Do You Have To Repay Grants

Grants dont function the same as student loans, and you typically dont have to repay them.

There may be some grant programs, however, that have stipulations for keeping the award. If you dont meet all of the requirements, you could lose the full grant amount or even have to pay back some of the grant money youve already received.

Pay Off Capitalized Interest

Unless your loans are subsidized by the federal government, interest will accrue while youre in school, your grace period and periods of deferment and forbearance. That interest capitalizes when repayment begins, which means your balance grows, and youll pay interest on a larger amount.

Consider making monthly interest payments while its accruing to avoid capitalization. Or make a lump-sum interest payment before your grace period or postponement ends. That wont immediately speed up the payoff process, but it will mean a smaller balance to get rid of.

» MORE:How much will deferment or forbearance cost you?

How Much Do I Pay Each Month Can I Pay More

Your minimum monthly payment is based on the type of loan, the amount you owe, the length of your repayment plan and your interest rate. Typically, borrowers have 10 to 25 years to repay federal loans entirely. Shorter lengths of repayment time or larger loans will result in higher monthly payments.

The Standard 10-year Repayment Plan is by far the most popular plan with borrowers, but that doesnt mean it is the best plan for you. This is the default plan. Borrowers are automatically enrolled in the Standard Repayment Plan unless they choose a different one.

Youll make fixed monthly payments for 10 years. Its a great plan if you can afford the monthly payments and the cheapest option long term because youll pay a lot less in interest. If you lack the income to support these payments, however, you should enroll in one of the income-driven repayment plans.

Or perhaps you have in mind applying for the Public Service Loan Forgiveness program. Work full-time in a qualifying field government at any level, or not-for-profit organizations that are tax-exempt under Section 501 of the Internal Revenue Code and make 120 qualifying monthly payments, and whatever balance remains will be forgiven.

Also Check: Usaa Auto Loan Application

How To Pay Off Student Loans Quickly: 10 Steps For Success

14 Minute Read | September 10, 2021

If paying off your student loans feels way too far awayor even worse, totally impossiblehear me out. You can do this.

Lets set some expectations first. I dont have a special magic trick or life hack to help you get rid of it all in 30 days flat. Its not going to happen overnight, just like I didn’t grow overnight. It took a lot of patience to finally hit five foot, six inches.

But by following these 10 steps, you can get on a fast track to dumping your student loan debt for good. Im not going to lie to yallpaying off your student loans takes time, hard work and a whole lot of sacrifice, but its totally doable! Years ago, using these same steps, I was able to pay off my $36,000 in student loan debt in just 18 months! The faster you get rid of your loans, the sooner you can live life on your terms. So, lets make it happen!

You Will Notice The Payments

Student loan payments are taken from your pay before you receive it, just like income tax and National Insurance are.

Many believe that this means they wont notice the cash going out. However, it will become very clear any time you receive a pay rise.

Say you earn £25,725, and get a pay rise to £30,725. Based on the current repayment rate, 9pc of that £5,000 would go on your student loan, plus 20pc on income tax and 12pc on National Insurance.

Without your student loan payment, youd be left with £3,400 of your raise after tax. With the payment, you would be left with £2,950.

In the higher-rate tax band, the combination of 40pc income tax, 2pc National Insurance and 9pc student loan payment pushes the effective rate of taxation to 51pc on every pound earned over the £50,000 higher-rate threshold.

Recommended Reading: How To Get Loan Originator License

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through September 30, 2021.

These Programs Can Help You Wipe Out Student Debt

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

How can people get rid of their student loan debtand, specifically, when is loan forgiveness an option? We don’t need another statistic to tell us how deep in student loan debt U.S. college graduates are. Total debt and average debt figures don’t mean much, except to say that if the sums you owe keep you up at night, you’re in good company. What really matters is finding a solution.

Also Check: Refinance Auto Usaa

Myth #: Lenders Wont Let Me Borrow More Than I Can Pay Back

Source: Gr8t Shots/Shutterstock.com

As an 18-year-old getting ready to go to college, youre probably pretty excited. Youve had the idea of college pushed on you your entire school life. It seems like the smart move to make, but its also one of the more expensive moves youll make.

