Capital One Spark Cash Plus

Best for small businesses

- This card is best for: Small business owners looking to earn high cash back rewards without keeping track of spending categories.

- This card is not a great choice for: People who may not have the cash flow in their business to cover the annual fee.

- What makes this card unique? Small business owners can earn unlimited 2 percent cash back on all purchases, making it a bit easier to earn consistent rewards on business expenses. Theres also the opportunity to earn cash bonuses with certain terms and conditions.

- Is the Capital One Spark Cash Plus worth it? For small businesses with the cash flow to handle an $150 annual fee, the Capital One Spark Cash Plus is a great way to earn consistent and high cash back rewards on purchases. If youre looking to earn some of the cash bonuses but youre worried about the spending requirements, there may be other cards on the market that offer a different set of rewards that better fit your needs.

Jump back to offer details.

Exit From Mortgage Banking

In November 2017, President of Financial Services Sanjiv Yajnik announced that the mortgage market was too competitive in the low rate environment to make money in the business. The company exited the mortgage origination business on November 7, 2017, laying off 1,100 employees. This was the second closure the first occurred on August 20, 2007, when GreenPoint Mortgage unit was closed. GreenPoint had been acquired December 2006 when Capital One paid $13.2 billion to North Fork Bancorp Inc. The re-emergence into the mortgage industry came in 2011 with the purchase of online bank ING Direct USA.

Compare Auto Refinance Loans

Before applying for an auto refinance loan, you should be sure to compare quotes from multiple different providers. Some factors to take into consideration include:

- Loan amounts: Most lenders have minimum and maximum loan amount requirements, usually somewhere between $7,000 and $100,000. Make sure that the loan you want to refinance is in between these limits.

- Rates: One of the main goals of refinancing an auto loan is to lock in lower rates. Make sure to compare rates from multiple different providers to ensure youre getting the best possible deal.

- Repayment terms: Whether you want to pay off your loan faster, or need a longer term length with smaller monthly premiums, look for an auto refinance loan with repayment terms that meet your needs.

- Some lenders have minimum credit score requirements for borrowers. If your credit score isnt where you want it to be, consider holding off on applying until you raise your score.

- Car requirements: Not all lenders will issue auto refinance loans for all cars. Make sure that your car meets the requirements for any lenders that youre interested in.

You May Like: How Long Sba Loan Approval

Capital One Auto Loan Requirements

Applicant requirements: In order to qualify for a Capital One auto loan, you must be 18 or older and have a valid address within the contiguous 48 states. A minimum monthly income of $1,500 to $1,800 is required, depending on credit qualifications.

Vehicle restrictions: Capital One doesnt finance boats, RVs, ATVs or motorcycles.

- New and used restrictions: In most cases, you may only finance a 2011 or newer vehicle with fewer than 120,000 miles.

- Refinance restrictions: To qualify for a Capital One refinance auto loan, the vehicle must be seven years old or newer, have an established resale value and cannot be currently financed through Capital One.

In addition, you cant buy or refinance an Oldsmobile, Daewoo, Saab, Suzuki or Isuzu with a Capital One auto loan.

Amount financed: Capital One offers car loans from $4,000 and up for new and used vehicle purchases, and loan amounts between $0 and $0 for refinance car loans. Depending on your approval, the amount you finance may exceed the sales price or value of the vehicle and could include:

- Tax, title and licensing fees

- Dealer add-ons, such as guaranteed asset protection coverage or extended warranty

Things To Consider Before Refinancing

Recommended Reading: Usaa Student Loans Refinance

Capital One Auto Loan Availability

You can’t just use a Capital One auto loan for any vehicle on the market. Once you get prequalified with Capital One, you can shop from 12,000 dealerships nationwide. These dealers are part of the Capital One Auto Navigator network. The Auto Navigator buying service allows you to browse the inventory of dealerships in your area.

Your Capital One auto loan is only finalized when you visit a dealership. So, you may not know the exact APR and payment amounts until you visit a dealer in person. You can only prequalify online, not start the official loan.

Refinance Auto Loan From Capital One

Capitol One saves consumers an average of about $500 per year on their monthly car payments when they refinance their auto loan through them. There are various terms and conditions to their program that will need to be met in order to receive this form of assistance. However when qualified this is the average savings level obtained.

Not all applications are approved and not all borrowers will save money, but an auto loan refinance from Capital One is another option that should be explored. It can offer help to lower income families that are struggling to keep up with their car payments, and it can also just assist anyone who is looking to save money each month. If you apply for this offering from Capital One, some or all of the conditions below will need to be met.

