Forgiveness With Revised Pay As You Earn

Revised Pay As You Earn works much the same way as Pay As You Earn. Under this plan, your payments will be capped at 10% of your discretionary income. Undergraduate loans are forgiven after 20 years, while graduate school loans are forgiven after 25 years.

Unlike IBR and PAYE which require you to end up with a lower payment than on the standard plan, theres no such requirement for REPAYE anyone with eligible loans can apply, even if they end up paying more with an income-based payment. As a result, you could end up with high monthly payments on REPAYE if you suddenly start making a lot more money.

How The Biden Administration Will Count Payments Towards Student Loan Forgiveness Prior To Consolidation

Under the PSLF waiver, for the first time since the programs inception, payments that borrowers made prior to Direct loan consolidation can now potentially be counted towards the 120 payments required to obtain loan forgiveness, provided that the borrower was in a repayment status while working in qualifying PSLF employment. But how will the Department count those payments when multiple loans may have different repayment histories?

The Department had previously indicated that in such scenarios, the Department will credit the Direct consolidation loan with the maximum number of qualifying payments based on the individual loan included in the consolidation that has the largest number of payments that could count towards PSLF. Assuming that your repayment history overlaps for each loan, the consolidation loan will be credited with the largest number of payments of the loans that were consolidated, says the Department in guidance posted on the Limited PSLF Waiver website.

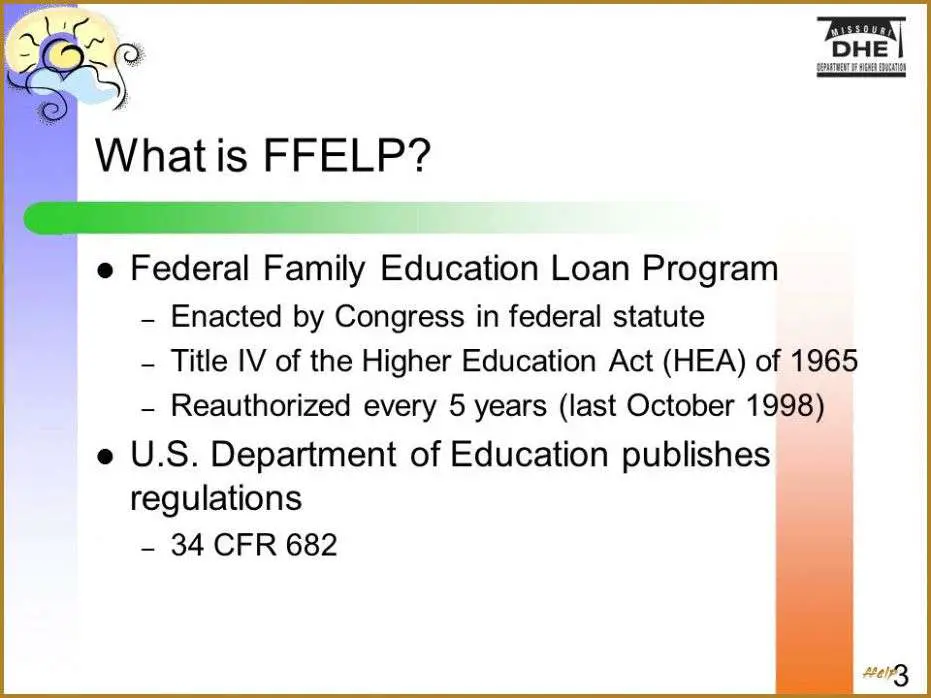

What Is An Ffelp Loan

The Federal Family Education Loan Program was a student loan program backed by the federal government. It began as part of the Higher Education Act of 1965 and officially launched in 1966. Through the program, private lenders provided student loans to students and parents that were backed by federal or non-profit guaranty agencies. Also, the government-mandated specific interest rate levels for all FFEL loans.

