How Much Sba Loan Can You Get

Each loan program carries a maximum loan amount for example microloans have a maximum loan amount of $150,000 and 7 loans offer a maximum loan amount of $5 million. But that doesnt mean the borrower will qualify for the full amount. The average microloan amount, for example, is about $14,000.

The lender will calculate the borrowers loan amount based on SBA criteria which include use of funds and ability to repay the loan.

How To Check Ppp Loan Status

The PPP extended forgivable emergency loans that provided funding to cover payroll and other eligible expenses related to ensuring employees could maintain their ability to earn a living during the pandemic. Application acceptance for both the first and second draws of the loan ended on March 31, 2021, but businesses that have already received loans can still apply to have their loans forgiven.

The lender partner servicing a PPP loan may be a valuable resource for determining application status. Many of the biggest banks, such as Wells Fargo, US Bank, Chase and Bank of America, have created online portals on their websites specifically for PPP applicants to access. If youre a business owner, you can establish login credentials with the specific bank that disbursed the funds to you and use these portals to check your SBA application status.

Entrepreneurs can also check their status with the SBA directly. You can email an inquiry including your name and loan number to [email protected], or you can call the SBA office for your region to learn more. This tool helps you identify SBA district offices by region.

What Is Needed To Qualify For A First Draw On A Ppp Loan

To qualify for a First Draw on a PPP loan in 2021, you must meet the following criteria:

- Your business was operating as of February 15, 2020.

- You own a small business with associated payroll costs, you run a nonprofit with associated payroll costs, or youre a sole proprietor/freelancer.

- You certify that your business has sustained economic damage due to the COVID-19 pandemic.

- You have 500 or fewer employees.

- Youre an independent contractor, sole proprietor, self-employed individual, or a business partner

- You have employed for whom you paid salaries and payroll taxes.

You May Like: How To Qualify For Loan Modification

What Documentation Will Be Required To Demonstrate The 25% Revenue Reduction

Quarterly âgross receiptsâ for one calendar quarter in 2020 and the âgross receiptsâ for the corresponding calendar quarter in 2019. Per the U.S. Treasury borrower guidance for Second Draw loans, the following are the primary sets of documentation that can be provided to substantiate your certification of a 25 percent gross receipts reduction :

- Quarterly financial statements for the entity. If the financial statements are not audited, the Applicant must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. If the financial statements do not specifically identify the line item that constitute gross receipts, the Applicant must annotate which line item constitute gross receipts.

- Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. The Applicant must annotate, if it is not clear, which deposits listed on the bank statement constitute gross receipts and which do not .

- Annual IRS income tax filings of the entity . If the entity has not yet filed a tax return for 2020, the Applicant must fill out the return forms, compute the relevant gross receipts value , and sign and date the return, attesting that the values that enter into the gross receipts computation are the same values that will be filed on the entityâs tax return.

Duplicate Loans And Other Hold Codes Not Covered In Tables 1 And 2

The SBA has controls in place to identify duplicate loan requests. Duplicate loans may be triggered if the tax ID is already in use on an application or if an applicant applies for more than one first or second draw loan.

Some borrower applications may have hold codes that trigger one of two messages: Internal SBA Hold Details Not Publicly Available or Internal SBA Hold that cannot be cleared at this time Details Not Publicly Available. Lenders can reach out to the SBA through the platform to address Internal SBA Hold Details Not Publicly Available messages. However, lenders are unable to resolve Internal SBA Hold that cannot be cleared at this time Details Not Publicly Available, which may need to be addressed by the SBA.

