How The Prime Rate Impacts You

Home equity lines of credit

If you have access to a HELOC, youll feel the movements in the prime rate most closely.

Rates on those products change in sync with the prime. The adjustable rate on a HELOC might be advertised as prime plus 1% or prime plus one, for example.

The rate on this hypothetical HELOC would have dropped from 3.95% to 3.45% a few weeks later after the prime slid from 2.95% to 2.45%.

Similar to HELOCs, some lower-interest or variable APR credit cards might have an interest rate described as prime plus 4.50% to 12.75% or prime plus 9.99%.

Auto loans

Variable-rate auto loans shift in line with the prime, and the rate youll get on a new fixed-rate loan will change, too.

How much depends on the institution, so its important to check with your lender when you hear about a prime rate hike or cut.

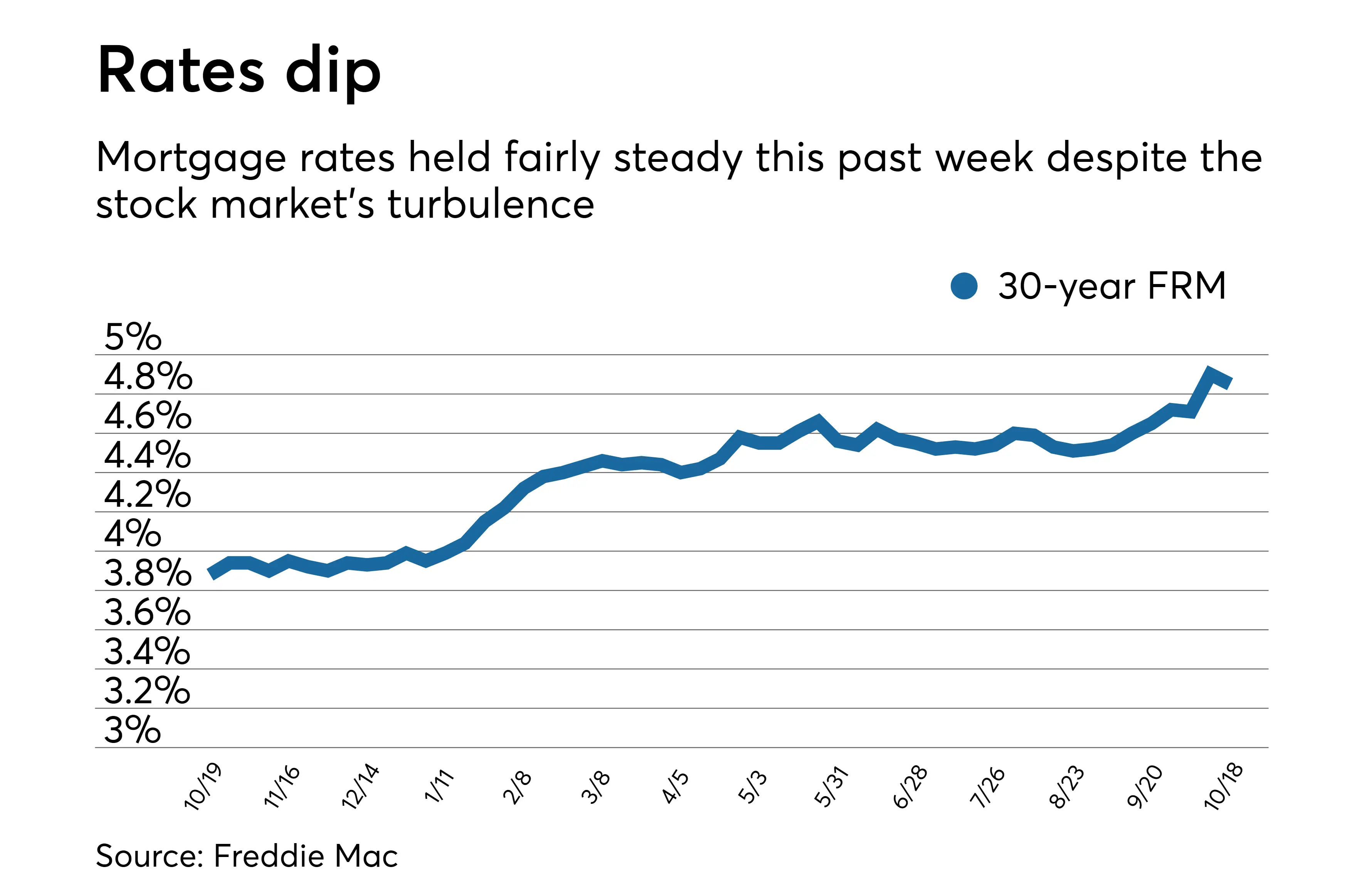

Mortgages

The two most common types of mortgages in Canada, fixed-rate mortgages and variable-rate mortgages, interact with the prime in different ways.