The terms FFELP loans and FFEL loans are often used interchangeably to refer to Federal Family Education Loan Program loans. There are 4 types of FFEL loans that were available to student loan borrowers during the programs existence:

- Subsidized Stafford loans: Interest is paid by the government while students are in school as well as during periods of grace and deferment.

- Unsubsidized Stafford loans: Interest isnt paid by the government at all.

- Plus loans: Available to parents and grad students to help to pay for education costs.

- Consolidation loans: Combines more than one student loan into one single loan.

Since 1966, over 60 million Americans have used FFEL to help pay for college expenses. The program was discontinued on July 1, 2010 and now FFELP loans have been made since.

Recommended Reading: Usaa Auto Loan Rates Credit Score

What Is An Ffel Loan

An FFEL loan is a loan issued by a bank or lender but backed by the U.S. Department of Education. For instance, you may have applied for a federal student loan and received one from Wells Fargo. These bank loans havent been issued since January of 2010. Since I completed my education in 2007, all my original loans were FFEL loans.

When I consolidated my loans after graduation, I consolidated my federal loans with one of my lenders. Thus, my loans were then changed to a consolidated FFEL loan.

How To Check If You Have A Ffel Loan

If you are a federal student loan borrower and you are unsure if your loan is a FFEL loan, you can access your federal student loan records at StudentAid.gov. Once logged in to your account screen, click the “View Details” button in the “My Aid” box. You can click the Download My Aid Data link to view a breakdown of your Direct loan and FFEL loan balances.

Recommended Reading: Usaa Car Payment Calculator

How Does Fafsa Loan Consolidation Work

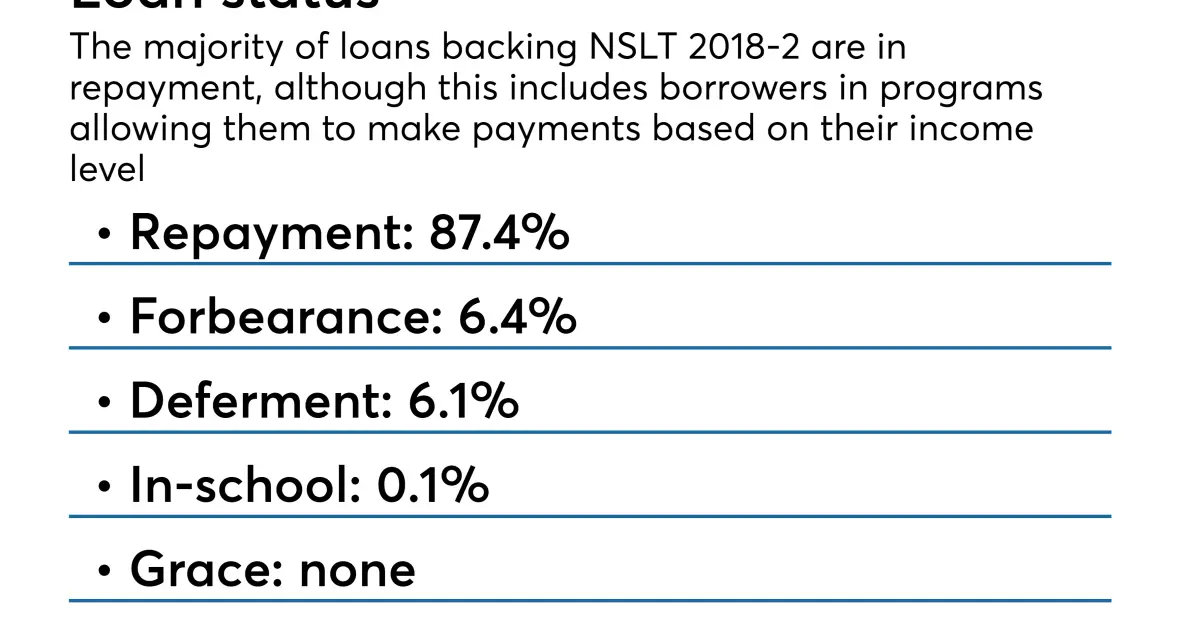

FFELP loans are government guaranteed student loans originally funded by private companies. The FFELP ended with the 2009/2010 academic year to make way for direct loans, some of which were purchased by the federal government. There are two types of FFELP loans: Department of Education owned and Commercially-owned.

