What Is A Car Loan Maturity Date

The maturity date of a car loan is the date when the borrower of the loan pays back the loan installments in full according to the schedule. However, when a car loan reaches its maturity date, one cannot say that its paid back fully. There are situations when some amount is remaining when the auto title loan reaches its maturity date.

Remaining Amount After Car Loan Maturity Date

If for any reason, you are unable to make the payment during the loan period, the car title loan lender will add a fee to the balance amount of the loan. Some lenders have an offer during the holiday season to skip the payment. However, there is a fee to benefit from this offer, which will be added to the remaining balance.

In case you skip or miss a payment, the due date goes to the coming month, while the interest continues to accumulate. If you have availed of such offers, the remaining amount on the maturity date will consist of skipped payments plus interest.

What Is My Actual Maturity Date

Your actual maturity date may occur earlier by up to four calendar days than your scheduled maturity date due to our system processing.

The actual maturity date depends on the day of the month the scheduled maturity date falls on, and if that day is on a business day or a non-business day.

Note: Interest in Advance periods will mature on the scheduled maturity date, even if it is a non-business day.

You May Like: What Happens If I Refinance My Car Loan

What Is A Short Term Debt Instrument

A short term debt instrument means a debt instrument that meets the requirements set out in Q4 and is issued on or after 25 March 2011 but before 1 April 2018, has an original maturity of less than 3 years or is undated and can be redeemed within 3 years from the date of its issue. 6. What is a medium term debt instrument?

What Happens If Loan Is Not Paid By Maturity Date

Payment Collection of Remaining Amount If you own a balance past the maturity date, your lender will charge fees on the payments you missed. And the interest

If borrowers do not apply for forgiveness within 10 months after the last day of the covered period, then PPP loan payments are no longer deferred, and

Acceleration happens typically after the lender makes a clear demand for payment of the entire loan balance, saying that it will accelerate the loan if not paid

You May Like: What Is Equity Reserves Fha Loan

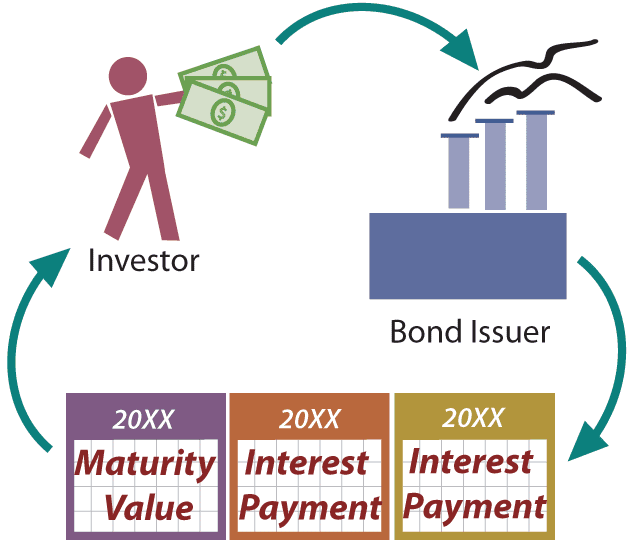

Relationships Between Maturity Date Coupon Rate And Yield To Maturity

Bonds with longer terms to maturity tend to offer higher coupon rates than similar quality bonds, with shorter terms to maturity. There are several reasons for this phenomenon. First and foremost, the risk of the government or a corporation defaulting on the loan increases, the further into the future you project. Secondly, the inflation rate expectedly grows higher, over time. These factors must be incorporated into the rates of return fixed income investors receive.

To illustrate this, consider a scenario where an investor who in 1996 bought a 30-year Treasury bond, with a maturity date of May 26, 2016. Using the Consumer Price Index as the metric, the hypothetical investor experienced an increase in U.S. prices, or rate of inflation, of over 218% during the time he held the security. This is a glaring example of how inflation increases over time. Furthermore, as a bond grows closer to its maturity date, its yield to maturity , and coupon rate begin to converge, because a bond’s price grows less volatile, the closer it comes to maturity.

With callable fixed income securities, the debt issuer can elect to pay back the principal early, which can prematurely halt interest payments doled out to investors.

What Is My Fixed Rate Home Loan Scheduled Maturity Date

Your Fixed Rate Home Loan/Investment Home Loan maturity date is the scheduled last day of your Fixed Rate term. At the end of day on your scheduled maturity date, your home loan will switch to a Standard Variable Rate Home Loan/Investment Home Loan, and the interest rate will revert to the Standard Variable Rate applicable to your loan and repayment type at the time, less any Wealth Package/Mortgage Advantage discount.

Recommended Reading: How To Accept Fafsa Loan

What Happens At The Date Of Loan Maturity In A Payday Loan

The borrower is responsible for repaying the debt. When people are in a financial bind, payday lending companies provide a safe haven, but payday is still a few days away.

