What To Watch Out For

- Prepayment penalty. State Farm charges a fee of $100 for any loan paid off within the first 12 months.

- Limits to mileage. To be covered by a loan, your vehicle must not have more than 150,000 miles or have been driven more than 50,000 miles per vehicle year.

- Online application restrictions. You wont be able to apply for a lease buyout or private party loan through the State Farm online application, and some states dont have access to the online application.

- Prequalification, not preapproval. While you can prequalify for rates and terms before shopping around, they arent guaranteed until you submit the full application.

Refinancing Your State Farm Bank Auto Loan

State Farm Bank has also offered auto refinance loans. If youâre not happy with the terms of your current loan, you can take out an auto refinance loan to pay off your existing loan at a more favorable rate

- You can no longer afford your monthly payments

- Your interest rates are very high

- You have better credit now to qualify for better terms than when you first signed

less

Can I Take My Vehicle Out Of The Country

You may take your vehicle out of the country if you meet certain requirements and obtain permission from Loan Servicing.

For more information or to request to take your vehicle out of the country, contact us at 866-207-9079.

*If you are deaf, hard of hearing, or do not use your voice to communicate, you may contact us via 711 or other relay services.

Read Also: What Does Va Loan Entitlement Mean

Message From State Farm Vehicle Loans

Being a good neighbor is about more than just being there when things go completely wrong. It’s also about being there for all of life’s moments when things go perfectly right. With a passion for serving customers and giving back in our communities, we’ve been doing well by doing good for almost 100 years.

What Are The Benefits Of A Vehicle Loan From State Farm

- High maximum loan amount. If you have your eye on an expensive vehicle, like a new car to a luxury RV, you can apply for a loan from State Farm for up to $250,000.

- State Farm Bank Payoff Protector. Automatically included with all vehicle loans, Payoff Protector cancels the outstanding balance on your loan if your vehicle is deemed a total loss by an insurance company.

- Wide range of vehicles. You arent just limited to cars with State Farm. You can also finance anything from a boat to a motorcycle.

- Loyalty discounts. If you already bank with State Farm, you might be eligible for a rate discount.

Recommended Reading: What Are Commercial Loan Rates Now

How Can I File A Credit Dispute

For your convenience, we have created an optional Consumer Report Dispute Form that you may use as your written statement. Please be sure to include all pertinent information related to your dispute on this form.

Important Note: We may be unable to investigate your dispute if sufficient information is not received in order to identify your account or the information being disputed.

To avoid experiencing a delay, please mail your form to this address:

Attn: Credit Reporting

Is Gap Insurance Worth It

Gap insurance is generally recommended by lenders or auto insurance companies for new vehicles when or if:

- The auto loan has a length of five years or longer

- Loan has a high-interest rate because the principal on the vehicle will take longer to pay down versus the depreciation

- You paid a low down payment

It is generally recommended to compare what you will pay for your car over the life of your financing to the cars MSRP or agreed-upon sales price and see if you have a gap from the start. In the event you do, gap insurance may be a good idea.

Keep in mind your gap cost is always fluctuating. Generally, the difference between what you owe and what the vehicles worth shrinks as you make monthly payments and as the car depreciates.

Other situations in which gap insurance might not be necessary include:

- When there was a large down payment

- If the initial loan term was short, say three years or less.

You can cancel the coverage at any time typically recommended only once the amount owed on the vehicle is less than its market value. If you are unsure of whether gap insurance is worth it, consider the cost to risk. Gap insurance is fairly inexpensive and, in many cases, can be added to your existing full-coverage policy for a nominal cost per year. That may be far less than the difference between your cars value and what you owe in case of a major accident.

Also Check: Why Did My Student Loan Interest Rate Go Up

State Farm Bank Payoff Address

The State Farm Bank payoff address is PO Box 5961, Madison WI 53705.

Hence, if you need the official payoff mailing address for State Farm Bank, you need to use the address PO Box 5961, Madison WI 53705.

That is the Standard or Regular mailing address.

Please note that the payment mailing address for the mortgage loan may be different and if that is actually the case for you, we will advise you to contact State Farm Bank for assistance.

Things To Consider Before Refinancing

Also Check: How Long Are Loan Pre Approvals Good For

What Is A Simple Interest Loan

Simple interest is a way of allocating monthly loan payments between the principal and interest. The amount of your loan payment that is allocated to interest is based on the unpaid portion of the principal balance, the interest rate on your loan, and the number of days since your last payment. For example, if we receive a payment 20 days since your last payment, you will then be charged 20 days of interest on the unpaid principal balance of your loan. The rest of your payment is credited to the principal which reduces the unpaid principal balance on your loan.

Who Holds My Title

In most states, the loan owner holds the title to a vehicle. However, in title-holding states you hold the title to your vehicle with our lien on it. A few states have an electronic title that the state retains electronically.

