What Is A Fha 203h Loan

A 203H loan is a special version of an FHA loan made for disaster victims, specifically people who lost their home in a Federally Declared Disaster Area.

Individuals are eligible for this program if their homes are located in an area that was designated by the President as a disaster area and if their homes were destroyed or damaged to such an extent that reconstruction or replacement is necessary. Insured mortgages may be used to finance the purchase or reconstruction of a single-family home that will be the principal residence of the homeowner. Like the basic FHA mortgage insurance program it resembles, Section 203 offers features that make recovery from a disaster easier for homeowners.

Fha Loan Limits In Georgia

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

The federal government has set the maximum amount a Georgian home buyer can borrow with an FHA loan between $356,362 and $412,850 for a single-family home, depending on which county the property is located in. The lower number applies to most of the Peach State, including the city of Savannah, while folks in and around Atlanta might be able to qualify for more than $400,000.

Dreaming about buying a house in Georgia? This may be the perfect time to make the leap. And thanks to the Federal Housing Administration , some Georgians can qualify for federally backed loans to help get them into a new house. This year, residents will be able to borrow even more with an FHA loan in some areas to make their homebuying dreams come true.

How To Apply For An Fha Loan

Applying for an FHA loan is simple when you know how. Follow the steps below to get started:

Getting an FHA loan can be easy when you understand how the process works. Though it can seem difficult to understand all the details, our Home Lending Advisors are here to guide you through each step.

You May Like: Usaa Rv Loan Rates Calculator

Fha Loan Requirements For 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Mortgages backed by the Federal Housing Administration have different requirements from other types of home loans. Though you don’t have to be a newbie, FHA loans are often popular with first-time homeowners because they couple lower down payment requirements with more lenient standards for credit scores and existing debt. Here’s a rundown of the key FHA loan requirements.

You Can Make An Offer That Sellers Take Seriously

Preapproval lets you know the price range of homes the lender may approve. You can look for houses in neighborhoods and home styles that suit that range, knowing that approval is likely.

Finally, preapproval gives you a competitive edge over other buyers.

If more than one person bids on the home you want, the seller is very likely to choose folks who have been preapproved. Sellers are picky in this market and will simply toss out offers without strong financing attached.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Where Can You Apply For An Fha Loan

Most banks and other mortgage lenders offer FHA loans. However, their lending standards, and the fees and rates they charge, can vary significantly from lender to lender, so it’s important to shop around and compare rates and terms that lenders will offer you. One way to do that is by using the from at the top of this page to request free rate quotes from several lenders at once.

Once you choose a lender, there are two ways you can apply for an FHA loan. You can go to the bank itself, obtain the necessary application forms, fill them out either there or at home, then submit them to your loan officer for review.

However, many lenders now allow you to apply for an FHA loan online as well. You log into a special section of the lender’s web site where you can complete the necessary forms, scan or otherwise obtain electronic copies of the documentation required, and submit the whole thing electronically. Your loan officer can then review your FHA loan application and let you know if other information is needed, which you can conveniently submit from home.

Keep in mind that an FHA loan doesn’t issue the loan itself, but ensures lenders are in line with the generous rates and that all the advantages are presented to the borrowers.

Renasant Bank Best Bank Lender

Renasant Bank is a bank and lender with branches in Alabama, Florida, Georgia, Mississippi and Tennessee.

Strengths: Like other mortgage lenders, Renasant Bank allows you to get competitive rates for up to 60 days. Being a regional bank, Renasant has a more local character, which can enhance the borrowers experience. Banks also offer community home improvement loans, which may be useful if you want to improve your home.

Weaknesses: Renasant Bank is only available in certain states, and does not provide information on interest rates online.

Recommended Reading: Refinance Avant Loan

Cardinal Finance Company Best For Low Credit Score Borrowers

Cardinal Financial Company, which also operates Sebonic Financial, is a mortgage lender available throughout the United States, offering a variety of loan products including FHA loans.