Many people take use of payday loans from non-banking financial institutions.The loans provide borrowers with enough assets to see them through to their next payday, at which point the advance and interest become due.

Borrow Against Your 401

Taking a 401 loan is an option, but many financial experts consider it a last resort. Not only will you miss out on compounding interest on any amount you borrow, but you risk being forced to pay more in taxes and possibly a penalty if you fail to repay the loan. However, this can be a viable option for low-credit borrowers or simply those whod rather avoid high interest debt. Just keep in mind that some 401 plan providers do not permit 401 loans.

This guide explains more about 401 loans and how they work.

You May Like: Greater Lakes Student Loans Login

What Is The Loan Maturity Date

The day when a debt must be paid in full is known as the maturity date. If you took out a mortgage, your lender will most likely advise you of the loans impending maturity date.

If you have a mortgage, youll generally be given 2 alternatives if the loan term expires:

The maturity date for a secured loanis the same as that of an unsecured one, when all assets given by the borrower have been repaid in full or are still owing.

What Will Happens If You Dont Pay On The Maturity Date

It varies based on the type of loan you took, but well go through each scenario:

- Personal loan: If your debt goes into collections, youll be in default. This implies that the lender may sell your debt to a debt collector. Youll probably see your credit score drop, and youll be contacted by debt collectors, who will attempt to collect whatever they can from you.

- Student loan: If you miss a payment, your debt will be considered delinquent after 90 days, which translates to ding to your credit score. After 270 days, the loan is in default and can be taken over by a collection agency.

- Payday loan: A payday loan default can result in bank overdrafts, collection calls, damaged credit scores, a day in court, and wage garnishment.

- Mortgage: You risk losing your home if you dont pay your mortgage according to the lenders terms.

- Business loan: The lender may take your company to court to recover the loan, and they are entitled to compensation not just for the outstanding amount of the loan, but also for interest, penalties, fees, and costs.

- Auto loan: If you do not make loan payments on time, your will bear evidence of this for 7 years. Your car may be repossessed as a result of your failure to pay off your loan on time.

If you decide to pay off the remainder of your loan early, figure out how much money youll save by not making future interest payments.

Don’t Miss: How To Remove Pmi From My Fha Loan

If A Lender Starts A Foreclosure Against You After The Statute Of Limitations Has Expired You Can Raise This Issue As A Defense

A “statute of limitations” sets the time limit for bringing a legal claim, like initiating a foreclosure. The limitations period varies depending on the type of action or claim involved. Oral contracts, written contracts, personal injury, and property damage, for example, all have different statutes of limitations.

If a significant amount of time lapses between when you stop making mortgage payments and the lender initiates a foreclosure, or restarts one against you, the action might violate the statute of limitations. When applicable, the statute of limitations can be a strong defense against a foreclosure.

When Does The Clock Start Running For The Statute Of Limitations

Not only is it sometimes challenging to figure out the length of a statute of limitations, but determining when it starts can also be an issue.

Sometimes, the statute-of-limitations clock for an unpaid installment begins when the default, like a missed payment, occurred. Some courts treat each missed payment as a new default that restarts the clock. Or the statute of limitations might start to run when the loan becomes due . The limitations period can also commence when the lender accelerates the loan after the borrower defaults. Once the loan is accelerated, the full outstanding balance becomes due. The lender can begin a foreclosure if the borrower doesn’t pay off the debt. After acceleration, the loan changes from an installment contract to a debt that’s due in a single, lump-sum payment.

Again, the law varies from state to state, so talk to a lawyer if you need help figuring out when the statute of limitations for a foreclosure begins to run in your state.

Read Also: How To Decrease Interest Rate On Car Loan

Getting Back To Financial Health

Analyse your situation and have a realistic estimate for when you can restart paying your loan. Treat this as a priority. It is human tendency to start avoiding calls and messages from the bank. Do not do this. Inform the bank as soon as you can about any change in your circumstances that prevents you from paying them.

Work with the bank and work out a time-frame for your repayment. If your reasons for not paying up are genuine, the banks usually give you leeway.

If possible, try to get your friends and family to arrange for a few EMIs. This will give you some breathing space while you focus on finding a long-term solution to your financial problem.

Finally, control your expenses and prioritise between essential and non-essential spending. Minimize eating outside, going to the movies, making impulsive purchases, and other discretionary expenses. These little savings will add up to a bigger sum that will get you closer to repaying your debt.

Remember that repaying the bank to the full extent of your dues is not only your legal responsibility but also a moral obligation. You can seek ways of easing the situation temporarily but ensure that you finally clear all dues and not let your creditworthiness be harmed.

Is It Smart To Pay Off A Car Loan Early

It can be smart to pay off a car loan early can save you money in the long run, but itâs not always the best decision. It depends on your interest rate. If you have money or funds to pay off a car load early, it can give you some good benefits, including enhancing your DTI, saving money, and making the car owner.