With no other experience with debt, its easy to assume that lenders wont let you borrow more money than you could reasonably pay back. Youd be wrong.

When youre taking out loans private student loans, in particular lenders have one main concept in mind: profit.

If you take out massive amounts of student loan debt but end up with a job that pays as much as you could have gotten without a college degree, you could be in big financial trouble.

For this reason, you need to do some serious investigation and number crunching long before you take out student loan debt.

Source: YP_Studio/Shutterstock.com

When you graduate from college, you may have several student loans you need to make payments on in the near future. Wouldnt it be easier to consolidate them into one loan and make a single payment each month?

In theory, this sounds good, and its entirely possible to do. But, it may not always be the best decision. Consolidating student loan debt isnt as simple as it sounds.

Read more: Student Loan Consolidation And Refinancing Guide

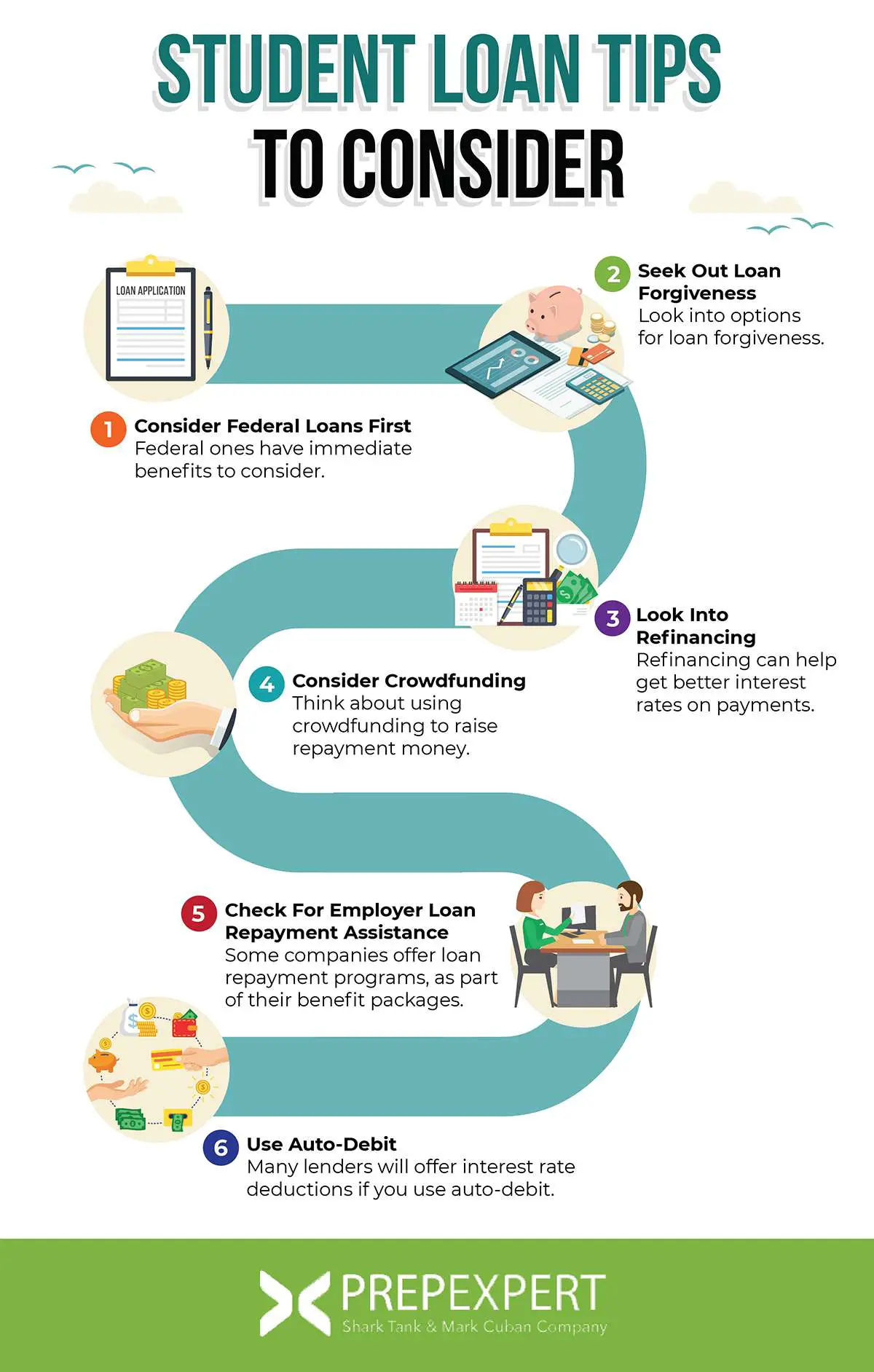

Refinance Student Loansif It Makes Sense

Before you go running into the arms of an all-too-eager lender, know that refinancing student loans is not the right move for everyone. If someone told you this is the absolute best way to pay off student loans, they were lying. But that doesnt mean you shouldnt at least look into refinancing.

When you refinance, youre taking all your loansfederal, private, often a mix of bothto a lender who pays them off for you. And now you owe this new lender the money they just fronted you.

With a refinance, the goal is to secure a better rate and better payment termswhich means you pay less each month and for a shorter amount of time to one lender instead of more money for a longer period of time to one or more lenders.

If youre in a position to keep paying the same amount you were paying before you refinanced, even better. Because that means youre throwing more at the principal each month than you were before and avoiding more interest. Plusand heres the best partif youve got other debt outside your newly refinanced student loan, you can ramp up your debt snowball even faster once you knock out that student loan.

Remember though, youre refinancing to get a better rate and payment terms. If thats not what youre being offered, dont refinance. Its a bad deal. Make sure to do your homework and read the fine print, or you could end up deeper in the hole than you were before.

You May Like: Loans Without Proof Of Income

Dont Bank On Student Loan Forgiveness

Okay, this one really grinds my little gears. I know people probably told you that taking out student loans was no big deal because you could just get them forgiven later.

