How To Apply For An Upstart Personal Loan

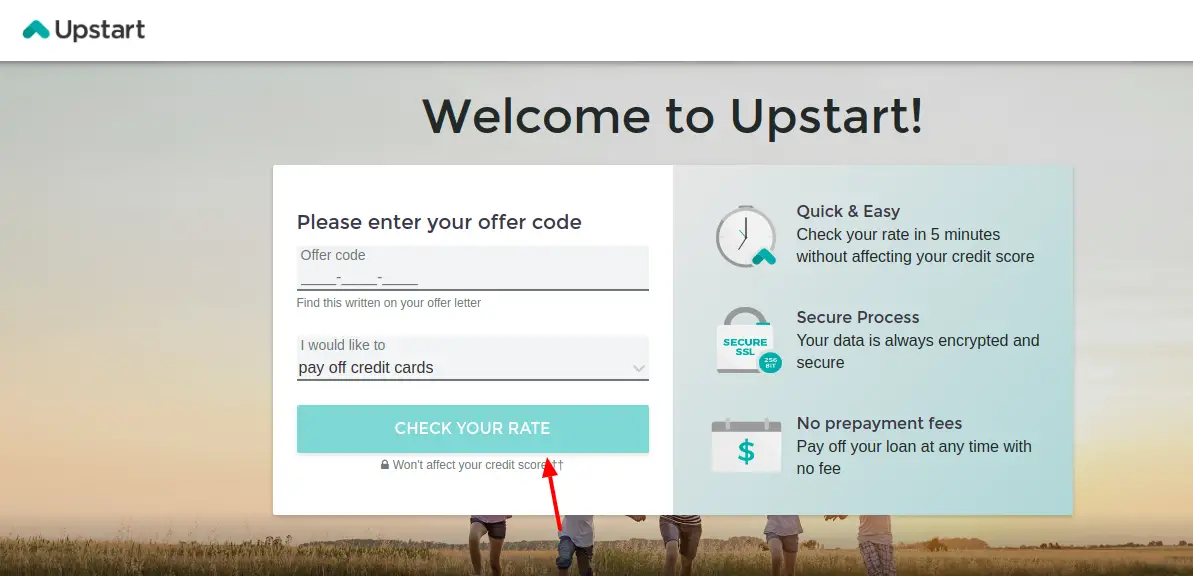

The Upstart loan application and funding process takes place entirely online and will have you create an account, indicate how much you want to borrow and select a loan purpose.

You’ll also need to share your personal information, including details about your academic and employment history, and agree to a soft credit check, which lets Upstart review your credit to verify your information and help determine if you qualify for a loan.

If you prequalify for a loan and accept an offer, you’ll then have to verify your bank account. You may also have to verify other information by uploading supporting documents, such as pay stubs, tax forms or school transcript. You may also need to call Upstart for additional verification.

Once your application is approved, you can view your final disclosure forms and sign the promissory note.

What Credit Score Do You Need For Upstart

With Upstart, a credit score of 580 is considered sufficient for applying for a personal loan in any state in the US. With the exception being you cant have bankruptcies or deliquincies.

However, in some cases such as a personal loan for educational purposes, they might require a minimum credit score of 620.

If you dont have a credit score of 620, you can increase your chances during the application process if you are sure to highlight your current and past employment, as well as academic achievements.

What To Know Before Getting A Personal Loan

Personal loans can be a quick way to access cash, but its important to use them wisely. Before applying, you should know how youll use the money and create a plan for repaying the loan. Then, you should compare multiple lenders to find the best interest rate and loan terms.

When shopping for lenders, keep in mind your interest rate may differ slightly from the advertised rates. Thats because rates and loan terms are based on factors like your , income, and loan amount. Some lenders will let you pre-qualify for a loan or check your rate with only a soft credit inquiry, which wont affect your credit score. You should also check out the fees youll pay and the length of the loan term, which can influence the cost of the loan.

Most lenders offer unsecured personal loans, which means you wont need to put down collateral to secure the loan. Secured loans may offer lower interest rates, but they come with more risk because you could lose your collateral if you fall behind on payments.

