Best For Refinancing High

Who’s this for? SoFi got its start refinancing student loans, but the company has since expended to offer personal loans up to $100,000 depending on creditworthiness, making it an ideal lender for when you need to refinance high-interest credit card debt.

If you have high-interest debt on one or more card, and you want to save money by refinancing to a lower , SoFi offers a simple sign-up and application process, plus a user-friendly app to manage your payments.

Another unique aspect of SoFi lending is that you can choose between variable or fixed APR, whereas most other personal loans come with a fixed interest rate.Variable rates can go up and down over the lifetime of your loan, which means you could potentially save if the APR goes down . However, fixed rates guarantee you’ll have the same monthly payment for the duration of the loan’s term, which makes it easier to budget for repayment.

By setting up automaticelectronic payments, you can earn a 0.25% discount on your APR. You can also set up online bill pay to SoFi through your bank, or you can send in a paper check.

Once you apply for and get approved for a SoFi personal loan, your funds should generally be available within a few days of signing your agreement. You can both apply for and manage your loan on SoFi’s mobile app.

Do All Banks Offer Personal Loans

No, not all banks offer personal loans. Bank of America, one of the biggest financial institutions in the country, doesnt carry them, for example. Most personal loans are unsecured, meaning they are not backed up by an asset that the lender can take if you default, and some banks don’t want the risk. Others just don’t want to deal with the expense of lending and servicing relatively small, 4- and 5-figure amounts.

Other large banks that do not offer unsecured personal loans are Capital One and Chase.

Lendingpoint: Best For Subprime Borrowers

Overview: LendingPoint specializes in loans for subprime borrowers, with loan amounts of $2,000 to $36,500.

Why LendingPoint is the best for subprime borrowers: You could get a loan with a credit score as low as 590, which is on the lower end of the range for fair credit.

Perks: There is no prepayment penalty for paying your loan off early, and the credit score requirement is low compared with other fair-credit lenders.

What to watch out for: Youll need to prove income of at least $35,000 and employment. Theres no co-signer option, which means if you dont qualify on your own, you wont be able to get a loan.

| Lender |

|---|

Don’t Miss: Bayview Loan Servicing Foreclosure Listings

Can I Get An Auto Loan With Bad Credit

Many auto lenders are willing to consider a loan application from someone who has bad credit. This is because, as previously mentioned, an auto loan is a form of secured loan.

When you agree to a vehicle loan, you also agree to use your newly purchased vehicle as collateral. That takes much of the risk out of the lenders hands.

As with any loan product, your credit score will determine your loan rates. If you have poor credit, you can expect a higher interest rate and possibly an origination fee or other charges.

But just because the borrower assumes more risk doesnt mean the loans will come cheap. The fees youre charged may slightly increase your monthly payment and overall cost of credit.

However, theyre still worth it compared with the cost of taking public transportation or purchasing a cheaper vehicle that may need extensive and expensive repairs.

What Credit Score Is Needed For A Personal Loan

Youll generally need a good to excellent credit score to qualify for a personal loan a good credit score is usually considered to be 700 or higher. Your credit score also plays a major role in determining what interest rates you qualify for. In general, the better your credit score, the lower the interest rates youll likely get.

Here are the credit score ranges you can typically expect to see as well as how they can affect the interest rates youre offered:

Poor :

Fair :

While there are several lenders that offer fair credit personal loans, you can generally expect to pay a higher interest rate. Having a cosigner might get you a better rate, even if you dont need one to qualify.

Good :

A good score greatly increases your chances of qualifying with several personal loan lenders. Youre also more likely to receive more favorable rates. While you likely wont need a cosigner to get approved for a loan, having one might help you get the best interest rates.

Fair :

Scores above 750 will qualify you for the vast majority of personal loans as well as help you get the lowest interest rates advertised by lenders.

Don’t Miss: Usaa Rv Financing

Best For Home Improvement Loans: Lightstream

- Starting interest rate: 2.49%

LightStream specializes in home improvement loans with fast funding times and your home isnt required as collateral.

-

Wide range of loan amounts

-

No fees

- Maximum/minimum amount you can borrow:$5,000 to $100,000

- 2.49%19.99%

- Fees: None

- Minimum recommended credit score: LightStream does not disclose a minimum credit score. It will consider the “unique nature of each individual’s credit profile.”

- Other qualification requirements: Applicant must have several years of credit history with a variety of accounts and a good payment history, evidence of ability to save, and stable and sufficient income and assets to repay currents debt obligations in addition to a new loan from LightStream.

- Repayment terms: 24 to 144 months

- Time to receive funds: Within the same day of loan approval if approval process and final verification is completed by 2:30 p.m. ET

- Restrictions: Minimum APR available will depend on the purpose for your loan

- Notes: APR of 2.49% is only available for loan amounts between $10,000 and $24,999 with repayment terms of 24 to 36 months. Only applicants with excellent credit are eligible for the lowest rates.