If the loan owner holds the title or the creditor has a lien on the title, it will be released to you on the 10th business day after the payoff is received, processed, and all other conditions are satisfied. Please allow for normal mail time.

Note: If you live in a state that retains titles electronically, time frames may vary.

You May Like: Personal Loans No Credit Check

Gap Insurance Is Worth It When:

- You dont have the savings to pay off your loan or lease if the car is totaled or stolen.

- Your down payment is less than 20% of the cars value.

- Your loan will last four years or more.

- You drive more miles than average, which reduces the cars value faster.

- Your car is a make and model that depreciates especially fast, like a luxury sedan or electric vehicle.

- You are a single-car household and need a car to get around.

- Your loan includes negative equity from your last car.

Since gap insurance covers the difference between the cars actual cash value and the amount you owe, researching these two numbers will be a key deciding factor in whether gap insurance is worth it.

Loan/lease Payoff Insurance: Gap Insurance Alternative

Not all insurance companies offer gap insurance, but some offer loan/lease payoff insurance as an alternative. Loan/lease coverage is similar to gap insurance, except that it usually only pays up to 25% of the vehicles actual cash value toward the policyholders loan or lease balance, which might not be enough to cover the full amount owed.

If youre curious about gap insurance or loan/lease coverage, you should check with your insurance company to see if they offer either.

Is gap insurance worth it?

Gap insurance is definitely worth the money if you owe more on your car loan or lease than the car is worth. For example, if you paid a small down payment on your car, your loan term is 4-5 years or your car will depreciate quickly, you should consider getting gap insurance. Gap insurance is never mandated by state law, and few lenders or lessors require it, so the decision to buy it depends on personal circumstances.read full answer

Recommended Reading: How To Apply For Freddie Mac Loan

Is State Farm Bank Now Us Bank

The expansion into business banking services marks another major enhancement of the alliance announced in early 2020 between U.S. Bank and State Farm. It follows the acquisition and conversion of the deposit and credit card portfolios of State Farm’s former federal savings bank subsidiary by U.S. Bank.

What Apr Does State Farm Auto Loans Offer On Its Car Loans

State Farm auto loans offers a car loan productthat ranges from 2.54% APR.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Also Check: Why Are Student Loan Interest Rates So High

How To Apply For A Loan From State Farm Bank

If you already have a State Farm Bank account or State Farm insurance policy, you can log into your account online and apply. If not, youll either need to apply via phone or contact a local State Farm Bank agent, according to a State Farm representative.

Typically, if your car loan application is submitted during normal hours of operation, you should receive a decision within an hour. If you complete a full loan application, your application is valid for 60 days from your submission date.

Car Loan Basics You Need To Know

Understanding a few key basics may help you make a good decision about borrowing money to finance a vehicle.

With the exception of a home mortgage, a car loan represents the largest sum of money most people will borrow at once. Yet, many people may not think much about financing their new ride until they walk onto the car lot. Check out this cheat sheet before you even start your car search.

You May Like: How To Get Loan Without Proof Of Income

Can I Make Changes To My Title

Yes. We accept customer initiated title changes. However, research fees and state title and registration fees may apply. If you wish to make changes to your title, contact us at 866-207-9079. Callers who are hearing or speech impaired should dial 711 or use a preferred Telecommunications Relay Service.

How Long Should My Car Loan Be

This is why Edmunds recommends a 60-month auto loan if you can manage it. A longer loan may have a more palatable monthly payment, but it comes with a number of drawbacks, as we’ll discuss later. The trend is actually worse for used car loans, where just over 80% of used car loan terms were over 60 months.

Read Also: What Is Rate Of Home Loan Interest

State Farm Credit Score Requirements By Card

You should note that while your credit score is an important factor, there are plenty of other things that will impact your chances of being approved for a State Farm credit card, too. Some other key criteria include your income, existing debt load, number of open accounts, recent credit inquiries, employment status and housing status.

The State Farm Student card currently offers 3 points for every $1 spent on insurance premium payments. The card will detect automatically the insurance premium payments.

All other purchases will earn you 1 point for every $1 spent.

When it comes to the credit score for the State Farm Bank Student Visa card, it’s best if you have no score. That being said, if you’re a student and you already have an established credit history, you need at least 640 to have a good chance of approval.

You have to be enrolled in anything after high school, such as non-degree certificate programs , community colleges, and colleges/universities.

What type of help do you need?

One State Farm Plaza E-6Bloomington, IL 61710 ⢠map

Information on this page is provided ‘as is’ and solely for informational purposes, not for any other purpose or advice. In addition, this information does not originate from us and thus, we do not guarantee its accuracy.