An active fixed-rate mortgage wont be affected thats what makes them fixed but the rates for new borrowers usually go higher or lower in step with the prime.

With interest rates this low, theres never been a better time to snag a mortgage, variable or fixed. Make sure youre shopping around before settling down on a rate. Online brokerages simplify the process by allowing you to compare rates from over than 30 federally insured lenders.

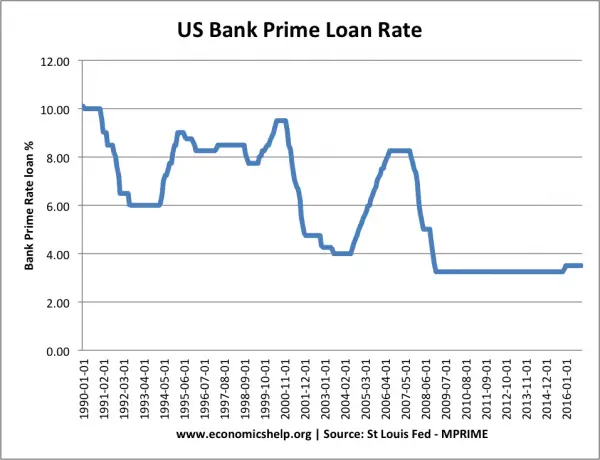

Prime Rate Changes In 2022

In March 2021 labor market was strong and unemployment far higher than the Federal Reserve’s target. FOMC increase its policy rate to a range of 0.25% – 0.5%. As a result prime rate increased to 3.5%. In May unemployment rate stood at 3.6% and CPI inflation at 8.5% suggesting that the Federal Reserve has delayed increasing interest rate for too long and is behind the curve now.

Thus on May 4, a 50 bps increase in the Federal Reserves funds rate was announced. Major banks followed fast by increasing the prime rates to 4%.

Given the state of the labor market and inflation, two more hikes of 50 bps each are expected after June 15 and July 27 FOMC meetings. Thus prime rates are expected to increase to 4.5% in June and to 5% in July.

| Date |

|---|

How Is The Prime Rate Set

Each bank sets its own prime rate, but the big five banks usually all have the same prime rate. The prime rate is primarily influenced by the policy interest rate set by the Bank of Canada , also known as the BoC’s target for the overnight rate. When the BoC raises the overnight rate, it becomes more expensive for banks to borrow money, and they raise their respective prime rates to cover the added costs. Conversely when the BoC lowers the overnight rate, banks usually lower their prime rates by the same amount.