Read the full review: LightStream Personal Loans

Check Your Credit Score

Large loans are typically more difficult to qualify for than those with smaller limits. To qualify for a $100,000 personal loan, you should have a score of at least 720, though a score of 750 or above is ideal. Before you apply for a large personal loan, check your credit score so you know what kind of loan terms youre likely to qualify for.

To do so, use a free online credit service. Some also offer cardholders access to credit score trackers, so take advantage of available resources to learn as much about your score as possible.

If your score isnt as high as youd likeand you dont need a loan immediatelytake time to improve your credit score before applying with a lender. The fastest way to build credit varies per borrower, but you can start by checking your credit report through AnnualCreditReport.com for accuracy and reporting any errors to the reporting bureaus.

Read Also: What Happens If You Default On A Sba Disaster Loan

How We Chose The Best Credit Unions For Personal Loans

Personal Finance Insider’s mission is to help smart people make the best decisions possible with their money. With that in mind, we reviewed several credit unions closely. We looked over multiple factors to figure out the best credit unions for personal loans, including:

- Annual percentage rates: The lower the interest rate on your loan, the better. We tried to choose lenders that offer low minimum and maximum rates across the spectrum of credit scores.

- Loan term length: We placed an emphasis on personal loans with a number of repayment lengths.

- Loan amount range: We chose lenders with a variety of loan minimums and maximums, so depending on the lender you choose, you may be eligible to take out anywhere from $500 to $100,000. Your exact loan amount will depend on your creditworthiness and other factors.

- Eligibility requirements: Generally, you can’t take out a personal loan from a credit union unless you’re a member, so we aimed to pick credit unions that make it easy to qualify for membership.

- Trustworthiness: Borrowing from an honest lender is often a top priority for many people. With the exception of Navy Federal and First Tech, we chose lenders with an A+ grade from the Better Business Bureau to provide the most trustworthy lenders possible. The BBB gives First Tech a C grade because of complaints filed against the business, while the group currently does not have a rating for Navy Federal as the credit union responds to previously closed complaints.

Where To Get Large Personal Loans

Online lenders are the best place to start your search for a large personal loan. Not only do they offer more streamlined application and approval processes, but they are also often more likely to lend large sums than their traditional competitors. That said, if you have an existing relationship with a local financial institution, its worth inquiring about the availability of large personal loans.

Consider these lenders if you need to borrow a large sum.

Recommended Reading: Loan Processor License California

Types Of Consumer Credit & Loans

Consumer loans and credit are a form of financing that make it possible to purchase high-priced items you cant pay cash for today.

Banks, and online lenders are the source for most consumer loans and credit, though family and friends can be lenders, too.

The loans and credit come in many forms, ranging from something as simple as a credit card to more complex lending like mortgages, auto and student loans.

Regardless of type, every loan and its conditions for repayment is governed by state and federal guidelines intended to protect consumers from unsavory practices like excessive interest rates. In addition, loan length and default terms should be clearly detailed in a loan agreement to avoid confusion or potential legal action.

In case of default, terms of collection for the outstanding debt should specify clearly the costs involved. This also applies to parties in promissory notes.

If you need to borrow money for an essential item or to help make your life more manageable, its a good thing to familiarize yourself with the types of credit and loans that might be available to you and the terms you can expect.

Bad Credit Personal Loans With No Credit Check

If youre applying for bad credit personal loans with no credit check, you should still be prepared to answer some questions about other areas of your financial life. Bad credit lenders that dont check your credit score do still look at other factors to decide whether or not to approve your bad credit loans request. Here are some of the things that bad credit lenders could ask you about before approving your bad credit loan:

- Your average monthly or yearly income

- Whether youre employed or are self-employed, and the size of the business where you work

- If you have anyone to co-sign your loan

- Whether you are currently going through bankruptcy

- How much debt you carry at the moment

You May Like: Upstart Loan Calculator

Best Places To Get A Personal Loan Online

Online lenders havent been around as long as banks and credit unions, but theres certainly no shortage of them. They process all of their applications online, so you typically wont have to wait long to receive a decision and get funded if youre approved. At the same time, their interest rates can be higher than those of banks or credit unions, depending on your credit.

Some online lenders may charge interest rates as high as 36% if your credit isnt the greatest. They may give rates as low as 6% to the most creditworthy customers, though. Online lenders may also be more willing than banks to lend to people with bad credit or no credit.

The Best Credit Unions For Personal Loans Of June 2022

You can get a personal loan from many types of institutions, but you may prefer to go through a credit union.

Getting a personal loan from a credit union offers many advantages over a bank or online lender. The max APR is capped by the NCUA, so if your credit isn’t in the best shape, you may get a lower rate than with some online personal loan lenders. Some of our top picks also have smaller minimum loan amounts than other lenders, which could be helpful if you just need a little cash.

You can take out a personal loan for a variety of purposes, including debt consolidation, home improvements, and major purchases. You’ll need to join one of these to take out a personal loan from them, but here are some great options for beginning your search.

Read Insider’s review of Alliant Credit Union’s personal loans.

In most cases, you can get loan approval and funding on the same day with Alliant, which gives the lender a leg up on competitors whose approval processes are slower. The lender charges no origination fees and has no late payment penalty, lowering the overall cost of your loan.

