How Do You Choose The Best Home Equity Loan

Choosing the best home equity loan will require you to do a bit of research. In order to get the best terms and interest rates, be sure to compare different lenders loan programs and fee structures.

Lenders can have different requirements for qualification and offer different terms for home equity loans. If you have a higher DTI or lower credit score, youll find that some lenders are more likely than others to offer you a loan. To ensure that you score the best deal, youll want to shop around to find out what your options are.

When determining which lender to choose, make sure you review the Loan Estimate forms provided by each lender. The Consumer Financial Protection Bureau requires all lenders to provide you with this standard three-page form to ensure that you understand the differences between what lenders are willing to offer you. Loan Estimates will give you a rundown of the terms of your home equity loan, including the interest rate, and itemize the closing costs and fees youll be charged.

Con: Potential Legal Appraisal Administration Fees

Refinancing your home involves a full credit application with debt and income verification requirements as well as a credit check. Registering a new mortgage on the property means legal fees and usually an appraisal fee to verify the property value. You might also have to pay an administration fee.

Talk to your advisor about what to know when youre refinancing your home as each financial institution might treat these fees slightly differently.

Where Can We Obtain Patta

Patta is issued by the administrative authority or Tehsildar of the district. There is a small process of obtaining the Patta. The owner has to submit an application or requisition along with necessary documents and details of the owner. There might be an interview of the owner or verification and inspection of the land and the owner. There is a specific format of the required details that the owner has to follow during the process of obtaining Patta. The authority will enquire and do survey of the land as well. The Patta does not need annual or monthly renewal. The renewal takes place only at the time of name transfer.

Home Loan Application Form is the first basic step to start the processing of home loan, post validation of all details in the application form the bank with process the loan and will let you know the next steps to make your dream come true.

You May Like: Is Bayview Loan Servicing Legitimate

Records To Prove Homeownership

Since your lender is offering you a HELOC that is tied to your house, it will need to know that your ownership position is secure. To this end, it may request supporting documentation about your house. This can include information on your homeowners insurance policy, a mortgage statement, and a tax bill. Your lender may also want to see a copy of your deed and of your title insurance.

Home Equity And Heloc Pros And Cons

Even if property values stay flat or rise, every new loan stretches your budget. If you lose your job, for example, itll be harder to keep current on your payments. Because a new lender has another lien on your home, theres a greater chance that you could face foreclosure if you fall behind for a long enough period.

-

Lower cost than many other types of loans

-

The ability to borrow a relatively large amount of cash

-

Potential tax breaks if you use the funds on the home

-

The safety of fixed interest rates on home equity loans

-

When you use your home as collateral, you shrink the amount of equity in your home

-

If the real estate market takes a dip, those with higher combined loan-to-value ratios run the risk of going underwater on their loan

Don’t Miss: Paypal Business Loan Reviews

Who Should Get A Home Equity Loan

Homeowners can apply for a home equity loan and use the funds for a variety of purposes. Common reasons for borrowing against your home equity include:

- Covering home improvement costs

- Paying for higher education expenses

- Buying an investment property

- Starting a business

Still, not every use of a home equity loan is financially sound. Review the best and worst ways to leverage equity.

Thoughts On Documents Needed For A Home Loan

Are there mortgage lenders that use your bank statements for income verification instead of tax returns?

Yes, its called asset depletion.

Hi, I need some understanding in getting a mortgage, my wife and I,both have FICO score in the 800+ range, we have land that we bought, the price of the land went way down, The Deltona corporation where we bought the land, told us we can use the equity from the land to purchase one of there new home. What is best way to approach shopping around for a mortgage, and how much it will affect our FICO score.Thanks.

Cavell,

There are numerous ways to shop for a mortgage, including local banks, credit unions, mortgage brokers, online lenders, and so on. For purchases, borrowers typically like a face to face interaction, but its your call. As far as credit score, FICO considers multiple inquiries during a shopping period as one inquiry if made in a typical shopping period and also ignores recent inquiries. Either way, a 800 score shouldnt be affected much by some mortgage inquiries.

Is it normal for a Bank to release closing docs at 7 pm on a Friday to be signed at 8:00 pm the same evening?

Wanda,

Things are rarely normal in the mortgage industry, so it is possible for a very late signing.

