How Do You Get A Better Rate For A Car Loan

There are many ways for you to influence your chance of getting a better rate. Lets take a look at a few of them:

Improve Your Credit Score Before Applying

Improving your credit score doesnt happen overnight. Over time, you need to show that you are responsible with your debts. This includes making your credit card payments on time and keeping the balance within 30% of your limit and building a diverse but manageable combination of debt. For more information about improving your credit score, check out Loans Canadas article on Improving Your Credit Score.

Increase Down Payment

No-money-down car loans may seem like a great deal, especially if you have trouble saving however, this route can almost certainly guarantee you a higher interest rate. Consider waiting a little longer before purchasing your car so that you have a sizeable down payment. Experts recommend at least 20%.

Get A Co-signer

Compare, Research, and Consider Pre-Approval

If you want to be prepared and well informed about the different deals and interest rates available to you, you might want to consider pre-approval for a loan. Dont worry a pre-approval wont damage your credit score. On the contrary, they can actually be quite helpful in helping you assess what youre eligible for. Furthermore, being able to compare rates with loans you are pre-approved for gives you more knowledge and in turn more power in negotiating a rate with a dealership.

Negotiate

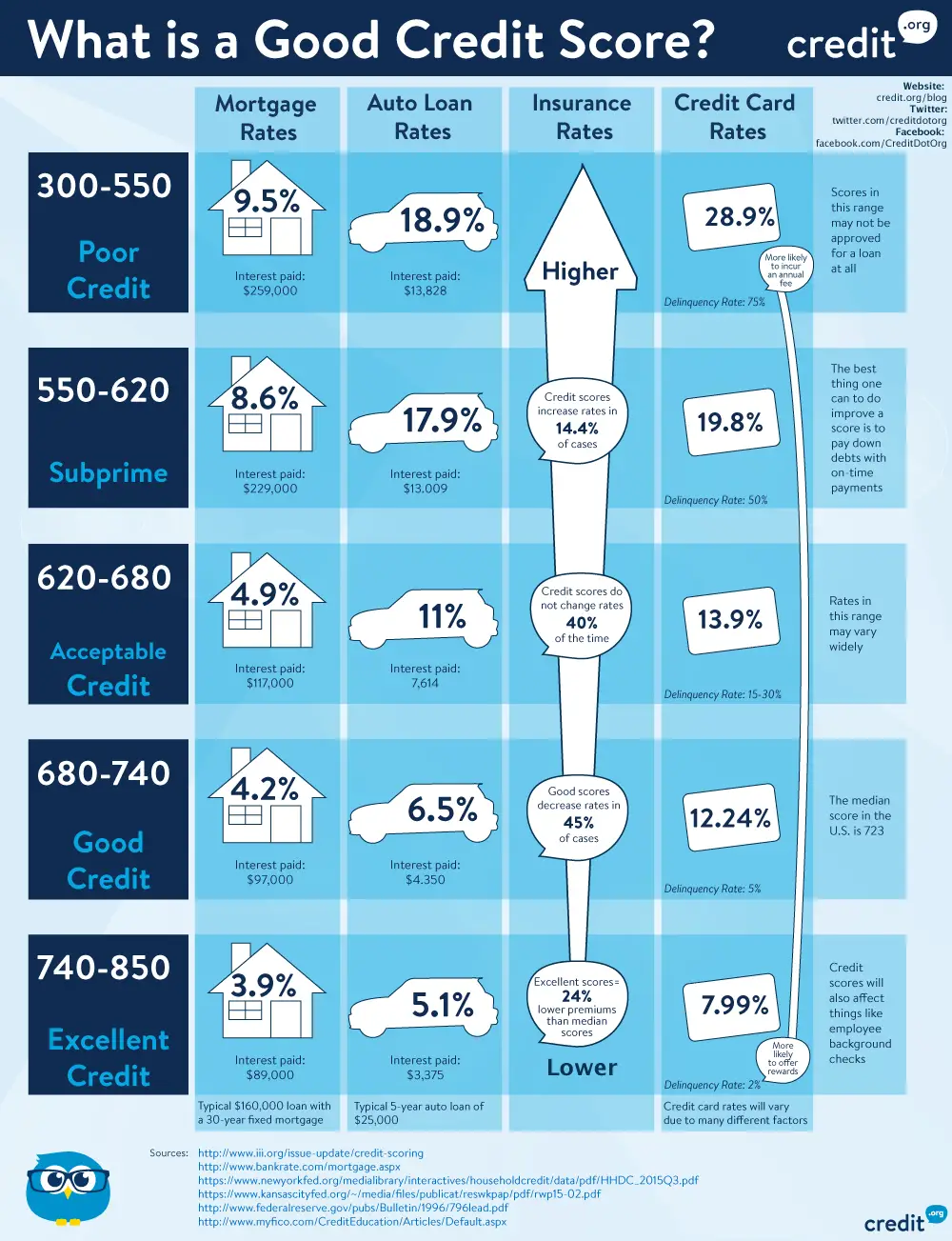

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.

Compare Auto Loan Providers

As mentioned, one of the simplest ways to find the best auto loan rates is to shop around. Do this before you get in the room with a loan officer at a car dealership. You can get as many pre-approval offers as you want, as long as you make sure they only require a soft credit check. When youre ready to go ahead with an offer, you can do a full loan application with the financial institution that gives you the best auto loan rates.

Also Check: Va Loan For Mobile Home And Land

Best Big Bank Lender: Capital One

Capital One

Capital One gives car shoppers the peace of mind of working with a major secure lender and offers competitive rates placing it in the top spot as the best big bank lender.

-

Offers competitive rates for all credit scores

-

Pre-qualify with a soft credit check

-

Must contact dealer directly to confirm vehicle is in stock

-

Loans only available through the lenders network of dealers

Understandably, some people aren’t as comfortable using lesser-known or niche lenders for something as crucial as an auto loan. If you want the backing of a major financial institution with a household name, Capital One may be your best bet. If you’re in the market for a new or used car, you can submit a request to get pre-qualified for auto financing through the bank’s Auto Navigator program. This early step does not affect your credit since it is a soft pull.