Borrowers with FFELP student loans may want to consolidate to take advantage of more student loan benefits, including Public Service Loan Forgiveness and Revised Pay As You Earn income-driven repayment.

When You Should Consider Private Student Loan Refinancing

If you dont qualify for Public Service Loan Forgiveness or direct lending specific income-driven repayment options AND youve already gotten whatever loan forgiveness will happen due to the pandemic, you may want to consider refinancing privately if you can get a lower interest rate. Unlike federal student loans, available rates can change throughout the year and can be improved by your

Reducing your interest rate by a percent or more can easily save you months to years off repayment time frames. You can use our tool to compare offers from different lenders.

However, you may want to consolidate your student loans with direct lending first as a pit stop if part of your student loans are forgiven due to the pandemic. This pitstop can also give you time to improve your credit and potentially the rates offered to you.

Don’t Miss: Usaa Rv Loan Reviews

Ffelp Student Loan Forgiveness Programs

FFELP borrowers are eligible for the following student loan forgiveness programs:

- IDR Loan Forgiveness forgives your remaining balance after you pay 15% of your discretionary income for 25 years of monthly loan payments under a qualifying repayment plan â Income-Based Repayment Plan or Income-Contingent Repayment Plan.

- Teacher Loan Forgiveness forgives up to $17,500 for teachers who teach full-time for five complete and consecutive academic years in a low-income elementary school, secondary school, or educational service agency.

- Closed School Discharge forgives the FFEL Loans you borrowed if your school closed while you were enrolled or soon after you withdrew.

- Total and Permanent Disability Discharge forgives your student loan debt if a doctor or the Social Security Administration or Veterans Administration determines you are totally and permanently disabled.

- Bankruptcy Discharge gets rid of your student loans if you can prove that repaying your loans causes you an undue hardship.

When Should You Refinance Your Ffels

Looking to reduce your student loan payments and pay off your debt more quickly? Refinance your FFEL loans if you can.

Your payback period and interest rate will be determined by your credit history, current wage when refinancing student loans. However, if you have fair to exceptional credit, you may apply for a cheaper interest rate, saving you hundreds of dollars.

Your federal FFEL loans will become private student loans if you refinance your student loans. As a result, you will lose numerous of the federal governments built-in safeguards. These safeguards include:

- Deferment of your loan

- Forbearance of Loan

- IDR Programs Availability

Borrowers with bad credit will almost certainly require a cosigner with good credit to qualify for student loan refinancing. However, keep in mind that if you fail on your student loans, your cosigners would be financially responsible. To avoid causing them financial hardship, be sure you can make your payments on time.

Don’t Miss: 84 Month Auto Loan Usaa

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Everything You Should Know About Ffelp Loan Forgiveness

- Student Loan Forgiveness

Student loans are eligible for federal FFELP loan forgiveness and repayment options, but you may need to combine them into a Direct Consolidation Loan before you can take advantage of them.

Federal Family Education Loans or FFEL student loan forgiveness is provided by private banks and state lenders and guaranteed by guaranty organizations and the federal government. If a borrower defaulted on these loans, the bank would be compensated with an interest subsidy, and the debt would be transferred to a guarantor agency or the Department of Education.

To refer to Federal Family Education Loan Program loans, the terms FFELP loans and FFEL loans are frequently interchanged. During the programs existence, there were four types of FFEL loans accessible to student loan borrowers:

- Stafford loans with government subsidies: Interest is paid by the government while students are in school, as well as during grace and deferral periods.

- Stafford loans that are not subsidized: The government does not pay any interest on these loans.

- Plus, there are loans: Direct PLUS Loans are accessible to the following people:

Graduate or professional students enrolled at least half-time in a school that offers a program leading to a graduate or professional degree or certificate

Parents of a dependent undergraduate student who is enrolled at least half-time at a qualifying school are eligible.