Also Check: What Is The Average Student Loan Debt

How Is Upstart Different From The Others

Upstarts main advantage over other lending sites such as Lending Club and Prosper seems to be its transparency when it comes to fees.

Members always know how much they have made or lost and because their rates are not fixed, they benefit from the most competitive interest rates available on the market at that given time .

This is way better than having fixed percentage taken out every time regardless of how much money someone has actually returned its investors trust so Upstart seems like a great alternative for those looking for more flexibility without giving up any stability

And finally

Upstart claims to be more transparent than other investment platforms so it is always better for investors to pay attention to their returns and fees before making any decision in case they want to take advantage of the best deals possible.

Read the Entire Personal Loan Series

Have A Fair To Average Credit Score

This is at a minimum. To maximize your chances of approval, get your score up to at least 620 at a minimum.

The simple way to do this is to pay your bills on time every month and dont use too much credit30% is ideal. As per their website:

Borrowers on Upstart must have a minimum FICO or Vantage score of 620 as reported by a consumer reporting agency. Note, we do accept applicants with insufficient credit history to produce a FICO score.

You May Like: Can You Pay Off Sofi Loan Early

Pros And Cons Of An Upstart Personal Loan

| Pros | Cons |

|---|---|

|

|

The Valuation Metrics Are Obvious

I’m not telling anyone anything new here, but Upstart is currently trading at what seems to be an absurdly high valuation, whether you look at it on a price-to-earnings or price-to-sales basis.

UPST P/E ratio data by YCharts.

Analysts on average expect Upstart to generate $1.33 in earnings per share this year, and management has told us to expect the company to do about $750 million in annual revenue for 2021. So for Upstart to trade at 50 times earnings, it needs to grow annual EPS by nearly 400%.

The good news is that analysts on average are projecting EPS to grow by nearly 30% in 2022, so it is growing the bottom line at a nice pace. And those are just estimates. Upstart could explode into the auto market and continue increasing bank partners and personal loans. But it’s a lot to wager on so much uncertainty.

And while Upstart has been growing revenue a ton , management’s guidance implies less growth in the third quarter. Management is guiding for revenue to be between $205 million and $215 million next quarter. At the high point, that would imply 11% year-over-year revenue growth in the third quarter, which is all well and good except when investors’ expectations for growth are so massive.

Recommended Reading: Does Refinancing Car Loan Hurt Credit

How Upstarts Debt Consolidation Loan Works

Upstart offers loans ranging from $1,000 to $50,000. It offers 3-to-5 year repayment terms, but you dont get to decide which. Your loan term and rate are non-negotiable. Theyre generated by Upstarts AI lending model, based on the information that you entered on your application and a soft credit pull. Once Upstart reveals your rate, you can either take it or leave it. Fortunately, you can check your rates without doing any damage to your credit score and it wont take more than a few minutes.

What Are Upstart’s Lending Terms

If you choose to apply for a personal loan through Upstart, you can choose from a flexible three or five-year loan with a fixed interest rate. You will pay around $28 for every $1,000 you borrowed each month. So this means if you borrowed $5,000 you would pay $140 a month until the loan is paid off. The minimum loan you can apply for is $1,000, and it goes up to $50,000 per loan, except if you live in Ohio or Massachusetts, then your minimum loan price goes up to $6,000 and $7,000, respectively. Since the interest rate is fixed, the interest rate you get when you first obtain your loan will be the interest rate you keep throughout the life of your loan. These fixed interest rates range from 6.37 percent to 29.99 percent.

You May Like: How To Figure Car Loan Payments

A Good Option For Middle

Upstart’s offering could appeal to a wide range of borrowers, as you may be able to borrow as little as $1,000 and as much as $50,000.

The interest rate you’ll end up paying also can vary widely. The low end isn’t as low as some personal loan lenders offer. At the high end, Upstart’s rates may be higher than the top rate some other lenders offer, but the rates from Upstart are still lower than you may find from some of the personal loan lenders that exclusively focus on borrowers who have bad credit.

