Get The Cash You Need When You Need It

One of lifes more annoying certainties is that no matter how well you plan, things will inevitably wind up off course at some point. In other words: stuff happens.

Emergencies crop up that can exhaust even the best emergency funds, making it necessary to find outside financing. While this can be a challenge with poor credit, it may not be an impossible task.

With a little research, most consumers can find the emergency loan they need. Reviews such as this can point you to the most promising sources of emergency funds.

Read all the terms and conditions before agreeing to a loan or credit card. Dont let an emergency blind you to the costs and restrictions you may face when borrowing money.

Lendyou: Small Online Loans With Fast Approval

LendYou is an online loan marketplace that specializes in short-term loans. LendYou offers a fast and secure online application with fast approval. After submitting an application with LendYou, you can receive cash in your account as soon as the following business day.

Whether you need fast cash for medical bills, auto repairs, or a vacation, LendYou can help you find the perfect loan for your needs. LendYou welcomes borrowers with all credit histories, including people with bad credit.

LendYou is not a direct lender and does not make loans or credit decisions. They are a loan marketplace that connects consumers with independent third party lenders. Once you submit an application through the LendYou platform, you will receive an offer in real-time from a direct lender, which will include the terms and conditions of the loan.

Getting a personal loan from LendYou does not require collateral. You’ll just need to show a regular source of income to qualify, such as a paycheck.

The LendYou application process is swift and only takes a couple of minutes to complete. After submitting an online application, you’ll see a real-time offer from a direct lender. Should you accept the terms, you’ll have your money deposited into your account as soon as the next business day.

Each independent lender has their own individual requirements that must be met, but the typical requirements to expect include:

Top 10 No Credit Check Loans & Bad Credit Loans Online

Sponsored ByAlex Bryce Review onSat, Aug 20, 2022 at 8:46 am

Considering a personal loan would be great when you need money rapidly for expenses, such as vacation or paying off medical bills. But what if you have a bad credit score? It’s common to think that you will never be eligible for getting a personal loan for bad credit.

When you visit a traditional bank to avail such loans, surely you will never get one. But with the loan service agencies mentioned below, you can avail of this fixed-rate loan, which needs to be reimbursed in monthly installments. So, your bad credit will never be a problem as you know the different bad credit loans will be given to you when you’ve got poor credit.

If a less-than-perfect credit score could never hold you back, this article has come up with the 10 best brokers that offer personal loans for bad credit.

Recommended Reading: Why Are Student Loan Interest Rates So High

Online Personal Loan Application Process

Once you decide to apply, prepare yourself to spend a few minutes entering all of your personal information, including:

- Proof of age

- Contact information

- Bank account information

Some personal loan lenders have a minimum credit score requirement for personal loans, so be sure to check the fine print to see if you’re eligible before you apply.

How Do I Choose The Best Bad Credit Personal Loan For Me

To get the best bad credit personal loan, consider what is most important to you. Many borrowers prioritize the lowest interest rate, but also consider any fees, the minimum credit score needed, and the accessibility of the lender’s customer service. You’ll also want to make sure you’re able to select a term length that works for you and that your loan’s purpose is allowed by the lender you choose.

For bad credit loans specifically, you’ll want to understand if you qualify for a loan or if you may need to add a cosigner to boost your chances of being eligible.

Guides like this one will help you weigh multiple lenders to compare their pros and cons. Make sure to also read individual reviews of any lenders you’re considering.

Also Check: How Do I Find Who Has My Student Loan

Consider A Credit Union

in that theyre member-owned and return all their profits back to their members in the form of affordable financial products. By law, credit unions can charge no more than an 18% interest rate on their loans, including credit cards.

A loan through your local credit union may provide substantial savings.

What Is The Easiest Business Loan To Get

The easier business loan to get is one that is secured. This means the loan is backed by collateral, and the lender gets that collateral if the business owner defaults on the loan. The collateral pledged usually includes property, inventory, equipment, savings accounts, blanket liens, and personal guarantees.

Read Also: What Are Commercial Loan Rates Now

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Look For Prequalifying Forms

You arent guaranteed a loan if you receive a prequalifying approval but chances are youll get an all-clear when you officially apply. Aside from gaining peace of mind, prequalifying forms wont leave a hard inquiry on your credit report that can harm your credit score.

