payments Refunded

All you need to do is call the lender servicing your student loan with this information:

- The dates you made payments

- The amount of each payment

- How many of the payments you want refunded

Borrowers who make payments to multiple loan servicing agencies would need to call each lender, but if you need the money, its time well spent.

When you get them on the line, it would help considerably to ask the lender for the date when you should expect the money to be refunded and how it will be refunded. Mark that date on your calendar and if you havent received the refund by then, make another call to the lender to see what happened.

If you happen to be part of the Student Loan Forgiveness Program, you can ask for a refund and not hurt your status. Even though you asked for the money back, as long as all other requirements were met, the payments you made still count toward the 120 payments needed to receive forgiveness.

Also Check: How Much House Can I Afford Physician Loan

Can I Reject All Or Part Of My Loan Can My Direct Loan Be Adjusted Or Cancelled

Yes. If you have applied for aid with a FAFSA then you may receive a loan offer. However, you are not required to accept the full amount of the offer. You can borrow less than what is offered or you can decline the full offer through your myBama account. You should only borrow what you need, therefore if you accept a loan but determine that you do not need the full amount contact our office to make an adjustment or to cancel your loan. If your loan has already disbursed to your student account our office can process any requested adjustment within 30 days at which point you may return the funds to the Department of Education.

When Can I Settle My Student Loans

You may have to wait a while before you can settle your student loans. You cant settle if your loans are in good standing and you make timely payments every month. Even if youre a little late on your last payment, youre usually not considered eligible until youre in default.

When youre late making a student loan payment, your loans are delinquent until you make that payment. If your loan continues to stay delinquent, it will eventually go into default. You can start requesting a loan settlement in delinquency, but only if its on its way to default. You can also request a settlement once your loan has passed into default.

Recommended Reading: Can You Use Fha Loan If You Already Own House

Youve Maxed Out Federal Student Loans Now What

As a last resort, you could look into the best private student loans. Private loans should be considered after federal loans because they typically have higher interest rates and carry fewer benefits. However, you can most likely take one out in the middle of the semester if youre eligible.

You will most likely need a cosigner with a good credit score to qualify, but you might be able to find some student loans without a cosigner.

Choose More Affordable Options

If youve maximized your scholarship and grant potential and dont qualify for work-study, consider more affordable options. Some small-scale changes include opting to rent or buy used textbooks instead of new, living off campus or getting roommates. You can also consider transferring to an in-state school, trying out an online program or dropping to half-time enrollment while you work a part-time job.

Read Also: What Kind Of Loan Do I Need To Buy Land

What If My Grants And Federal Loans Don’t Cover The Cost Of Attendance

If your grants and federal loans are not enough to cover the cost of your education, you should consider the following options:

- and scholarships using one of the many free scholarship search options available. Servicemembers, veterans, and their families may be eligible for GI Bill benefits and/or military tuition assistance.

- Cut costs. Consider getting one or more roommates or a part-time job, possibly through Federal Work-Study.

- See what your family can contribute. Your parents may be able to get tax credits for their contributions. Parents can also explore the federal Direct PLUS Loan program.

- Shop around for a private loan. Remember that these loans generally have higher interest rates and less repayment flexibility compared to federal student loans. You generally should turn to private loans only after you have explored all other grant, scholarship, and federal loan options. If you can show you have a very high credit rating, you may find an affordable private student loan, though you will likely need a co-signer, who will be legally obligated to repay the loan if you can’t or don’t. Look for the one with the lowest interest rate and flexible repayment options.

Who Can Be A Student Loan Cosigner

Your student loan cosigner must be a U.S. citizen or permanent legal resident who agrees to be your cosigner. To apply for a cosigned loan with Ascent, theyll also need to meet the minimum income and credit score requirements with at least two years credit history. You can check out Ascents other eligibility requirements here.

If you decide to apply for a cosigned loan with Ascent, you only need one person to cosign your loan. For example, if both of your parents are willing to cosign your student loan, you will only need one of them. Cosigners can be a relative, like a parent, grandparent, aunt or uncle, but a cosigner can also be a mentor or teacher you trust, as well.

Just because nearly anyone can be your cosigner it doesnt mean you should pick a name out of a hat. Later in this piece, well talk about choosing the right cosigner and share some tips to help prepare you for this conversation.

Read Also: What Is My Monthly Loan Payment

I Didnt Get Enough Financial Aid: Now What

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Tuition and fees for the 2020 to 2021 academic year averaged $11,171 at in-state public colleges, and a whopping $41,411 at private colleges. And the price tag for an undergraduate degree keeps going up every year. Any way you look at it, college is a huge expense for students and their family.

Most schools offer financial aid to make college more affordable. But sometimes your initial financial aid offer, whether that includes need-based aid, federal loans, or perhaps both, just arent enough to cover the cost. And your family may not be in a position to help you make up the difference.

You know that a college education is valuable and are hopeful that it will set you on the path to higher earnings over the course of your career. But what do you do if you cant afford college, even with financial aid?

The key is doing the research and giving yourself enough time to take advantage of all the opportunities potentially available to you. Heres a few ideas on how you could get more money for school:

Ways To Lower Your Student Loan Interest Rate

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A lower student loan interest rate could reduce your monthly payments or help you pay off student loans faster. Heres how to lower the interest rate on federal or private student loans.

You May Like: Is Federal Student Loan Forgiveness Real

Planning Ahead Before College

If you make a plan before college, you might be able to save yourself thousands in potential student loan debt. Only a portion of families have a college savings account, and its a good idea to get started as early as possible to grow over time. This type of account has certain tax advantages and allows students to save over time for college. Despite a relatively low number of families using these types of accounts, half of families have some kind of plan to help their children through college. When youre determining how much tuition you can pay every year or every month, youll need to take your financial situation into account. Whether youre just graduating high school or going back to school after a long break, these are some of the factors that will matter:

- How much you make on a yearly or monthly basis

- The cost of living, including expenses like groceries and rent

- How much youre liable for in loan payments

- Whether you are the recipient of any grants or scholarships

- How much supplies and equipment for school cost

The more youre paying on a month-to-month basis, the less youll be able to afford college tuition. Some student loans do cover the cost of tuition in addition to your living expenses.