Va Home Loan Requirements

I know what youre thinking So, does everyone who serves in the U.S. Armed Forces qualify for these loans? Not quite. Your length of service, as well as the years when you served, will impact your qualifications for a VA loan. For example, someone who served during wartime will qualify with a shorter amount of time served than someone who didnt.

The first step, then, is to learn about these requirements. If you meet them, youll need to request a VA home loan certificate of eligibility from your local Department of Veterans Affairs.

Who Is Eligible for a VA Loan?

To obtain VA home loans in SC or NC, you need to meet one of these requirements:

- You are an active duty service member or you have been honorably discharged.

- You have at least 90 days of consecutive service during a time of war period or you have at least 181 days of service during a time of peace.

- You have at least six years of service in the National Guard or Selected Reserve.

- You are a spouse of someone who died in the line of duty in a recognized Armed Service.

Obtaining Certificate Of Eligibility

Only active and/or retired members of the United States Military with Certificate Of Eligibility can qualify for VA Loans. Gustan Cho Associates will assist borrowers in obtaining their Certificate Of Eligibility through the Department of Veterans Affairs. This can be done in a matter of hours and the assigned loan officer and/or mortgage processor will handle it on behalf of our borrowers.

The Real Fha And Va Guidelines

FHA Purchase: The minimum credit score is 500. Your qualifying score is middle of your three scores from credit bureaus Equifax, Transunion, and Experian.

- For credit scores between 500 579, the minimum down payment is 10%

- For credit scores of 580 and above, the minimum down payment is 3.5%

FHA Cash-Out Refinances:

- For credit scores of 500 and above, the max cash-out is 85% of the appraisal value

FHA Streamline Refinance:

- There is no minimum credit score. You can streamline without even having a lender look at your scores

VA Down Payment:

Also Check: Investor Loans With 10 Down

Why Do Credit Scores Matter For Mortgages

What Is a Credit Score?

Your credit score is a number between 350 and 850 that defines your creditworthiness, that is, how likely you are to repay debt. Higher scores indicate higher creditworthiness, whereas a lower score means that you are a more unreliable borrower. Technically, this three-digit score is known as a FICO score, and three major credit agencies generate these scores based on several factors, including:

- Your payment history

- The total amount of money you owe

- Length of credit history

- Types of credit you have

- Frequency of new credit inquiries and accounts

Of the above factors, payment history plays the largest role in determining your credit score. That is, do you make your payments on time, or have you had some late payments? According to a CNBC study, payment history makes up 35% of your total credit score calculation.

Most lenders and credit agencies divide borrowers into the following tiers:

- Exceptional: 800 850

- Poor: 300 579

Why Do Credit Scores Matter for Mortgages?

Tips To Improve Your Credit Report Before Home Buying

Bad credit doesnt necessarily mean you wont qualify for a mortgage. But borrowers with good to excellent credit have the most loan options. They also benefit from lower rates and fees.

If you can polish up your credit report before shopping for a mortgage, youre more likely to qualify for the best loan terms and lowest interest rates.

Here are a few tips to improve your credit report and score before applying:

Removing inaccurate information can increase your credit score quickly. Developing better credit habits will take longer to produce results.

If youre looking to buy or refinance and know you may need to bump your credit score, it can be helpful to call a loan advisor right now even if youre not sure youd qualify.

Most lenders have the ability to run scenarios through their credit agency providers and see the most efficient and/or costeffective ways to get your scores increased. And this can be a much more effective route than going it alone.

Don’t Miss: Signing Loan Agent

What Is The Minimum Credit Score For Va Loans

The VA doesnt require a minimum credit score for VA home loans. That said, every lender has its own underwriting requirements and may require specific minimum scores in order to approve a loan. If you have a credit score of 620 or higher, then you should be able to qualify for a VA home loan with most lenders.

Of course, there are always exceptions to the rule, but homebuyers should approach lenders when their credit score is as high as possible. If youre almost there, say, a credit score of 580, then its probably worthwhile to work on your credit and raise your score.

| Poor credit |

Shop For Lenders Regardless Of Your Va Loan Credit Score

It always pays to shop with at least three to five lenders for a mortgage. Whether you have a stellar or bad credit score, shopping with multiple lenders allows you to compare offers and loan terms side by side.