Prequalifying forms perform soft pulls on your credit report that show enough basic information to match your qualifications with a lenders requirements.

If you meet the eligibility requirements, you can submit a full application which will require a hard inquiry. If theres nothing drastically different on that credit report, you should receive loan approval.

You May Like: Should I Refinance My Rv Loan

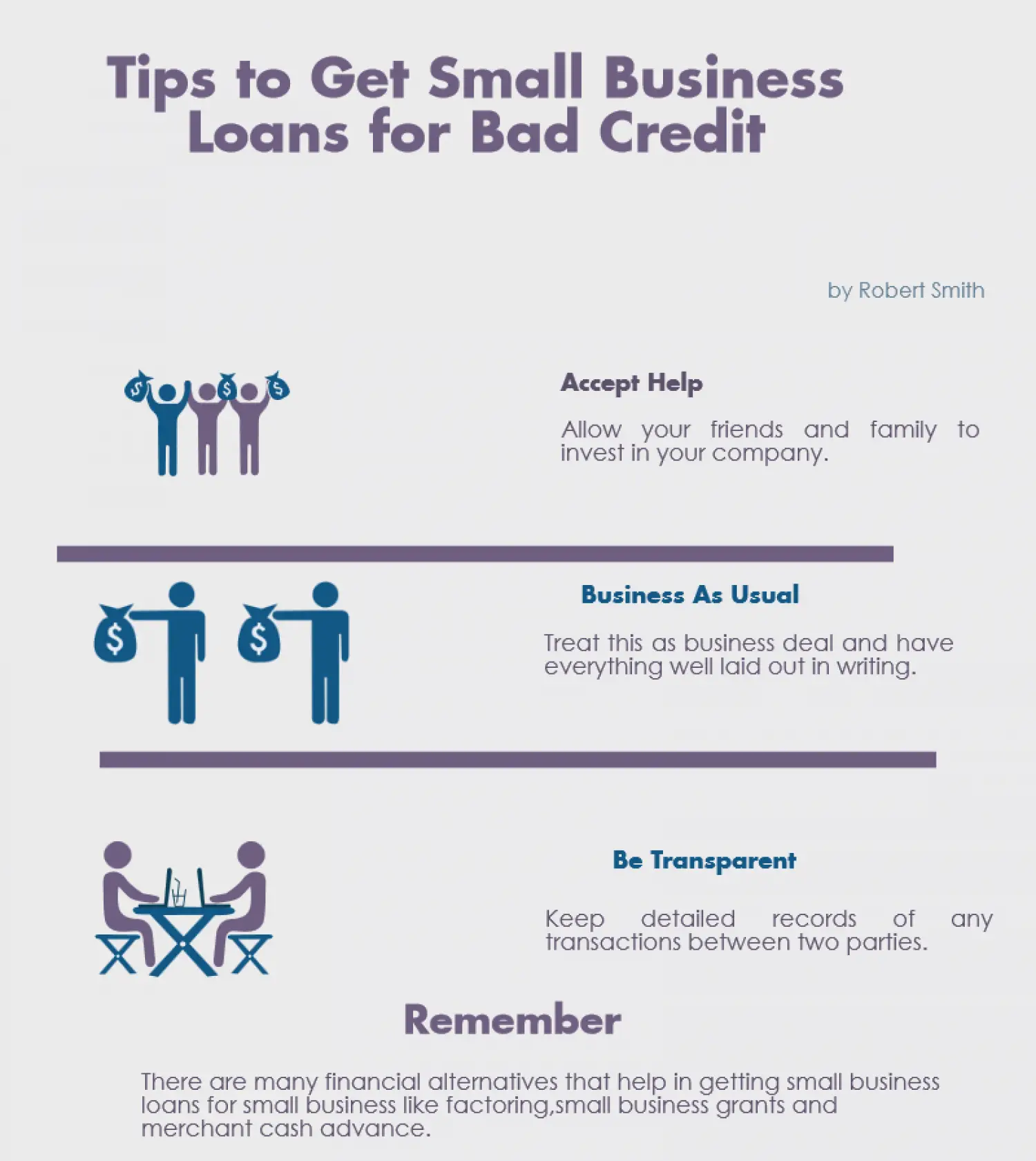

How We Chose The Best Small Business Loans For Bad Credit

We looked at 19 of the best small business loans available and narrowed it down to the best six options for bad credit based on several features and considerations. We considered rates, credit score requirements, loan amounts, and repayment terms. Reviews of customer service, sales, and ease of use weighed heavily into our decisionobtaining a small business loan should be a pleasant, stress-free experience for business owners.

