Variable Interest Rates Explained

Variable means that the interest rate may fluctuate based on market conditions. While variable rates may sometimes be lower in the short-term, the danger is that they may suddenly increase.

Besides paying significantly more interest every month, your monthly student loan payment may also increase over the life of the loan.. If your payments increase so much that youre not able to keep up with them, your interest could start capitalizing and the size of your loan could snowball quickly.

Can You Combine Other Loans Into Your Student Loans During Refinancing

If you have Federal loans, you can combine them with private loans during the refinancing process. However, if you choose to do this, you will lose any benefits that came with the Federal loan like income-driven repayment plans. You can also choose to combine your loans with your mortgage. By doing this, you would be refinancing your mortgage with a new loan or additional home equity. You would use this money to pay off any student loan debt that you have left.

Pros of Rolling Your Student Loans into Your Mortgage

- Deduction. Your mortgage payment and your student loans are both tax deductible. However, you may not qualify to deduct your student loan payments each year. You will have no problem qualifying and deducting your new mortgage payment on your taxes.

- Lower Interest Rate. The interest rate on a 15-year fixed mortgage is right around 3.32%, and your student loan interest rate is around 4.29%.

- Reduce the Number of Monthly Payments. Your two biggest payments each month are usually your mortgage and your student loans. This process combines them both into one payment.

Cons of Rolling Your Student Loans into Your Mortgage

Will The Government Pay My Student Loan Interest For Me

There are certain times that the Department of Education will pay some or all of a borrowers federal student loan interest on their behalf. First, the government will pay the interest charges on subsidized student loans while the borrower is enrolled at least half-time in school. Second, borrowers may qualify for a subsidy on unpaid interest charges during the first three years of repayment on the IBR and PAYE plans and at all times while on the REPAYE plan.

Don’t Miss: Bayview Loan Servicing Foreclosure Process

How To Use Bankbazaars Educational Loan Emi Calculator

Using BankBazaar’s student loan interest calculator is similar to child’s play, to quote a frequently phrase. The tool is designed to be user-friendly, time-saving, and highly scalable, with an extremely simple UI. The following information will be needed to use this thorough educational loan interest calculator:

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Don’t Miss: Capital One Pre Approval Auto Loan

How Can I Limit The Amount Of Money I Need To Borrow For College

Before taking out student loans, its a good idea to finance your education through other means. Here are some of your best options to limit the amount of money you need to borrow in student loans:

- Use a 529 plan: If your parents or other relatives have set up a 529 plan for you, you can use that money to help cover the costs of college.

- Apply for scholarships and grants:One of your best bets is to research and apply for gift aid, like scholarships and grants. Gift aid is a great resource because its money you dont have to pay back.

- Fill out the Free Application for Federal Student Aid : Always fill out the FAFSA even if you dont think youll qualify for financial aid. To be eligible for federal student loans and work-study, for example, you must have completed the FAFSA.

Capitalization Increases Interest Costs

In most cases, youll pay off all of the accrued interest each month. But there are a few scenarios in which unpaid interest builds up and is capitalized, or added to your principal loan balance. Capitalization causes you to pay interest on top of interest, increasing the total cost of the loan.

For federal student loans, capitalization of unpaid interest occurs:

-

When the grace period ends on an unsubsidized loan.

-

After a period of forbearance.

-

After a period of deferment, for unsubsidized loans.

-

If you leave the Revised Pay as You Earn , Pay as You Earn or Income-Based-Repayment plan.

-

If you dont recertify your income annually for the REPAYE, PAYE and IBR plans.

-

If you no longer qualify to make payments based on your income under PAYE or IBR.

-

Annually, if youre on the Income-Contingent Repayment plan.

For private student loans, interest capitalization typically happens in the following situations, but check with your lender to confirm.

-

At the end of the grace period.

-

After a period of deferment.

-

After a period of forbearance.

To avoid interest capitalization, make interest-only student loan payments while youre in school before you enter repayment and avoid entering deferment or forbearance. If youre on an income-driven repayment plan for federal student loans, remember to certify your income annually.