But student loan forgiveness isnt really the dream come true it sounds like. First off, with the current program, there are so many requirements you have to meet in order to be eligible . And even then, forgiveness isnt guaranteed.

Now, theres been a lot more talk lately about the government wiping out student loan debt across the board. Okay, that would be awesome, but dont bank on it. I mean, Biden talked a lot about that sweet student loan forgiveness. So far, hes canceled nearly $3 billion of current student loans.3 That may sound like a lot until you hear the current federal student loan debt sits at $1.57 trillion .4 So after all that talk, only 0.19% of the debt was forgiven. Listen: Politicians make a lot of empty promises. It doesnt matter whos in the White House. Youre responsible for taking care of your money and your debts.

Youre better off having a job that pays well so you can go ahead and pay off your student loans as fast as you can. That way you wont spend years of your life waiting to have your loans forgivenit may never happen.

P.S. If youre into podcasts, you need to check out a podcast series I hosted called Borrowed Futureits all about the student loan debt crisis in America. Specifically, listen to Episode 6: Dont Bank on Student Loan Forgiveness. Its real good.

Student Loan Myths You Cant Afford To Believe

Modified date: Nov. 3, 2021

Its no secret that student loans are confusing. Most students get to college after signing document after document, not really understanding what kind of loan they took out.

Because no one really learns anything about student loans in high school, a whole bunch of myths have popped up about how student loans work.

If youre lucky enough to be reading this before you take out student loans, take action today to make sure you dont get in over your head by listening to these myths.

If youre already in debt, well, most of us are right there with you. Learning about these myths now can help you figure out the best way to move forward.

Whats Ahead:

Also Check: Va Loan Requirements For Mobile Homes

Extend Your Grace Period By Another Six Months If You:

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9 ½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

You can make payments on your loan at any time to repay it faster.

Get repayment assistance:

If youre having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you cant attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9 ½ up to 14 ½ years. Log in to your National Student Loans Service Centre account.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Read Also: Usaa Refinance Rates Auto

Should I Invest Or Pay Back My Student Loan First

If you are thinking of investing, I would suggest that you prioritise paying back your tuition fee loan first. This is because the interest rate is rather high, and you may not be able to beat this amount.