Recommended Reading: What Happens To 401k Loan When You Quit

How To Reinstate A Car Loan

The maturity date of your car loan is the day on which your final payment is due to be made. If, having paid your final installment, you still owe money on your account, it’s likely that either your lender has made an error or you have failed to keep your account in good order. Either way, action will be required on your part.

TL DR

If your car loan is about to end, yet you still owe money, you’ll need to pay the remaining balance in full before the lender will release the vehicle’s title.

What Is An Amortization Period For Reverse Mortgages

The amortization period for a reverse mortgage is a document that illustrates how your loan will change over time. Unlike traditional mortgages, the reverse mortgage is a negatively amortizing loan. In other words, itll grow instead of decrease. This is because reverse mortgages arent paid in full until they reach maturity, but interest still accrues. While monthly payments arent required, borrowers can choose to pay off their reverse mortgage early so the loan can amortize positively.

The reverse mortgage amortization schedule can help borrowers gauge how much will be due once the loan matures, allowing them to prepare their heirs for the future. The amortization schedule will include the following information:

- Number of years on the loan

Read Also: Dept Of Education Student Loan Forgiveness

What Is A Loan Maturity Date

Loan maturity date refers to the date on which a borrowers final loan payment is due. Once that payment is made and all repayment terms have been met,

1 answerIf youre not able to pay your loan by the maturity date, your lender will probably charge you a late fee. Youll also continue to accumulate

How To Calculate Maturity Date

Knowing the maturity date of a loan is also an important part of calculating the total amount the lender will ultimately receive when you factor in interest. This is called the maturity value and its a helpful thing to know if youre thinking of investing in a debt instrument. In order to go about these calculations, youll need to know several pieces of information:

- P= The original principal amount

- r= the interest rate per period on the loan

- n= the number of compounding intervals from the date the loan starts until it reaches its maturity date.

Once you have these numbers, youll be able to calculate V= the maturity value using the formula below.

You May Like: What Happens After Sba Loan Is Approved

What Does The Maturity Date Indicate On A Convertible Note

The maturity date of a note indicates the date when the note is due to be repaid to the investor along with any accrued interest, if it has not yet converted to equity.

In practice, in most situations, startup investors will not call for a note to be repaid at the maturity date, and will instead amend the note to extend the notes maturity date, typically for a period of another year. This is because calling a note from a startup is usually self-defeating to the investor the startup most likely will be bankrupted or at least adversely impacted by a called note, and by providing the startup with more time to reach a next milestone, the investor is getting an option on upside gain. Finally, calling a note and bankrupting a startup will most likely permanently tarnish the reputation of the investor, preventing them from gaining access to promising investment opportunities in the future as other investors and entrepreneurs alike avoid the investor. There are rare instances, for example when a startup has managed to reach profitability and has plenty of excess cash, where calling a note may not adversely impact a startup, but in those cases, an investor most likely has more to gain by enabling their note to convert to equity at a subsequent equity round or acquisition than to call their note.

There are some convertible notes that call for automatic conversion to equity at maturity date at a pre-defined price, but these are unusual.

How Long Does It Take For A Debt Instrument To Mature

Long-term debt instruments are typically considered to have maturity dates 10 years after their issuance dates. Medium-term debt instruments have maturity dates between four and 10 years after their issuance dates, while short-term instruments cover shorter periods. Examples of debt instruments are bonds, loans, and mortgages.

Don’t Miss: How To Apply For Student Loan For Masters

What Happens When A Debt Instrument Matures

When the debt instrument has matured, the Treasury can either pay the cash owed or issue new securities. Debt instruments issued by the U.S. government are considered to be the safest investments in the world because interest payments do not have to undergo yearly authorization by Congress.

Content

What Happens When A Reverse Mortgage Matures

When a reverse mortgage reaches maturity, the loan becomes due and payable immediately and funds will no longer be disbursed. Once the loan servicer is notified of a mortgage maturity event, theyll send a demand letter to the borrowers estate within 30 days. The letter will contain essential mortgage law information, such as:

- Options to pay back the reverse mortgage

- Number of days to respond

After the letter is received, the borrowers estate will respond with how they wish to repay the loan. They can either use personal savings, sell the property, or purchase the home to keep for themselves to satisfy the debt. This must be done within six months.

Don’t Miss: What Are Commercial Loan Rates Now

How Can I Determine My Actual Maturity Date

Youll need to identify your scheduled maturity date and determine whether it falls on a business day or non-business day. To determine your actual maturity date:

What Is The Maturity Date On A Loan Askmoneycom

You can either finish paying off the loan in full or attempt to refinance it with the lender. In the case of secured loans, the maturity date is

10 postsWhere I work if your loan matures and you have not paid it off, you are late as of the maturity date. You will be 30 60

Loans that are not paid by the maturity date become defaulted. This means that the borrower has failed to meet the loan requirements, and the

You May Like: How Much Income Needed For Fha Loan