Heres What Youll Need To Do:

- Receive a BLANK CHECK for up to your Pre-Approved Limit

- Bring your check to the dealership and Start Shopping!

2 Middle Road, PO Box 250

Sabattus, ME 04280

Phone: 375-6538 | 503-0434

Fax: 375-8933

Routing number: 211288653

To report your Visa®Card lost or stolen, contact the credit union at 375-6538, or 1-800-472-3272 24 hours a day, 7 days a week.

Drive Thru: 7:30am to 5:00pm

Saturday

Drive Thru: 7:30am to 12:00pm

Friday, December 24th – Closing at Noon

Saturday, December 25th – Closed

Friday, December 31st – Closing at 3:00pm

Saturday, January 1st – Closed

Sign Up for News & Alerts!

Disclosures

We do business in accordance with the Federal Fair Housing Law and the Equal Opportunity Act. Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government.

If you are using a screen reader and are having problems using this website, please call 207-375-6538 for assistance.

© 2022 Copyright ·Sabattus Regional Credit Union· All Rights Reserved · Website by Seaside Web Design, LLC· This website contains material for informational purposes only. Any links to other websites are provided only for the purpose of convenience and do not constitute a referral or endorsement of any linked site or its owner. Sabattus Regional Credit Union is not responsible for the contents of any linked site or any link contained in a linked site, or any changes or updates to such sites.

Refinance To Reduce Your Rate And Lower Your Payment

Most people dont get the best deal when they first finance their purchase, whether it be at the dealer or a bank. Thats where we come in, with exceptional refinance terms that may help recoup money you can use for other needs.

Through January 31, 2022, get $50 and choose to make no payment for 90 days when you refinance a non-NIHFCU auto loan of at least $5,000 with us! 3, 4, 13

What Happens If My Car Is Totaled Or Stolen While I Am Financing It

- The vehicle’s VIN

- Insurance companys claim number

- Payout amount for the vehicle

Once the request is received, we will forward the Letter of Guarantee within 2 business days. Its important that you continue to make your scheduled payments until we receive payment from your insurance company. This will ensure that your credit is not adversely affected.

1 Jovia Financial will finance vehicles from 2012 and newer. The minimum vehicle loan amount for a 6-year term is $15,000 the minimum for a 7-year term is $25,000, and the minimum for an 8-year term is $30,000. Not all borrowers will qualify for the 96-month financing. In order to qualify, the borrower must maintain a credit score of 670 or higher. Only new vehicles will qualify for an 8-year term with a maximum loan-to-value equal to 100%.

2 APR = Annual Percentage Rate. All loan types, rates, and terms are based on an applicant’s credit history and are subject to change without notice. Not all applicants may be approved.

3 Monthly payment per $1,000 borrowed.

4 This is an estimate based on the information you provide and we do not guarantee the accuracy of these results. This example is for informational purposes only and is not a commitment by Jovia Financial to lend. To apply for an Auto Loan, you will need to complete an application and provide additional details.

Recommended Reading: Diy Loan Agreement

Can I Apply For A Trumark Financial Auto Loan If I Havent Found The Vehicle I Want Yet

Yes, you can apply for an auto loan, even if you have not found the vehicle you want. TruMark Financial will give you a cashiers check up to your pre-approval amount to take to the dealership.* .

*Subject to credit approval. Only available in Pennsylvania, New Jersey, and Delaware. Other restrictions may apply.

Learn How Bank Drafts Work: Safe Payments

A bank draft is a check that is drawn on a banks funds and guaranteed by the bank that issues it. Similar to a cashiers check, a legitimate bank draft is safer than a personal check when accepting large payments. To get a bankers draft, a bank customer must have funds available. The bank will freeze the amount needed or move those funds into the banks accounts to complete the payment.

Read Also: Loan Processor License California

Before You Hit The Road

How Do You Stop An Automatic Bank Draft

You should be able to cancel automatic bank drafts with either your bank or the entity drafting money from your account, but your bank will have the most control over whether the payment goes through or not. The Consumer Financial Protection Bureau recommends requesting that your bank stop automatic payments at least three business days before the next scheduled transaction. This request can be given in person, by phone, or in writing.

