Assess Why You Are Struggling To Make Car Payments

Are you facing a temporary hardship, or is the car just not affordable? You will be better able to determine an appropriate course of action if you know why you are struggling. If you are not sure if you can afford to keep your car, create a budget, listing your income and expenses could be helpful. Are you spending more than you are earning? If so, that is probably one of the reasons why you are struggling with your payments. Can you make any changes to your expenses or income to make the payments more affordable, such as getting a part-time job or eating out less? It is also helpful to consider if you can get by without the car. Is there another car you can drive? Are you able to carpool or take public transportation to work? If you absolutely need the car to get to work or run errands, it may make sense to sacrifice whatever you can to be able to keep the car.

You May Already Have The Best Rate

If you purchased your car new, you likely got an attractive new car rate, especially if you took advantage of a special interest offer that can feature rates as low as 0% APR. The refinancing rates for some lenders, among them Bank of America, are higher than even their used-car rates. Also, interest rates have been at record lows due to COVID-19 experts predict rates will begin to rise in late 2022 to 2023.

You’ve Improved Your Credit Score

The wonderful thing about knowing your credit score is that you can work to improve it. After you order your free report from AnnualCreditReport.com, you can start to pay down debt, clean up black marks, and raise your credit rating

Your score could see a major improvement within six months to a year if you’re diligent. And if you purchased a vehicle when your credit was poor, improvements will give you the opportunity to improve interest rates on any outstanding lines of credit.

Recommended Reading: Fha Mortgage Insurance Cut Off

What Happens If You Stop Making Car Payments

When you first fall behind, your lender may call you and/or send you letters in an attempt to collect the delinquent amount. If you continue to miss payments, and do not reach an agreement with your lender, the car will likely be repossessed. If reported, the late payments and repossession can damage your credit score and make it harder to get credit in the future.

Mistakes To Avoid When Refinancing Your Auto Loan

Refinancing your car loan doesnt always make financial sense. The main mistake you can make when it comes to refinancing is timing. If any of the following scenarios apply to you, it may be worth it to stick with your current loan.

- Youre far along in your original loans repayment: Through the amortization process, your interest charges gradually decrease over the life of the loan. As a result, a refinance has more potential to save money when youre in the earlier stages of repaying the original loan.

- Your odometer is hitting big numbers: If youre driving an older car with high mileage, you may be out of luck. Most auto lenders have minimum loan amounts and wont find it worthwhile to issue a loan on a car that has significantly depreciated in value.

- Youre upside-down on the original loan: Lenders typically avoid refinancing if the borrower owes more than the cars value .

- Your current loan has a prepayment penalty: Some lenders charge a penalty for paying off your car loan early. Before you refinance your loan, investigate the terms of your existing loan to make sure that there are no prepayment penalties.

Don’t Miss: Capitol One Autoloans

You May Not Qualify For A Top Rate

If it has only been a short time since you got your initial loan, your credit score still may be suffering from the temporary hit from a hard inquiry to your credit report, especially if youve also applied for other types of credit, such as a mortgage or one or more credit cards. Your refinancing rate may also be affected if you were late on or missed loan payments, or you havent had the loan long enough to demonstrate that youll consistently pay on time, especially if you dont have a long credit history.

Improve Your Cash Flow

If you currently owe less than what your vehicle is worth, you may be able to access more cash by refinancing. For instance, lets say you have owned your vehicle for three years. Your vehicle is currently worth $8,000, and you still owe $5,000 on your auto loan. You need money for a small home improvement project. One option would be to refinance your vehicle for $6,500. You will still owe less than what the vehicle is worth and have $1,500 of new money available to spend after the new loan pays off your previous $5,000 balance. The $1,500 can now be used for your home improvement project.

Be careful, though. A car, unlike a home, is always a depreciating asset that can lose more than 10 percent of its value within the first month of ownership and more than 20 percent within the first year.

You dont want to risk going underwater on your loanthat is, owing more on your car than the car is worth.

Also Check: Usaa Car Financing Calculator

Youre Underwater On Your Loan

Finding a lender to refinance a vehicle when youre upside down on your loan isnt easy. Even if you can find a lender, it may not be the best move. The interest rate is likely to be much higher than average, and it will cost you more in the long run.

When you refinance your upside-down vehicle, you add to the overall cost of the vehicle. One way around this is to pay the difference in cash so youre no longer upside down, then you can refinance at a lower rate. Even if it takes you a few months of making a few extra payments, it may be worth it in the long run. Alternatively, you could also take out other financing, like a personal loan or home equity loan, to help you cover the full cost of refinancing.

The Cons Of Auto Refinancing

You might spend more over the long run. As mentioned above, a lower monthly payment is an attractive reason to refinance your auto, but it can sometimes mean you pay more interest in the long run. A lower payment usually means a longer loan term, which means more money spent overall during the life of the loan.