You can also purchase debt protection for your loan that covers death, disability, and involuntary unemployment, safeguarding you from unexpected events that could leave you unable to repay your loan. The monthly cost for debt protection is $1.99 per $1,000 of your outstanding loan balance.

Read Also: Rv Loan Calculator Usaa

How To Use A Small

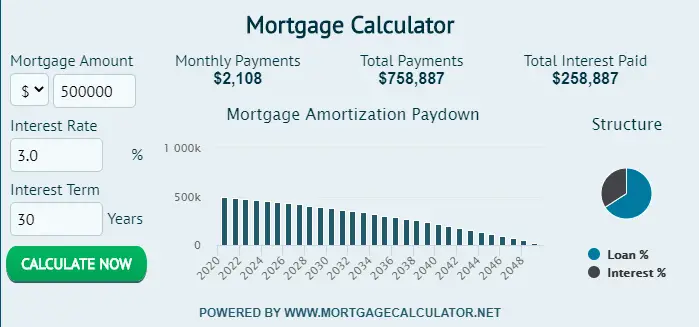

To get the most accurate total cost estimate, youll need to gather a little information before you use a business loan calculator:

- Loan amount

- Interest rate

- Loan term

- Extra monthly loan payment amount

You dont need to have the exact numbersafter all, you probably wont know your final interest rate until you get approved for your loanbut more accurate numbers will give you more accurate results .

Once you put in all those numbers, just click the button to have the calculator do the math for you. And there you gothe total cost of your loan.

You can also use a loan calculator to see how different rates, terms, or payments would affect the total cost of your loan. So if youre deciding between a loan with a longer repayment term and a lower rate and a loan with a shorter repayment term and a higher rate, you can use a calculator to find out which one offers the better deal.

But thats not the only thing a loan calculator can show you.

How Do You Qualify For A $100000 Personal Loan

To qualify for a $100,000 personal loan, make sure you have a strong credit profile and present a low level of risk to the lender. In general, a qualified applicant for a large loan has a FICO credit score of at least 720. However, prospective borrowers with a score of 750 or higher are more likely to qualify for the best rates.

Qualified applicants should also demonstrate stable employment and an income large enough to comfortably cover loan payments and other debt services. Lenders will look at your income when determining whether you qualify.

Read Also: How To Get A Mortgage License In California

How To Qualify For A Loan With Fair Credit

To improve your chances of obtaining a personal loan with fair credit, try taking the following steps before you apply:

- Use a co-signer: While a co-signer adopts some responsibility for your loan and therefore some risk they may also make it easier for you to qualify. Choosing a co-signer with good credit will improve your overall creditworthiness.

- Prequalify: If you’re unsure if you’ll qualify for a loan with a particular lender, see if it offers prequalification. That way, you’ll avoid harming your credit score even further before applying.

- Pay down debt: Many lenders consider your debt-to-income ratio in addition to your credit score. By paying down credit card debt before applying for a loan, you’ll look better to potential lenders.

- Use a local bank or credit union: Your existing bank or a local credit union may be more lenient when it comes to your credit score, especially if you have a history of timely payments on your accounts.

Is It Important To Compare Mortgage Rates

Comparing mortgage rates is one way to save money on your home loan. If you accept the first offer you see, you may regret it later. With so much competition in the lending industry today, you can usually find a lower rate if you do a little price comparison.

The easiest way to find low rates is to shop around. This is really easy in todays internet-driven world. There are loan calculators, comparison tools, lender portals, and more all designed to help you line up offers to see which is giving you the right deal.

Recommended Reading: Usaa Student Loans Review

Does The Va Offer Jumbo Loans

In general, jumbo loans exist outside government-backed mortgage programs, with one exception: the Veterans Administration. The VA offers jumbo loans to qualifying service members. In fact, the VA sets no specific loan limits most of the time. The only limit in many cases is based on lender risk tolerance.

Other Ways To Get $100000 In Financing

If a personal loan isnt an option, there are other ways to get $100,000 in financing. There are options for people with equity in their home or other real estate, including:

- Home equity loan. A home equity loan is a lump-sum loan that is secured by the borrowers equity in their home. This involves taking out a second mortgage by borrowing against that equity. Because the loan is collateralized, the lender faces less risk than with unsecured loans. Consider a home equity loan if you need a lump sum of cash and have substantial equity in your home.

- Home equity line of credit . Like a home equity loan, a HELOC lets borrowers use their home equity to access a line of credit, which they can use on an as-needed basis and only pay interest on the funds they borrow. If you have a lot of equity in your home and need funds over an extended period of timerather than all at oncea HELOC may be a good option.

- Cash-out refinancing. In contrast to home equity loans and HELOCs, cash-out refinancing does not involve a second mortgage. Instead, the borrower refinances her mortgage for more than the outstanding balance of the original mortgage and gets the difference as a lump sum payment. This may be a good option if you have a high credit score and substantial equity in your home.

Also Check: Car Loan Interest Rates Credit Score 650