Don’t Miss: Golden1 Car Loan

Private Student Loan Repayment Assistance Programs

Some private lenders offer deferment or forbearance options, which will allow you to temporarily postpone making payments.

Deferment is sometimes available to borrowers who are planning to go back to school or who are entering military service.

Forbearance is typically available for those who have had an unexpected hardship that makes repayment difficult, such as an illness or job loss. Keep in mind that student loan interest will still accrue during these private loan payment breaks, so dont jump into this option without doing the math and understanding what it could mean for your financial future.

As with federal loans, your employer may assist you with your private loans, especially if your skills are in high demand. Also, many industries and professional associations offer student loan repayment assistance, including student loan forgiveness options for firefighters, teachers, lawyers, doctors, nurses, and other health care workers.

Recommended Reading: Usaa Refinance Auto Loan Calculator

Do You Want A Fixed Interest Rate Loan Instead Of A Variable Rate Loan

Some older federal student loans have a variable interest rate. If you have a variable rate student loan, your interest rate can go up or down over time. Direct Consolidation Loans have a fixed interest rate, meaning your interest rate will not change over the life of the loan.

The fixed interest rate for a Direct Consolidation Loan is the weighted average of the interest rates of the loans being consolidated, rounded up to the nearest one-eighth of a percent. While consolidating your loans may slightly increase your interest rate, it will lock you into a fixed interest rate so your new payment wont change.

Read Also: Should I Choose Fixed Or Variable Student Loan

Bidens Executive Action On Ffelp Loan Forgiveness

The Biden administration released an executive action on October 6, 2021, that significantly impacts borrowers with FFELP loans employed in a government or non-profit job. And you may get a tax discharge for free.

Your entire loan total will be wiped away tax-free if you consolidate your student loans through the governments Student Aid website. However, you should have made ten years worth of payments while employed full-time at a qualifying job.

You must also use the federal governments PSLF support tool to certify your employment, and you must do all of this before October 31, 2022. The limited period is due to the Biden administrations reliance on authority to undertake such broad measures during national emergencies.

As a result, they must only be available for a short period. If you need help, this is the time to get it now. We can assist you for professional assistance.

One more thing: Between March 13, 2020, and May 1, 2022, the government suspended payments, including interest on FFELP loans controlled by the U.S. Education Department. But this suspension doesnt apply to FFELP loans that are commercially owned.

Well show you everything you have to know about FFELP loans, including your repayment options. And also, the best ways to get FFELP loan forgiveness.

What Are The Advantages Of Ffel Loans

Most of the benefits that are found in the FFEL loan program are also found in the Direct loans program.

The one disadvantage is that FFEL loans do not qualify for any type of loan forgiveness. Even if you have Direct loans which do qualify, and you work in a qualifying job, any payments youve made toward your 5-year or 10-year requirements will not be reflected with an active loan of this type.

You may be asked to consolidate all your loans into a new Direct loan program to qualify for loan forgiveness if you have FFEL and Direct loans. In this situation, you may have your 5-year or 10-year clock reset.

It was actually more difficult to qualify for FFEL loans when this program was active compared to the Direct loan counterparts. In one of the final surveys of the program, provided by the National Postsecondary Student Aid Sutdy, 42% of applicants for an FFEL PLUS student loan were denied.

In comparison, only 21% were denied under the Direct PLUS program.

The reason for the difference in denials was that the law allowed private lenders to apply restrictive standards to their loan products in ways that are similar to traditional lending products, like a loan or a credit card.

Some schools only participated in one program, which was an advantage for some FFEL loan recipients. In March 2008, only 25% of schools were using the Direct loans program. By March 2010, 46% of colleges were part of the Direct program with 39% more transitioning to the program.