You May Like: What Happens If You Default On An Sba Loan

How Credit Score Affects Your Capital One Auto Loan

Borrowers with low credit scores should be prepared to find higher interest rates from Capital One Auto Finance. The good news is that you can get a prequalification without hurting your credit score. We recommend comparing this to other prequalifications you can get from different lenders.

Below, you can see the average APR for different credit score ranges according to Experian’s 2021 State of the Automotive Finance Market Report. Even taking a few months to raise your score can help improve your APR and reduce the total you pay on the loan.

More From Capital One

Capital One Auto Navigator works with over 12,000 participating dealerships. After you pre-qualify, youâll see personalized loan rates and can compare payments and save customized terms on the cars you like.

Keep in mind that the vehicle prices listed on participating dealer sites are the âaskingâ price and can probably be negotiated. Before you agree to a sale price, ask the dealer for an âout the doorâ price that lists all dealer fees. These fees are not set or controlled by Capital One. Typically, dealers will charge a documentation fee, sales tax and registration fees.

Capital Oneâs website includes details on its auto financing and refinancing products, a loan calculator and a blog featuring credit score and car-buying information. Capital One also offers a wide variety of , banking accounts and investing products.

Save on Your Car

Don’t Miss: Calculate Pmi On Fha Loan

Capital One Platinum Secured Credit Card

Best for bad credit

- This card is best for: Anyone who wants to start their credit-building journey and needs a low barrier to entry to do so.

- This card is not a great choice for: Those who want to be rewarded for their spending or carry a large balance .

- What makes this card unique? The Capital One Platinum Secured Credit Card is a smart option among secured credit cards since it doesnt come with an annual fee, and you can get started building credit with a security deposit as low as $49. In addition, you will be automatically considered for a higher line of credit in as little as six months with on-time monthly payments.

- Is the Capital One Platinum Secured Credit Card worth it? If you have bad credit and need easy approval, this card can set you on the right path to prove your creditworthiness and earn a higher credit limit over time.

Jump back to offer details.

How To Verify External Bank Account After Linking It

After adding your external account information, you can follow the given steps to verify it for transfers:

- Within two business days subsequent to linking your account on the web, Capital One will put aside two little test installments into your external account, trailed by one withdrawal for the aggregate sum of the two test deposits.

- Survey the activity on your external financial records, and distinguish the little test deposits.

- When you know the sums, sign in to capitalone.com, and select the Capital One account you are connecting your external account to.

For Capital One 360 accounts, select your client profile at the upper right corner of the screen, and then select Settings, and go down to the External Account segment. In the External Account segment, select Verify Account to affirm your link.

For every other account, click on the Account Services and Settings link under your balance data, and afterward go to Manage External Accounts to affirm your link.

It would be ideal if you keep in mind that if this is a joint external account, with a similar shared account holder, you should both sign in to capitalone.com with your individual sign in details and complete the steps mentioned above.

When you affirm the link, you will have the option to move cash between accounts. When you verify your external account, any cash you booked to be stored to a Capital One account that was recently opened, will be transferred.

Recommended Reading: Prosper Loan Denied After Funding

Capital One Reviews And Reputation

Capital One is accredited and holds an A rating from the Better Business Bureau . It was named one of the best places to work by Fortune magazine in 2017 and is well regarded within the financial services industry.

Despite this, Capital Ones online customer review profile is average. It has a 1.1 out of 5.0-star customer rating on the BBB website and a Trustpilot score of 1.3 out of 5.0 stars. Its important to note a few things about these low ratings. First, many customer reviews mention Capital Ones banking services, not its auto loans. Second, although auto loans are only a small part of Capital Ones business, complaints from banking customers may still speak to the overall quality of the company.

Finally, keep in mind that Capital One is a large company with many products and services, millions of customers, and billions of dollars of revenue. Though there are thousands of complaints online, these represent a small fraction of total Capital One customers.

Alternatives To Capital One Auto Refinance

There are a good deal of supplies with an APR lower than 10.99%. You only need a while to hunt and locate. We recommend you to apply for a car refinance to various companies and compare the conditions, because sometimes they make special offers that permit you to save additional money. Check these variations, also:

lists Open Road Lending, Auto Pay Car Refinance,Innovative Funding Services,Rate Genius Automobile Refinance,MotoRefi Automobile Refinance,Clear lane driven by Ally,First Investors FinancialServices Auto Refinance Posts

Don’t Miss: Loaning Money To Your S-corp

Negative Capital One Auto Finance Reviews

Naturally, not everyone has a great experience with Capital One Auto Finance. Here are two Capital One Auto Finance reviews that speak to some potential pitfalls of the company:

I refinanced my vehicle back in October 2020 and to this day have not received my title. Upon moving to Florida, I had to call and request my title and was told 49 days, and its past 90 days, and Im still being told its coming. I have been trying to make a corporate complaint, and it has gone .

