What Are The Steps To Getting A Loan

The Loan File. The loan file is where it all begins. … The Credit Report. In many cases, the credit report may already be provided for you. … Title Records and Information. … Verify Income Sources. … Appraisals, Insurances, and Inspections. … Loan File Review. … Certify and Deliver the File.

Things To Know About Homeowners Insurance

Receive Unconditional Approval And Pay Your Deposit

Once youve satisfied the lenders conditional guidelines, your home loan will most likely be formally approved.

The lender will issue a formal approval letter indicating that theyre happy to proceed to the settlement stage.

Once you have received your formal approval, you can get in touch with your lender and arrange to sign the home loan contract!

In the meantime, the unconditional approval letter can be used to secure your property, and you can arrange with the seller of your new home for you to pay the deposit.

Once the lender has confirmed that all of the documents youve signed are in order, they can then transfer the loan funds so that you can pay the seller.

In most cases, theyll contact your solicitor or conveyancer and advise them that the funds are available and that they can book a settlement time and date with the lender.

Don’t Miss: When Can You Use Your Va Loan

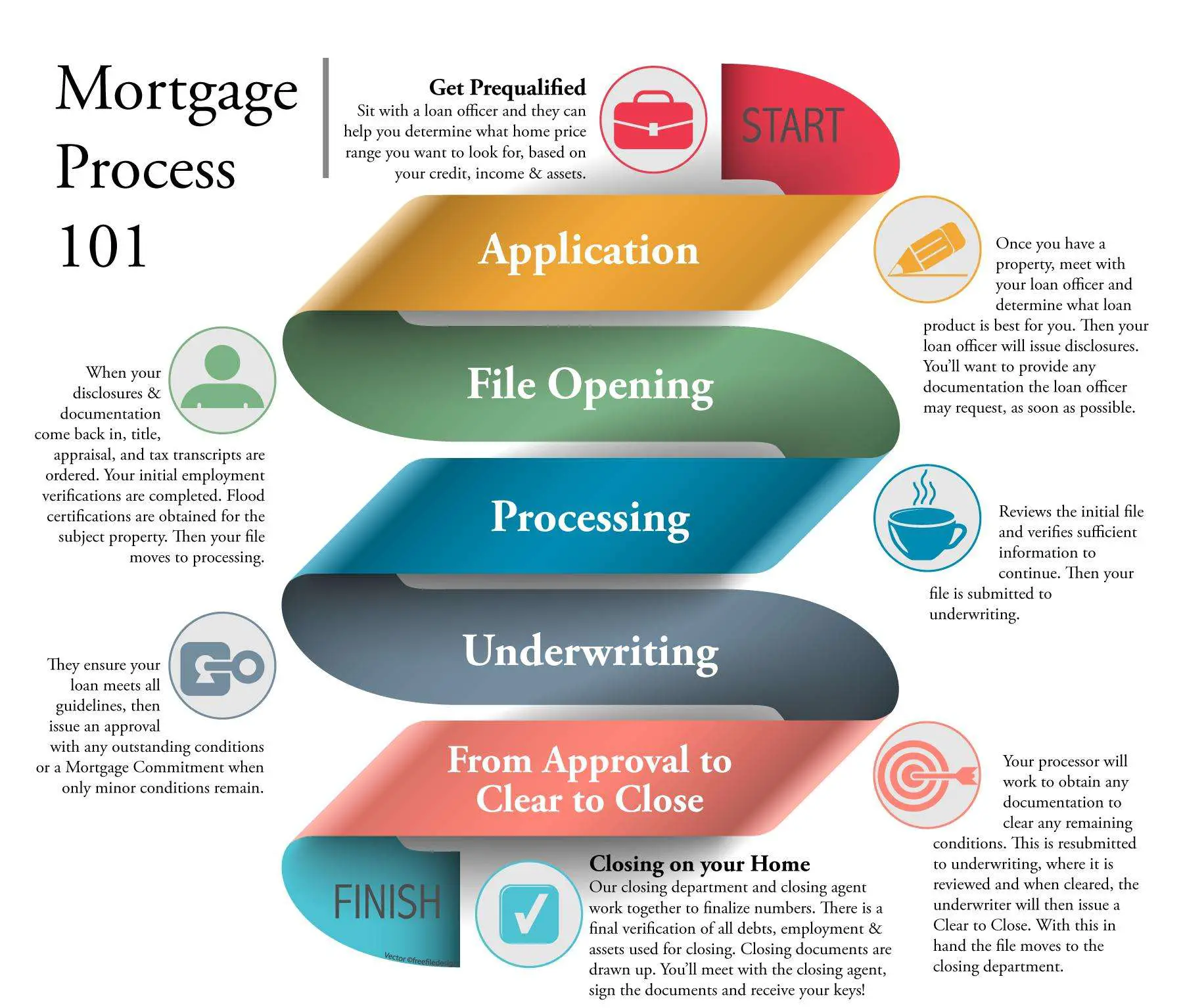

The Mortgage Origination Process Defined From An Operations Perspective

The mortgage loan origination process typically includes all the steps leading up to, and including, the successful closure and funding of a mortgage loan. The process is triggered when a borrower inquires about a loan, or when a lead is generated through the banks marketing channels. On average, this process takes anywhere from 30 60 days.

Sales & Business Development: Lenders and mortgage loan officers develop relationships with potential borrowers through multiple channels .

Application Processing: Borrower data is collected and prepared for underwriting. Pre-approval is typically obtained at this point before the final underwriting decision.

Underwriting: Borrower data is verified for accuracy and completeness, and used to assess credit-worthiness.

