Choose Exempt Or Not Exempt

One of the first things the W-4 form prompts you to answer is whether youre exempt, which means your employer wont withhold federal income taxes from your paycheck.

For your taxes and the W-4 form, youre exempt only if the following are both true:

- In 2019, you had a right to a refund of all federal income taxes withheld because you had no tax liability.

- In 2020, you expect a full refund of all federal income taxes withheld because you have no tax liability.

If youre working full-time, you likely wont qualify for tax-exempt status. As of Jan. 13, 2020, you must make less than $12,200 a year to qualify if youre single.

Make sure you only claim exempt status if you meet all the criteria. If you claim it when youre not really exempt, youll owe a significant amount when you file your taxes, along with penalties.

Take Advantage Of New Fannie Mae Guidelines

In 2017, Fannie Mae had some changes to the way it looks at student loan debt. These changes are specific to people paying back student loans through an income-driven repayment plan. Here are the new guidelines, according to Fannie Mae:

- If the borrower is on an income-driven payment plan, the lender may obtain student loan documentation to verify the actual monthly payment is $0. The lender may then qualify the borrower with a $0 payment.

- For deferred loans or loans in;forbearance, the lender may calculate

- a payment equal to 1% of the outstanding student loan balance , or

- a fully amortizing payment using the documented loan repayment terms.

Before 2017, lenders were instructed to always use 1% of the student loan balance when determining a buyers DTI instead of the actual student loan payments borrowers were making. For example, if you had $90K in student loan debt, a monthly student loan payment of $900 would be added to your DTI calculation, even if your payment was only $100 .

That difference was enough to push many borrowers DTIs beyond what was acceptable to lenders. The new guidelines should make it much easier for those on income-driven repayment plans to qualify for a mortgage loan.

Consider Parent Plus Loans When Calculating Monthly Payments

While Parent PLUS loans dont belong to the student, you should calculate your payments on these loans on a semester-by-semester basis.

If you are unprepared to repay them, the student may be able to pick up a part-time job or they can apply for more scholarships.

Another option is for the student to transfer to a school where you dont have to borrow so much.

The good news is, schools offer new scholarship awards in sophomore, junior, and senior year of college. Students need to check in regularly with their financial aid office and the department for their major.;

A student may qualify for a scholarship from their major that is only available in their 2nd or 3rd year.

They can also go to the financial aid office on campus to ask about additional grant and scholarship money.

Don’t Miss: How To Get An Fha Loan With No Money Down

If You Enroll In Repaye As A Public Defender

If you begin earning $58,000 as a public defender, your monthly payments in REPAYE will start at $327 and gradually rise to $557 as your salary increases. Over the life of your loan, your payments will average $442 a month, assuming you qualify for more than $170,000 in Public Service Loan Forgiveness.

Private Student Loan Deferment

To defer a private student loan, you’ll need to contact your lender. Many offer some form of deferment or relief if you are enrolled in school, serving in the military, or unemployed. Some also provide deferment for economic hardship. As with unsubsidized federal loans, in most cases, any deferment of a private loan comes with accrued interest that will capitalize at the end of the deferment period. You can escape this by paying the interest as it accrues.

Forbearance is another way to put off repayments for a period of time. But, as with deferment, it’s only a temporary fix. An income-driven repayment plan may be a better option if you expect your financial difficulty to continue.

Read Also: Where To Apply For Small Business Loan

Mortgage Options For Homebuyers With Student Loan Debt

If you need help coming up with the funds to buy a home, consider a down payment assistance program to help supplement what youve saved toward your home purchase.