Strengths: Like many mortgage lenders, Cardinal Financial offers FHA loans to borrowers with low credit scores , as well as other loan types with some credit flexibility . on VA and 580 for USDA loans). One key benefit: The lenders proprietary system, Octane, guides borrowers through the home loan process with a personalized to-do list.

Downside: While you can easily find out Cardinal Financials credit terms and down payments for certain products online, you wont be able to find information about interest rates or fees. To receive offers and details of fees, you will need to contact the loan officer.

Apply For The Correct Type Of Fha Loan

Lenders offer a variety of FHA loans in addition to the most common type, the 30 year fixed interest. You can also get a fixed interest rate on an FHA loan for 10, 15, 20 or 25 years or you can get an adjustable rate FHA loan. An adjustable rate loan allows for the fluctuation of interest rates at certain periods of time. For example, a 3/1 adjustable rate FHA loan means the interest rate is fixed for 3 years and can adjust every year thereafter. FHA adjustable loans come in the form of a 3/1, 5/1, 7/1 or 10/1 with 30 year terms. These are not as popular as fixed interest FHA loans since they provide more risk to the average homebuyer.

Recommended Reading: What Happens If You Default On Sba Loan

Georgia Fha Loan Limits

Every county in the United States has specific maximum loan limits that are set for single family homes, as well as 2-4 unit properties. The limits are set based upon the average home sales value in that county. The base FHA loan limit for single family residences in Georgia for most counties is $331,760. Use this FHA loan limit lookup tool to see what the FHA loan limits are in your county.

| County Name |

|---|

| $638,100 |

Washington State Fha Loan

Washington State FHA Loan Requirements

Below are some of the basic requirements to get an FHA loan in Washington State. If you would like to find out if you are eligible for an FHA loan, we can help match you with a lender. To have an FHA lender contact you, request a free consultation.

Would you like to see if you qualify for an FHA loan? We can help match you with a mortgage lender that offers FHA loans in Washington State. To have an FHA lender contact you, request a free consultation.

2020 Washington State FHA Loan Limits

Below are the 2020 FHA loan limits for every county in Washington State:

| County |

|---|

Read Also: Loan Without Income Proof

Benefits Of An Fha Loan

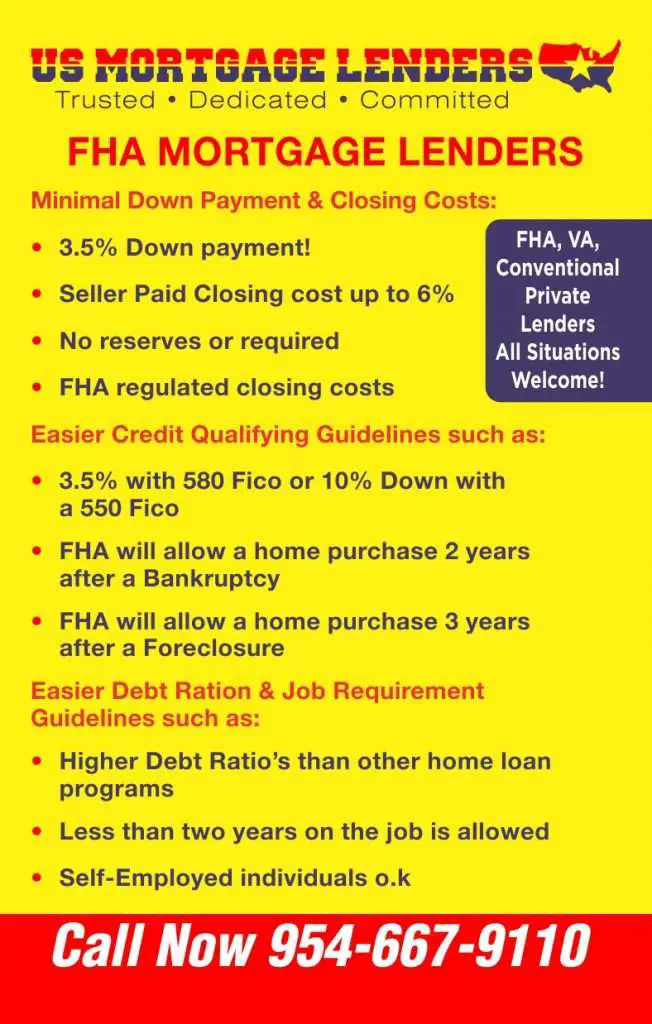

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

Save At Least A 35% Down Payment

The minimum required down payment for an FHA loan is 3.5%. In reality, youll need to save closer to 6% of the homes purchase price to account for closing costs- which include an upfront mortgage insurance premium equal to 1.75% of the homes value. You can reduce this premium to 1.25% by undergoing an FHA-approved credit counseling program prior to closing.

Also Check: Usaa Credit Score

Should I Apply For An Fha Loan

FHA loans make homeownership more achievable for many people, especially first-time homebuyers. In fact, 83% of FHA purchase loans were for first-time buyers, according to the FHAs Annual Report for 2020.

A 3.5% down payment is much easier to save for than the traditional 20%, so you can achieve your dream of homeownership that much sooner by going FHA.

Consider that on a $200,000 home, youd have to save a hefty $40,000 to afford a house with the traditional 20% down. But the down payment on an FHA loan for the same home totals just $7,000 $33,000 less.

Many conventional loan programs now allow you to put down as little as 3%. But FHA often has lower interest rates and lower mortgage insurance premium rates than youd find with conventional interest rates and private mortgage insurance .

Its worthwhile to apply for an FHA loan if you have an average credit score or have experienced some bumps with credit in the past. FHA lenders can approve buyers with credit scores of 580 and above. Some will approve a loan with scores between 500 and 579, although they will require a 10% down payment.

Income And Proof Of Employment

You will need to be able to verify your employment history to qualify for an FHA loan. You should be able to provide proof of income through pay stubs, W-2sand tax returns. There are technically no income limits, but you will need enough income to have an acceptable DTI ratio. Having a higher income will not disqualify you from receiving a loan.

Recommended Reading: Va Loan On Manufactured Home

Frequently Asked Fha Questions

Can I get an FHA loan with a bankruptcy?In general, you will need to wait two years before applying for an FHA loan after a bankruptcy. However, there are some exceptions which may allow you to apply sooner. Read our article on the bankruptcy waiting period.

Are all FHA lenders the same?Not all lenders who offer FHA loans are the same. They all do not offer all of the FHA programs and their rates and fees may also vary. Most importantly, the individuals who help to process and underwrite your loan will have a huge impact on your FHA loan experience.

Can I use gift funds for an FHA loan?FHA loans do allow for gift funds to cover your down payment as well as your closing costs. The gift funds must come from a relative or a close friend as approved by the lender. You will need to provide the lender with a gift letter that is signed by the donor.

Do I need an appraisal for an FHA loan?The FHA does require an appraisal and inspection before your loan can be approved. The FHA inspection has clear guidelines on what needs to be repaired before your loan can close. They want to make sure home buyers are moving into a home that is safe and operational.

You Can Compare Your Options

A preapproval also allows you to determine whether an FHA loan is actually the best option for you. Despite their many benefits, FHA loans do have some drawbacks.

You must pay an upfront mortgage insurance premium of 1.75% of the loan amount for FHA. There is no upfront mortgage insurance requirement with a conventional loan, even if you only put down 3-5%..

And, a conventional loan may be the better option if you have excellent credit. Youll pay private mortgage insurance until you reach 20% equity, but after that, it falls off.

Getting preapproved tells you all the potential loan programs that may be right for you, allowing you to make the most informed choice.