Robert G. via BBB

After paying on my car loan in a timely manner and paying it off early, lost my title by being cheap and using first-class mail. They now are forcing me to get a duplicate title and any fees associated with the replacement.

John D. via Trustpilot

One rule of thumb for customer reviews is that as a company grows, it will receive more complaints. With Capital One among the 10 largest banks in the U.S., Capital One Auto Finance reviews are mixed.

Capital One is a BBB-accredited business and carries an A rating from the agency, but customers on the BBB website give it 1.1 out of 5.0 stars based on more than 750 Capital One Auto Finance reviews. The BBB has fielded over 7,400 complaints against Capital One in the past three years. On Trustpilot, the bank has a 1.3 out of 5.0-star rating average from more than 1,000 Capital One Auto Finance reviews.

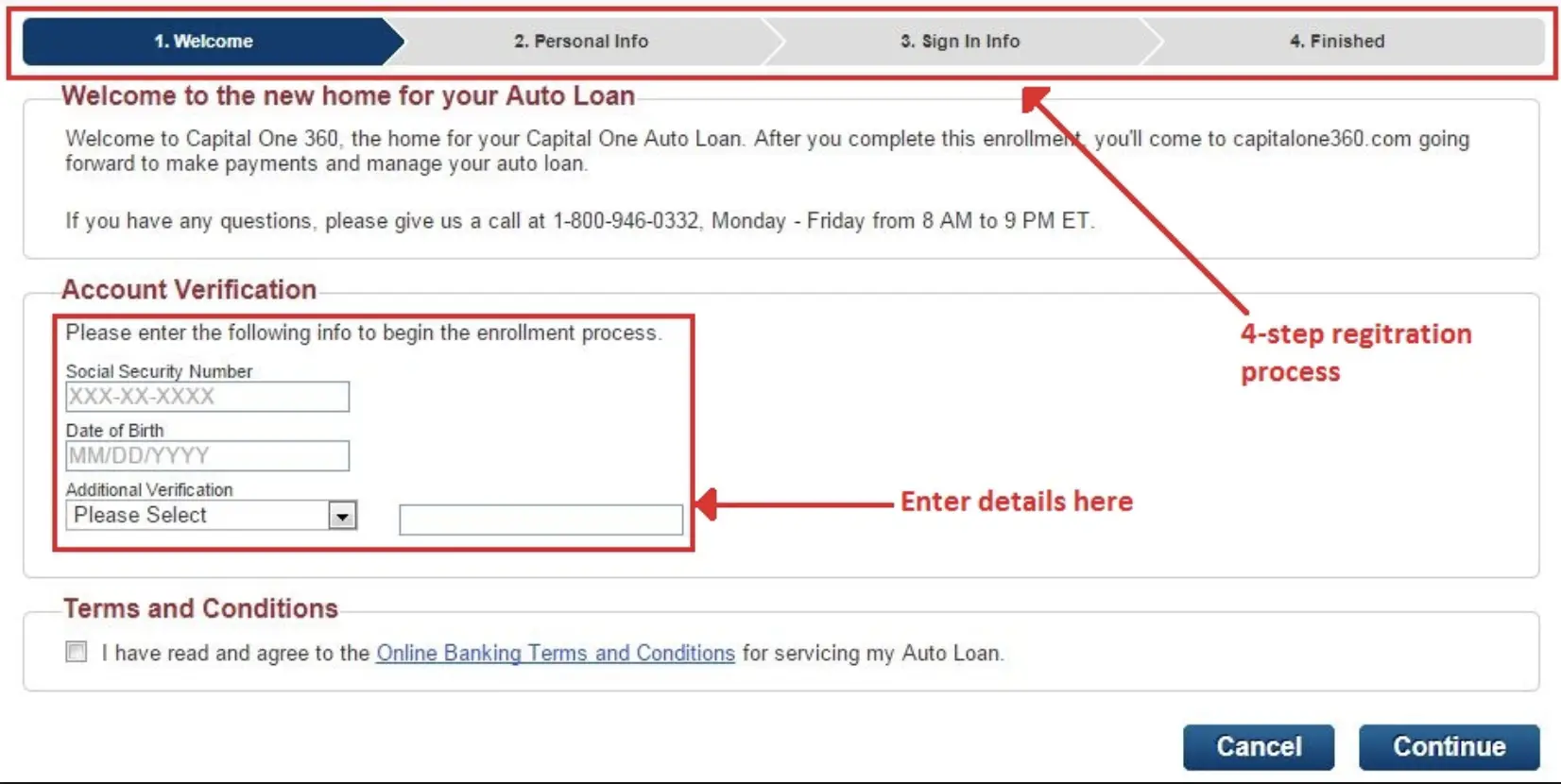

How To Apply For A Loan From Capital One Auto Finance

Applying for an auto loan from Capital One Auto Finance is simple and straightforward.

