Auto Approve: Top Choice For Refinancing

Starting APR:2.25%Loan amounts: $5,000 to $85,000Loan terms: 12 to 84 monthsAvailability:50 statesMinimum credit score:580

Unlike the other lenders on this list, Auto Approve doesnt finance new car purchases. Instead, the company specializes in refinancing auto loans. However, when it comes to the type of vehicle you can refinance, Auto Approve offers much more flexibility. The company works with a network of lenders to offer refinancing for motorcycles, ATVs, boats and RVs in addition to the standard cars, trucks and SUVs.

Auto Approves auto loan refinancing rates begin at 2.25% APR, which is toward the lower end of the rates we saw in our research, but note that only the most qualified borrowers will likely get a rate this low. The company doesnt charge an application fee or a prepayment penalty.

Borrowers can select terms of 12 to 84 months to refinance their vehicles. Auto Approve is also accessible to those who dont have the best credit history since it has a minimum credit score of only 580. However, borrowers with lower credit scores should expect to pay higher rates than the minimum APR featured here.

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

Best For Used Cars: Chase Auto

Chase

Chase Auto offers the security of a stable financial institution with competitive rates, high loan amounts, and a concierge car-buying program that makes it easy to get the best rates and financing options for a used car.

-

Pre-qualify with a soft credit pull

-

Car-buying and car-management services

-

0.25% discount for Chase Private Clients

-

Must finance from a Chase network dealer

-

New application needed when switching dealers

Chase Auto is the car financing arm of J.P. Morgan Chase & Co., the largest bank by assets in the U.S., and allows users to shop for, finance, and manage their vehicle all from one account.

Although Chase Auto doesnt list rates online, it has a calculator that will allow you to get an idea of your potential rate. Chase also offers generous loan amounts ranging from $4,000 to $600,000 and 12 to 84 months flexible repayment terms.

Chase Auto doesnt require you to make a down payment for a loan, though putting money down can reduce the total amount you need to borrow and your monthly payments. You can also get a 0.25% interest rate discount as a Chase Private Client, which requires you to have a minimum average daily balance of $150,000 in qualifying personal, business, and investment accounts or a Chase Platinum Business Checking account.

Read Also: Fha Refinance Fees

Interest Rate By Loan Term

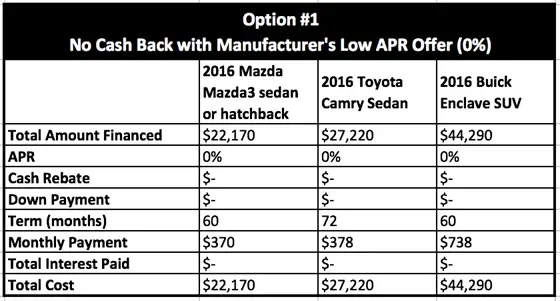

The interest rate you get can also depend on your cars loan term. In fact, the average interest rate on a 60-month car loan from a commercial bank in the first quarter of 2021 was 5.21%, according to the Federal Reserve.

While some lenders may charge lower rates for a longer term, others like credit unions offer higher rates for longer terms.

How does loan term change the amount I pay?

The longer your loan term, the lower your monthly payment. However, it makes the total cost higher. For example, if you borrow $15,000 for a used car and your lender offers you a 10.5% interest rate, your monthly payments and total interest can vary greatly.

| Loan term | |

|---|---|

| $281.68 | $5,281.29 |

As you can see, your monthly payments are lower the longer you borrow, but youll end up paying about $1,000 more in interest each year your loan is outstanding.

Moreover, lenders generally charge lower interest rates for shorter loan terms. If you want to get the lowest rate possible, calculate your monthly car loan payments and interest charges based on different loan terms. This helps you determine the minimum term you can afford based on your interest rate to save money.

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

You May Like: Can I Buy A Mobile Home With A Va Loan

Myautoloan: Most Popular Marketplace

Starting APR:2.14% for new vehicles, 2.39% for used vehiclesLoan amounts:$8,000 purchase minimumLoan terms: 24 to 84 monthsAvailability:48 states Minimum credit score:575

The myAutoloan online marketplace lets you comparison shop for the best auto loan rates from a number of lenders. You can enter personal information into the sites online form and receive loan offers from lenders almost immediately, allowing you to compare offers side-by-side.