Closing: Final interest rates and loan terms are locked in here, fees are collected and the borrowers loan is funded.

Post-Closing: Loan data is checked again for accuracy and completeness, and the loan is boarded into the lenders system for servicing . Loans may also be prepared for sale to another financial institution at this point.

Do You Have Questions About The Mortgage Loan Process

Hopefully, you now better understand how the mortgage process works. Do you still have questions? Dont hesitate to contact us. Were here to help the process and to provide the kind of personal service you deserve.*

*Guaranteed Rate cannot guarantee that an applicant will be approved or that a closing can occur within a specific timeframe. All dates are estimates and will vary based on all involved parties level of participation at any stage of the loan process.Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply, contact Guaranteed Rate for current rates and for more information.Guaranteed Rate does not provide tax advice. Please contact your tax adviser for any tax related questions.

- Manage your mortgage

Read Also: Home Equity Loans Us Bank

How To Fill Out And Sign Prepares Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The days of distressing complex legal and tax forms are over. With US Legal Forms the procedure of completing official documents is anxiety-free. A powerhouse editor is directly at your fingertips offering you a range of useful tools for filling out a Mortgage Loan Process Flow Chart Pdf. The following tips, together with the editor will guide you through the whole procedure.

We make completing any Mortgage Loan Process Flow Chart Pdf more straightforward. Use it now!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Clear To Close Timeline

How many days before closing do you receive mortgage approval? Clear to close timelines vary by lender and even underwriting team. There are also unique conditions that could extend the clear to close timeline. Unusual aspects on a loan application or spikes in mortgage team workloads can cause the process to take longer.