Also Check: The Mlo Endorsement To A License Is A Requirement Of

When Can I Apply For Ppp Loan Forgiveness

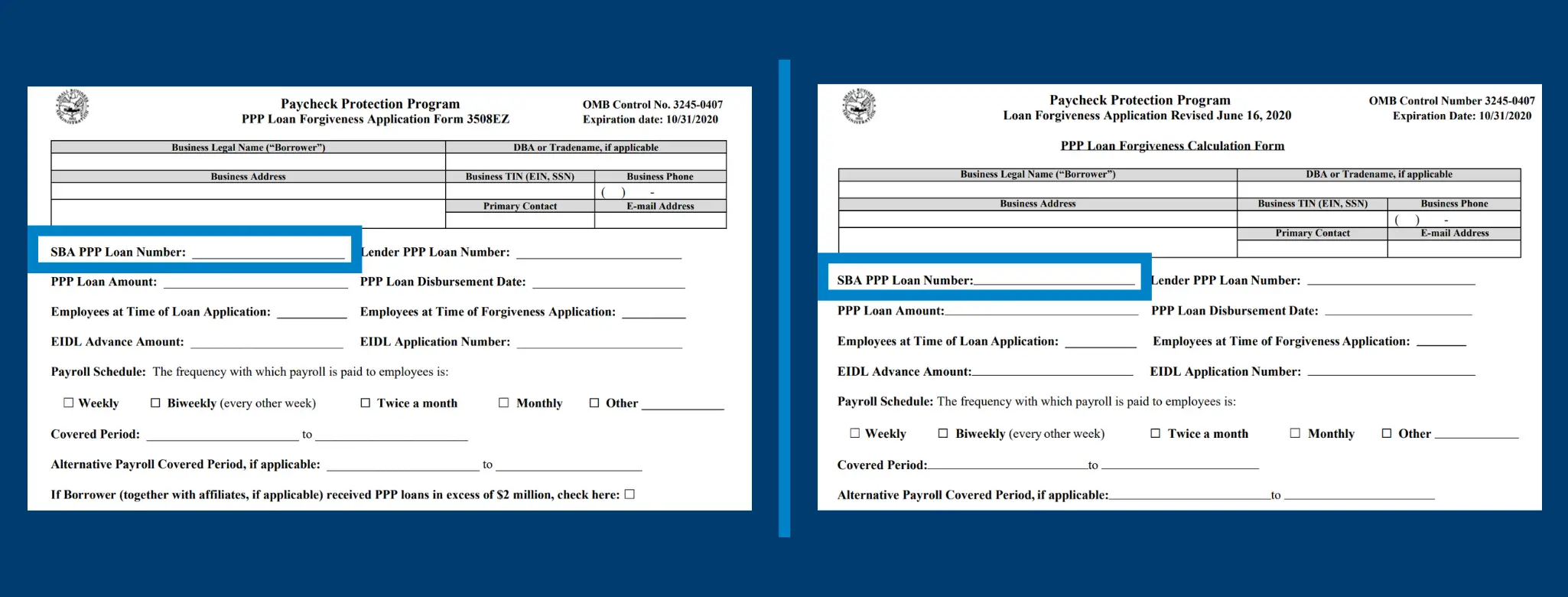

The simplified SBA Form 3508S is now available, in addition to the revised SBA Form 3508EZ and SBA Form 3508 applications. Eligible clients will receive an email with a link to access our loan forgiveness application when it becomes available to them.

As a reminder, based on the latest updates from the SBA, you now have more time to gather your documents and prepare your application. The timeframe for applying for loan forgiveness in the promissory note no longer applies.

For additional assistance with PPP loan forgiveness documentation, view our documentation guide.

What Documents Are Needed For Payroll Expenses

- Tax forms and bank account statements or third-party payroll service provider reports documenting cash compensation paid to employees

- Tax forms or equivalent third-party payroll service provider reports for: payroll tax filings and state quarterly wage reporting and unemployment insurance tax filings

- Payment receipts, canceled checks, or account statements documenting employee health insurance and retirement plan contributions

- FTE documentation: any employee job offers and refusals, firings for cause, voluntary resignations, and written requests by any employee for reductions in work schedule documentation showing average number of FTE employees

Don’t Miss: Pre Approved Auto Loan Usaa

Ppp Payoffs And Payments

Can I start making PPP loan payments early?You can begin making payments early, if you’d like. Please visit your local store to make a loan payment through the drive-thru or make an appointment to make a payment in the store.

How do I pay off my PPP loan?If you wish to pay off your PPP loan, please call your local Store Manager or Relationship Manager for assistance.

If I don’t apply for forgiveness, when is my first payment due?Customers who haven’t applied for forgiveness will have to begin making payments on their loan starting 10 months after the end of their 24-week covered period.Customers who apply for forgiveness will have to start making payments on any portion of their loan that is unforgiven once the SBA sends the approved forgiveness amount to TD Bank or informs the bank that the loan does not qualify for forgiveness. Interest accrues on PPP loans even during the deferral period. Customers should prepare to make payments on any unforgiven portion of their loan. Any portion of a PPP loan which is forgiven, plus the interest accrued on that portion, does not have to be repaid.