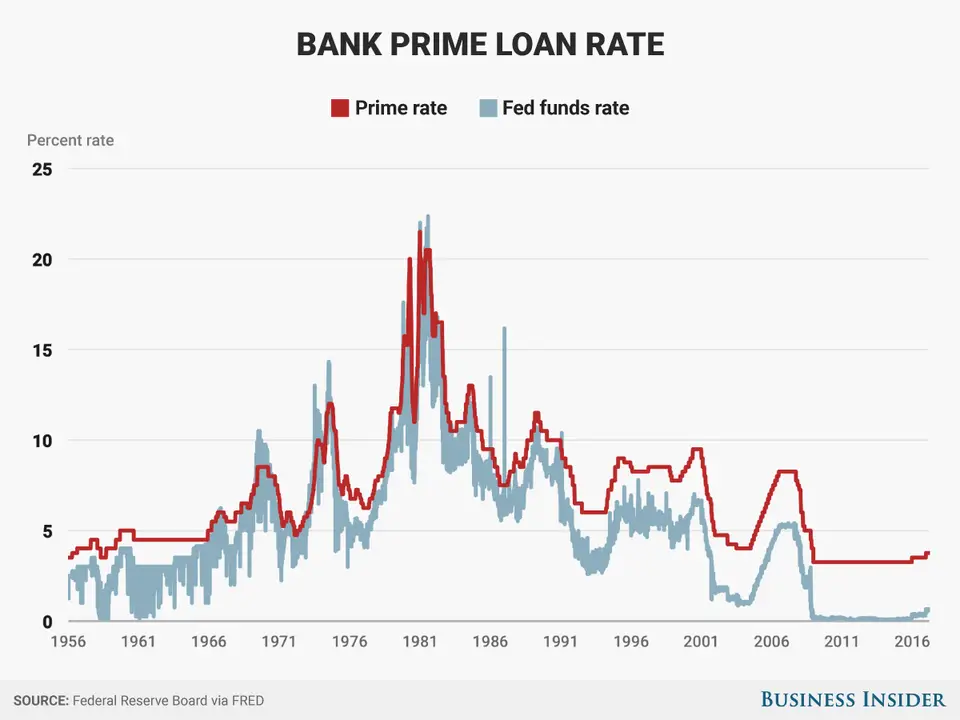

This chart shows the relationship between the overnight rate and the prime rate over time. As you can see, the rates usually move in lockstep, but not always. In recent years, there have been times when the BoC has lowered the overnight rate, but the banks have not passed on the full discount to their customers.

Recommended Reading: Refinance Fha Loan To Conventional Calculator

How To Get A Subprime Loan

Lenders have different definitions of subprime borrowers, so checking your credit score won’t give you a definitive answer on where you stand, but it will give you a good idea. If your credit score falls at the high end of the subprime range, you may get better loan terms by delaying your loan application a bit while you work to improve your credit score.

If you’re solidly in the subprime category, follow these steps to get the best subprime loan for you.

Prime Rates And Auto Loans

Auto loans are taken for the purpose of purchasing a vehicle, similar to other short-term loans the Prime Rate impacts the interest charged on auto loans. An increase in the Prime Rate will result in higher monthly payments on the loan. As of November 2021,theaverage auto loan interest ratefor new cars is 4.58%.

Recommended Reading: Sss Loan Requirements

Should You Get A Subprime Loan

If you need money quickly, a subprime loan might be your best option. But keep in mind that the bigger the subprime loan amount, the more the higher interest costs will add up. For example, interest on a subprime mortgage loan over 30 years could cost you tens of thousands of dollars more than interest on a prime loan for the same amount. Think long and hard about whether you really need a loan immediately or whether you should wait until you’ve improved your credit scoreand your odds of qualifying for a prime loan.

Bank Prime Loan Rate Download

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of daily figures.Rate posted by a majority of top 25 insured U.S.-chartered commercial banks. Prime is one of several base rates used by banks to price short-term business loans.

Suggested Citation:

Board of Governors of the Federal Reserve System , Bank Prime Loan Rate , retrieved from FRED, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/MPRIME, May 29, 2022.

Don’t Miss: Usaa Used Car Loan Rate

How Often Does The Prime Rate Change

On the bright side, while the prime rate can adjust anytime, it typically tends to shift only when a major benchmark and index for example, the federal funds rate is adjusted, such as during disruptive times like pandemics and receptions. Severe economic pullbacks are often a major predictor of pullbacks here, with the prime rate currently sitting at one of the lowest levels in years in the wake of COVID-19. Although capable of changing at any point, its not uncommon for years to pass without a major shift here.

What Prime Rate Affects

The primary impacts certain products. These include the following:

- : The interest rate you pay for credit card balances is tied to your annual percentage rate . The APRs for most credit cards are variable from month to month and tied directly to the banks prime rate.

- Adjustable-rate mortgages : ARM rates tend to be based on things like this Secured Overnight Financing Rate and Constant Maturity Treasury. These in turn are influenced by the federal funds rate which many prime rates are based on. Home equity lines of credit are also influenced the same way. The difference is that HELOCs change much more often than ARMs.

Also Check: The Mlo Endorsement To A License Is A Requirement Of

What Is The Prime Rate And Does The Federal Reserve Set The Prime Rate

The prime rate is an interest rate determined by individual banks. It is often used as a reference rate for many types of loans, including loans to small businesses and credit card loans. On its H.15 statistical release, “Selected Interest Rates,” the Board reports the prime rate posted by the majority of the largest twenty-five banks. Although the Federal Reserve has no direct role in setting the prime rate, many banks choose to set their prime rates based partly on the target level of the federal funds rate–the rate that banks charge each other for short-term loans–established by the Federal Open Market Committee.