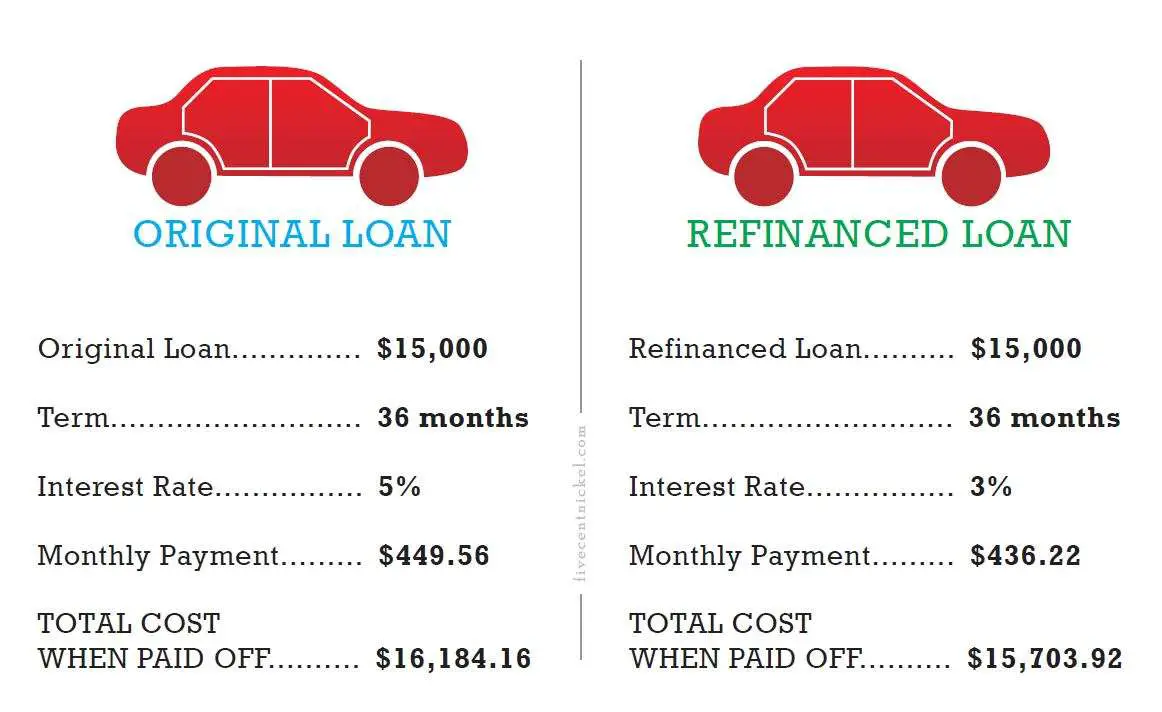

Imagine your original loan was for $15,000 financed at 3.5% for 48 months. Your monthly payment is $335. To keep this example within readable math terms, we’ll pretend you’re refinancing the full $15,000 at the same rate of 3.5%, but youre extending the loan term to 60 months. Your new monthly payment drops to $273. Having the extra $62 a month might be worth the change, but you should know the tradeoff: with the 48-month loan, the total amount you pay back is $16,080, but with the 60-month auto refinance loan, the total amount you pay is $16,380..

Your credit score might be impacted. Refinancing your auto loan can negatively affect your credit score. This is a concern for many people, especially people who are forced to get into a higher interest rate auto loan than they would have liked because of a low credit score. The good news is that in most cases, your credit score only takes a small and temporary hit when you take out an auto refinance loan.

Don’t Miss: Golden1 Car Loan

When Does Refinancing A Car Loan Make Sense

It depends on your situation. For example, if your credit score decreased since you took out your original auto loan or you missed a payment, you may not qualify for a lower interest rate. But, if your credit score has increased and youve made all payments on time, it may be a great time to refinance.

Cant Make Your Car Payments

Having a car provides many conveniences. You do not have to worry about lugging groceries on the bus or waiting 45 minutes for the train. However, for those experiencing financial problems, having to pay a car loan can make owning a car seem more like a burden than a convenience. If you are behind with payments, or worried you will be soon, assessing your financial situation and actively pursuing your options can help you make the best of a difficult situation.

You May Like: Va Loans Mobile Homes

After Youve Been Approved

Once youre approved with several different lenders, compare the various offers carefully. The most important factor is the annual percentage rate and total interest paid over the life of the loan. The APR includes the interest rates and any fees, including the lender and title fees. A lower APR means youll pay less in fees and interest.

You may be approved for several different interest rates and loan terms. Loans with longer repayment terms generally have higher interest rates and lower monthly payments. A loan with a shorter term means youll have higher monthly payments and a lower interest rate.

Look at your budget and decide how much you can comfortably afford each month. Remember, you can also make extra payments on the loan if you choose a lender that doesnt charge a prepayment penalty.

After you select the lender, youll have to finalize the car loan. The new lender is responsible for paying off the loan balance from the old lender, but its a good idea to double-check that this goes through correctly. Its also important not to fall behind on your car payments during this transfer process. Once the first lender is paid off by the new lender, they should return any extra payments you made during that window.

Once the loan is paid off, you can start making payments to your new lender. Consider setting up automatic payments so you dont have to worry about remembering your new due date.