What Will The Requirements Be For A Second Draw On A Ppp Loan

If you received a PPP loan during one of the early rounds and need additional funding, you may apply for a Second Draw if you meet the following requirements:

- Your business has fewer than 300 employees.

- You can show a 25% revenue reduction during the first, second, third, or fourth quarter of 2020 .

Recommended Reading: How Can I Refinance My Car Loan With Bad Credit

What Is Disaster Customer Service Sba

The Office of Disaster Assistance’s mission is to provide low-interest disaster loans to businesses of all sizes, private non-profit organizations, homeowners, and renters to repair or replace real estate, personal property, machinery & equipment, inventory and business assets that have been damaged or destroyed in a …

What Is Included As Covered Worker Protection Expenditure

An operating or capital expenditure to facilitate the adaptation of the business activities of an entity to comply with requirements or guidance issued by HHS, CDC, or OSHA, or any equivalent requirements issued by state or local government from March 1, 2020 until the President declares and end to the national emergency for COVID-19. Expenses may include the purchase, maintenance, or renovation of assets that create or expand:

- A drive-through window facility

- An indoor, outdoor, or combined air or air pressure ventilation or filtration system

- A physical barrier such as a sneeze guard

- Expansion of additional indoor, outdoor, or combined business space

- On- or offsite health screening capability

- Other assets relating to the compliance with requirements or guidance from HHS, CDC, or OSHA, including personal protective equipment

Read Also: Usaa Auto Loan Application

How Do I Withdraw My Sba Loan

If your application has not yet been accepted by the SBA, you can withdraw your application by logging into your Biz2Credit account and navigating to the ‘Applications’ tab at the top of the page. From here, you can locate the application you wish to withdraw and click on the menu icon to reveal the ‘Withdraw’ option.

What Is The Pre

To determine whether your loan forgiveness amount is subject to reduction due to a decrease in average weekly FTE during your covered period , you must select a pre-COVID reference period to make the necessary comparison. You can choose any of the following:

- Seasonal employers can also consider: any consecutive 12-week period between February 15, 2019 and February 15, 2020

For each employee, follow the same method that was used to calculate Average FTE on the PPP Schedule A Worksheet.

Recommended Reading: 20/4/10 Car Calculator

Does The Lender Actually Underwrite Each File

Yes. The lender will review each application and the necessary payroll documents to make sure that the loan amount is calculated correctly. They will also validate that the business has fewer than 500 employees and was in business prior to February 15, 2020. If the lender believes that the loan amount calculation was incorrect or doesnt have proper documentation, they will reach out to you for additional information.

What Is The Covered Period

The covered period is the period in which loan funds must be used to qualify for loan forgiveness. You can choose a covered period of any length between 8-weeks and 24-weeks , beginning on the date you received the loan proceeds.

Funds must be used for eligible costs incurred during the covered period.

Payroll costs for the covered period must be paid or incurred during the period to be eligible. If payroll costs are incurred during the last pay period within the covered period selected, but paid after the end of the covered period selected , these payroll costs will still be eligible for forgiveness.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Why Ppp Loan Applications Are Getting Stuck And How To Keep Yours Moving

James Fugate, co-owner of Eso Won Books, arranges copies of President Obama’s memoir “A Promised … Land” in the Leimert Park neighborhood of Los Angeles, California, November 24, 2020. – It’s been a rough year for Black-owned small businesses, and the latest surge in coronavirus cases suggests a festive season without much celebration. “Black Friday” normally kicks off the holiday shopping season the morning after Thanksgiving. But rising coronavirus cases have prompted fresh restrictions in Los Angeles and elsewhere. The new rules mean Hotville Chicken, a south Los Angeles restaurant specialzing in “Nashville-style” spicy dishes, will have to shut its outdoor eating space after already closing the dining room. / TO GO WITH AFP STORY BY JOHN BIERS “Covid-19 dampens holiday cheer for Black small businesses”

Small business owners and the American economy needed this extension. And though it has passed, the extension doesnt necessarily mean the process will be any less frustrating for those in need of immediate financial relief.