Read Also: One Main Financial Bill Payment

Re: Penfed Auto Loan Process

They have a process. You can not hurry it. It does take a few days while they check you out. They are extremely methodical in processes, and you will understand. Sit back and relax for a while. More than likely they will request additional information from you. Did you apply for a cc with them? If so what limit? This may add to your application time. I can tell you, for me it was well worth the wait.

How Do You Determine The Interest Rate On My Auto Loan

Your auto loan rate is based on your:

- length of the loan

- cars model year

| Collateral Titled in KY, MD, MN, MT, NY, & OK | Security Interest Filing or Copy of Title |

| Vessel/Boat Registered with U.S. Coast Guard | Copy of Preferred Ship Mortgage or Abstract of Title |

| Collateral Registered but Not Titled Due to State Regulation | Copy of State-Issued Registration or Copy of Bill of Sale |

| Aircraft | Copy of FAA Registration |

For a new or used vehicle or collateral located overseas, Navy Federal requires one of the following:

- Copy of Manufacturer’s Statement of Origin

- Copy of Military or Foreign Registration

- Copy of Bill of Sale

Recommended Reading: Refinance Conventional Loan

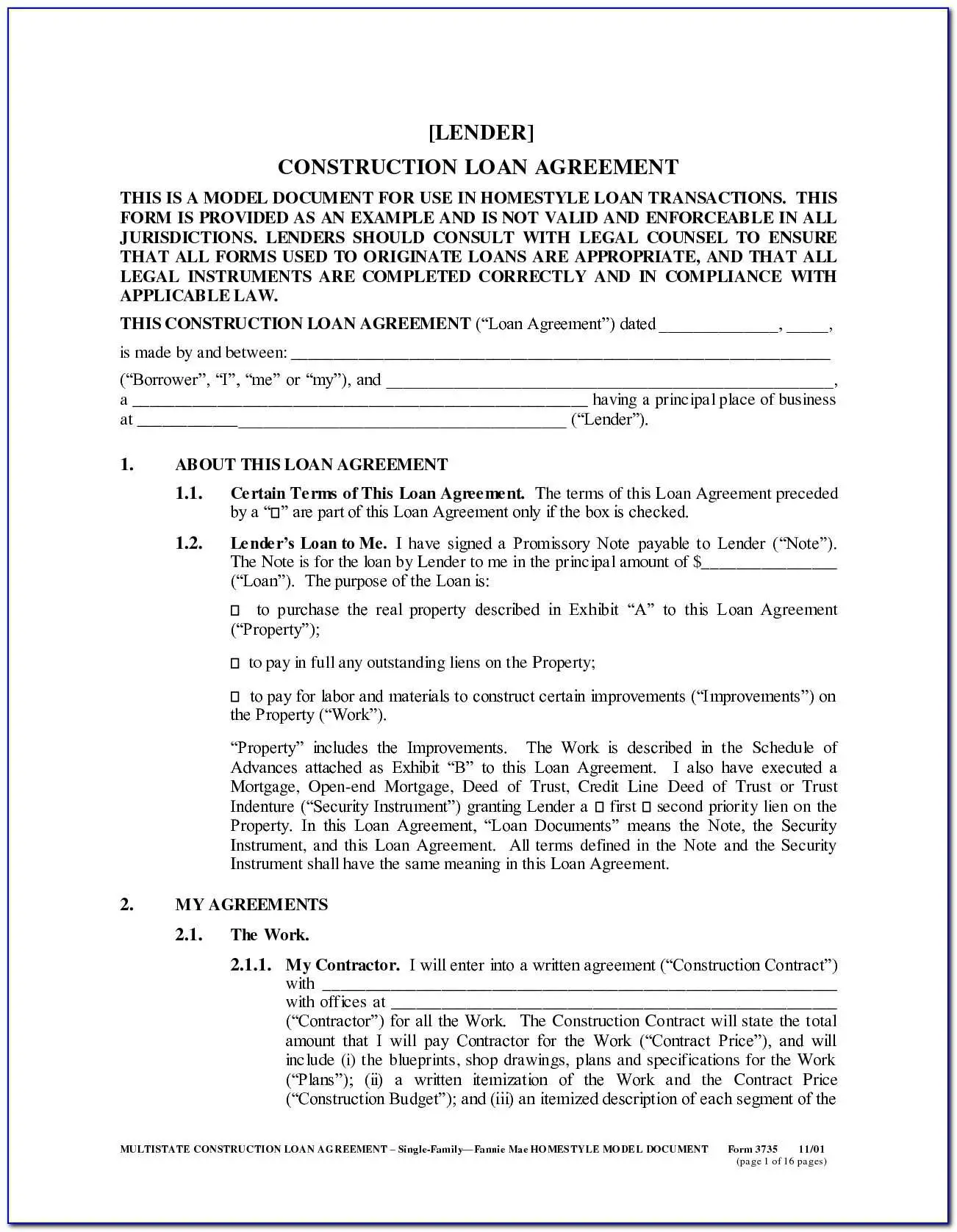

Revolving Vs Term Loan

Loans can also be described as revolving or term. A revolving loan can be spent, repaid, and spent again, while a term loan refers to a loan paid off in equal monthly installments over a set period. A credit card is an unsecured, revolving loan, while a home equity line of credit is a secured, revolving loan. In contrast, a car loan is a secured, term loan, and a signature loan is an unsecured, term loan.

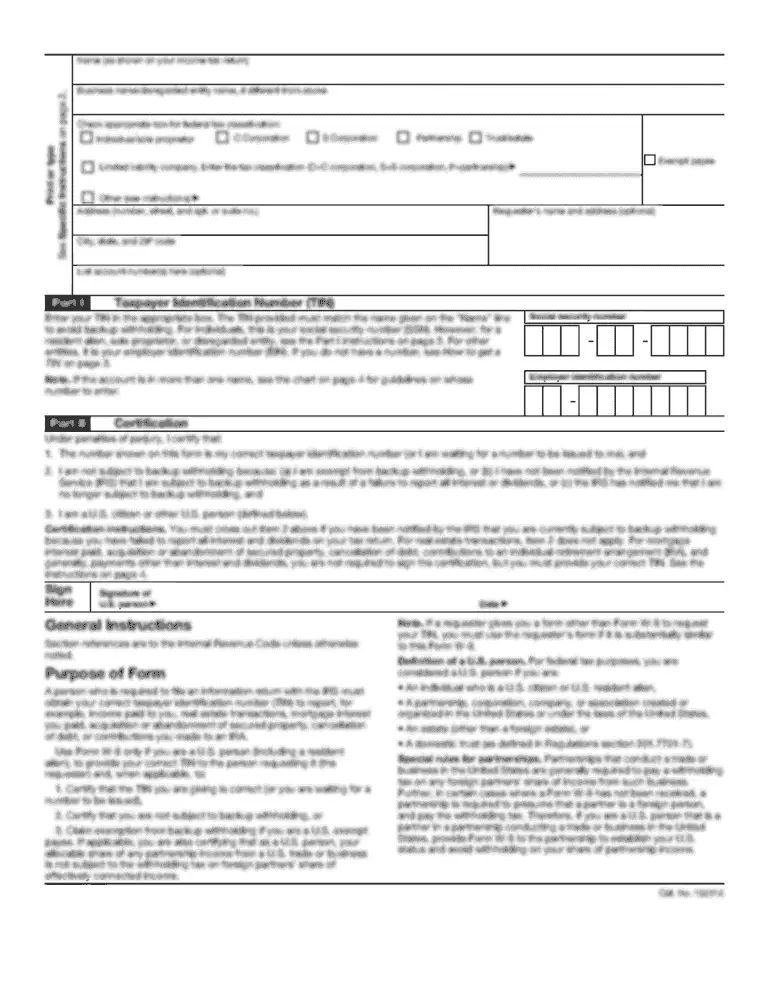

Free Personal Loan Agreement Templates

A personal loan agreement is a legally binding contract between a lender and a borrower that describes various aspects of a personal loan transaction including loan amount, repayment options and the rights of the lender in case of a default. A personal loan is meant to meet the borrowers current financial needs.