Read Also: What Is The Max Student Loan Amount

How To Create Flow Chart For Loan Management

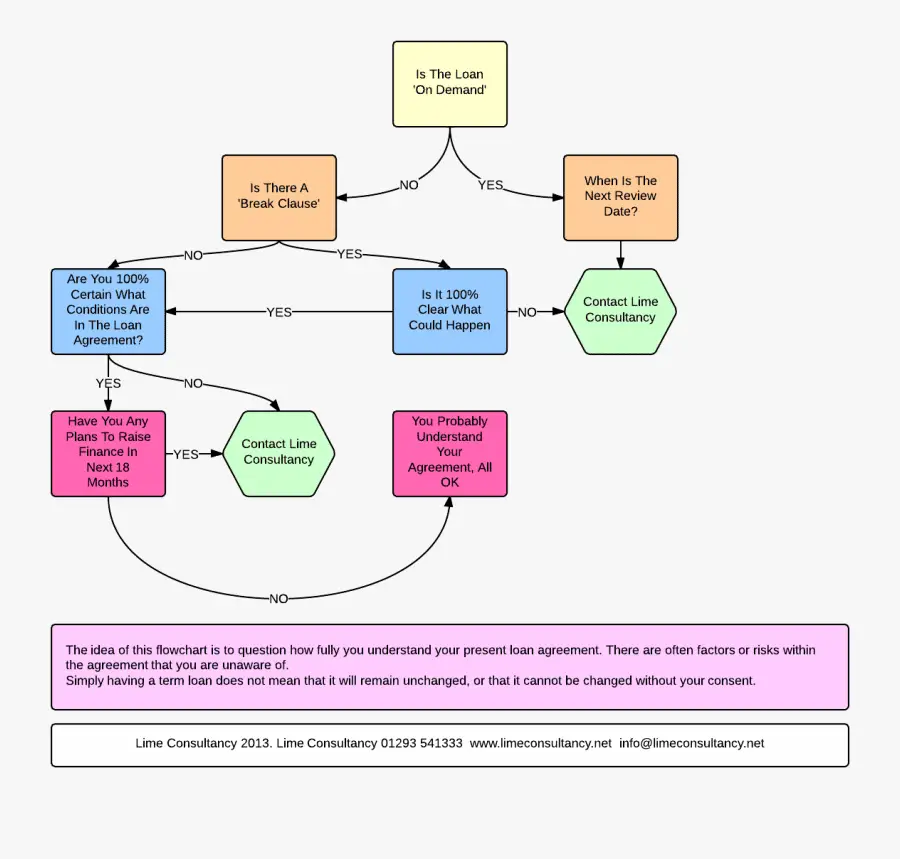

Loan Management, which means managing the loans and aims to use the loans reasonably and avoid bad loans. There are main three loans, which are mortgage loans, consumer loans and installment loans. Before allowing loans, the first thing customer managers should do is assess the borrower to check if he meets the conditions of loaning and make sure the borrower has no misconduct. Then customer managers determine the loan limit according to borrowers credit , producing and operating status.

Flow chart for loan management is a diagram which uses vector symbols to visually depict the managing process. It helps customer managers to go on those steps one by one without miss any steps and follow up borrowers easily to avoid bad loans.

Edraw Flowchart Maker is a professional application for creating flow chart for loan management. Users like it for its following handy features:

Following is tutorial which will show you how to create a flow chart for load management with no difficulty.

Mortgage Loan Process Overview

The third and final stage in the home loan process is the mortgage loan process. The mortgage loan process typically begins after executing a purchase contract with the seller.

Please revisit the dos and donts from the qualifying for a home loan section to ensure a smooth closing. You may also want to visit our closing costs overview and our mortgage payment calculators in the mortgage resource library.

Also Check: How To Qualify For Fha Loan In Arizona

Close On The Property

If your mortgage application is approved, its now time for closing. At this stage, a large stack of documents will be printed out and youll be invited to the title company for a closing meeting.

One of the most important documents youll see at this meeting is your closing disclosure form. On this form, youll see a column showing the original estimated closing costs and final closing costs, along with another column indicating the difference if costs rose.

Closing costs typically range from 2% to 5% of the homes purchase price. Thus, if you buy a $200,000 house, your closing costs could range from $4,000 to $10,000. Closing fees vary depending on your state, loan type, and mortgage lender, so its important to pay close attention to these fees.

If you see new fees that were not on the original loan estimate or notice that your closing costs are significantly higher, immediately seek clarification with your lender and/or real estate agent.

If everything looks to be in order, you will sign to accept the mortgage and you will leave the office with the keys to your new home. Well done!

The Buying Process In A Easy To Follow Flowchart

Depending on who writes/designs a home buying diagram the process can look slightly different. Reviewing a lender’s, escrow’s, or title’s buyer flowchart they all start a bit different yet end at the same place, closing. The below buyer’s diagram starts at the real estate broker but experience shows the buyer starts in 1 of 3 places: the real estate agent, the lender, or home searching on their own.

Don’t Miss: How To Calculate Student Loan Interest Per Month

How The Mortgage Agency Can Help You

The home loan process can be quite a long one. But, doing it properly means you will be able to reap the rewards.

Mortgage brokers can play an important part in the process by advising you on preparing your credit rating and making yourself an attractive borrower to lenders. Theyll also help you apply for the loan and can provide guidance right up until the settlement money is transferred and you pick up the keys.

At The Mortgage Agency, the road doesnt end there. Not only will our expert brokers guide you through the home loan process step by step, but they will also continue to provide support afterwards should you have any questions or even want to refinance or buy an investment property or holiday home one day in the future.

If you would like to see how our expert team of mortgage brokers can assist you in the home loan approval process, get in touch today.