Unfortunately, this round of the program has been plagued with fraud, and its only increased in the last few weeks. Small businesses that have already been dealt an unfair hand by the pandemic now have to contend with further scrutiny on their applications. Due to this increased scrutiny, lenders and the SBA now have less time for processing the legitimate PPP loan applications.

Which Covered Period Is Right For Me

A borrower should choose a covered period that will allow all eligible payroll and non-payroll expenses to be paid out prior to applying for loan forgiveness. The covered period begins on the day the PPP funds were deposited into your account. It ends on a date selected by you that is at least 8 weeks following the date of loan disbursement and not more than 24 weeks after the date of loan disbursement. The covered period chosen needs to align with use of eligible payroll and non-payroll expenses, payment and documentation.

Example: PPP funds were exhausted during Week 9. The chosen covered period for the PPP loan forgiveness application would be a 9-week covered period.

You May Like: Texas Fha Loan Limits 2020

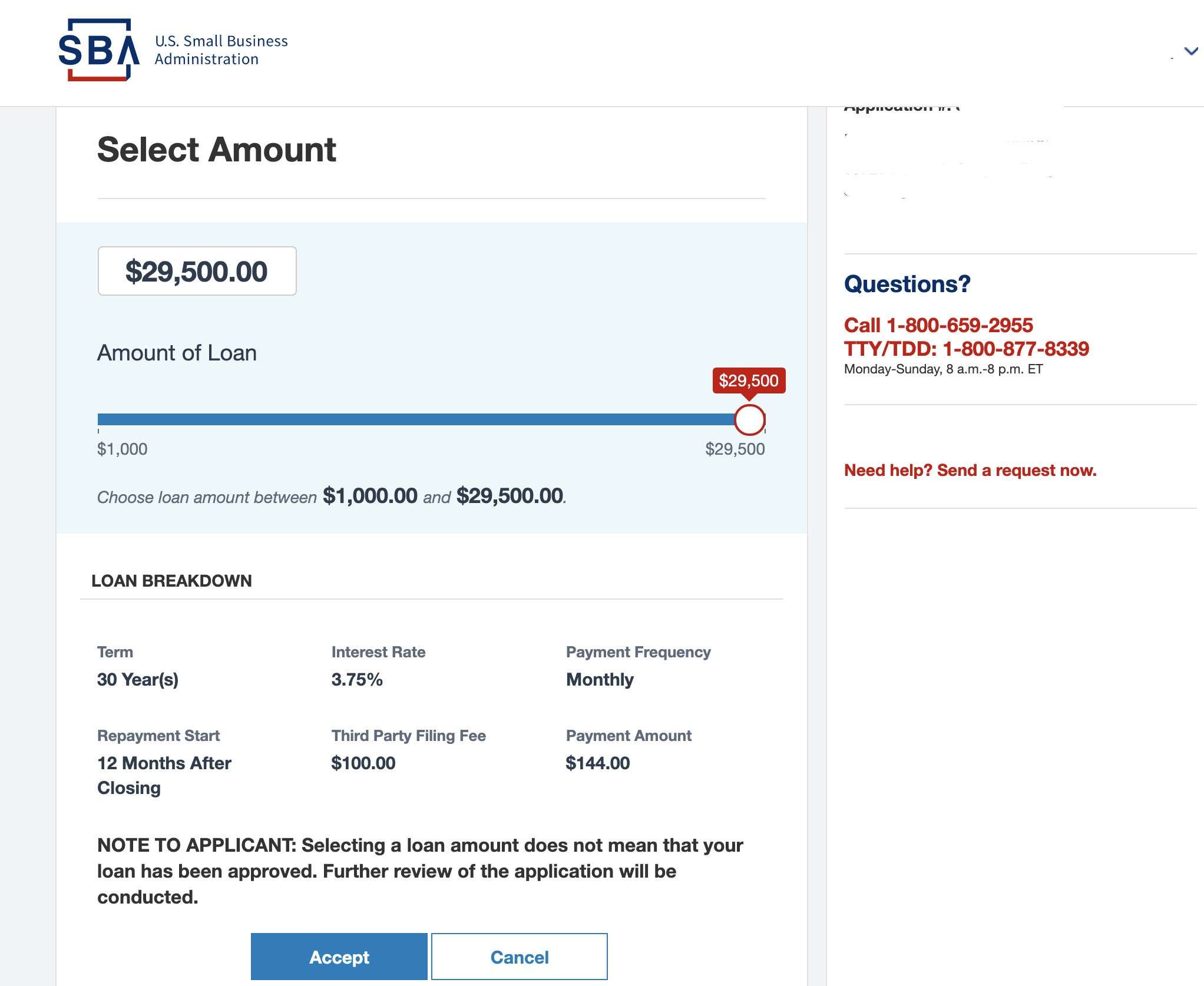

Latest Sba 2021 Method Step By Step

1. Go to

2. Click on Applicant is an individual who operates under a sole proprietorship, with or without employees, or as an independent contractor.

3. you will see Review and Check All of the following:

4. Check All the Boxes in that

5. For the Business and Trade Name, Put the First and Last Name of the social security number info you using

6. Put the social security number info of the client there, and choose Sole Proprietorship. If asked about Non-Profit Organization choose NO

7. For the Gross Revenue put any amount above $150,000

8. For the cost of goods, write anything Above $50k

9. For the rental properties, write anything below $35k

10. From the Non-Profit to the Compensation Sources, you can leave those boxes empty

11. When they ask for a Business address, Put the Address of the Ssn information you are using there

12. You can use any phone Number there, but you must create a new email either using Gmail or Hotmail and put it there as the Business Email ??

13. With the Business Activity, Choose anything related to Sales or business information or Retail

14. Now this is the MOST IMPORTANT, when they ask for employees, put in any number between 10 and 17, this will make you eligible for a higher amount

15. At this page, Choose NO

16. Write the same information on the social security number info you are using, with Ownership percentage, write 100 and you can choose either Owner or CEO as title

18. Leave this whole page blank

Received A Contract But Not Funded Yet

If you have received and signed a contract, but it hasnt been funded, there could be a few reasons. Your application may have errors on the contract, including the wrong name, wrong bank routing number, or incorrect bank account number. Its also possible your application hasnt passed the lenders quality control review.