Recommended Reading: Cap One Auto Loan

Why Should You Write An Agreement

A loan agreement protects you as the lender as it legally enforces the borrowers pledge to repay the loan in regular payment or a lump sum. A loan agreement is also important to the borrower as it clearly spells out the details of the loan for their records and is handy for keeping track of the payments made.

Penfed Auto Loan Process

hi there,

we applied for penfed auto loan this Saturday. I didn’t see where it listed a member number. Or if it did, I didn’t realize how important it would be. Anyhow, so I get all these emails that say I am basically getting everything online. I have no idea if we were approved. I can’t seem to sign up online without this member number. They won’t give it to me personally. Hubs is on a business trip and doesn’t want to deal wtih this right now.

i am wondering if we are approved online, do we need to take some sort of action to go forward? or do they just send the check?

if you apply on a Saturday, when do you typically find out?

You May Like: What Is The Average Interest Rate On A Commercial Loan

How A Bank Draft Works

Consumers have several avenues available when they need secure, certified payment options. They may require them to secure an apartment or for a deposit for a very large purchase. Certified payment options give the payee security, knowing that the funds are available. These options include certified checks, wire transfers, and bank drafts.

Bank draftsalso called banker’s drafts, bank check, or teller’s checkare just like cashier’s checks. They are secure payment options that are guaranteed by the issuing bankin many cases, for a large amount of money. When a customer requests a bank draft, the representative ensures they have enough money in their account to cover the amount requested. Once verified, the bank withdraws the funds from the customer’s account and transfers it to a general ledger or internal account. The bank prepares the draft with the payee’s name and the amount. The draft has a serial numberwhich identifies the remitting customerwatermarks, and may even have micro-encodingidentifying it as a legitimate financial instrument that can be negotiated when presented by the payee to their bank. Since the funds are already withdrawn from the requesting customer’s account, the issuing bank ultimately becomes the payer.

Blank Check Car Loan Dangers Examined

Many used car buyers want to finance a vehicle before they buy and blank check auto loans are one way to accomplish this. For borrowers who qualify for a blank check auto loan, there are some definite pluses to going this route however, there are also a few things to look out for in using a blank check auto loan to finance a used car purchase.

May Not Be in Your Best InterestThe first is that bad credit can sink a buyer who applies for a blank check auto loan. Many lenders offering this kind of service require decent credit, and if a consumer’s credit is less than stellar, they can be denied, and then it’s back to square one. Many lenders like to know as much as possible about the vehicle they will be financing, and so it is generally not in the best interests of a buyer with poor credit to hold out for a blank check auto loan.

Mix it UpOne option for dealing with these liabilities is to mix a blank check auto loan with a down payment. This has two upsides: the first is that a down payment minimizes the amount that needs to be financed, so that over the term of the loan the buyer pays less. The second is that a buyer can use the combination of a possible down payment and a blank check auto loan amount to be a little more flexible in terms of a vehicle’s total cost during the shopping process.

Also Check: Capital One Pre Approved Car Loan

What Are The Current Rates For New And Used Auto Loans

Navy Federal offers competitive rates and flexible terms. Check out our auto loan options. Our advertised rates offered are subject to change at any time and depend on the individuals credit, in addition to vehicle characteristics. Your actual annual percentage rate will be based on your specific situation.

Applying For An Auto Loan Is Easy

- Already a Member? Log into Insight Online to access your account and well use the information already on file for your application.

- Not yet a Member? Use the link above to register and provide your information to apply for membership, accounts, and loans.

- Check Application Status! You can also check the status of submitted applications, or continue where you left off with an application already in progress.

Don’t Miss: How To Transfer A Car Loan To Someone Else

Blank Check Auto Loan Requirements

Blank check auto loans have requirements similar to any typical auto loans. There are some basic requirements and these include that the car must be at least worth $7,500. Most lenders will only allow you to buy your chosen car from an authorized dealer, not independent used car dealers or private party sellers. There are some exceptions but check with your blank check lender first before starting to shop.

