Who Qualifies For A Va Loan

For those who are eligible, VA loans are attractive because they dont require a down payment. They also have lower interest rates than many other types of mortgage loans you can get for similar terms. They dont have monthly mortgage insurance.

Although lenders set their own requirements for certain aspects of qualification, VA loans have more lenient credit requirements than many other mortgage programs.

Not all who have served in the Armed Forces qualify for a VA loan. You must meet at least one of the following criteria to qualify:

- Served 181 days of active service during peacetime.

- Served 90 consecutive days of active service during wartime.

- Served more than 6 years of service with the National Guard or Reserves or 90 days under Title 32 with at least 30 of those days being consecutive.

- Are the spouse of a service member who lost their life in the line of duty or as the result of a service-connected disability. You generally cannot have remarried, although there are exceptions.

What If I Want To Purchase A Condo With A Va Loan

The Department of Veterans Affairs has a condo database of approved developments. If your dream condo is not on the VAs list, your lender can ask the VA to approve this development. Keep in mind that the VAs process for adding a new condo development to their approved list can take months and is not guaranteed to be approved once the process is over.

Va Buyers Can Use Their Home Loan Benefit To Purchase:

- Existing single-family homes

- Multi-unit properties

* Veterans United does not currently make construction loans or loans for manufactured housing.

Like the other government-backed mortgage options, VA loans are for purchasing primary residences you intend to live in full time. Veterans can look to buy a multiunit property as long as they intend to live in one of the units.

Homes generally need to be in good shape. The VA appraisal process includes a look at the home in light of some broad property condition requirements, known as the Minimum Property Requirements. This a high-level look at a home and not as in-depth as a home inspection.

If the appraiser notes MPR issues, they may need to be addressed before the loan can close. VA buyers can ask sellers to pay for repairs and even cover the cost themselves if needed.

Purchasing a fixer-upper is possible with a VA loan, but they can present challenges for the VA appraisal process. Talk with a loan specialist in more detail if youre looking for that type of property.

Once you find a home that you love, the next step is making an offer to buy it.

Recommended Reading: How To Transfer Car Loan To Another Person

How To Compare Mortgage Loan Offers

To compare your loan offers, youll want to look at the loan estimate a three-page document given to you by the lender. These forms break down all the costs, fees and other financial details of your loan. These loan estimates are standardized, so comparing them line by line is quite simple.

Youll want to pay particular attention to the loan amount, the interest rate, the estimated monthly payment, and your estimated closing costs. The Comparisons section on page 3 can be helpful, too. It shows what your balance will be in five years and can be a good way to compare loan option costs.

Familiarize Yourself With Your Mortgage Options

You already know you want a VA loan, but there are actually several types of VA mortgages to choose from. Its helpful to know what type of mortgage you want before you start shopping.

For example, if youre a Native American veteran and are buying on certain federal lands, youd use the VAs NADL program. If youre refinancing, you could opt for a VA cash-out refinance or VA Streamline Refinance ).

The VA has a full breakdown of these loan options on its website.

Determining which VA mortgage program you want to use will help narrow down your choice of VA lenders since not all companies offer the full suite of VA loans.

Read Also: How To Transfer Car Loan To Another Person

Make Sure You Have Enough Saved

Its a common misconception that because VA loans dont require a down payment, buyers wont be required to pay anything upfront out of pocket. People hear this a lot, Williams says. But it couldnt be further from the truth.

Even if you dont need a down payment, youre still responsible for certain closing costs, including the following:

- Loan origination fees

- Appraiser fees

- Home inspection fees

Other third-party fees, like brokerage fees and termite reports are absorbed by the seller with VA loans.

Additionally, youll have to pay the VA funding fee. The funding fee is a one-time payment you make which enables VA loans to have such favorable terms. The fee varies depending on whether you are a first-time homebuyer and if you make a down payment. It can be up to 3.6% of your loan amount.