Thanks for the kind words Kelita! People like you keep me going!

Not surebest to ask your lender directly instead of speculating.

Read Also: Usaa Auto Refinance

Home Equity Line Of Credit Combined With A Mortgage

Most major financial institutions offer a home equity line of credit combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

It combines a revolving home equity line of credit and a fixed term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender will generally only require you to pay interest on the money you use.

The fixed term mortgage will have an amortization period. You have to make regular payments on the mortgage principal and interest based on a schedule.

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65% of your homes purchase price or market value. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage.

The following example is for illustration purposes only. Say youve purchased a home for $400,000 and made an $80,000 down payment. Your mortgage balance owing is $320,000. The credit limit of your home equity line of credit will be fixed at a maximum of 65% of the purchase price or $260,000.

This example assumes a 4% interest rate on your mortgage and a 25-year amortization period. Amounts are based on the end of each year.

Figure 1: Home equity line of credit combined with a mortgage

| $260,000 | $260,000 |

Buying a home with a home equity line of credit combined with a mortgage

- personal loans

- car loans

- business loans

Advantages And Disadvantages Of A Home Equity Line Of Credit

Advantages of home equity lines of credit include:

- easy access to available credit

- often lower interest rates than other types of credit

- you only pay interest on the amount you borrow

- you can pay back the money you borrow at any time without a prepayment penalty

- you can borrow as much as you want up to your available credit limit

- its flexible and can be set up to fit your borrowing needs

- you can consolidate your debts, often at a lower interest rate

Disadvantages of home equity lines of credit include:

- it requires discipline to pay it off because youre usually only required to pay monthly interest

- large amounts of available credit can make it easier to spend higher amounts and carry debt for a long time

- to switch your mortgage to another lender you may have to pay off your full home equity line of credit and any credit products you have with it

- your lender can take possession of your home if you miss payments even after working with your lender on a repayment plan

These are some disadvantages of a home equity line of credit that are common to other loans:

- variable interest rates can change which could increase your monthly interest payments

- your lender can reduce your credit limit at any time

- your lender has the right to demand that you pay the full amount at any time

- your credit score will decrease if you dont make the minimum payments as required by your lender

Also Check: Va Manufactured Home Loans

Documents Required For Salaried Individual

- Loan Form: Bank loan application form to be filled with passport size photographs affixed

- Address Proof: Leave and License / Registered Rent Agreement / Utility Bill , Passport

- Identity Proof: Passport / Driving License / Voter ID / PAN

- Income Proof: 3 month payslips, 2 years Form 16, Copy of Income Tax PAN

- Bank Statement: 6 months bank statement that shows salary from the employer and any EMI paid for outstanding debit.

Government Help Due To Covid

There is some protection if you are struggling to pay your mortgage due to the coronavirus pandemic. While the Supreme Court rejected the CDC’s latest extension of its previous moratorium on evictions and foreclosures, there is still help available. The Consolidated Appropriations Act, 2021 passed in December 2020, provided $25 billion to the U.S. Treasury Emergency Rental Assistance program which is still being distributed to those in need.

The National Low Income Housing Coalition provides a searchable list of all the programs available on its website. Some states have instated moratoriums of their own. Consult the Treasury’s list of rent relief programs in your state to know your options.

The government has also encouraged all loan servicers to help prevent foreclosures via mortgage modifications and other relief options. Please check with your mortgage service provideror the company that receives your mortgage paymentsto determine if your mortgage loan qualifies for the moratorium program.

Don’t Miss: What Car Loan Can I Afford Calculator

Interest Rates And Fees If You Borrow On Amounts You Prepaid

You pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term.

Fees vary between lenders. Make sure to ask your lender what fees you have to pay.

You may not have to make any changes to your mortgage term.