Special Student Loan Repayment Programs

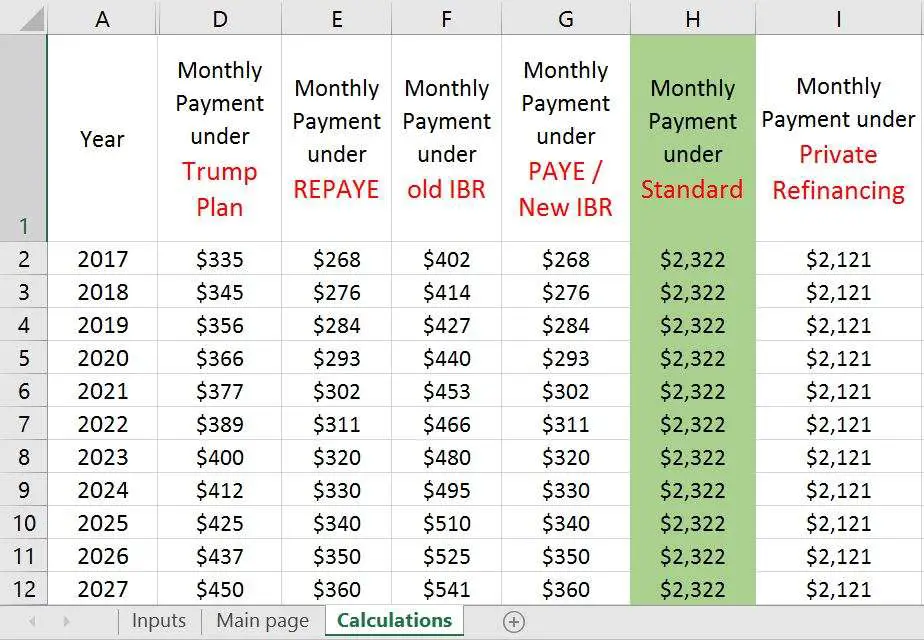

As the cost of tuition rises — and with it the average student loan balance — an increasing number of student loan borrowers are seeking out special programs that let them make monthly payments based on their earnings. These programs — which include the Pay as You Earn, Revised Pay as You Earn, and Income-Based Repayment plans — look at your income and then calculate your actual monthly payment amount.

The way monthly payments are calculated varies depending on the type of loan. Some look at total family income, including what your spouse earns if you’re married, while others only look at the borrower’s individual income. In addition, some loans never have a monthly payment that’s higher than what a normal amortization schedule for a 10-year loan would require, while others require you to make larger monthly payments if your earnings rise substantially.

Further, the fact that these loans typically forgive any remaining balance at the end of a certain period also adds complexity. Forgiveness often happens at 20 years for undergraduate loans and 25 years for graduate loans, but you’ll sometimes find different provisions.

Also Check: Can Other Than Honorable Discharge Get Va Loan

Change #: Student Loan Payment Calculation

Fannie Mae has changed how lenders calculate student loan payments.

Lenders may use the student loan payment as it appears on the credit report for qualification. Period. That may seem like common sense, but its not how things have been done in the past.

Before the change, lenders had to use 1% of the outstanding balance or the fully amortizing repayment amount. But this isnt what student loan holders were actually paying if they were on an income-driven repayment plan such as PAYE and REPAYE.

These plans allow graduates to repay student loans based on income. Often, the monthly payment isnt enough to pay the interest owed. Lenders would have to calculate the monthly cost to fully repay the loan over the loans term. Often, the fully amortized payment was sky-high compared to the IDR-required amount.

The higher payment would put the buyer outside DTI guidelines.

For instance, a borrower makes $4,000 per month and has:

- A fully amortized payment of $750

- An income-driven repayment of $250

The lower amount shaves twelve points off the buyers DTI. That will help tremendously when going to qualify for a home loan.

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

You May Like: When To Apply For Ppp Loan Forgiveness

Ask The Underwriter: How Are Student Loan Payments Calculated When Qualifying For An Fha Loan

FHA guidelines on student loans are stricter

Ask the Underwriter;is a regular column for HousingWire’s;LendingLife newsletter,;addressing real questions asked to, and answered by, professional mortgage underwriter, Dani Hernandez.;

Question from lender:

My borrower has applied for an FHA loan to buy their first home, and they have several student loans in deferment. The monthly payment on their credit report is $0 but the underwriter said we must use 1% of the balance for each loan as the qualifying payment on the mortgage application. Why must they use a higher payment than what is reported on their credit report to qualify?;Does FHA require that a higher payment must be used or is this just something required by the underwriter on this file?