Our research indicates that myAutoloan rates are low for the industry. Borrowers can access rates as low as 2.14% APR for new vehicles through the marketplace. With a minimum credit score requirement of 575, myAutoloan can be a good option for people with below-average credit.

That said, the companys $8,000 purchase minimum loan amount may mean you need to spend more on a car than you planned to get a loan from the company. In addition, myAutoloan wont authorize a loan on a car more than 10 years old or with more than 125,000 miles on it. Some may find these restrictions a little too cumbersome.

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

You May Like: Usaa Car Loan Apr

Bank Of America: Top Choice For Poor Credit

Starting APR: 3.29%Loan amounts: $7,500 minimum Loan terms: 12 to 75 monthsAvailability: 50 statesMinimum credit score: 580

Bank of America is one of the largest financial institutions in the United States. It offers a wide variety of banking and lending products, including auto refinancing loans, at very reasonable rates. Furthermore, our researchers found that the company offers loans to people with below-average credit, with a minimum credit score of 580.

If you want to refinance your auto loan, Bank of Americas rates start at 3.29%, depending on your location. While the company is a smart choice for those with lower credit scores, youll only get the banks best rates if you have a good credit score. In addition, the minimum refinance loan amount is $7,500, or $8,000 if you live in Minnesota, which may rule some potential borrowers out.

Current Car Loan Rates In Canada

When researching rates, its helpful to have a general range to work with first. From there, you can take a closer look at how rates compare across different lenders.

Generally, current car loan rates in Canada can range from 0% to as much as 36%. The 0% rate usually applies to new cars. The starting APR for used cars is typically around 5%.

Recommended Reading: Is Usaa Good For Auto Loans

Top 6 Auto Loan Providers

Based on our research, these providers are among the top car loan lenders in the industry, and weve ranked them after evaluating their rates, reputations, availability, and customer service. Be sure to compare personalized quotes from lenders before making a decision.

| Lender | |

|---|---|

| Top Choice for Poor Credit | 7.0 |

| 6.5 | 8.5 |

*Auto Approve only offers auto loans for refinancing and lease buyouts. This rate reflects the companys starting APR for refinancing.

**Bank of Americas starting annual percentage rate may vary by state. The APR shown here is for New York.

When it comes to the best auto loan rates, each provider offers varying rates to car buyers in different situations. While one lender may offer lower interest rates for borrowers with good credit than other financial institutions, another provider may specialize in lending to people with bad credit. Weve noted the starting APRs for top providers in the table above, but only borrowers with excellent credit will be eligible for rates that low.

Each of our five best auto loan providers has its benefits, as well as drawbacks. Based on what we learned from studying the top auto lenders in the country, our team recommends the following providers to start your search for the best auto loan rates.

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

You May Like: Are Auto Loans Amortized

Auto Approve: Top Choice For Refinance Auto Loans

Starting APR:2.25%Loan amounts:$5,000 to $85,000Loan terms:12 to 84 monthsAvailability:50 statesMinimum credit score:580

Auto Approve has a reputation as a refinance auto loan specialist, but the companys lease buyout option makes it a viable choice for people looking to purchase vehicles. And given the companys strong industry reputation and high customer ratings, our team felt it was worth including.

Auto Approves rates start at 2.25% APR for refinancing, though only borrowers with high credit scores will have access to the best auto loan rates. People who want to buy out their loans or refinance their vehicles need a minimum credit score of 580. That means that while people with fair credit may not get the lowest rates on their auto loans, they may get approved by Auto Approve.

Again, you cant use Auto Approve loans for buying a new or used car, so if thats what youre looking to do, you should consider other lenders. However, if you need to refinance your current auto loan or are considering buying your current lease out, Auto Approve could be a great choice for you.