Don’t Miss: Usaa Rv Loan Rates Calculator

How Do Interest Rates Work

Depending on your credit worthiness and the type of loan you get, you can expect to pay somewhere between 1.25% and 12% interest for the money you borrow as part of a college loan.

Interest rate is expressed as an , or annual percentage rate. The APR refers to the amount of interest that is charged over one year.

Let’s use some round numbers to make this easy. If you have a 10,000 loan at 5% APR, you’d expect to pay around $500 in interest during the first year of the loan.

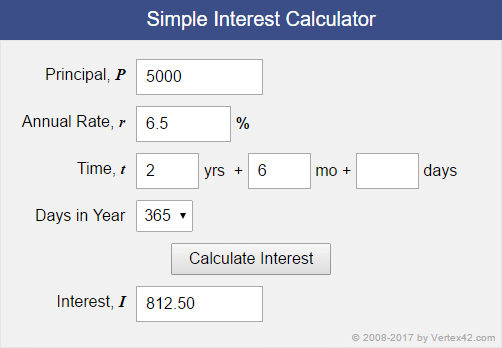

The simple equation is:

$10,000 principal x 0.05 APR = $500 in interest

However, the amount you actually pay depends on how the interest rate is applied. Yes, this is where that fine print comes in, but remember, we promised to make it easy so stick with us.

Commonbond Disclosures: Private In

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

Don’t Miss: Bayview Loan Servicing Tucson

Start Your Loan Repayment

Six months after you leave school, youll start repaying your loans. Your monthly payment is automatically calculated. Your repayment schedule depends on:

|

Repayment term for Alberta loans |

Repayment term for Canada loans |

|

$0 – $3000 |

Learn more about adjusting repayment details.

What Is Loan Interest

Interest is the price you pay to borrow money from someone else. If you take out a $20,000 personal loan, you may wind up paying the lender a total of almost $23,000 over the next five years. That extra $3,000 is the interest.

As you repay the loan over time, a portion of each payment goes toward the amount you borrowed and another portion goes toward interest costs. How much loan interest the lender charges is determined by things like your , income, loan amount, loan terms and the current amount of debt you have.

Recommended Reading: Fha Loan Refinance Calculator

Why Does The Amount Fluctuate Each Month

Between my student loan and my wifes student loan we paid $277 in interest for January 2010. In December of 2009 we paid only $261 in interest and in November of 2009 it was $288. Our principal decreases every month, so whats up with the large fluctuations and how could we have paid more in November of 2009 than in January of 2010 if the principal is less? Great question.

The answer lies in 2 conditional variables that effect the number of days since last payment from month to month:

The number of days since the last payment will obviously differ from month to month based on these two variables.

If the month has 28 days the interest calculated will be less than in a month that has 31 days because 3 extra days were figured into that months calculation. Also, if the last day of the month falls on a weekend or holiday, the calculation will not be performed until the next business day thus increasing that months number of days since last payment.

Thus regardless of the fluctuation in monthly amounts we will never be charged anymore than 365.25 days worth of interest on our student loans in a given year.

If You Have A Plan 4 Loan And A Plan 2 Loan

You pay back 9% of your income over the Plan 4 threshold .

If your income is under the Plan 2 threshold , your repayments only go towards your Plan 4 loan.

If your income is over the Plan 2 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan 2 threshold of £2,274.

Your income is £317 over the Plan 4 threshold which is the lowest of both plans.

You will pay back £28 and repayments will go towards both plans.

Also Check: Usaa Personal Loan Approval Odds

Lender And Bonus Disclosure

All rates listed represent APR range. Commonbond: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

CommonBond Disclosures: Refinancing

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

CommonBond Disclosures: Private, In-School Loans

Student Loan Planner® Disclosures

Repaying Your Student Loan

Student loans must be paid back. Many students have two loans that need to be managed separately. Heres what to expect after you leave school.

On this page:

Most students leave school with an Alberta student loan and a Canada student loan.