Mortgage rates change daily, and because VA lenders often set their own credit score standards, its best to compare loan estimates from several companies to ensure youre getting a competitive rate with the lowest VA closing costs.

Read Also: Bayview Loan Servicing Reviews

Best Va Loan Rates For 660 To 669 Credit Score

Congratulations! You’ve reached a 660+ credit score.

This is a critical score because once you get past 659 and into the 660’s, most lenders give you a slight break on the interest they charge, meaning lower payments for you!!

Just remember there are many factors that may affect your VA loan rate .

It’s NOT 100% about your credit score. Someone with a 662 credit score might actually qualify for a better rate than someone with 667 , and they can do so if their other qualifying numbers are better.

Let’s take a look at some sample rates.

What Is The Interest Rate On A Va Loan

Interest rates on VA loans can be fixed or adjustable.

- With an adjustable-rate mortgage, your interest rate is tied to a financial index or market interest rate, such as the Libor, and it can change periodically. If interest rates rise, your rate can go up and your monthly payments increase.

- With a fixed-rate mortgage, your interest rate and mortgage payment should stay the same for the life of the loan.

Interest rates on VA loans are typically lower than rates on conventional mortgages. But rates and fees vary among lenders, so be sure to shop around.

Also Check: Can You Use The Va Loan To Buy Land

Fannie Mae Homeready: Minimum Credit Score 620

Released in December 2015, HomeReady is a great Fannie Mae loan program for low to moderateincome borrowers, with expanded eligibility for financing homes in lowincome communities.

Unlike Freddies Home Possible program, you dont have to be a firsttime homebuyer to qualify for HomeReady.

Along with its 3% minimum down payment requirement, this loan type has another attractive feature: Underwriting can include income from other people in your household, regardless of their credit history.

Rather than basing your debttoincome ratio only on your monthly income and your coborrowers income, the DTI ratio can include the income of your roommates, adult children, or parents who happen to live with you.

Most lenders require a minimum credit score of 620 to qualify for this type of mortgage.

Lender Reduced Credit Score From 620 From 550

Most lenders require a 640 or 620 credit score for VA Loans. Mortgage Solutions Financial has reduced this requirement and will now accept a 550+ Credit Score.

If youve been turned down by a lender citing your credit score being lower than 620, theres still hope to get into the home youve always wanted. Pre-Approval is quick and easy. It only takes 5-10 minutes over the phone to find out if you can qualify.

Fill out this form:

Recommended Reading: Sss Loan Requirements

Va Loans With No Credit Score And Dti Requirements

This Article Is About VA Loans With No Credit Score And DTI Requirements

Many borrowers do not know that there are lenders like Gustan Cho Associates that offer VA Loans With No Credit Score And DTI Requirements. The Department of Veterans Affairs does not mandate a minimum credit score nor debt to income ratio cap on borrowers who get an approve/eligible per automated underwriting system. Many borrowers at Gustan Cho Associates have closed their VA Loans with credit scores in the 500s and over 60% DTI with an approve/eligible per AUS. But why do most lenders require minimum credit score requirements and debt to income ratio caps on VA Loans?

In this article

Is There Anything I Can Do To Mitigate A Low Credit Score When Applying For A Va Loan

Veteran home buyers should work with their lenders to create a financial plan of action if having a less than ideal credit score could potentially be a disqualifying factor from a loan application approval. Take the following tips into consideration when you are looking to boost your loan application attractiveness:

- Show them the money. It is possible that the right combination of income and a more significant down payment can offset and overcome the risks associated with bad credit.

- Raise your credit score. This is one of the most direct methods to resolve your low credit score dilemma. Request a that outlines a financial recovery starting point to raise your credit score.

- Get a co-signer. A co-signer comes in handy when they have better financial credentials that will qualify for a loan application. A co-signer ensures a lender that they have the ability to repay the mortgage loan if the primary borrower defaults. Keep in mind that on a VA loan, the VA requires the co-signer to be a spouse or another eligible military service member.

- Work on your debt-to-income ratio . Your DTI is an indicator that your lender uses to measure your ability to manage repaying your monthly payments. Aim for a DTI of 43% to gain your lenders approval on a loan application.

Don’t Miss: Average Interest Rate For Commercial Real Estate Loan

Learn More About Va Loans

If you are thinking about obtaining a VA mortgage, reach out to Dash Home Loans. We can help you with everything from VA mortgage eligibility to securing the best VA home loan rates. Here are some commonly asked questions to help you begin.