Also Check: Capital One Auto Finance Approval

Is Your Student Loan A Ffel Loan That May Matter For Student Loan Forgiveness

FFEL student loans are often excluded from key government student loan relief programs.

getty

Not all student loans are created equally, as some student loan borrowers have been learning in recent years, with increasingly harsh consequences. And one type of student loan in particular continues to be a disappointment for borrowers.

Ffelp Loans Vs Direct Loans

FFELP Loans: Private lenders made FFELP Loans, which were guaranteed by the federal government.

Direct Loans: on the other hand, are made by the Department of Education directly.

Many FFELP Loans continued to accrue interest and require payments during the coronavirus epidemic. Meanwhile, all Direct Loans were put into deferment, and the interest rate was reduced to zero.

Also Check: When Does Pmi Fall Off Fha Loan

Are Ffelp Loans Eligible For Student Loan Forgiveness

As said earlier, FFELP was phased down in 2010, but borrowers are still repaying their FFEL loans. Therefore, if you want to receive student loan forgiveness, your FFEL loans will prevent you from doing so.

Only Direct Loans are eligible for forgiveness, not FFEL loans. Therefore, consolidate your FFEL debts into a Direct Consolidation Loan if you want to qualify for forgiveness. This transfers your loans to the Direct Loan program, allowing you access to all of the benefits and protections of Direct Loans.

Then, you can enroll in a Public Service Loan Forgiveness or income-driven repayment plan. These two programs forgive your outstanding loan balances after a specified repayment period.

While combining your loans will help you get on the path to forgiveness, keep in mind that youre starting over. PSLF needs 120 qualifying monthly payments, and income-driven repayment options might extend that time to 20 or 25 years.

But what is an FFELP loan?

What Other Benefits Do You Lose Eligibility For If You Have Ffel Loans

Student loan forgiveness programs and certain income-driven repayment plans arent available if you have an FFEL loan. The Public Service Loan Forgiveness program is a prime example. Under PSLF, loans are forgiven after ten years of on-time payments while working for a public service employer. Over one-quarter of borrowers could qualify if with direct lending.

As far as income-driven repayment plans, Income-Based Repayment is available but RePay as You Earn Expanded isnt. For FFEL loans, IBR has payments that are 15 percent of discretionary income versus 10 percent under PAYE. The maximum time frame for repayment is 20 years for REPAYE versus 20 years for IBR for FFEL borrowers.

Recommended Reading: Bayview Loan Servicing Dallas Tx

Other Ffelp Repayment Options

Closed School Discharge. This discharge forgives your FFEL Loans if your school closed while you were enrolled or shortly after you dropped out.

Total and Permanent Disability Discharge. Forgive your loan debt if you are totally and permanently handicapped, as determined by the Social Security Administration, a doctor, or the Veterans Administration.

Bankruptcy Discharge. If you can show that repaying your student loans is causing you undue hardship, your student debts will be discharged.

Make Use Of The COVID-19 Emergency Relief. While Ed-owned FFELP loans have always been eligible for COVID-19 loan forgiveness, privately-funded FFEL loans have not. President Bidens administration, however, extended the relief to commercially owned FFEL loans in default in March 2021. As a result, some FFELP borrowers will now be eligible for a 0% interest benefit until May 1, 2022.

This new relief doesnt apply to FFELP loans privately held that are still in good standing. Its worth noting that the additional assistance for defaulted FFELP borrowers went into effect on March 13, 2020. That means that any voluntary contributions made after that date and any tax returns or garnished earnings may be refunded.

The Graduated Repayment Plan Can Help. This repayment plan allows you to make lower monthly payments at first, then increase them every two years for ten years .

Forgiveness With Pay As You Earn

Pay As You Earn is similar to Income-Based Repayment, in that it isnt a typical forgiveness program. However, you could be eligible for forgiveness after a certain period of time.

The PAYE plan caps your monthly payment at 10% of your discretionary income. After borrowers make payments for 20 years, any remaining balance becomes eligible for forgiveness.

As with IBR, your forgiven balance might be treated as taxable income.

You May Like: Car Loan With Credit Score Of 600

Recommended Reading: How To Become A Mlo In California