How Can Freelancers Get Their Ppp Loans Forgiven

According to Greene-Lewis, once the check arrives, how most freelancers use it is up to them. In many cases, the funds fall into a category thats considered owners compensation replacement.

Yes, the funds can be spent to cover your personal salary, Lewis-Greene said. You can also pay for mortgages, rent or utilities for your place of business, or any other supplies and business-related expenses.

Once youve spent your sweet influx of federal aid on any of the above, the good news is the loan is forgivable. But as Greene-Lewis is quick to point out, that part of the process isnt guaranteed.

You have to apply for forgiveness on the SBA website, she said. They may require some documentation and receipts showing what you paid for. In other words, you may have a harder time getting a trip or vacation forgiven unless it directly relates to your work.

Average Monthly Payroll Costs

Your loan amount calculation starts with finding your average monthly payroll costs. Your average monthly payroll costs can be calculated using one of the following:

-

the one year period before the loan application

-

the calendar year of 2020

-

the calendar year of 2019

Once youâve chosen the time period you want to use, follow these steps:

Step 1: Add up the payroll costs for all employees whose principal place of residence is in the United States. Payroll costs include:

-

Salaries, wages, commissions or tips

-

Employee benefits including paid leave, allowance for separation or dismissal, and healthcare benefits including insurance premiums and retirement benefits

-

State and local taxes

If you are including your net or gross income as reported on a Schedule C, use form 2483-C.

Step 2: Subtract any compensation paid to an employee in excess of $100,000. This step is required because the PPP sets a cap on salaries of $100,000 per employee. For example, if you have two employees earning $120,000 over the year, subtract $40,000 from your payroll total.

Step 3: Divide the total amount from Step 2 by 12 months and put it in the Average Monthly Payroll box.

Ppp First Draw Eligibility Criteria

If the following statements apply to your business, you are eligible to apply for your first PPP loan.

-

Your business was operational before February 15, 2020

-

Your business is still open and operational

-

You have no more than 500 employees

-

If your business has multiple locations, you have no more than 500 employees per location

You May Like: Does Va Loan Work For Manufactured Homes

To 24 Weeks Of Expense Coverage

Expenses eligible for forgiveness are those that are incurred over the 8 to 24 week period, starting from the day you receive your PPP loan from your lender. This is not necessarily the date on which you signed your loan agreement.

You do not need to adjust your payroll schedule. All payroll that your employees incur over the 8 to 24 week period is eligible for forgiveness, even if the actual payout date falls outside the covered period.

Is There Loan Forgiveness For Second Draw Ppp Loans

Yes! As with the first round of PPP, these loans may be entirely forgiven if spent for the proper purposes during the proper time period. Currently there are three PPP loan forgiveness applications:

- Form 3508

From 3508S is a simplified form that previously was available for loans of $50,000 or less. Now it covers loans of $150,000 or less. It requires the borrower to:

- Describe the number of employees retained due to the PPP loan,

- The estimated amount of the loan proceeds spent on payroll, and

- The total amount of the loan

The borrower will have to certify they have complied with the requirements of the loan and retain records to prove compliance.

We recommend considering opening a separate bank account to deposit your PPP funds and track expenditures.

The SBAs new online SBA PPP Direct Forgiveness portal allows borrowers with loans of $150,000 or less to apply for forgiveness directly with the SBA.

Recommended Reading: Can You Use A Va Loan To Buy Land And A Manufactured Home

What Kinds Of Ppp Loans Are Available

There is funding for three categories of PPP loans in this legislation:

- First time PPP loans for businesses who qualified under the CARES Act but did not get a loan

- Second draw PPP loans for businesses that obtained a PPP loan but need additional funding and

- Additional funding for businesses that returned their first PPP loan or for certain businesses that did not get the full amount for which they qualified.

In this round, certain small news organizations, destination marketing organizations, housing cooperatives, and 501 nonprofits may now also be eligible for PPP loans.

For all PPP loans, no collateral or personal guarantee is required. For these new loans, any amount not forgiven becomes a loan at 1% for five years.

What Expenses Can I Use My Ppp Loan For

Its important to spend your loan proceeds correctly if you want to qualify for full forgiveness. The SBA has established some very specific guidance regarding the use of PPP loan proceeds for those with income from self-employment who file a Form 1040, Schedule C.