As financial institutions and fintech providers across the country work diligently to process these loans, we implore applicants to proactively supply as much documentation as possible. We know how badly you and your employees need these relief funds, and we want to help you get funded as expeditiously as possible. Thankfully, money remains in the program and with the recently-passed extension, lenders can continue to push applications across the finish line until the funds are exhausted.

Don’t Miss: How To Get Loan Originator License

What Are The Terms Of The Loan And Are There Any Fees

The term or period of the PPP loan is stated in your promissory note and is either two or five years.

The PPP loan will accrue interest at an annual rate of 1%.

No payment is due during the deferral period, which ends:

If your loan is forgiven, any interest accrued during the deferral period is eligible for forgiveness.

There is no penalty for loan pre-payment, however partial or full pre-payment may impact forgiveness.

After the deferral period, any balance that is not forgiven will become a term loan with monthly payments due up to the maturity date and with an annual interest rate of 1%.

For each payment of principal, interest, and/or fees that has not been paid in full within 15 days after its due date, you will be assessed a late charge of $15 or five percent of the amount due, whichever is greater.

There are no annual or documentation fees associated with the loan. However, if you are late on payments after the deferral period, you may be liable for late fees for any portion of the loan that is not forgiven.

You will receive a loan statement before any payment is due, so you can plan accordingly.

Please refer to the SBA site for more details on the covered period, the term of the loan and other loan forgiveness details.

What If I Plan To Sell My Business Can I Still Apply For Loan Forgiveness

You should consult your attorney to understand the potential ramifications and additional requirements of completing the sale of your business while you have an open PPP loan. If you sell your business before completing the loan forgiveness process, you may jeopardize your forgiveness claim.

You can request to have your planned ownership change approved by U.S. Bank.

You May Like: Credit Score For Usaa Auto Loan

What Do I Do With Employees That Refuse To Come Back To Work

If a return to work offer at the same salary/wages/hour was rejected by an employee, the borrower must maintain records documenting the written offer and its rejection and inform the applicable state unemployment insurance office of such employee’s rejected offer of reemployment within 30 days of the employee’s rejection of the offer. The SBA will be posting state unemployment offices on the SBA website.