I would only recommend that you start investing if you are confident of consistently beating the 4.75% interest you owe the bank. It may be possible if you choose to invest in the S& P 500, which has an average return of 10%.

However, this is only the average return. You may not be receiving 10% returns every year.

There may be some years where you may receive negative returns too!

To get consistent returns above 4.75% may be something thats quite hard to achieve. This would mean that your debt grows larger than your wealth, so you may still have a negative net worth.

As such, it may be a better choice for you to aim to be as close to debt free as possible before starting to invest!

Do The Math And Find Your Payoff Date

Effectiveness level: Low

Do you know exactly when youll be free of student loan debt? If you answered no, youre not alone.

But figuring out your payoff date is always a good place to start when it comes to managing debt. Why? Because once you know this date, you can work on moving it closer.

The easiest way to figure this out: Use the National Student Loan Data System to view all of your federal loans and AnnualCreditReport.com to make a list of private loan lenders. Then, confirm payoff dates with your loan servicers.

Also Check: Does Fha Loan On Manufactured Homes

Revised Pay As You Earn

REPAYE sets your monthly payment at 10% of your discretionary monthly income. Under this plan, your repayment period is 20 years if all of your loans were for undergraduate studies. If any loans were for graduate studies, the repayment period jumps to 25 years. For the purposes of this program, discretionary income equals the difference between your annual income and 150% of the poverty guideline for your family size and state.

The REPAYE plan is good for those with high balances and a modest income. It is also a solid plan for an individual who doesnt mind if their monthly payment is larger than what it would be under the standard repayment plan, since there is no cap. Additionally, for those with very large loan balances, the government subsidizes some of the interest that accrues if your monthly bill is not large enough to cover the interest payment.

Pros

- Any borrower with eligible federal loans can choose REPAYE

- Access to loan forgiveness at the end of your repayment period

- Monthly payments will decrease if your income decreases, keeping the payment affordable

Cons

- If you dont recertify your income and family size annually, you will be removed from the plan, which could make your payment jump

- Depending on your income and family size, your monthly payment might be higher than the amount youd pay under the standard repayment plan

- Due to the longer payment period, you may pay more in interest

How To Repay Your Ocbc Student Loan

You may have taken a tuition fee loan with OCBC to fund your NUS or NTU tuition fees.

The best part is that the loan is interest free during your university course!

However, once your course is over, you may be wondering how you should go about paying it.

Here is my experience with repaying my tuition fee loan with OCBC.

Contents

Also Check: Get A Loan Without Proof Of Income

If You Pay Back More Than You Owe

HM Revenue and Customs will tell your employer to stop taking repayments from your salary when you have repaid your loan in full. It can take around 4 weeks for salary deductions to stop.

This means you may pay back more than you owe.

You can avoid paying more than you owe by changing your payments to direct debit in the final year of your repayments. Keep your contact details up to date so SLC can let you know how to set this up.

If you have paid too much the Student Loans Company will try to:

- contact you to tell you how to get a refund

- refund you automatically

If youve overpaid and have not heard from SLC you can ask them for a refund.

Quick Tips For Calculating Student Loan Payments Each Semester

Start with federal loans issued directly to students using the Repayment Estimator calculator.

- Understand student loans can be accepted, rejected, or canceled on a semester-by-semester basis.

- Gather basic information about your students private student loans and then call the servicer or use the Road2College calculator to calculate monthly payments for each loan separately. Then add them up for a total monthly payment your student will be responsilble for. If you co-signed for the loan, be ready to repay these loans if your student cant.

- Calculate Parent PLUS loan payments each semester.

- No matter which loans end up being too high, look for ways for the student to painlessly rebudget. Changing meal plans or changing the way they buy or sell textbooks alone could save the student hundreds per year.

Calculating your student and your monthly student loan payments, while your student is in college, will keep you abreast of what your monthly financial commitments will be.

You will have a good idea of what the future holds in terms of financial obligations, and you will be able to reassess if necessary along the way.

CONNECT WITH OTHER PARENTS TRYING TO FIGURE OUT

HOW TO PAY FOR COLLEGE

Also Check: How To Get A Loan Officer License In California