Answer:

FHA guidelines for calculating the monthly payment on student loans are much more restrictive than conventional loans. FHA does not allow student loans in deferment to be excluded from your debt-to-income ratio. In fact, if the monthly payment on your credit report is less than 1% of the total balance of your student loan, the lender must increase the monthly payment to 1% of the balance and use that to qualify. The only instance when FHA allows for a qualifying monthly payment that is less than 1% of the balance to be used, is if you can provide the original student loan agreement and the fully amortizing payment listed on the agreement is less than 1% of the total balance.

FHAGuidelines:

Standard

How To Juggle Repaying Student Loans And Buying A House

Now that youre clear on how student loans impact mortgage approval, keep the following tips in mind before you start the application process:

Lower your DTI ratio. A high debt-to-income ratio indicates to lenders that youre a risky borrower who is more likely to fall behind on debt payments, and it can disqualify you from getting a mortgage. Lower your DTI ratio by paying down your student loan, credit card and any other outstanding balances you have. Consider a temporary side gig to increase your monthly income and pay down debt faster.

Boost your credit score. The higher your credit score, the more creditworthy lenders are likely to perceive you. Review your credit reports and dispute any errors you find, such as an incorrectly reported late payment or an unfamiliar medical bill in collections. Additionally, always pay your bills on time.

Consider a student loan refinance. A student loan refinance can help you snag a lower interest rate and stretch out your repayment term to reduce your monthly payment amounts. The drawback here if you have federal student loans is that youll lose important protections, such as income-driven repayment plan options.

You May Like: How To Find My Loan Servicer

How To Fill Out A W

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Heres what you need to know about the form, starting with how it affects your paycheck and taxes:

Consider All Loan Types

You may not qualify for a conventional loan if you have a DTI ratio thats higher than 50%. A conventional loan is a mortgage that follows guidelines set by Fannie Mae and Freddie Mac, which standardize mortgage lending in the U.S. However, you may still be able to buy a home with a government-backed loan. These loans are insured by the federal government, making them less risky for a loss from a default. This allows mortgage lenders to issue loans to borrowers with lower DTI ratios.

You could also consider an FHA loan, which is backed by the Federal Housing Administration. The maximum DTI ratio for an FHA loan is 57% in many cases. On the other hand, if youve served in the armed forces or National Guard, you might qualify for a VA loan. You can buy a home with a DTI ratio of up to 60% with a VA loan. Make sure you meet service requirements before you apply for a VA loan.

Read Also: How To Pay Upstart Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Consolidation Changes Everything

Finally, it’s important to understand that student loan calculations only apply to the initial loan that you take out. If you decide to take advantage of provisions that allow you to consolidate your student loan debt, then everything essentially starts over, and the calculation of your consolidation loan will involve the total of whatever outstanding student loan debt you consolidate and the terms of the consolidation itself.

The usual process that lenders follow with consolidation loans is to gather up all of your outstanding loans and repay them, combining the balance into a single loan. You then get to make one monthly payment each month, and because lenders often offer longer terms on consolidation loans, the monthly payments can be lower. However, because you’re repaying the consolidation loan over a longer time period, the net result is usually a big increase in the amount of interest you pay over the lifetime of the loan. In addition, consolidations loans usually wipe out any favorable provisions of the underlying loans that you consolidate, so you might lose the opportunity for loan forgiveness, deferment, or other benefits when you consolidate.