As a result, Upstart might not be the best option for those with excellent credit. However, it may be a good fit for almost anyone elseâparticularly those who have trouble getting approved by other lenders.

Once you take out your loan, your interest rate will be fixed for the lifetime of the loan, which could be either three or five years, and you’ll make fixed monthly payments.

Can You Refinance A Personal Loan With Upstart

Upstart allows borrowers to use personal loans obtained through the platform for “almost anything,” including refinancing other debts. Upstart specifically notes that you can use your loan proceeds for the following purposes:

- Paying off credit cards

- Paying off student loans

Upstart’s loan platform is worth considering if you have less than perfect credit or you need to access loan proceeds quickly. The ability to take out a second loan through Upstart, if you are eligible, may also be beneficial to some borrowers.

However, its important to note that borrowers with good or excellent credit might be able to find a better deal elsewhere. Some personal loan providers may offer lower interest rates, fewer fees, and larger loan amounts than you can find with Upstart.

Perhaps the best news is that Upstart makes it easy for you to compare your loan offer to deals you find from other lenders. Simply complete the prequalification process on the Upstart website to discover your rate and see if the platform gives you the best offer for your situation.

Read Also: Can I Get An Auto Loan With No Credit

Prequalify With Soft Credit Pull

Through Upstart’s website, you can fill in an application to prequalify for a loan. This will trigger a soft credit inquiry that won’t harm your credit score.

The information required to prequalify and check estimated loan terms is:

- Loan amount needed and intended use

- Full name, address, contact details, and date of birth

- Level of education

- Loan activity in recent years

Upstart Personal Loan Rates & Terms

Depending on your credit history, education, and career credentials, your APR will be anywhere from 6.76% to 35.99%. According to Upstart, the average APR for a three-year term is 25.79%.

Upstart doesnt offer the widest range of terms: Youll get a choice between a three-or five-year term. However, Upstart doesnt charge a prepayment penalty, so you can pay off your balance early if you can afford it.

Upstart offers funding for a variety of purposes. While the rates and repayment lengths are the same for all loan types, the average amount of each loan type may differ. The average Upstart home improvement loan amount is around $8,983.59, while the average for medical loans is around $5,598.43.

Don’t Miss: What Bank Has The Lowest Home Equity Loan Rates

Who Qualifies For An Upstart Personal Loan

Although Upstart’s unique underwriting may improve your chances of getting a loan, make sure you meet the following borrower and credit eligibility requirements.

Minimum borrower requirements:

- Be a U.S. citizen or permanent resident living in the U.S. with a verifiable Social Security number

- Be at least 18 years old, or at least 19 if you live in Alabama or Nebraska

- Not live in Iowa or West Virginia

- Have a valid email account and personal U.S. bank account

- Have a regular source of income, such as a part- or full-time job have an offer to start a job within six months or have been accepted to one of the partner coding bootcamps

If you are a current or previous Upstart borrower, you may qualify for a second loan if you’ve made at least six consecutive payments on time and don’t have more than $50,000 in outstanding debt.

In addition to the borrower requirements, you need to meet some credit requirements, including:

- Have a FICO® Score or VantageScore® that meets lender requirements

- No bankruptcies on your credit report

- No currently past-due accounts on your credit report

- No more than six hard inquiries on your credit report

Even if you get preapproved for a loan offer, Upstart will check your credit before sending your loan and may revoke the offer if it finds your credit score drops by more than 25 points or you no longer meet the requirements.

What Happens If I Cant Repay

Before you miss a payment, reach out to your lender and let them know whats going on. Lenders are more likely to work with you before you have months of missed payments and mounting fees. One you miss a repayment, lenders will reach out to you to figure out how to get your personal loan back on track. If you remain behind on your payments, lenders will report this to the credit agencies, which will have a negative impact on your credit score.

Recommended Reading: How Many Months To Pay Off Loan

Does It Cost Anything To Apply For A Personal Loan

Once the personal loan has been finalized, most lenders will take out an origination fee before transferring the money. This fee is only charged once and is essentially to help the lender pay for the cost of issuing the loan. This fee is generally removed from the funds you receive, so if you take out a $10,000 loan with a 4% origination fee, you would receive $9,600 from the lender.