You can go directly to the Capital One website and fill out the online application if you are ready to take out a loan, and if you want to check your possible interest rates, you can use the free pre-qualifying tool.

Also Check: How To Calculate Amortization Schedule For Car Loan

You May Like: Auto Calculator Usaa

Visit A Dealer To Finalize The Auto Loan

The last step is to visit a Capital One network dealer to choose your car and finalize the loan. At this step, you should expect to complete a full credit application. Capital One will run a hard inquiry on your credit report, so your score may dip a few points.

You will need to supply the following required documents to complete the process:

- Proof of income

- Title and registration if you are trading in a vehicle

- Prequalification letter

It is possible that your final Capital One auto loan terms will differ slightly from those offered during prequalification. There are also rare cases where you may not be approved for a new loan after you do a full credit application.

Best Trusted Name: Bank Of America

Bank of America

Bank of America is a good choice for an auto loan refinance for borrowers looking to work with an established brick and mortar bank with widespread availability.

-

Discount for Preferred Rewards members

-

Car must be fewer than ten years old

-

Minimum loan amount of $5,000

-

Car must have fewer than 125,000 miles

If you opt for an auto loan refinance from Bank of America, you get a trusted financial institution â and a decision in less time than it takes you to tie your shoes. Thereâs no fee to apply, and you can help yourself to all of their helpful online tools once you are a member of the Bank of America family. To qualify, your car will need to be fewer than ten years old and have less than 125,000 miles on it, and you will also need to have $5,000 or more remaining on your loan. Bank of Americas current APR for refinancing a vehicle is 4.13%. It is smart to pay off your existing loan with proceeds from a new loan to take advantage of lower monthly payments, lower interest rates, or save on financing costs. Compare prices and use a car loan calculator to help determine the savings.

Read Also: Usaa Personal Loan Calculator

Best Capital One Credit Cards

Capital One® Platinum Credit Card

Why is it the best Capital One credit card for building credit

Need a major advantage over your credit? Look no further. The Platinum is an extraordinary first card or an item for the shopper attempting to construct their credit with mindful card use.

Pros

This card acknowledges purchasers with average, reasonable or restricted credit. There is no yearly charge, in contrast to the QuicksilverOne, and like the QuicksilverOne, you might have the option to up your after the initial a half year of on-time installments.

Cons

Unlike QuicksilverOne there are no ongoing rewards with this card.

Capital One® Quicksilver® Cash Rewards Credit Card

Why is it the best Capital One credit card for cash back?

The Capital One Quicksilver Cash Rewards Credit Card is extraordinary for buyers who need the opportunity of money back without stressing over rotating classifications.

Pros

In contrast to QuicksilverOne, which acknowledges customers with lower credit, the Quicksilver has no yearly expense. This card cant be beat when you are searching for a no-annual-fee card that has in all cases supported progressing rewards.

Cons

In the event that you are eager to pay a yearly charge, you can get an improved welcome bonus and better layered progressing rewards, just as with the Blue Cash Preferred Card from American Express.

Capital One® Secured Mastercard®

Why is it the best Capital One secured credit card

Pros

Cons

Capital One® Venture® Rewards Credit Card

Pros

Capital One Credit Card

Just think of credit cards that are anything but difficult to utilize, miles that are absolutely easy to reclaim and remunerates that are easy to cherish. Capital One has this and that is only the tip of the iceberg. You will discover travel cards, money back cards and items for the consumer who is simply starting out, all sponsored by one of the countrys biggest banks.

The best Capital One Visa is the Capital One Venture Rewards Credit Card. This card offers a heavy sign-up reward of 10,000 miles for burning through $20,000 on purchases in the initial year or you can procure 50,000 miles for burning through $3,000 in the initial 3 months. The reward is worth either $1,000 or $500 separately when reclaimed for travel. You will likewise acquire 2X miles on all passing buys. Capital One offers adaptable reclamation alternatives as you can recover your miles with any hotel or airline.

You May Like: Fha Refinance Mortgage Insurance