Related Information

Prime Rate In 201: Stable At 395%

Canada’s Prime rate in 2019 remained stable at 3.95% as the Bank of Canada maintained its target overnight rate at 1.75%. Despite increasing asset prices with the S& P/TSX Composite index growing 19% in 2019 and stable global economic growth, pressures from Canada’s lagging energy sector and uncertain trade relationships with US and China created a headwind to further tightening of monetary policy and rising interest rates.

Read Also: How To Use Va Loan For Investment Property

What Does The Prime Rate Affect

The prime rate affects nearly all credit products with interest. Anytime the federal funds target rate is changed, the prime rate will generally follow suit. But the extent of the impact depends on whether the financial product in question has a variable or fixed interest rate.

If the federal funds target rate is adjusted, your credit card’s annual percentage rate could trend in the same direction. These updates are usually reflected on your credit card statement within two billing cycles.

Loan products with fixed interest rates, including personal loans, auto loans and fixed-rate mortgages, aren’t impacted by changing rates in the same way. If you have existing fixed-rate debt, you won’t experience interest rate fluctuations if rates change. The interest rate you received when you were approved for the loan will remain intact until you pay the balance in full. Prime rate could still influence the interest rate you receive when you apply for a new, fixed-interest loan product, however.

Loan products with variable rates, like home equity lines of credit and adjustable-rate mortgages, are heavily impacted when the prime rate changes. As the rate rises, mortgage payments can increase and vice versa. If the changes are drastic, refinancing your home loan could become a viable option to make your monthly mortgage payments more affordable.

Prime Loans Vs Subprime Loans

When lenders consider your loan application, they assess factors including your credit score, credit history and debt-to-income ratio to determine your and how much risk you present as a borrower. You might be considered high risk if you are new to credit, if you have a fair or poor credit score, or if your credit history shows serious negative events such as a bankruptcy in your past.

Lenders use risk-based pricing to set loan terms such as interest rates and fees. There are different credit scoring models, and each lender may have its own criteria for assessing your creditworthiness. A FICO® Score of 670 to 739 is considered prime and generally qualifies you for loans at competitive rates, if your FICO® Score is 740 or above, you’re considered super prime and can qualify for the lowest rates.

Experian generally defines subprime borrowers as those with a FICO® Score of 580 to 669, or fair credit. Subprime loans include many of the same types of loans open to prime borrowers there are subprime mortgages, auto loans and personal loans . But because these loans are designed for subprime borrowers, there are some key differences.

Don’t Miss: Usaa Auto Loan Application

Why The Prime Lending Rate Matters For Your Mortgage

Although a baseline from which lenders start to determine interest rates on mortgages, personal loans, credit cards and other financial products, the prime rate is not the actual interest rate that you can expect to pay on any money you borrow. Rather, the actual interest rate that youll be asked to pay will likely be above the prime rate as determined by your financial lender. In other words, when determining interest rate versus APR and calculating monthly payments, prime rate will exert a large influence and impact over the ultimate size of these sums but it wont be the final determinant.

By way of illustration, you may find that APRs on many credit cards may top 15 20%, as determined by individual financial institutions and influenced by your credit history and credit score. The current prime rate can also exert considerable influence over real estate loan products that come with variable interest rates attached such as adjustable rate mortgages and home equity lines of credit . If youre wondering what your monthly payments on these loan products may look like, it helps to note that prime rate may impact various housing matters such as:

What Should You Do When The Wsj Prime Rate Changes

You don’t need to monitor the WSJ Prime Rate every day, but depending on your financial goals, you might want to pay attention to the prime rate and its recent trends. If you want to pay off credit card debt, you should be aware of what interest rate you’re paying on that debt. If you have some cash savings in the bank, you might want to look for a higher-yielding savings account. The overall cost of money” and your costs of borrowing are affected by the prime rate.

If the prime rate goes up, that means that banks are charging higher interest rates, and so the interest rates on your credit card or adjustable rate mortgage might go up too, making it more expensive to borrow.