Gap Insurance For Leased Cars

Like any car or SUV, leased vehicles depreciate quickly. Therefore, if you did not put much money down and still owe a sizable amount on your total lease payment, you will likely owe more than the vehicle is worth if you get into an accident. In this situation, gap insurance coverage for your lease might be a smart financial decision.

As with a purchased car, it may help you to compare your total cost including taxes and anything else you rolled into the lease to the vehicles MSRP to determine if you have a gap.

And just like a purchased vehicle, the difference between what you owe and what the cars worth decreases as you make monthly payments and as the car depreciates. This means you may not need the coverage for your entire lease period. You may only need it for a few months, depending on your lease agreement.

Looking to save money on auto insurance?

Read Also: How To File Bankruptcy On Car Loan

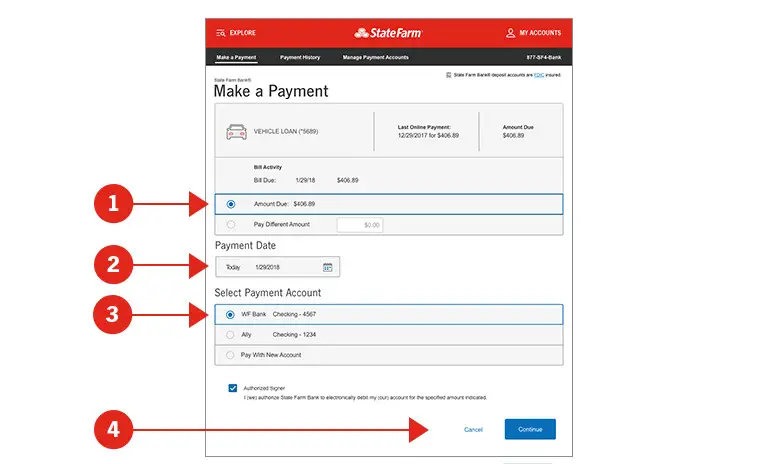

How To See Car Loan On State Farm

- Go to the State Farm site, click Menu in the upper left-hand corner and then select Vehicle Loans.

- Enter your ZIP code on the loan page.

- Sign in to your State Farm account or continue as a guest.

- Select the type of loan youre requesting, as well as your vehicle type and year.

- Enter your address, name, date of birth, Social Security number, email and phone number.

- Enter information about your employment, income and housing.

- Select if youre applying by yourself, with a cosigner, as joint credit or as joint credit with a cosigner.

- Read over the terms and conditions, agree and submit your application.

State Farm Bank Reviews

- BBB: 1.1 out of 5 stars and 1,363 complaints

- Wallethub: 3.7 out of 5 stars from 1,085 reviews

- Glassdoor: 3.5 out of 5 stars from 9,464 reviews

- and a few more.

- BMW Financial

- and a few more.

You May Like: How Much House Can I Afford With Fha Loan

Message From State Farm

Being a good neighbor is about more than just being there when things go completely wrong. It’s also about being there for all of life’s moments when things go perfectly right. With a passion for serving customers and giving back in our communities, we’ve been doing well by doing good for almost 100 years. And we’re happy you decided to get to know us better. State Farm is a mutual company that makes its primary focus its policyholders. Our more than 58,000 employees and more than 19,000 independent contractor agents service 83 million policies and accounts throughout the U.S.

What Is Gap Insurance

Gap insurance is optional car insurance coverage that covers the gap between the amount owed on a vehicle and its actual cash value in the event it is totaled or stolen from a covered claim.

If you are planning on leasing or buying a car or have already done so, you may be wondering if you should buy gap insurance, or possibly where to buy gap insurance. Gap insurance is typically an optional coverage for drivers, but in some cases your loan or lease contract may require it.

But, what is gap insurance? Say you have been involved in an accident and your vehicle has been damaged beyond repair and must be replaced. You still owe $18,000 on your auto loan but the vehicle is now worth only $15,000. Gap insurance would cover the $3,000 difference between what you owe on your car and its current market value, after accounting for deductibles. Some policies also cover the deductible.

Remember that gap insurance typically applies only to vehicles that are brand new, or models less than a year old, that have been totaled or stolen. It does not cover accidents, damages, repairs or a sale or trade-off, even if the financed amount is higher than the value of the vehicle. It will also not help buy you another vehicle you would need new car replacement coverage to cover the expenses of a new vehicle.

Looking to save money on auto insurance?

Don’t Miss: Which Bank Gives Lowest Interest Rate For Business Loan

Does State Farm Still Do Auto Loans

What you need to know about State Farm Bank auto loans. State Farm is primarily known for its insurance offerings, but the company also offers a variety of auto loan options through State Farm Bank that may be worth considering. Here are a few. New- or used-car loans Refinancing Lease buyout loan Private-party vehicle financing Payoff Protector