With the new rule the SBA introduced a new term called proprietor expenses and describes it like this: In the context of determining a borrowers eligible expenses and forgiveness amount, this interim final rule refers to the owner compensation share of a Schedule C filers loan amount as proprietor expenses.

PPP is intended to keep workers on payroll, and that may include compensation for self-employed individuals. In fact, full forgiveness generally requires the business to use at least 60% of PPP funds for payroll related expenses during specific time periods. The March 3, 2021 guidance from the SBA describes it this way:

- For borrowers that use net profit to calculate loan amount, owner compensation replacement, calculated based on 2019 or 2020 net profit.

- For borrowers that use gross income to calculate loan amount, proprietor expenses , calculated based on 2019 or 2020 gross income .

- For borrowers who used gross income to calculate the loan amount and have no employees, proprietor expenses equal gross income.

- For borrowers who used gross income to calculate the loan amount and have employees, proprietor expenses equal the difference between gross income and employee payroll costs.

You May Like: What Is The Commitment Fee On Mortgage Loan

How To Apply For Ppp Forgiveness Loan

The U.S. Small Business Administration issued a one-page application form that aims to simplify the application process for forgiveness of Paycheck Protection Program loans, along with newly updated and revised forms that conform to the requirements of the latest stimulus legislation.

The COVID-19 aid package Congress passed last month revived the PPP with $284 billion in financing for small-scale businesses looking for forgivable loans to help them to deal with the effects of economic collapse from the coronavirus pandemic. The package also mandated the SBA to issue simplified forms within the first 24 hours of the bill being signed into law to simplify the process of applying for forgiveness. The legislation also contained conditions meant to encourage more loans from community banks, particularly for minority-owned businesses that had trouble getting loans in the past.

Ed Zollars, a partner with Thomas, Zollars & Lynch CPAs and said that the Small Business Administration fulfilled the obligation to issue the one-page form for PPP loan forgiveness within the first 24 hours of the date of enactment under the Consolidated Appropriations Act, 20,21. This was on the Current Federal Tax Developments blog of Kaplan Financial Education. The agency also published more updated forms.

Second Draw Ppp Loans

The stimulus legislation created second draw PPP loans for those who:

- Previously received a first draw PPP Loan and has or will use the full amount only for authorized uses by the date the second loan is disbursed

- Have no more than 300 employees and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

More information about qualifying for a second draw PPP loan can be found here.

The calculation for second draw loans is similar to first draw loans with one exception: if your business has a NAICS code beginning in 72 you may qualify for a loan of 3.5 times average monthly payroll. Other businesses will qualify based on 2.5 times average monthly payroll as before.

The March 3, 2021 Interim Final Rule describes the following method for calculating the loan amount:

The maximum amount of a Second Draw PPP Loan to a borrower that has income from self-employment and files an IRS Form 1040, Schedule C, is calculated as follows, depending on whether the borrower has employees:

For a borrower that has income from self-employment and does not have any employees, the maximum loan amount is the lesser of:

the product obtained by multiplying: the net profit or gross income of the borrower in 2019 or 2020, as reported on IRS Form 1040, Schedule C, that is not more than $100,000, divided by 12 and 2.5 .

This amount cannot exceed $29,167 for NAICS code 72 borrowers and $20,833 for all other borrowers.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

How To Calculate Ppp Loan Amount If You Are Self Employed

Here we are focusing on those who are self-employed and who file a Form 1040, Schedule C. As a reminder, the SBA states you may be eligible for a PPP loan if:

- You were in operation on February 15, 2020

- You are an individual with self-employment income

- Your principal place of residence is in the United States and

- You filed or will file a Form 1040 Schedule C for 2019 or 2020.

For those who are self-employed and file a Form 1040, Schedule C, the SBA provides separate calculations based on whether or not you have employees. You will find those below.

Update: On March 3, 2021 the SBA released a new Interim Final Rule that applies to PPP applicants who are self-employed. Prior to this change, self-employed borrowers who file Schedule C used line 31 of their Schedule C to calculate the owners compensation portion of their loan amount. The new calculation provides more flexibility, allowing borrowers to use net profit or gross income.