Recommended Reading: Can I Refinance My Parent Plus Loan

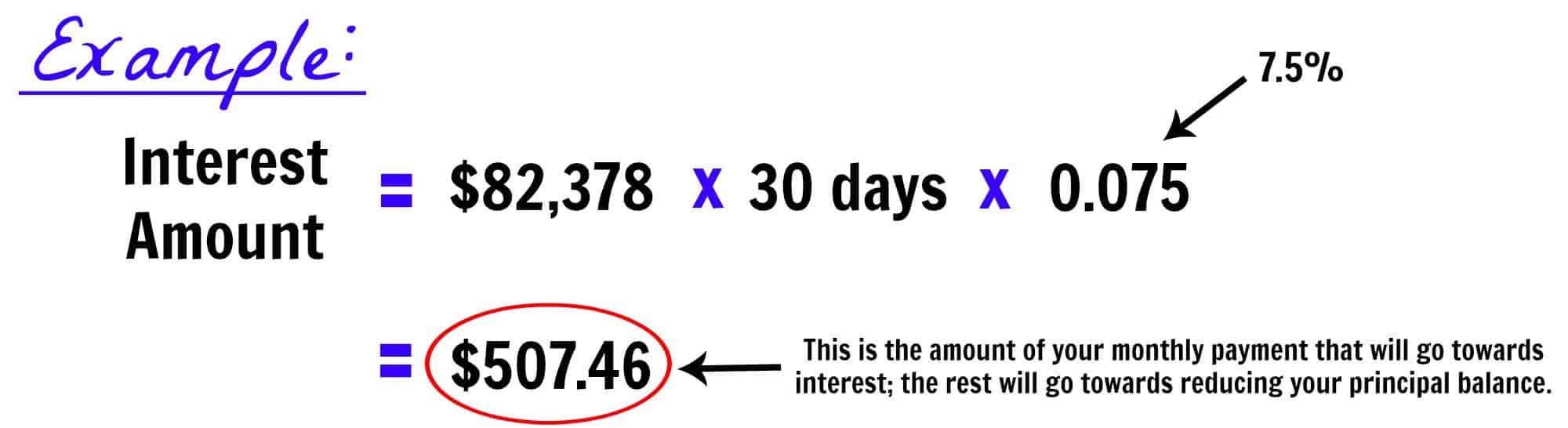

Get The Information You Need To Calculate Your Student Loans

Calculating a student loan can seem complicated, but behind all the numbers, the important thing to remember is that payments are based on the amount you borrow, the time you have to repay it, and the interest rate on the loan. Managing your student loans well means minimizing costs while taking advantage of features that some loans offer. If you do that, you’ll be well on your way to getting your loans taken care of as quickly as possible.

Student Loan Guidelines Snapshot

- Non-amortized Payment – Use actual payment from credit report or servicer if over $0.00

- Amortized Payment – Ok with all lenders

- Deferred, forbearance, or $0.00 income-based payment use .5% of the loan balance.

Fannie Mae Conventional

- Income-Based Payment – Allowed – $0 ok with supporting documentation* – Updated April, 2017

- Amortized Payment – Ok with all lenders

- Deferred or forbearance use 1% of the loan balance.

- *Expect to get documentation from your student loan servicer

Freddie Mac Conventional;

- Income-based payments – May use payment as reported on credit report

- $0 payment on NO LONGER used – must use .5% – See PSLF Update

- Can exclude from debt to income calculation if less than 10 months payments left

- Deferred or forbearance use .5% of loan balance – Effective November 1st, 2018

VA Guaranteed Loan

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

How Student Loans Are Factored Into Your Mortgage Application

A major consideration for student loans and mortgage approval is how youre managing your loan repayment responsibilities. This includes whether youre participating in a special repayment plan or have your payments paused altogether.

Heres how different loan programs evaluate borrowers who are interested in buying a home with student loan debt.

Finding A Better Mortgage Option

If youre struggling with your lender, or your lender isnt able to answer these questions, its probably time to find another lender. We recommend LendingTree to compare your loan options. In about 5-10 minutes, youll get quotes from multiple lenders, and you can have conversations with the about your debt-to-income ratio situation.

The earlier you share this with your lender in the process, the smoother you can go. Some lenders will write you off right away, but others may be more willing to work with you through the process.

We like LendingTree because you have multiple lenders working at once, versus just one bank or credit union you might have otherwise. Give it a shot here: LendingTree.

A second option is Credible Mortgage. Less spammy, better experience.

Don’t Miss: What Is The Current Va Loan To Value Ltv Rate