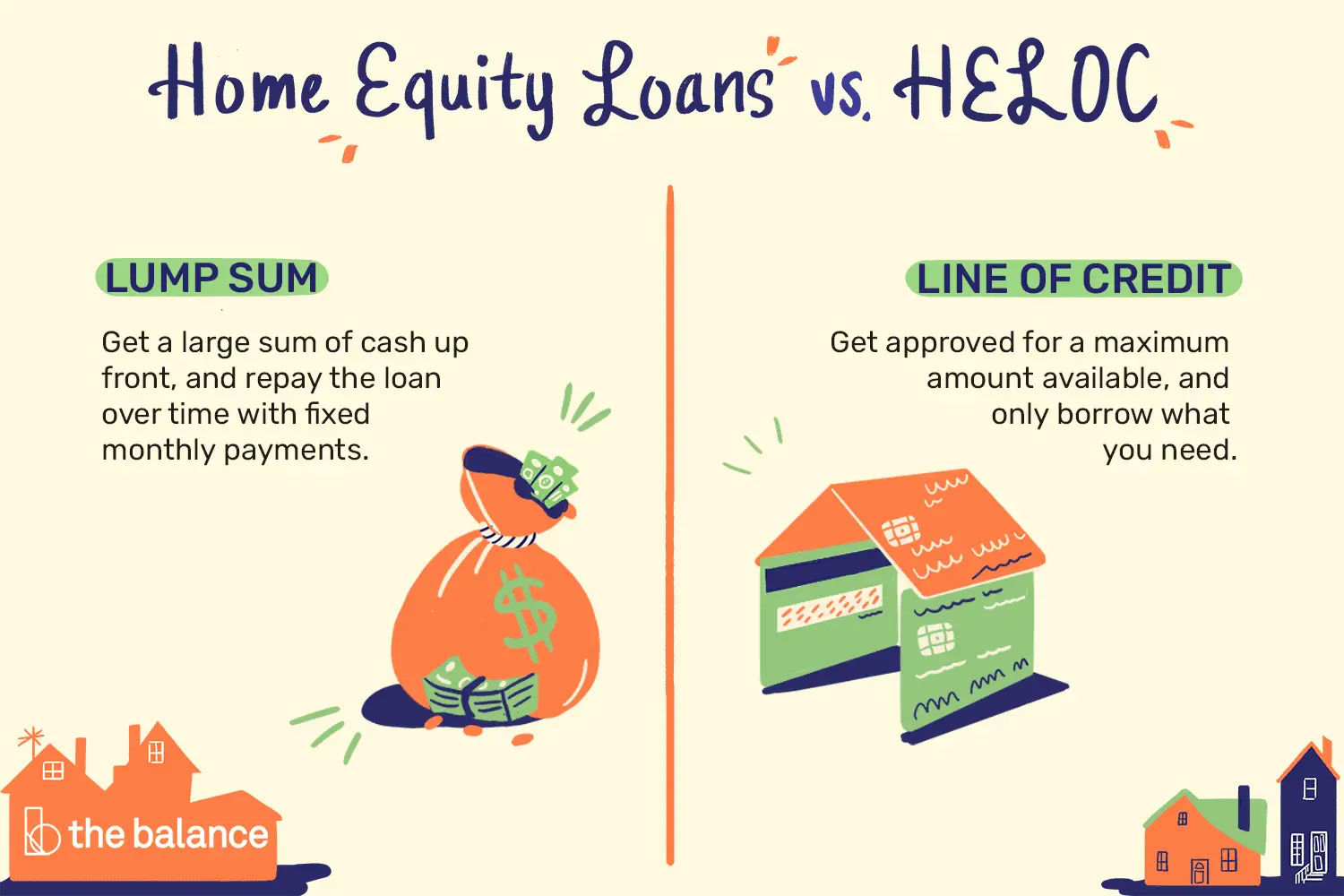

What Is A Home Equity Loan

A home equity loan allows you to borrow against the equity you have in your home. Equity is the difference between your outstanding mortgage balance and your homes market value.

This type of loan is also called a second mortgage, because it takes second priority after your first mortgage when debts need to be repaid in a foreclosure. Your home is used as collateral as is the case with the first mortgage you took out to buy your home.

Home equity loan terms often range from five to 20 years, and can sometimes go up to 30 years. The loan is paid to you in a lump sum, and youre generally given both a fixed interest rate and fixed monthly payments as part of your repayment agreement.

You May Like: Minimum Credit Score For Rv Loan

What Is Home Equity

Home equity is the difference between the value of your home and how much you owe on your mortgage.

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

Be aware that you could lose your home if youre unable to repay a home equity loan.