A Guide Of Editing Mortgage Loan Process Flow Chart Pdf On G Suite

Google Workplace is a powerful platform that has connected officials of a single workplace in a unique manner. While allowing users to share file across the platform, they are interconnected in covering all major tasks that can be carried out within a physical workplace.

follow the steps to eidt Mortgage Loan Process Flow Chart Pdf on G Suite

- move toward Google Workspace Marketplace and Install CocoDoc add-on.

- Attach the file and Push “Open with” in Google Drive.

- Moving forward to edit the document with the CocoDoc present in the PDF editing window.

- When the file is edited ultimately, download and save it through the platform.

Recommended Reading: Which Bank Gives Lowest Interest Rate For Home Loan

Other Features Of Mortgage Loans

Heres a look at some of the other features and benefits of a Mortgage Loan

- High value loansA salaried individual can avail up to Rs. 1 crore, while a self-employed individual can avail up to Rs. 5 Crore*

- Longer repayment tenorThe repayment tenor ranges from 2 to 18 years for salaried and for self-employed customers

- Competitive interest ratesMortgage loan interest rates are lower than the interest rates of unsecured loans

- Minimal documentsYou only have to provide few basic documents to avail a mortgage loan. Bajaj Finserv processes the fastest Loans Against Property in just 72 hours* along with loan amount disbursals within 3 days*

- Simple eligibility criteriaThe mortgage loan eligibility criteria can be fulfilled easily. You must be within the age bracket of 28 and 58 if you are salaried, and between 25 years and 70 years of age if you are self-employed. A good CIBIL score will further ease the loan approval process

Apply for a Bajaj Finserv Mortgage Loan and finance your needs today.

How Does A Mortgage Loan Work

A mortgage loan is secured in nature. This means, you pledge a property and avail a loan against it. This property is the collateral that is held by the lender until you repay the loan fully. Repayment is made through equated monthly EMIs. Mortgage loan interest rates are lower than the interest rates of unsecured loans due to the presence of collateral, which reduces the lending risk.

In the initial stages, the interest component constitutes a larger part of your EMIs as compared to the principal amount. As you continue through the tenor, the principal component of your EMI increases while the interest value decreases. However, the total EMI value remains constant.

As you continue through the tenor, the principal component of your EMI increases while the interest.

You May Like: How To Get Low Interest On Car Loan

Go Through Underwriting Process

The next stage is for your application to be assessed by underwriters.

Though you are unlikely to deal with them directly, mortgage underwriters are actually the key decision-makers in the mortgage approval process and are the people who will give final approval for your mortgage.

Underwriters will check every aspect of your mortgage application and carry out a number of other steps. For instance, borrowers are required to have an appraisal conducted on any property they take out a mortgage against. The underwriter orders this appraisal and uses it to determine if the funds from the sale of the property are enough to cover the amount you will be lent in your mortgage.

Once underwriters have assessed your application, they will give you their decision. This will either be to accept the loan as it is proposed, reject it, or approve it with conditions. Your mortgage might be approved, for instance, on the condition that you supply more information about your credit history.

If your application is approved, you will then lock in your interest rate with your lender. This is the final interest rate you will pay for the remainder of your mortgage term.

Look At Houses Online

Online shopping is very convenient and you can even shop for houses here. There are a few things you need to know first. Know that none of the prices posted are final. Most of the prices posted are starting points, every smart home shoppers should know this. The second thing you should know is that the listings on even the biggest real estate portals arent always updated. Lastly, the portals do not show the availability of the property most of the time. It would be better if you have an agent to help you out.

You May Like: What Is An Agency Loan

Why Do I Need A Home Inspection

A home inspection is an added expense that some first-time homebuyers dont expect and might feel safe declining, but professional inspectors often notice things most of us dont. This step is especially important if youre buying an existing home as opposed to a newly constructed home, which might come with a builders warranty. If the home needs big repairs you cant see, an inspection helps you negotiate with the current homeowner to have the issues fixed before closing or adjust the price accordingly so you have extra funds to address the repairs once you own the home.During the inspection, be sure to ask questions and bring a checklist of things you want information on. Note that a comprehensive inspection should not only bring defects and problem areas to your attention, it should also highlight the positive aspects of a home as well. When you receive the final report, prioritize the issues and decide whether you want to negotiate those items with the sellers. Remember: Every deal is different and negotiable.