How does the VA home loan work?

A VA mortgage loan allows you to purchase a home using a loan from a private lender. This type of loan is partially backed by the U.S. Department of Veterans Affairs. This backing allows consumers to qualify for key benefits, including a lower interest rate and no down payment.

Can you get a VA loan for a second home?

You can only purchase a home using a VA loan if it is for your primary residence. However, there are some ways to still use some of your benefits to purchase a second home, depending on the lenders ability to work with you.

Who qualifies for a VA loan?

You must obtain a certificate of eligibility from the VA to obtain this loan. That means, for most active duty personnel, serving at least 90 days of consecutive active duty during wartime or 181 days during peacetime. National Guard or Selected Reserve members need at least six years of service. Those who have had spouses who have died in the line of duty may also qualify.

How long does it take to get pre-qualified for a VA home loan?

Pre-qualification for a VA home loan can take just a few days after you submit your complete application and eligibility forms. However, the closing process can take 30 to 90 days to complete.

Legal information

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

You May Like: Usaa Used Car Loan Restrictions

Va Home Loan Credit Score Requirements

What are the credit score requirements for a VA mortgage? The basic answer to this question may surprise you. The VA Lenders Handbook indicates no VA-required minimum FICO score to qualify for the loan.

That does NOT mean there are no minimum FICO score rules, just that the Department of Veterans Affairs does not set those standards. Instead, it relies on the participating VA lender to establish FICO score minimums.

Even on a VA mortgage with no VA-required down payment, credit scores may determine whether or not the borrower is required to put money down on a mortgage that would otherwise be zero-down.

The VA Home Loan offers $0 Down with no PMI. Find out if youre eligible for this powerful home buying benefit. Prequalify today!

Va Loan: When In Doubt Ask A Lender

If you’re navigating the process of re-establishing your credit after a bankruptcy or foreclosure or simply aren’t sure if your credit will suffice for a loan, the best way to get an answer is to use our VA loan finder to see if you qualify for a loan. If so, the lender will be happy to address your questions and guide you through the process.

Don’t Miss: Capital One Preapproved Auto Financing

How To Apply For A Va Home Loan

Applying for a VA loan is different from applying for a conventional mortgage in that youll need to find a lender who knows how to process VA loans and you might find the process is smoothest if you choose a lender who specializes in them.

Youll also need to get a certificate of eligibility telling your lender youre eligible for the VA mortgage program and have an entitlement to use. You can have your lender pull your COE for you, or you can apply online or by mail.

Heres the documentation youll need to get your COE:

| Status | |

|---|---|

| Statement of service signed by your commander, adjutant, or personnel officer | |

| Current or former activated National Guard or Reserve member | Copy of your discharge or separation papers . |

| Current member of the National Guard or Reserves, and have never been activated | Statement of service signed by your commander, adjutant, or personnel officer |

| Discharged member of the National Guard and were never activated |

|

| Discharged member of the Reserves and were never activated |

|

| Surviving spouse | The Veterans discharge documents if available and other documents depending on if you’re receiving Dependency & Indemnity Compensation benefits. To see the full list of required documentation, . |

Applying For A Va Loan

Applying for a VA loan is different from applying for a conventional mortgage, and this affects the home-buying process.

The VA recommends working with a real estate agent whos familiar with VA loans and getting prequalified with a lender before making an offer.

There are a number of steps to applying for a VA loan, including

- Obtaining a certificate of eligibility, which verifies to the lender that you meet minimum eligibility requirements.

- Comparing offers from different VA lenders to find the best interest rate and most affordable fees for you.

- Submitting a loan application and providing financial information, including pay stubs and bank statements.

- Obtaining a VA appraisal, which is ordered by the lender.

Your credit information, income and the value of the home will be reviewed, and then the lender will either approve or deny your loan. Make sure your purchase agreement has a clause called a VA option clause, which allows you to avoid financial penalties if the home doesnt appraise high enough.

When your loan is approved, the lender will choose a representative to conduct a closing, during which the money can be released and the property transferred to you.