Student Loans For Bad Credit

If youre trying to cover higher education expenses, a student loan for bad credit is likely the direction you want to look. Although private student loans typically require good credit, borrowers with bad credit can take out federal student loans, which dont require a credit check. Federal loans also come with the most flexible repayment terms, including forgiveness if you work in public service or choose certain repayment plans.

Don’t Miss: Can You Switch From An Fha Loan To Conventional

How Soon Do I Have To Pay My Loan Back

If you take out a loan it will have to be paid back according to the repayment schedule detailed in your loan agreement, just like any other type of credit agreement. The good news is that you can almost always make early or additional payments to repay your loan early . Doing this will mean you get to pay your loan back early and demonstrate your credit-worthiness to any future credit providers you may deal with. Check the terms and conditions received from your lender to understand their specific policies.

Small Cash Loans For Bad Credit

These loans must be repaid quickly, usually within a month, and are for small amounts of up to $2,000 or so. They are unsecured loans given based on the word and creditworthiness of the borrower.

Personal loans and credit cards are both generally considered to be unsecured debts because the lender has no way of securing, or guaranteeing, that the debts will be paid. Unsecured debts are thus riskier for the lender than secured debts, and will usually carry much higher interest rates.

| Varies |

See representative example |

An unsecured loan may not involve collateral that the bank can repossess, but lenders do have options if you default on your loan, including taking you to court. Make sure to pay your loan on time, in full, to avoid any nasty repercussions.

Don’t Miss: What Kind Of Loan For Home Improvement

Are Bad Credit Loans Legitimate

Yes, personal loans with a reputable lender are absolutely safe to borrow. Look over reviews of the company, dig for more information, and disregard offers that feel too good to be true. Search for personal loans that are backed by a Member FDIC bank or NCUA-accredited credit union.

You can find potential scams by looking out for these common indicators of fraud:

- The lender doesn’t request your payment history or credit score.

- The lender’s website isn’t secured.

- The lender ensures approval.

- The lender isn’t transparent about fees.

- The lender coerces you into taking out a loan instantly.

The Ultimate Guide To Small Loans For Bad Credit

Life can sometimes be surprising, and you might end up having Bad Credit. It might be indicated in your credit file, and it could result in difficultness to access credit from a majority of lenders. That is where MiFinance comes in since we can help you get small loans for bad credit.

Did you get declined by your credit union or bank? There is a high chance that this is because you have a bad credit score. It is also likely that your adverse history might relate to something like going into a bankruptcy agreement, not paying credit card monthly payments, being late for a particular mobile phone payment, or not paying a utility bill.

To confirm if you have bad credit, you can always obtain your credit file for free from any of the Credit Reporting agencies. Before we can look at small loans for bad credit, lets take first understand what exactly is a bad credit loan and why it is somewhat challenging to access loans when you have a bad credit history.

Don’t Miss: What Is Portfolio Loan In Real Estate

No Credit History Check

Lenders should always check your credit score and credit history as part of their loan application. Even if a lender does not require a minimum credit score, it needs this information to determine your interest rates and repayment terms. If a lender claims it isn’t interested in your credit report, you can assume it is trying to scam you.

What Are The Interest Rates On Bad Credit Loans

Lenders calculate interest rates based on a number of variables ranging from your creditworthiness and income to the size of the loan and repayment term. Because your credit score and history play a key role in determining the interest rate you receive, you should not expect the lowest rates on bad credit loans the lowest rates are typically reserved for highly qualified applicants.

Although interest rates on our list range from about 3% to 36%, its more than likely that the interest rate you receive will fall toward the top end of the range with damaged credit. If you want to improve your chances of getting a lower interest rate, take time to boost your credit score before applying.

You May Like: What Does The Va Home Loan Do

What Are Bad Credit Personal Loans

Simply put, bad credit loans are a way for borrowers with a lousy credit score to get a financial fix through a personal loan . Direct lenders and companies that feature an online lending marketplace can help you find an unsecured or secured loan through debt consolidation, a credit union, or even home equity.

