Max Dti Ratio For Va Loans

- VA states 41% is max acceptable DTI

- And 41% max without compensating factors is likely the limit

- Possible to get approved with DTI between 41-50% with compensating factors

- Or even higher in certain cases with exception

For VA loans, the same automated/manual UW rules apply. If you get an AUS approval, the maximum DTI ratio can be quite high.

However, if its manually underwritten then the maximum debt-to-income ratio is 41% . There is no front-end debt ratio requirement for VA loans.

Again, as with FHA loans, if you have compensating factors and the lender allows it, you can exceed the 41% threshold and enjoy higher DTI limits.

Specifically, if your residual income is 120% of the acceptable limit for your geography, the 41% DTI limit can be exceeded, so long as the lender gives you the go-ahead.

In other words, most of these limits arent set in stone, assuming youre a sound borrower otherwise.

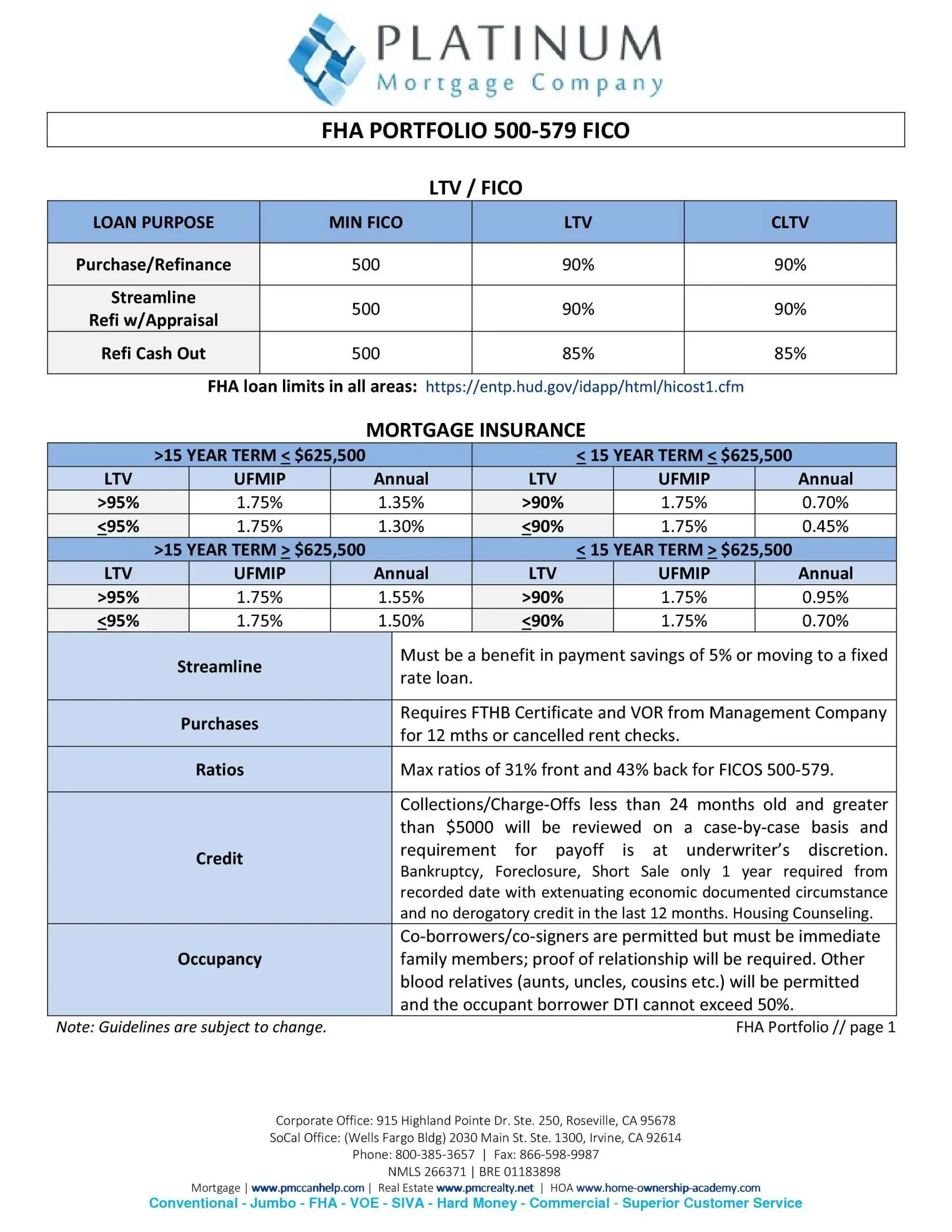

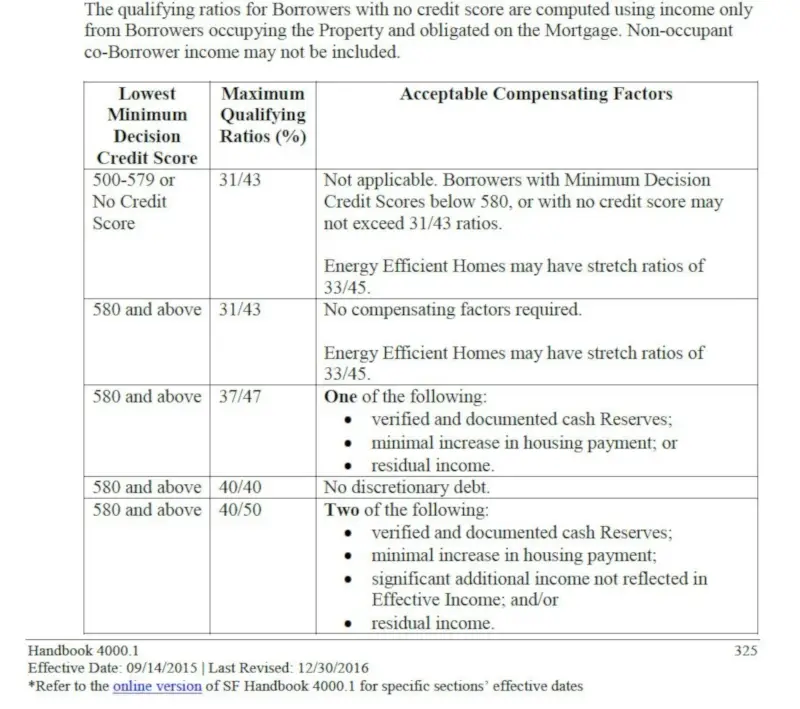

Fha Debt To Income Ratio Chart

This chart will indicate what DTI is acceptable based upon your credit score. This also talks about some compensating factors that may be needed to qualify for the higher DTI levels. Keep in mind this is just a basic guideline and it would be best to discuss your personal scenario because you still may qualify despite what this chart says.

| Minimum Credit Score |

|

Two Types Of Dti: Front

There are two types of DTI lenders typically look at:

Front-End DTI This is the ratio of all your housing-related payments to your income. This includes the principal, interest, property taxes and insurance for your primary home.

Back-End DTI This is the ratio of all your debt payments to your income.

Also Check: Usaa Auto Loan Approval Odds

When Can Dti Be Higher Than 36%

Some mortgages such as those offered by the FHA, have certain, more stable features that make it more likely youll be able to afford your loan, according to the CFPB. Current FHA loan requirements allow for a total DTI ratio of up to 50% or less.

Both small lenders and large banks may offer loan options at higher DTI percentages. Be sure to compare mortgage loans from several lenders to find the best option for your financial needs.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Don’t Miss: Va Loan Requirements For Mobile Homes