Additionally, blank check loans are not available for commercial vehicle, motorcycle or recreational vehicle purchases. The vehicle cannot be more than 7 years old or have more than 70,000 miles on the odometer if used. Individual lenders will have different sets of criteria determining an individual’s credit worthiness. An important tip would be to obtain a personal credit report to check for any adverse entries that you might be able to correct before beginning the process.

When Should You Consider Getting A Personal Loan

If you needto borrow some money for general use, getting a personal loan is a much betterdecision than getting a standard loan. Personal loans are ideal for situationswhere borrowing is for personal use.

If you areunable or unwilling to get collateral for a standard loan, a personal loan maybe a viable option since personal loans may be provided without security.

You may also consider getting a personal loan if you prefer to have more flexibility on how to use the loan proceeds that is if in the future you might change how you plan to use the proceeds.

Also Check: Used Car Loan Rates Usaa

Would You Like To Join Ask Sawal

Ask Sawal is a fast growing question and answer discussion forum.

25 lakh+ questions were answered by our Ask Sawal Members.

Each day 1000s of questions asked& 1000s of questions answered.

Ask any question and get answer from 5 Lakh+ Ask Sawal Members.

Constant moderation and reporting option makes questions and answers spam free.

And also, we have free blogging platform. Write an article on any topic.

We have 10000+ visitors each day. So a beneficial platform for link building.

We are allowing link sharing. Create backlinks to your blog site or any site.

Gain extra passive income by sharing your affiliate links in articles and answers.

Difference Between Standard And Personal Loan Agreement

A standard loan agreement prescribes how the proceeds of the loan may be spent. Examples of standard loan agreements are mortgage agreements that specify the money may only be spent to buy a house and student loan agreements that prescribe that the funds may only be spent on paying school fees. Standard loan agreements are generally relatively rigid compared to personal loan agreements.

A personal loan agreement does not specify how the loan proceeds may be spent. Personal loan agreements, therefore, allow the borrower the freedom to use the money in any way they deem fit. Personal loan agreements offer flexibility.

Standard loan agreements often specify collateral for the debt. Collateral is an asset that can be forfeited should the borrower defaults in paying the loan.

Personal loan agreements generally dont specify collateral. This is because personal loans are often unsecured that is they are provided without collateral.

Don’t Miss: Usaa Auto Loan Refinance

How Can I Find Out The Amount To Pay Out And Close My Td Auto Finance Loan

You can view the Payout Amount for your TD Auto Finance Loan, on your Account Details page in EasyWeb.

On EasyWeb, after you login:

If you’d like to pay out and close your TD Auto Finance Loan, we are pleased to offer you several convenient payment options:

- Option 1: Make your payment online in EasyWeb. Please add “TD Auto Finance Inc.” to your online bill profile or payee list using your account number. Please do not use the reference number found on your contract.

- Option 2: Visit any TD Canada Trust branch. Please bring a printed copy of your Account Details page for your TD Auto Finance Loan.

- Option 3: Via cheque/draft made payable and sent to:

Please include your account number in the memo section of the cheque/draft and attach a printed copy of your Account Details page for your TD Auto Finance Loan. Please do not use the reference number found on your contract.

- Option 4: Call us at , and a banking specialist can assist with paying out your loan. Our hours of operation are Monday to Friday from 7:30 a.m. to 10:00 p.m. E.T. and Saturday from 9:00 a.m. to 8:00 p.m. E.T.

Should You Get Prequalified Instead Of Preapproved

Getting preapproval for an auto loan is not the same as getting prequalified its a little more serious. When youre ready to buy, the cash-in-hand offer, or preapproval, is what can help you at a dealership, says Delvin Davis, senior researcher at the Center for Responsible Lending.

If you have no idea what your credit score is or what kind of loan you could get, prequalification is a low-risk way to find out. It only requires a soft credit pull, so you can get a ballpark estimate of what kind of rates you might get without damaging your score. But rates arent guaranteed they can only be as accurate as the limited information you provide for prequalification, so your final rate could be higher.

In general, wait to get preapproval until youre serious about buying a car and know your credit score because applying will have an impact on your credit. While neither guarantees funding, both can be good indications of your ability to secure financing and help determine how much car you can afford.

Recommended Reading: California Mortgage License Requirements