When Should I Refinance My Car Loan

The best time to refinance your car loan is when it can save you money in the long term, but it may also help if youre hoping to catch a break on your monthly payments. Here are a few situations where it may make sense to refinance:

- Refinance car loan rates have gone down: Most car loan interest rates fluctuate based on the prime rate and other considerations. If you purchased your car a while ago, its possible that car loan rates have decreased since then.

- Youve improved your credit score: Even if market rates havent changed, improving your credit score may be enough to get a lower rate. The better your credit, the more favorable loan terms youll receive. If youve improved your credit score since signing for your initial loan, you may qualify for better loan terms.

- You got your initial loan from the dealer: Dealers tend to charge higher rates than banks and credit unions. If you took out your initial loan through dealer-arranged financing, refinancing directly with a lender could get you a lower rate.

- You need lower monthly payments: In some cases, refinancing a car loan may be your ticket to a more affordable payment, with or without a lower interest rate. If your budget is tight and you need to reduce your car payment, you could refinance your loan to a longer term . Keep in mind, though, that while you will pay less per month with this strategy, you can expect to pay more over the life of the longer loan.

Also Check: How To Stop A Student Loan Garnishment

Wait For The Right Reason To Refinance

Be honest about why you want to refinance your auto loan. Here are the top reasons why car owners refinance:

- Lower monthly loan payment: You can lower your monthly payments by refinancing to a lower interest rate or waiting for auto industry interest rates to go down.

- Pay off your car loan faster: If you have a car loan with a repayment term thats 60 84 months long , refinancing can help you shorten the loan term, and that can help you own your car sooner.

If youre facing a cash crunch and need to lower your monthly expenses but cant get a better interest rate, re-extending your auto loan at the same interest rate over a longer term can also help lower your monthly payments, but itll cost you more in interest over the life of the loan.

Weigh The Benefits And Other Considerations

Before you make a decision on refinancing, take some time to understand your options and how they could potentially affect you down the road. Weighing the costs and benefits will help assess whether refinancing is right for you.

Finally, dont forget that its not just the money thats there when you need it we are. If you have questions about your finances or refinancing an auto loan, wed love to help.

Thinking of applying?

Read Also: Fha Maximum Loan Amount Texas

Your Car Is Not Aging As Well As Your Loan Is

- Scenario: The vehicle you purchased is not as great as you thought it was, and its starting to break down. Or your car is fine, but youve put a lot of miles on it due to your job commute or vacation travel. In any case, you doubt the vehicle will last until your current loan is paid off.

- Refinancing Result: In this case, it makes sense to refinance to a shorter loan period. Yes, that will increase the monthly payments in the short term. But there will be long-term savings. First, youll pay less in interest charges with a shorter-term loan. Second, you wont have to make two sets of car payments when you buy your next vehicle. And third, you might get a better interest rate when you finance your next car or truck if youre not carrying as much debt.

There are, of course, other reasons to refinance your auto loan. If you have shifted your checking and savings accounts to a new credit union, for instance, you may want to move your car loan as well. Thats because many institutions offer loan discounts to checking and savings customers. At MECU, we offer Vehicle Loss Protection , and discounted Auto/Motorcycle Insurance.

What You Need To Refinance

To refinance an existing loan, you need the following :

You May Like: What Do Loan Officers Look For In Bank Statements

Wait For Your Credit Score To Improve

Your credit score likely dropped after you bought your car, especially if it was the first time you made a purchase of that size.

If your credit score is in the mid-600s or higher, you can probably start shopping for a new loan after about 6 months. Thatll give your credit score time to recover, and itll help you build a consistent repayment history .

On the other hand, if your credit score is in the low 600s or lower, you may want to wait a little longer before you refinance and start taking steps to improve your credit score.

You Want To Change The Loan Term

It also makes sense to refinance your car loan when you need a lower monthly payment. You could extend the length of the loan on your car refinance to get a lower payment. Still, its important to note that extending the length of your loan, which is known as the loan term, reduces your payment but also increases the amount of interest youll pay over time. And it works the other way, too: Reduce the term, and your monthly payment will increase while the amount of interest you pay overall will fall.

Don’t Miss: Bayview Loan Servicing Hardship Application

How Can You Refinance An Auto Loan

Each lender has its own process and requirements for refinancing auto loans. However, the steps to refinance are generally similar to taking out an initial car loan. Heres what the refinance process looks like:

Understand How Your Credit Will Be Impacted

Virtually every time you apply for credit, the hard inquiry will reduce your credit score by a few points. If you then open a new loan account, itll lower the average age of your accounts, which can also lower your credit score.

That said, both of these factors are much less important in calculating your credit score than your payment history and making timely payments on your new loan will increase your score over time. So unless youve applied for a lot of other credit accounts recently or you dont have a long credit history, refinancing is unlikely to make much of a difference.

Recommended Reading: Can I Refinance Fha Loan

Time Remaining On Your Loan

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

If your answer to When should I refinance my car loan? is Soon, review our current refinance rates and take a look at our auto loan refinance calculator to get a better understanding of whether refinancing makes sense for you.

You may also like