Having two loans means you need to handle twodebts and two payment schedules.

Your Alberta loan is managed through MyLoan and your Canada loan is managed through the National Student Loans Service Centre Online Services. You must create individual accounts through these websites and handle your repayments separately.

This is what the lifecycle of student loans looks like:

|

While youre a student |

Dont Miss: Transferring An Auto Loan

Recommended Reading: Usaa Boat Loan Credit Score

How Payments Are Applied

Each month, your loan payment is prorated based on the amount due. Your payment is first used to pay any interest that has built up since your last payment. Then, the rest is used to pay down your principal. If your payment is late, the funds will be applied to the most past due loan group first.

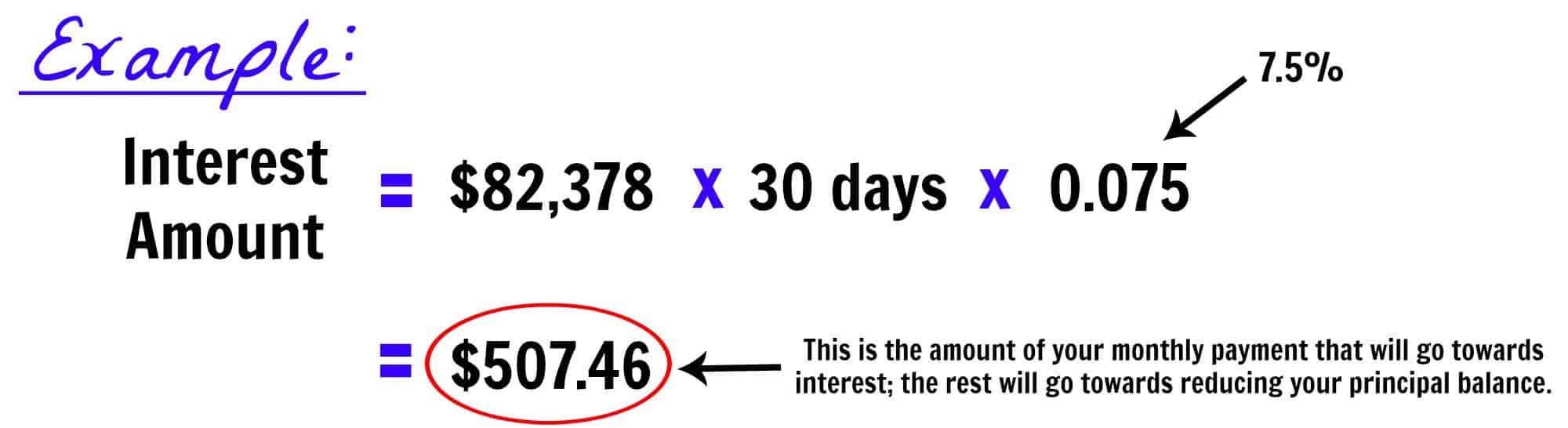

To estimate how much loan interest has built up since your last payment, use this calculation:

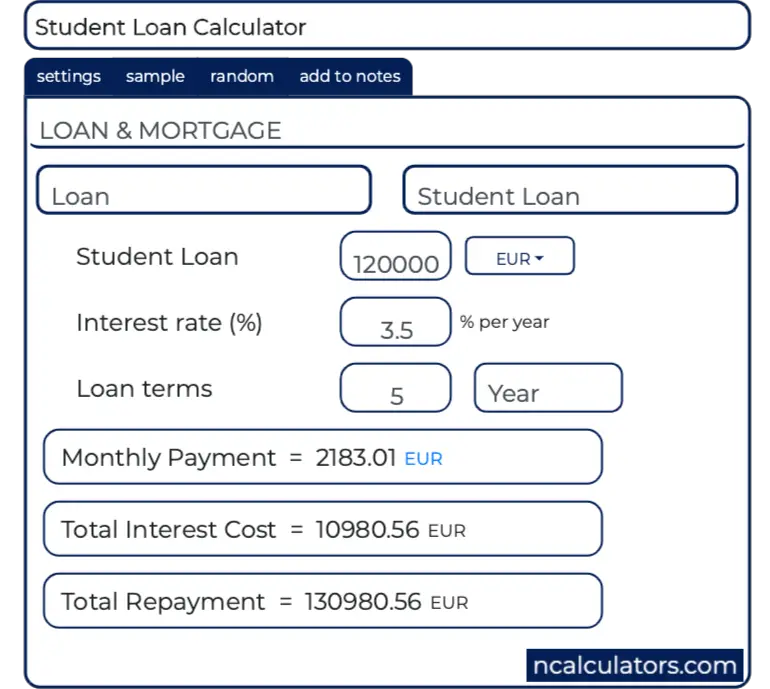

Nper: The Number Of Payments Youll Make On A Loan

Once youve established your monthly interest rate, youll need to enter the number of payments youll be making. Since were calculating the monthly payment, we want this number in terms of months.

For example, a 30-year mortgage paid monthly will have a total of 360 payments , so you can enter “30*12”, “360”, or the corresponding cell *12. If you wanted to calculate a five-year loan that’s paid back monthly, you would enter “5*12” or “60” for the number of periods.

Read Also: Usaa Refinance Auto Loan Rates

Find Out How Much This Totals Each Month

Take this figure and multiply it by the number of days since your last payment. If you are making monthly payments, this should be 30 days.

For example: $1.60 x 30 = $48.00

The typical monthly payments for a person who owes $20,000 with 3% interest using a 10-year fixed-interest repayment plan is about $193. This means that $48 of this payment would be going towards interest while the remaining $145 would go towards repaying the principal.

This math shows just how significantly interest can impact your monthly student loan payments and millions know just how much those payments impact their finances. Even before the pandemic hit and unemployment spiked, more than 20% of student loan borrowers were behind on their payments.

Don’t miss:

How To Choose A Student Loan And Repayment Plan

If youre trying to choose between student loan providers, there are few things you should consider, including:

- Interest rates

- Loan eligibility requirements for you or your cosigner

- Repayment terms, such as number of years, options for paying while in school, penalties for early repayment, and grace periods after youre no longer in school

- Options for forbearance if you cant pay for some reason

- The lenders reputation

If youre looking for a private student loan, its important to make sure that youre working with a lender that doesnt issue predatory loans, that is, loans with terms that are likely to put the borrower deep into student loan debt and maybe even into default.

Your student loan repayment plan should be reasonable and aligned with what you can reasonably handle upon graduation. Your loan amount should align with your financial need – try not to take out more than you reasonably need for your education.

Check out our picks for the best deals on private student loans.

Also Check: Usaa Auto Pre Approval

How To Pay Less Student Loan Interest

One of the best ways to reduce student loan interest is to pay extraeven if its just a little bitwith each payment.

Heres why:

Your interest is calculated based, in part, on your principal amount. So the lower your principal, the less interest youll have to pay each month. Plus, when your principal balance reaches $0, you have successfully paid your loan in fulland you no longer need to pay principal or interest.

So the goal is to pay down the principal as quickly as possible.

If you send more than the amount due each month, the extra funds are first applied to any outstanding interest and the remaining amount goes directly toward paying down your principal. This helps you to pay off your loan more quicklyand reduce your total estimated interest charges.

When Box 2 Is Checked

If Box 2 of Form 1098-E is checked, it means that the amount reported in Box 1 doesnt include the loans origination fees and/or any capitalized interest. Only loans you took out before September 1, 2004, however, should have box 2 checked.

An origination fee is typically a percentage of your loan thats withheld from the disbursed funds. You can include a portion of this fee as deductible interest. Dividing the origination fee by the number of years you have to pay off the loan gives you the amount you can treat as student loan interest each year. And if the lender capitalized for unpaid accrued interest, you calculate the portion thats deductible each year in the same way as the origination fee.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, weve got you covered. Feel confident doing your own taxes.

Recommended Reading: Loan License California