How Much Dti Do You Need To Qualify For A Loan

DTI has to be below a certain threshold for a lender to feel comfortable lending to you, as we highlighted earlier. That threshold is different for different mortgage loans.

There are three main types of mortgage loans and each has a different DTI requirement:

Conventional Loans: Most of the loans originated in the US fall under this category. These are loans that are backed by Government-Sponsored Enterprises Fannie Mae and Freddie Mac.

The thresholds for Conventional loans are defined as 28/36, which means 28% limit for the front-end DTI and 36% for back-end DTI and both must be met.

But these are just legacy limits that apply to manual underwriting. With better credit scores and cash reserves, the back-end ratio can be as high as 45%.

Moreover, for loans underwritten through Fannie Maes automated underwriting system, the Desktop Underwriter , that limit is 50%. To see your own scenario, please refer to Fannie Mae’s guidelines on DTI

FHA Loans: FHA loans are insured by the Federal Housing Administration . These loans are especially helpful to borrowers with relatively low credit scores.

General DTI guidelines for FHA loans is 31/43. But with automated underwriting, these limits can be higher, say as high as 50%. Whether the higher limit is applicable to a borrower depends on his or her specific situation. Based on factors such as bigger down payments, higher credit scores and excess reserves, a higher limit may apply.

The Problem With The Fha 1% Rule

In 2015, new guidelines were introduced for calculating your student loan payment for the purposes of qualifying for a home mortgage loan.

These new rules were designed to address the payments for student loans that are deferred, in forbearance, or in a repayment plan that does not fully pay the student loan balance at the end of a fixed repayment term.

We have been following these ever-changing guidelines since 2015, which you can find here 2021 Guide to Qualifying for a Mortgage with Student Loans.

The most egregious of these new underwriting guidelines were introduced by FHA.

Simply put, if your loan is not in a repayment plan that will completely pay off your student loan at the end of a fixed-term you have to use the 1% rule.