Some of these costs can be rolled up into your loan but that will result in a higher monthly payment. Thats why Williams recommends building a nest egg to pay these fees up front before beginning the home buying process.

Decide How Youll Pay Loan Costs

Like other mortgages, VA loans have closing costs, which are fees charged to cover services and expenses such as the appraisal, inspection, title and origination fees. Closing costs typically run from 2% to 5% of the loan amount and are detailed in the Loan Estimate.

Another cost is the VA funding fee, a one-time fee most borrowers will pay, based on the down payment amount and prior use of the VA loan benefit. The 2020 funding fee for a zero-down loan on a first VA loan is 2.3% of the loan amount.

Here are the options if you can’t pay these costs upfront:

-

Roll the funding fee into the loan. Doing so will increase your loan amount and monthly payment, and it will mean you pay interest on the funding fee over the life of the loan.

-

Ask the seller to pitch in. The VA allows the seller to contribute up to 4% of the loan amount to cover some closing costs and the VA funding fee. Keep in mind, though, sellers are less likely to make concessions when the competition to buy homes is fierce.

-

Find out if your lender is willing to cover closing costs in exchange for you paying a higher interest rate. Understand that this will increase your monthly mortgage payment.

-

Seek closing cost assistance through a state home buying program for first-time buyers or veterans, as well.

You May Like: How To Get Loan Originator License

Whos Your First Contact

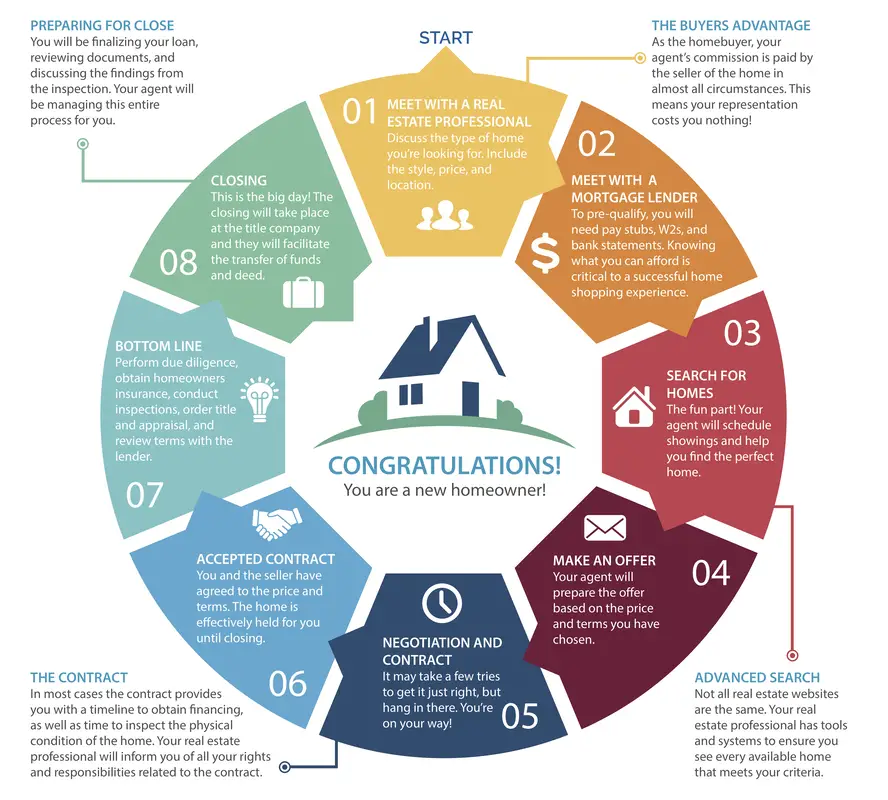

This chicken-or-egg question is among the most common for first-time homebuyers. Theres no right or wrong answer. You can start the home purchase process by contacting either a lender or a real estate agent.

But one of the first things a real estate agent will ask you is: Have you been preapproved for a mortgage?