You might want to:

- Aggressively pay down your debt

- Delay making a big purchase

- Consider refinancing your debt with a debt consolidation loan or balance transfer to lower your interest rate.

If the prime rate goes down, that means that it’s becoming cheaper to borrow money.

You might want to:

- Consider refinancing your mortgage at a lower interest rate

- Make a major purchase with borrowed money. For example, lower interest rates might make it easier for you to afford a newer or better vehicle than you could before.

Recommended Reading: Used Car Loan Calculator Usaa

Determining The Prime Rate

Default risk is the main determiner of the interest rate that a bank charges a borrower. Because a bank’s best customers have little chance of defaulting, the bank can charge them a rate that is lower than the rate they charge a customer who has a greater likelihood of defaulting on a loan.

Each bank sets its own interest rate, so there is no single prime rate. Any quoted prime rate is usually an average of the largest banks’ prime rates. The most important and most used prime rate is the one that the Wall Street Journal publishes daily. Although other U.S. financial services institutions regularly note any changes that the Federal Reserve makes to its prime rate, and may use them to justify changes to their own prime rates, institutions are not required to raise their prime rates in accordance with the Fed’s.

How Are The Fed Funds Rate Prime Rate And Interest Rate Connected

The Fed Funds Rate, the Prime Rate and the interest rate on different loans are all linked. A change in the Fed Funds rate by the Fed will result in changes in the other two rates.

The Fed determines the Fed Funds Rate. The Prime Rate is based on the Fed Funds Rate with an additional 3%. Finally, the bank determines the interest rate it charges on its loans by adding a certain Interest Rate Spread to the Prime Rate.

Also Check: Bayview Loan Modification

The Prime Rate And Variable

If you have credit cards or a home equity line of credit, you feel the movements in the U.S. prime rate most closely.

Interest rates on those products change in sync with the prime rate. The adjustable rate on a HELOC might be advertised as “prime plus 1%” or “prime plus one,” for example.

The interest rate on that hypothetical home equity line will go up from 4.5% to 5% now that the benchmark rate is increasing. Again, the current prime rate is 4%.

In similar fashion, a credit card might have an annual percentage rate, or APR], described as “prime plus 11.49%” or “prime plus 9.99%.”

Who Gets The Prime Rate

Banks usually only charge the prime rate to large, corporate customers with lots of financial resources. Thats because they have more money and assets to pay the loans back. Since individual consumers do not have the same resources, banks typically charge them the prime rate plus a surcharge based on the product type they want. A credit card rate might be the prime rate plus 10%, for instance.

On the other end of the spectrum, a banks very best borrowers may be able to negotiate lower than the prime interest rate. This kind of negotiation happened more frequently in the 1980s, Garretty notes, when interest rates were much higher. Lenders would try to attract blue chip borrowers by offering interest rates lower than the prime rates.

Read Also: California Mortgage Loan Originator License

Prime Rate: What It Is And How It Affects You

What is the definition of prime rate and how does it impact current mortgage rates and loan products? If youre shopping for a new home or interested in making a real estate investment, youve no doubt heard the term thrown around. As it turns out, the prime rate equates to the best interest rate at which any given financial institution will lend money to its most creditworthy and trusted clients.

How Does The Prime Rate Affect You

While the interest rate on most financial products is dependent on the prime rate, the actual rate you receive is rarely the same exact amount. Typically, your interest rate is above the prime rate, but the amount can be greater depending on the lender. For instance, the average credit card APR on accounts assessed interest is currently 15.78% the prime rate plus 12.53%.

Of course, most credit cards set variable ranges for interest rates, meaning you can receive an APR anywhere on a preset scale, such as 12% to 24%. Consumers with excellent credit will likely qualify for rates as low as 12%, whereas someone with good credit may receive rates closer to 24%.

When prime rate changes , your credit card APR also fluctuates. The change follows the same pattern as the prime rate meaning a decrease in the prime rate results in a decrease in your card’s APR. The exact change in your interest rate depends on how much the prime rate changes take for instance, the two recent adjustments that resulted in .50% and 1% APR reductions. A 1% decrease means a 14.99% variable APR would decrease to 13.99%. This change often takes one to two billing cycles.

Fixed-rate financial products, such as many personal loans and auto loans, won’t fluctuate since you lock in your interest rate when you open the loan.

Recommended Reading: How Much Car Can I Afford Based On Income