The 1% rule is when the underwriter uses 1% of your student loan balance as a payment when calculating your debt to income ratios.

Heres an example of how the 1% rule worked in the past:

- Your student loan balance is $100,000

- Youre on an Income-Based Repayment plan

- The underwriter will calculate 1% of your balance and use $1,000 as adebt payment

In most cases, the 1% rule all but eliminated FHA as an option for homebuyers and homeowners.

You May Like: How Do I Refinance An Auto Loan

Total Fixed Payment To Effective Income

Add up the total mortgage payment and all recurring monthly revolving and installment debt . Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 43%.

See the following example:

Please note that the above indicators do not exclusively determine whether or not a candidate will qualify for an FHA loan. Other factors will be considered, including credithistory and job stability.

Dti Ratio And Mortgage Loans

DTI ratio directly factors into whether a mortgage lender will approve your loan or not. When buying your first home, your DTI is calculated with the estimated payments, taxes, and fees from the purchase. Depending on your credit score, savings, and down payment, lenders may accept higher ratios.

Lender limits can vary considerably, depending on the type of loan and overall financial profile of a prospective applicant, but there are guidelines in place that can serve as a frame of reference. Since the Federal National Mortgage Association raised their DTI limit in 2007, the maximum limit for most lenders will not exceed 50%.

Prospective borrowers should strive for a DTI of at least 43%, or the maximum allowed to access Qualified Mortgage loans. These loans comply with federal guidelines that were created to prevent high-risk transactions between lenders and borrowers.

For some examples of what this looks like in real life, lets look at some lenders:

Loans guaranteed by the Federal Government have their own set of limits, as well:

To make sure you get a good deal on your mortgage, pick one of the best mortgage lenders of the year

You May Like: How To Get An Aer Loan

Is An Fha Mortgage Right For You

An FHA mortgage is a great option for borrowers who may not qualify for a conventional home loan. Here are five important questions to ask yourself before deciding:

If you answered yes to all of these questions, an FHA loan may be a good fit for you. There are many factors you should consider before you apply for any type of loan. One of the best things you can do is talk to an experienced Home Lending Advisor about the options available to you.

Calculate Your Debt Ratio

First, lets look at your debt ratio as the lender does. It might look different to you because certain things are not included. The lender only counts those bills that report to the credit bureaus. Think of bill, such as:

- Personal loans

- Mortgages

These bills report to the credit bureaus. This means Experian, TransUnion, and Equifax report how often you make your payments on time. Lenders can see how many 30-day late payments you have or how much of your available credit on your credit card you used. While these factors are important, what they focus on for your debt ratio is the monthly payments.

For the most part, the payments are reported on the credit report. Car payments and personal loans are good examples. Lenders only use your minimum required payment for your credit card for the DTI, though. This means if you have $1,000 borrowed, but your minimum payment is $49, the lender uses $49 to calculate your DTI.

Calculating your debt ratio can get tricky if you have any of the following debts:

You May Like: Aer Scholarship For Spouses

What Are Debt Ratios

Your debt-to-income ratio gives lenders a clear picture of how much you owe each month to how much you earn. The debt ratio is calculated by dividing the sum of your monthly debts and dividing it by your total assets.

For your monthly debt, the FHA take into account all the money you owe: credit card or lines of credit payments, car payments, student loan payments, taxes, insurance, alimony and child support, as well as the amount of your potential new house payment. Your pre-tax income, wages, tips, child support, social security, amounts to your total monthly assets. The number you arrive at after dividing your total debt by assets is your debt-to-income ratio.

Whats Included In Your Dti

On the debt side, your lender includes your monthly housing payment of principal, interest, property taxes, HOA dues , homeowners insurance and mortgage insurance.

FHA loans require mortgage insurance. Your debts also include minimum payments on your credit card balances, student loans, installment and other accounts. If your student loan payments cannot be documented, FHA loan guidelines assume a monthly payment of one percent of the balance.

Installment loans that will be paid off within 10 months wont count as part of your DTI. However, your lender must include the amount of that payment that exceeds 5 percent of your monthly income. So if you earn $4,000 a month, and your auto loan has six payments left at $500 a month, youll only be hit with $300 a month.

- $4,000 income * .05 = $200

- $500 payment $200 = $300

If youre on the edge of being able to qualify, paying down an installment debt to less than ten remaining payments can be a good strategy for loan approval.

Also Check: Becu Auto Loan Payoff

How Do I Calculate My Debt To Income Ratio

Calculating your DTI is simple and not very time consuming. To calculate your debt to income ratio, add up all of your monthly debt payment obligations including your mortgage, car loans, student loans, and minimum monthly payments on credit cards. Do not include expenses such as groceries, utility and gas. Then, calculate how much you earn each month. Finally, divide your monthly debt obligations by your gross monthly income to get your DTI.