Sign A Purchase Contract

Your agents job is to help you craft a strong offer and formulate a sound negotiation strategy. This can include sellers paying for some or all of the VA closing costs.

Dont forget to ask about contingencies that youll want included in a contract. This can include how long you have to secure financing, the amount of earnest money youll need and the right to have a home inspection.

Though not required by the VA, getting a home inspection is a good idea. Youll be able to get to know your property better and back out if you cant get the seller to agree to make certain repairs before closing.

Recommended Reading: Va Manufactured Home 1976

The Va Loan Process From Start To Finish

Buying a home can be difficult and stressful for many buyers. When you are a service member, buying a home can seem equally daunting until you learn the amazing benefits of a VA loan. Its easy to hear people talk about VA loans and how helpful they are, but do you really know the exact ins and outs of getting one? Here are the 6 steps involved with obtaining and using a VA loan for your next home purchase:

How The Va Loan Funding Fee Works

The rules governing the VA loan funding fee are found in Chapter 8 of the VA Lenders Handbook. The first part of Chapter 8 reminds us that the VA loan funding fee is meant to offset the use of tax dollars, but also that the funding fee is subject to change or revision by Congress.

The fee should not be confused with other expenses of the loan such as the lenders flat fee, which is separate from the VA loan funding fee.

Applying for a VA home loan involves several steps the lender is required to take which include:

- Identifying whether the applicant is exempt from paying the VA loan funding fee .

- Calculating the VA funding fee owed by any non-exempt borrower.

- Collect the non-exempt borrowers funding fee at loan closing time.

- Send proof to the Department of Veterans Affairs that the funding fee has been paid or that the veteran is exempt from the fee .

The basic chain of events for the lender to calculate the borrowers funding fee is more or less as follows:

- The borrower applies for the VA loan and submits a VA Certificate Of Eligibility .

- The lender processes the loan application, reviews the COE to check the borrowers status as a first-time applicant, second-time use, etc.

- The VA Loan Funding Fee is calculated using a table referencing the borrowers status as a first-time user, active duty/Guard/Reservist/Retired or Separated status, etc.

- The borrower chooses to finance the fee or pay it as part of the cash required to close the loan.

Recommended Reading: How To Transfer A Car Loan

How The Process Differs From Other Types Of Home Loans

The process to get a VA loan can take longer compared to conventional loans since there are additional documentation requirements as part of the appraisal and inspection process. However, borrowers will get more favorable terms which can save thousands of dollars throughout the lifetime of the loan.

Borrowers can take certain steps to help speed the process such as getting a Certificate of Eligibility before signing a purchase agreement and ensuring you have other necessary documents during the underwriting process.

Comparison shop for a VA loan today.

Why Do I Need A Home Inspection

A home inspection is an added expense that some first-time homebuyers dont expect and might feel safe declining, but professional inspectors often notice things most of us dont. This step is especially important if youre buying an existing home as opposed to a newly constructed home, which might come with a builders warranty. If the home needs big repairs you cant see, an inspection helps you negotiate with the current homeowner to have the issues fixed before closing or adjust the price accordingly so you have extra funds to address the repairs once you own the home.During the inspection, be sure to ask questions and bring a checklist of things you want information on. Note that a comprehensive inspection should not only bring defects and problem areas to your attention, it should also highlight the positive aspects of a home as well. When you receive the final report, prioritize the issues and decide whether you want to negotiate those items with the sellers. Remember: Every deal is different and negotiable.

You May Like: What Happens If You Default On Sba Loan

Access To Specially Adapted Housing Grants

Do you have a disability that affects your mobility or sight? You may qualify for a SAH grant.

SAH grants can go toward constructing a special home designed to fit the needs of the disabled individual. Or they allow you to modify an existing home to make it more accessible. SAH grants can also pay the unpaid balance of an adapted home already purchased without VA grant assistance.

In 2020, you may qualify for a grant of up to $90,364, and you may use the grant up to three times as long as your disability qualifies. Because the SAH is a grant and not a loan, you dont need to pay it back.