Also Check: Usaa Prequalify

What Is The Minimum Credit Score For A Va Loan

So what is the minimum credit score for a VA loan? The VA itself does not establish a minimum credit score for veterans applying for a VA mortgage. Its up to each lender to determine their own credit score standards. Although the minimum credit score will vary from lender to lender, generally most see it as too risky to approve credit scores below about 620 to 640.

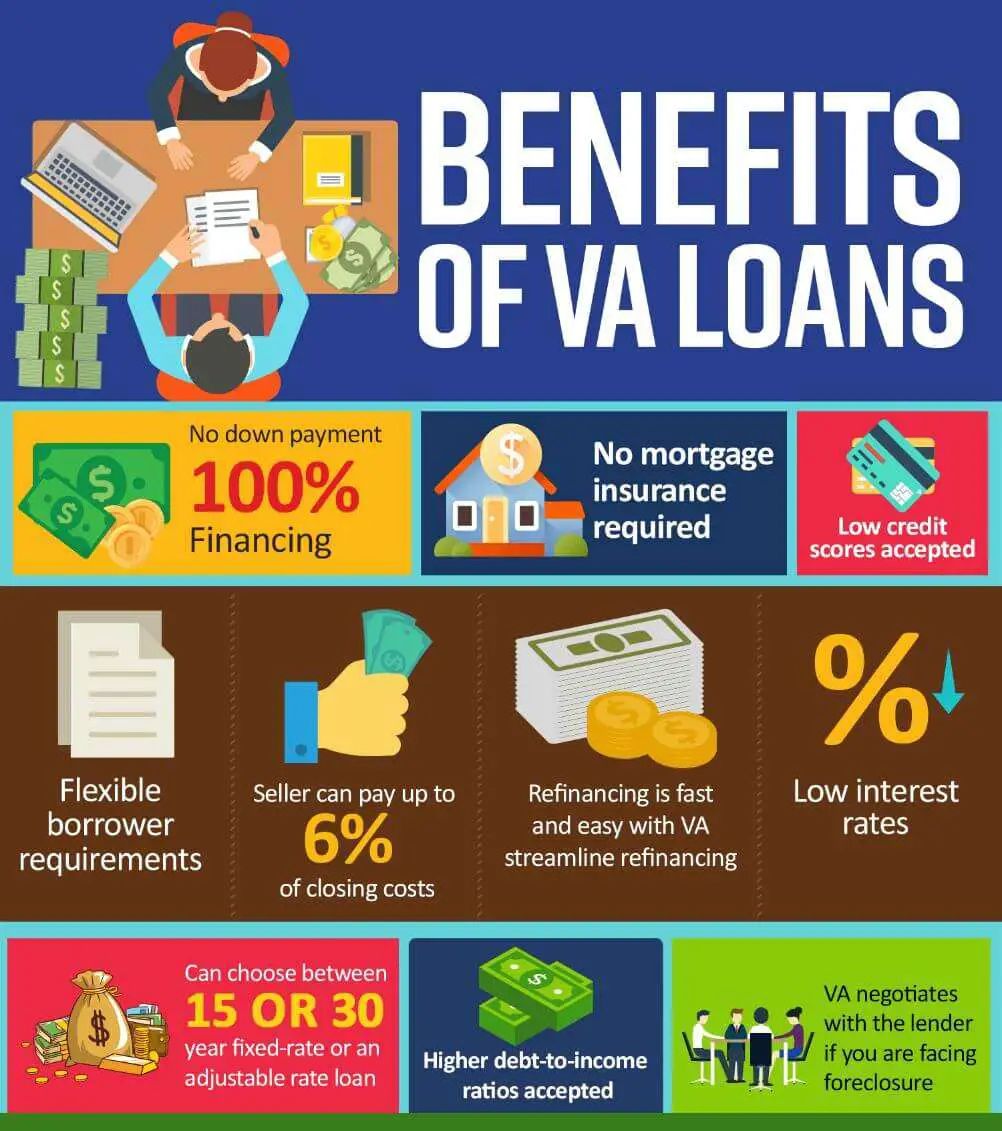

One of the first rules of taking out a mortgage is to shop around and know your options. If one of your options happens to be a VA loan, then youve probably found the best place to start! VA loans are especially unique options because they often require low down payments, no mortgage insurance, and competitive interest rates.

Eric with Low VA Rates talks about some of the VA loan requirements and the minimum credit score for VA loan.