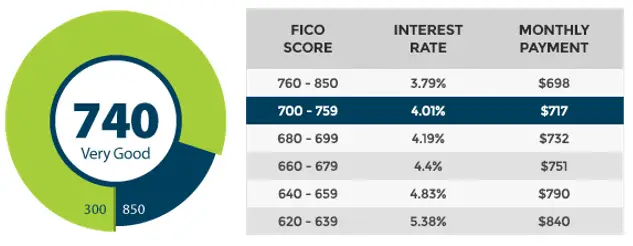

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.

Don’t Miss: Usaa Rv Buying Service

The 4 Best Companies To Refinance Your Auto Loan

If youre stuck with a bad rate on your current auto loan, you could be paying significantly more than you need to. Refinancing your auto loan can help you get a better rate and pay less for your car over time if your car is worth more than you owe or your credit score has improved or interest rates have dropped since you got your loan. Auto refinancing may not be the right option if your loan has prepayment penalties or you owe more than your car is worth.

In this review, we at the Home Media reviews team will take a close look at which lenders offer the best auto loan rates for refinancing. Our experts have researched the top lenders in the industry based on their rates, reputations, availability and customer experience to help you get started.

What Determines Your Apr On A Car Loan

APR accounts for both your car loan interest rate and the cost of any financing fees and prepaid expenses. The Truth In Lending Act , a federal law, requires lenders to disclose the APR on your vehicle purchase before signing a loan agreement. An example of a prepaid expense would be an origination fee.

Interest rate

Your interest rate usually makes up the biggest part of the total APR on your vehicle. Because of this, lowering your interest rate can help you get the best APR on your car loan.

Origination fees

A loan origination fee is the amount of money youll pay upfront to cover the cost of processing your loan. These fees can be a small percentage of your loan amount or a flat fee.

Recommended Reading: Usaa 10 Day Payoff

Top Lenders To Refinance Your Auto Loan

An auto refinance can be a great way to save money as long as you get good terms on your new loan. Our experts compared some of the top loan providers in the country to see which lenders offer the lowest rates for refinancing. We also examined the fine print for hidden fees, vehicle restrictions and other issues worth considering.

Here are our top provider choices for refinancing auto loans:

| Lender | |

|---|---|

| Top Choice for Poor Credit | 7.0 |

*Bank of Americas starting annual percentage rate may vary by state. The APR shown here is for New York.

The ratings in this table reflect our overall review scores for each company and are not specific to refinancing auto loans. The order of providers in this article, however, is based on refinancing specifically. While provider annual percentage rates start at the figures noted in the table, only borrowers with excellent credit will be eligible for rates that low.

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

You May Like: Bayview Loan Servicing Foreclosure Process

What Is A Good Interest Rate For A Car Loan

The average APR for an auto loan was 9.46% in 2020, but its possible to get a lower rate, especially if your credit is strong. tend to offer some of the lowest starting rates weve seen if you meet their membership requirements, which may be easier than you think. Car manufacturers offer 0% financing, but those deals require high credit scores and only apply to certain models. Used car loans tend to have higher starting rates than new, but manufacturers do offer APR deals on certified pre-owned cars.

Bank Of America: Top Choice For Bad Credit

Starting APR:2.29% for new vehicles, 2.49% for used vehiclesLoan amounts:$7,500 purchase minimum Loan terms: 12 to 75 monthsAvailability:50 statesMinimum credit score:580

Bank of America is one of the largest banks in the world, so its no wonder it offers a wide range of vehicle loan services. The Charlotte, North Carolina-based bank offers competitive rates to borrowers with a range of credit scores, with some of the best auto loan rates for people with less-than-ideal credit.

Rates start at 2.29% APR for new vehicles at Bank of America, which is about average for the industry. Unfortunately, the purchase minimum of $7,500 rules out using the company to finance some budget-friendly used vehicles. With loan terms limited to 12 to 75 months, Bank of America auto loans are slightly less flexible than some of the other providers we reviewed. The company does not have an option to allow you to get preapproved for a loan like some lenders do.

Read Also: Does Usaa Refinance Auto Loans