Your Home Must Qualify For Va Loan

This is one of the harder aspects of VA loan restrictions to explain. Before you can purchase your home using VA loans, your property must qualify. The VA will send a specially appointed VA appraiser to assess the house. Here is a good breakdown of the VA property requirements but in general, your home must be a conventional home in good working condition.

Read Also: How To Get An Aer Loan

Order A Home Inspection

After your offer is accepted, the next step in the mortgage process is typically a home inspection.

A thorough home inspection gives you important details about the home beyond what you may be able to see on the surface.

Some of the areas a home inspector checks include:

- Homes structure

- Plumbing

- Roofing

Getting a home inspection is important because it helps the buyer know if a home may need costly repairs.

What is uncovered during an inspection can become part of a sales negotiation between buyer and seller, and their respective real estate agents.

Obtain Your Certificate Of Eligibility

A certificate of eligibility or COE is needed to prove that you meet the initial eligibility requirements to get a VA loan. An experienced lender can help you obtain a COE, which is also guaranteed by the Department of Veteran Affairs. The COE also lets the lender know how much entitlement you can receive. You will need to give information about your service. In most cases, a COE can be obtained instantly through the lenders website, however, there are some instances when the COE cannot be obtained online and must be facilitated by the lender.

Don’t Miss: How Long For Sba Loan Approval

If Youre In The Military An Eligible Veteran Or A Qualifying Spouse Of A Service Member You May Want To Look Into Getting A Va Loan When You Buy A Home

You can obtain a VA loan to buy a property thats your primary residence, even if youve already had a VA loan in the past. The government guarantees these loans, so its easier to qualify since theres little to risk for lenders. In fact, you can get a VA loan with no down payment and you may qualify even if your credit isnt very good and youve had a history of past foreclosures.

Unlike most mortgage options that dont require a big down payment, such as FHA loans, VA loans dont require you to buy mortgage insurance. There is a funding fee for most borrowers though, which adds to the cost of your mortgage.

While VA loans are often a great choice, the funding fee means these loans arent right for everyone. And since theyre issued by private lenders, youll need to shop around. If youre thinking about applying for a VA loan, heres what you need to know.

| Qualifying requirements |

- Purchase and improve a home

- Make energy-efficiency improvements to your existing home

- Buy a lot and/or a manufactured home

- Refinance an existing loan

If youre eligible, VA loans are fairly easy to qualify for, since theres no down payment required, no minimum credit scores, and no maximum limit on how much you can borrow relative to income.

What Is The Va Funding Fee

To get a VA home loan, youll need to pay the VA funding fee. This is a one-time cost at closing which helps the VA maintain the VA home loan program and continue to offer valuable home loan products to military homebuyers. The VA funding fee can be financed into your total loan amount and paid down over time.

The amount of the VA funding fee depends on your loan type, the nature of your military service, the number of times youve used your VA loan benefit and the amount of your down payment.

Also Check: Aer Loan Requirements

Sign The Final Paperwork

Youll likely go to the escrow agents office to sign all the final paperwork. Review all the documents carefully. Compare your most recent loan estimate with the closing disclosure. , according to the CFPB.)

If there are discrepancies between your closing disclosure and your last loan estimate, your lender must justify them. While some costs can increase at closing, others legally cant. Call your lender immediately if something doesnt look right.

If you need to pay any closing costs, youll pay those at this time too. Bring a cashiers check or other certified funds to the escrow office when you sign your documents your escrow company provides the total amount needed.

Documents Needed During Va Loan Prequalification:

VA loans are approved much like other loans. Income, assets, and credit will all be examined. During prequalification the common items listed below will be required.

- A clear copy of your drivers license and Social Security Card

- A copy of your DD214 or Reserve/Guard points statement

- Recent 30-day paystubs

- Past 2-years w-2s or tax returns

- 60 days bank statements

Don’t Miss: How To Find Your Student Loan Number