You May Like: Can I Refinance My Car Loan With The Same Lender

What Happens After You Apply For An Fha Loan

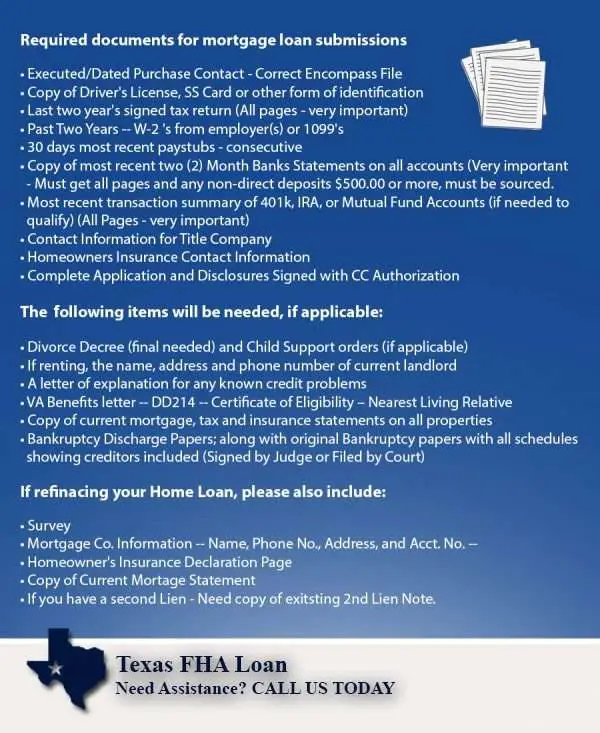

The typical timeline from application to closing with an FHA loan ranges from 30 to 45 days.

During this time, your loan file goes through underwriting. The underwriter takes a closer look at your application and reviews supporting documents to ensure you meet the minimum guidelines for FHA financing.

- The underwriter will review your current debts and minimum payments, then calculate your debt-to-income ratio

- The underwriter will review your bank statements and other assets to confirm that you have enough in reserves for the down payment and closing costs. If your down payment is coming from a cash gift or down payment assistance, youll need documents verifying the source of the funds

- The underwriter will review your previous tax returns and W2s statements to confirm a two-year history of stable, consistent income

- The underwriter will review your recent pay stubs to confirm youre still employed and earning income

- The mortgage lender will schedule an appraisal to determine the homes current market value. You cannot borrow more than the property is worth

You should also schedule a home inspection after getting a purchase agreement. A home inspection isnt required for loan approval, but its recommended because it can reveal hidden issues with the property.

If your offer was subject to a satisfactory home inspection, you can ask the seller to correct these issues before closing.

Submit requested information as soon as possible to keep closing on schedule.

Georgia Fha Down Payment Assistance

There are various down payment assistance programs in every state. Below is a list of just a few down payment assistance programs that may be available to you in Georgia. Home buyers will need to contact, and arrange for these programs independently. Lenders will accept the funds from these programs for your down payment but they will not arrange for the down payment assistance.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Down Payment Assistance In 2021

Down payment assistance programs make the mortgage process more affordable for eligible applicants who are interested in purchasing a home but need financial help to do so. Money is usually provided in the form of a non-repayable grant, a forgivable loan, or a low interest loan. Homebuyer education courses may be required.

Typically, a property being purchased must serve as the applicants primary residence and must be located within a specific city, county, or state. It may also need to fall within a program’s maximum purchase price limits. Income limits may apply, and will look something like this :

- 1 person household: $39,050

Guidelines For Manual Underwriting

The waiting period and documentation requirements mentioned above pertain to automated underwriting, in particular. This is when the lender uses the FHAs TOTAL scorecard through an automated underwriting system. Youll notice that at the end of the passage above, it also refers to a manual underwrite.

On page 258 of the official handbook, we encounter some guidelines for manual underwriting.

A Chapter 7 bankruptcy does not disqualify a Borrower from obtaining an FHA-insured Mortgage if, at the time of case number assignment, at least two years have elapsed since the date of the bankruptcy discharge.

During the two-year time frame mentioned above, the borrower must have:

- re-established good credit or

- chosen not to incur new credit obligations.

In some cases, the waiting period for getting an FHA loan after bankruptcy can be shorter than two years . This is possible if the borrower can show that the bankruptcy was the result of extenuating circumstances beyond the borrowers control.

Additionally, the borrower must be able to exhibit a documented ability to manage their financial affairs in a responsible manner. Its up to the mortgage lender to determine these things, and to document them accordingly.

You May Like: Usaa Auto Refinance