Most personal loans do not have loan application fees, so there is usually no cost to applying for the loan if you do not get it. If you are unsure, ask before applying as most application fees are nonrefundable.

Will Upstart Hurt Your Credit

According to the Upstart website, your credit score will not be hurt if you apply for a personal loan with Upstart.

However, if you stick to the repayment schedule and pay the monthly installments on time, your credit score stands to increase. And when you pay off the loan in full, your credit should also improve.

Some borrowers have reported that after being denied credit from Upstart, their credit report was negatively impacted. And some borrowers with already poor credit who have tried to use Upstart for debt consolidation have noticed that rejections have hurt their credit standing.

So while it may not hurt your credit if youre approved, you could see a ding on your credit if you are rejected and already have poor credit.

Upstart states on their site that they only do a soft inquiry first. And then when you accept the loan, they do a hard credit check, which will impact your score.

A post shared by Upstart | Personal Loans on Feb 26, 2020 at 4:17pm PST

NOTE: Upstart will report you to the credit bureaus when you do take out the loan as well as your repayment information, so keep this in mind.

Defaulting on a Loan

Your credit score will most certainly take a hit if you default on payments. Or if you fail to pay off the loan in during the timeline set forth in the terms of the loan.

As I mentioned above, the minute you take out the loan you will be reported to the credit bureaus from that point on.

You May Like: Can I Get Home Equity Loan On Investment Property

What Is A Floating Rate Loan

While most personal loans have a fixed interest rate, some personal loans allow the rate to change over time usually after an initial period such as 1 year. Typically the rate will increase based on some external measure like the prime rate. Its important to know if your rate is fixed or floating, because a floating rate will likely mean that your required monthly payment will increase in the future. Because this rate usually goes up, the lower initial rate is sometimes called a teaser rate.

Fees For Upstarts Services

At Upstart, you can find debt consolidation loans with fixed rates between 7.98%-35.99%. Theres no prepayment penalty so you can pay off as much as you want as quickly as you want.

An Upstart debt consolidation loan comes with its fair share of fees. Most wont affect you if you pay your bills on time and in full.

The first fee is an origination fee ranging from 0%-8% of the loan. Some lenders charge origination fees to help offset the cost of underwriting a loan. Its a service fee that gets taken out of the initial loan amount. If you were approved for a $30,000 loan with an 8% origination fee, your actual loan amount would be $27,600. An 8% origination fee is considered high, so Upstart loses some points with consumers here.

Theres a late fee after a 10-day grace period. Upstart will charge you either 5% of the monthly past due amount or $15, whichever is greater.

Also, it charges an ACH return or check refund fee of $15. It will charge you this for trying to pay when you have insufficient funds in your account. This may happen if you had the funds ready when you initiated the payment but your account was short by the time it went through.

Generally, banks dont like it when you try to pay bills without enough money in your account. They often charge their own overdraft fees, as well.

Recommended Reading: What Kind Of Car Loan With 600 Credit Score

Upstart Personal Loan Features

Online Application

Upstart makes it easy for applicants to apply for a personal loan online, no doubt because its the only option available. Borrowers who prefer to apply for loans over the phone or in-person may not be happy with this limitation.

Second Loan

Even if you already have a personal loan through the Upstart platform, you may be able to take out a second loan. To qualify for one, you will need to satisfy the following criteria:

- Your last six monthly payments must have been made on time.

- You have no more than one outstanding loan with Upstart.

- The outstanding balance on your existing loan cannot be higher than $50,000.

Soft Initial Credit Inquiry

As do many providers in the personal loan space, Upstart allows you to see if you prequalify and check your rate with just a soft credit inquiry. Such a credit check does not damage your credit score indeed, it doesnt even appear on credit reports viewed by lenders, though you can see soft inquiries when you check your credit personally. If you accept your rate and decide to move forward with an official loan application, Upstart will then perform a hard credit inquiry, which could potentially impact your credit score temporarily.