Closing On Your Home Equity Loan

Once the processing period is complete, it is time to close on your home equity loan. With Discover Home Loans, the loan closing process is quick and convenient. In most cases, a notary will meet you at your home, office, or other convenient location where you will sign your loan documents. In some states, an attorney that we will provide will need to be present as well. Once the loan is closed, you have three business days to change your mind and cancel the loan, known as the right of rescission. You will receive your money on the 4th business day after closing.

Did you know?

You May Like: How To Transfer Car Loan To Another Person

How To Get A Home Equity Loan

Apply with several lenders and compare their costs, including interest rates. You can get loan estimates from several different sources, including a local loan originator, an online or national broker, or your preferred bank or credit union.

Lenders will check your credit and might require a home appraisal to firmly establish the fair market value of your property and the amount of your equity. Several weeks or more can pass before any money is available to you.

Lenders commonly look for, and base approval decisions on, a few factors. You’ll most likely have to have at least 15% to 20% equity in your property. You should have secure employmentat least as much as possibleand a solid income record even if you’ve changed jobs occasionally. You should have a debt-to-income ratio, also referred to as “housing expense ratio,” of no more than 36%, although some lenders will consider DTI ratios of up to 50%.

Transfer Your Home Equity Line Of Credit

When your mortgage comes up for renewal, you may consider transferring your mortgage and home equity line of credit. Youll likely have to pay legal, administrative, discharge and registration costs as part of the switch.

You may also be required to pay off all other forms of credit, such as credit cards, that may be included within a home equity line of credit combined with a mortgage.

You may be able to negotiate with a lender to cover some costs to transfer any credit products you may have. This can be difficult if you have different sub-accounts within your home equity line of credit combined with a mortgage that have different maturity dates.

Ask your lender what transfer fees apply.

Recommended Reading: Does Va Loan Work For Manufactured Homes

How Do You Pay Back A Home Equity Line Of Credit

A HELOC has two phases: the draw period and the repayment period.

During the draw period, you can borrow from the credit line by check, transfer or a credit card linked to the account. Monthly minimum payments often are interest-only during the draw period, but you can pay principal if you wish. The length of the draw period varies its often 10 years.

During the repayment period, you can no longer borrow against the credit line. Instead, you pay it back in monthly installments that include principal and interest. With the addition of principal, the monthly payments can rise sharply compared with the draw period. The length of the repayment period varies its often 20 years.

At the end of the loan, you could owe a large lump sum or balloon payment that covers any principal not paid during the life of the loan. Before you close on a HELOC, consider negotiating a term extension or refinance option so that you’re covered if you can’t afford the lump sum payment.

A Note About Technology

The detailed list above is only partial. As mortgage industry technology improves, more lenders will be able to obtain many of the documents above from their sources rather than getting paper, emails, or uploads from you.

Improved technology may help with convenience, but it wont reduce the documentation needed, so this list provides the proper perspective of what goes into a loan approval.

You May Like: How To Transfer Car Loan To Another Person

How Does A Home Equity Line Of Credit Work

Much like a credit card that allows you to borrow against your spending limit as often as needed, a HELOC gives you the flexibility to borrow against your home equity, repay and repeat.

Most HELOCs have adjustable interest rates. This means that as baseline interest rates go up or down, the interest rate on your HELOC will adjust, too.

To set your rate, the lender will start with an index rate, then add a markup depending on your credit profile. Generally, the higher your credit score, the lower the markup. That markup is called the margin, and you should ask to see the amount before you sign off on the HELOC.

Harmful Home Equity Practices

You could lose your home and your money if you borrow from unscrupulous lenders who offer you a high-cost loan based on the equity you have in your home. Certain lenders target homeowners who are older or who have low incomes or credit problems and then try to take advantage of them by using deceptive, unfair, or other unlawful practices. Be on the lookout for:

- Loan Flipping: The lender encourages you to repeatedly refinance the loan and often, to borrow more money. Each time you refinance, you pay additional fees and interest points. That increases your debt.

- Insurance Packing: The lender adds credit insurance, or other insurance products that you may not need to your loan.

- Bait and Switch: The lender offers one set of loan terms when you apply, then pressures you to accept higher charges when you sign to complete the transaction.

- Equity Stripping: The lender gives you a loan based on the equity in your home, not on your ability to repay. If you cant make the payments, you could end up losing your home.

Also Check: Usaa Auto Refinance Phone Number