Note: Do not include payments you make to 1099 contractors in your payroll. They can apply for PPP themselves.

Harvest Small Business Finance**

With headquarters in Laguna Hills, California, Harvest Small Business Finance is a non-bank lender that serves small business borrowers who have traditionally been ignored by large, regional, and community banks. It has halted accepting PPP loan applications from existing and new customers. Its site says it will resume if there is a third round of funding. For updates, go here.

You May Like: How To Get Loan Originator License

What Are Paycheck Protection Program Loans

The Paycheck Protection Program loan is a type of SBA loan designed to provide funds to help small businesses impacted by COVID-19 to keep their workers on payroll. These loans may be completely forgiven if spent on eligible expenses during a specific time period.

Update: Paycheck Protection Program Loans are no longer available.

Ppp Loan Specific Information

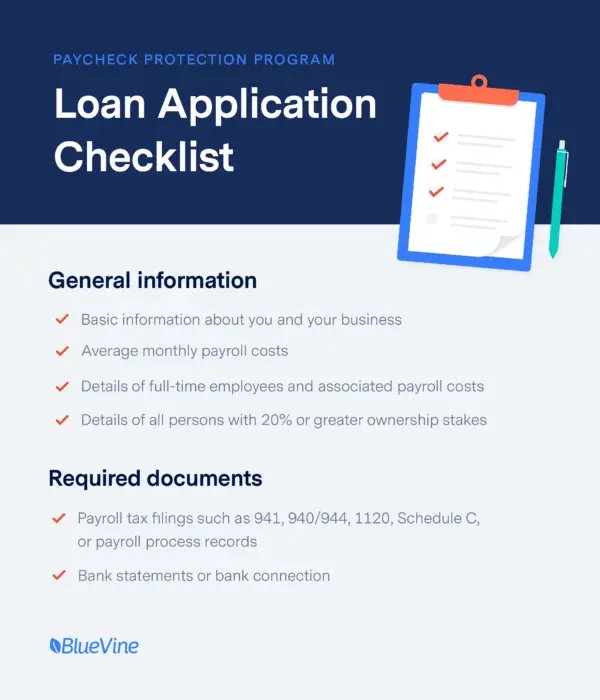

Next, the application asks for some information about your business. For starters, how many employees do you have and what is your average monthly payroll?

The application is going to ask you to multiply your average monthly payroll by 2.5. The result of this simple calculation is your loan amount request.

You will also see a reference to adding EIDL to your average monthly payroll. This applies to businesses that have an outstanding balance from an Economic Injury Disaster Loan.

Finally, this section is going to ask for the purpose of your loan. This is verification that you are using the loan for payroll, mortgage/rent interest, or utilities.

Read Also: Do Loan Officers Make Commission

Second Draw Ppp Terms Of Loan Forgiveness

Second Draw PPP loans granted to borrowers who meet the criteria are eligible for full loan forgiveness if during the 8to 24-week duration following loan payment:

- The First Draw PPP loan requires that the compensation and employee levels be maintained in an identical manner.

- The loan funds could be used to cover payroll costs or other eligible expenses.

- A minimum of 60% of the profits go towards the cost of payroll

- What is the best time to apply for loan forgiveness?

Once all of the loans proceeds have been used The borrower may apply for forgiveness. Borrowers may apply for forgiveness at any time until the date of maturity. Borrowers who do not request forgiveness within 10 month after the date they will be able to repay the loan will be able to receive loan payments from their PPP lender.

Business Name And Address

You are required to provide both your Business Legal Name and your DBA or Tradename if applicable. Your Business Legal Name is found on any government forms. A DBA or Tradename is what appears on bank statements or invoices if itâs different than your Business Legal Name. Your Business Address is also found in these documents.

Recommended Reading: What Happens If You Default On Sba Loan

Businesses With More Complex Situations Or Those Businesses That Made Significant Reductions In Employees And Wages

You are eligible to apply using the PPP Forgiveness Application 3508

Form 3508 helps businesses that have PPP loans $150,000 or more and made more significant employee reductions and wages, or for businesses that may have more complex situations. The application is more complex than that of its peer applications and it requires multiple calculations and documents to be submitted and sent to the SBA.