Generally, applying for a loan with bad credit means you’ll pay higher interest rates. Depending on the loan company, your personal credit history, and your qualifications, you could end up paying 35.99% or above, in some cases. Personal loans for bad credit also include other short-term fixes, like payday loans or car-title loans, both of which usually have multiple fees, including a high origination fee.

The application process is straightforward. First, log online. Do some research, then choose a loan company. Of course, you’ll need to provide the usual information: social security number, income sources, employment, debt-to-income ratio, etc. Some companies offer a pre-qualification process that allows you to view your available loan rates without impacting your credit score, known as a soft credit check.

Where Can I Get A Small Loan With Bad Credit

Even with bad credit, you may be able to get a small loan from traditional and online lenders. However, the options you’ll haveand the cost of fees and interestwill depend on where exactly your credit falls. Read on to find out how to get a small loan if you have less-than-perfect credit.

Read Also: Does Bank Of America Loan Money

As A Borrower How Do I Repay The Loan

As you may expect, lenders in the lending networks make it easy to make payments.

They and other third-party lender networks generally have online systems that accept electronic payments and manage your account. Customer service agents are also often available to take payment by phone.

Most of these loans will be installment loans, so youll have the same payment amount for each month of the loan. Payment terms are set before you accept the loan, so be sure to know how many payments youll have to make before you sign on for a short term loan.

PersonalLoans.com, for example, has a 90-day minimum repayment, and also has loans for as long as 72 months.

All lenders are required by law to clearly disclose the terms of the loan offer before you can accept the offer. Carefully read all of the disclosure and the loan agreement entirely, and make sure you understand the detailed information about and repayment terms.

Online Personal Loans For Bad Credit

Applying to online lenders can be a good option for borrowers with bad credit, especially if you submit an application through an online lending network. These online networks often allow you to submit a single initial application and then compare offers from responding lenders. Online lending networks make it easier to find the lenders willing to work with you and decide which one will work best for you.

Direct lenders also can offer online personal loans. In this case, you would go directly to a lender you would like to work with that offers online options to apply. In this case, you will want to research beforehand to find lenders that offer bad credit loans.

Read Also: Can You Finance 2 Cars On One Loan

How To Get Online Loans With Bad Credit

The process for bad credit borrowers to apply for personal loans is very simple, making it even more important to compare rates and research every option available to you. As long as you have a computer, internet access, and a few minutes of free time, you can apply for a personal loan from reputable online lenders or your financial institution of choice.

If you’re unsure where to start, the five companies we just reviewed have some of the best loans for bad credit borrowers, with a simple and speedy application process.

How Can I Instantly Borrow Money

There are many ways to get money quickly, such as personal loans, loans from pawn shops, cash advances online, loans from payday lenders, and loans from banks or credit unions. These are far superior options compared to the weeks or months it can take to obtain a bank loan.

Check out some of the most reputable no credit check loan services for fast loans.

You May Like: How Much Will My Auto Loan Be

How Much Will An Emergency Loan For Bad Credit Cost

Some emergency loans are costly. Payday, pawnshop, and title loans have three-digit APRs. The latter two will also cost you your pledged property if you default on the loan.

Cash-out auto loans may charge a nominal processing fee, and you can expect an APR of up to 24% if you have bad credit. A HELOC may charge subprime borrowers an 18% APR.

Can I Get An Installment Loan With Bad Credit

An installment loan is the most common type of loan. These financial products pay a specific loan amount in one lump sum, and the borrower pays the lender back in payments over a predetermined amount of time.

These payments almost always include interest fees and may sometimes include processing fees and other charges. Lenders like issuing installment loans because it gives them a steady repayment on their loan with added interest to their profit margins. Many options exist if you want to take out an installment loan with bad credit.

The lending networks listed above all partner with several nationwide lenders that specialize in bad credit loans. If you meet the income requirements, you may qualify for a poor credit installment loan, despite your bad credit history.

These loans are easier to repay than short-term loans that require repayment in one lump sum by a specific date. Plus, on-time payments can improve your credit score over time.

If you receive a loan offer that you like, the network will redirect you to the lenders website where you will complete the paperwork and finalize the loan application. Youll only make payments to the lender not the network.

Keep in mind that many lending networks have rules in place that dont allow applicants to apply for multiple loans at one time. If youve already received a loan from a specific network, chances are you wont receive approval for another until you pay off the current loan.

Don’t Miss: How Much To Refinance Car Loan