For example if you and your spouse earn $6,916 per month, your mortgage payment is $1,350, your car loan is $365, your minimum credit card payment is $250, and your student loans are $300, then your recurring debt is $2,265. Divide the $2,265 by $6,916 and you will find your DTI is 32.75 percent.

- The FHA Loan is For:First time buyers, repeat home buyers, families and qualified permanent residents

- The FHA Program Can Be Used To:Buy HomeRefinance

- $0 Down

- Low Closing Costs

- As low as 5% Down

- Low Closing Costs

What Is A Good Debt

The lower your DTI ratio, the more likely you will be able to afford a mortgage opening up more loan options. A DTI of 20% or below is considered excellent, while a DTI of 36% or less is considered ideal. Compare your debt-to-income ratio to our measurement standards below.

| 36% or less | DTI ratio is good | A debt-to-income ratio of36/43 is favorable to lenders, because it shows you’re not overstretched. After paying your monthly bills, you most likely have money left over for saving or spending. |

|---|---|---|

| 37% – 50% | DTI ratio is OK | The maximum allowed DTIcan vary depending on the type of home loan you’re applying for and the requirements set by your lender. In most cases, the highest DTI that a homebuyer can have is 50%. |

| 51% or higher | DTI ratio is high | Just because you have a high DTI ratio doesn’t mean you can’t still qualify for a home loan. Lenders will look at your credit score, savings, assets, down payment and property value in addition to your DTI when considering your loan eligibility. Paying down debt or increasing your income can helpimprove your DTI ratio. |

Recommended Reading: How To Transfer Car Loan To Another Person

Got Student Loan Debt An Fha Loan May Be Your Best Mortgage Option

If youre among the nearly 45 million people in the U.S. who owes some of the more than $1.71 trillion of student loan debt, you may feel that homeownership is out of reach.

But lenders can work with you to review your individual circumstances and possibly qualify you for a mortgage. Loan programs address student loan debt in different ways, so its important to work with a lender who can analyze a variety of financing options and someone who stays up to date on the latest changes to loan requirements.

Loans that are guaranteed by the Federal Housing Administration have always been designed as a vehicle for homeownership for first-time buyers and those who lack cash for a large down payment, who have low-to-moderate incomes and who have credit challenges. In exchange, and to fund the program, borrowers pay mortgage insurance for the life of the loan.

Recently the FHA adjusted its student loan rules about how to calculate monthly student loan payments, which may make it easier for those with education debt to qualify for a mortgage.

Previously, the FHA assumed borrowers with student loan debt were paying one percent of their loan balance every month, Hope Morgan, a Mortgage Network branch manager in Salisbury, Md., wrote in an email. The new FHA policy assumes they are paying 0.5 percent, which more closely reflects what borrowers actually pay each month.

Morgan provided the following example of the potential impact of the new FHA loans:

Will All Lenders Remove The 1% Rule

We get this question a lot. Do all lenders require the 1% rule?

The answer is that the lender chooses whether or not to follow the underwriting guidelines for the type of mortgage you are applying for.

Fannie Mae, Freddie Mac, FHA, VA & USDA offer guidelines, which are minimum requirements to qualify for the loan program.

Individual lenders have the freedom to add overlays or restrictions to these guidelines. Many lenders do this.

Between lender overlays and inexperienced loan officers, you will often get 5 different answers if you call 5 different lenders.

What these lenders and inexperienced loan officers are failing to tell you is that THEY do not follow the guidelines and that another lender that does follow the guidelines could help you.

Also Check: Defaulting On Sba Disaster Loan

What Is Included In Debt

A lender typically uses two sources for your financial information: your credit report and required documentation that comes from you. Your credit report supplies all of your credit cards and loan balances so lenders know exactly how much you owe.

The downside is that credit reports can take a month or more to update new information. So if you made a large payment on one of your credit cards a week before applying for your mortgage, that new balance might not be reflected on the credit report pulled by your lender.

Luckily, you can request a rapid rescore, which updates your credit report within just a few business days. Your lender pays for the cost of the rescore and you benefit from having a low and accurate debt balance for your DTI ratio.

Your lender will also ask you to verify your monthly income with documentation such as pay stubs and bank statements. Youll also need to submit at least two years of W-2s and/or tax returns.

Some lenders also ask for an employment verification letter. This helps them determine exactly how much money you bring in each month that can be applied to your loan balances.

Fha Minimum Credit Score: 500

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, it’s important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans don’t come directly from the government the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why it’s smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders’ rates and fees.

It’s worth noting that even with a lender who’s following FHA guidelines to the letter, you’ll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

Recommended Reading: Does Va Loan Work For Manufactured Homes