Application Form 3508 eligibility information:

If you are not eligible to complete form 3508S or 3508EZ, you are required to apply using the standard application.

You can find more details and instruction about Form 3508 on the SBA’s website.

Bank of the West Forgiveness Assistant Form

We understand that Form 3508 is more complex and requires multiple calculations. Don’t worry, if you’re a Bank of the West PPP customer, we’ve created the Forgiveness Assistant Form to help you through the standard application. The Forgiveness Assistant Form is required if you are applying for PPP loan forgiveness with us and you are not eligible to complete Forms 3508S or 3508EZ. You will need to download the Forgiveness Assistant Form, complete it, save it and then upload it into our online portal when prompted.

If I Elect To Use The Sba’s New Loan Forgiveness Application Will I Be Required To Submit Documentation

The latest guidance from the SBA states for first draw PPP loan forgiveness applications using the S form, documentation does not need to be uploaded, however, you are required to retain all records relating to your PPP loan and may be required to submit such documentation to the SBA, upon request.

For second draw PPP loan forgiveness applications, you may be required to provide revenue reduction documentation if your loan was $150,000 or less and you did not provide such revenue reduction documentation prior to your forgiveness application.

The SBA requires borrowers using Form 3508 and Form 3508EZ to submit documentation in connection with their loan forgiveness application. You will not be eligible to receive loan forgiveness without supporting documentation.

For detailed information on the application, including Covered Periods, the type of costs that are eligible for forgiveness, and what documentation you will need to submit in connection with your application, please visit the U.S. Treasury and SBA websites.

For additional assistance with PPP loan forgiveness documentation, view our documentation guide.

Recommended Reading: Does Va Loan Work For Manufactured Homes

First American Bank **

This local independent community bank primarily operates branches in New Mexico. Its website says that it has helped more than 600 businesses receive a total $123 million in loans. The bank says for small businesses in need of financial assistance, presumably in its community but not necessarily existing customers, to contact them to apply for a PPP loan. For more information, go here. Consolidated assets: $5.32 billion.

How Does New Legislation Change The Ppp Loan Forgiveness Process

Legislation signed into law December 27, 2020, known as the Economic Aid Act, contained the following changes:

- You now have the option to select a covered period which ends on a date that is at least 8 weeks following the date of loan disbursement, and not more than 24 weeks after the date of loan disbursement

- Includes provisions that expand the list of allowable and forgivable expenses, which apply to existing PPP loans for which a borrower has not yet received forgiveness

The Paycheck Protection Program Flexibility Act, signed into law on June 5, 2020 contained the following requirements:

- Your deferral period, during which payments on your loan will be deferred, will commence on the date on which your PPP loan was funded and end on the date on which the amount of forgiveness as determined under section 1106 of the CARES Act is remitted to the Bank or the date which is ten months after the last day of your covered period , if you have not applied for forgiveness by such date

- You must use at least 60% of funds for eligible payroll costs to qualify for full loan forgiveness, down from 75%

- You can use up to 40% of funds for eligible nonpayroll costs, up from 25%

For additional details, please visit the SBA website.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How Can Freelancers Apply For Ppp Funds

The next step is figuring out how to get your slice of the pie. If youre working with an accountant, theyll be able to guide you through the application process. If not, its as simple as visiting the Small Business Administration s website and finding a lender. The SBA can match you with an approved lender, or you can research the various options yourself.

Throughout this process, youll need some basic documents on hand, including proof you were in businesses before February 15, 2020 your 2019 or 2020 tax return and any 1099-Misc forms from the same year. Some lenders may only require your Schedule C and proof of business operations, while others will ask for more detailed information. Your lender will let you know about any additional documents youll need to complete your application.

Now, the golden question: How much can you request? It all depends on your past tax returns and if you have any employees, but the max is 2.5 months worth of income.

To start, find line 7 of your 2019 or 2020 Schedule Cthis is your gross income. Divide this number by 12, and then multiply by 2.5 to calculate the amount youre eligible for. Recipients of Economic Injury Disaster Loan loans who wish to refinance may also need to factor in some additional calculations.