The pre-qualification is then valid at more than 12,000 dealers throughout the nation, each of which you can find on Capital One’s website. Just present the qualification note at a participating dealership and begin the full application process once you find the perfect ride.

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

Read Also: How Much Car Can I Afford Calculator Salary

How To Calculate Car Loan Emi

The Equated Monthly Installments that you will pay will depend on a few key factors.

- The size of the loan

- The interest rate that is applicable to the loan

- The tenure of the loan

- The processing fees

The higher the loan amount, the higher your EMI will be. Similarly, the shorter the loan tenure the higher the EMI. To find the best compromise between an affordable EMI and duration you should check out our car loan EMI calculator.

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Don’t Miss: When Can I Apply For Grad Plus Loan 2020-21

Checklist: Applying For A Car Loan

Ready to apply for a car loan? Youll need to gather a few documents ahead of time to start the process. Heres what you can expect to need:

- Your credit score and credit report: The higher the credit score, the lower the interest rate, so its in your best interest to try to improve your credit score as much as possible ahead of time. This can be done by paying off any credit card balances or outstanding debts.

- Information about the vehicle: The lender will need to know the make and model of the vehicle you wish to purchase so that they can have a price to then determine the terms of your car loan.

- Personal and Financial Information: The basics like your full name, birthdate, and current address will be required as well as any information about mortgage or rent payments and outstanding debt if applicable. You may be asked to show recent bank statements as well.

- A drivers license: While it is technically possible to get a car loan without a drivers license, most lenders will require one because those with licenses have been proven to be more likely to pay back their car loan.

- Employment History and Income: You will likely be asked about your employment history for the past three years. You will also be asked for proof of income which can be shown through notices of assessment.

Best For Refinance: Autopay

- As low as 1.99%

- Minimum loan amount: $2,500

AUTOPAY offers several different refinance options, competitive rates, and has flexible credit requirements. Borrowers can easily compare offers from different lenders on AUTOPAY’s site and choose the best deal.

-

Considers all credit profiles

-

Excellent credit required for the best rates

While AUTOPAY’s rates start at 1.99%, only those with excellent credit will qualify. According to AUTOPAY, they can, on average, cut your rate in half on a refinance.

AUTOPAY offers more refinance options than many lenders. In addition to traditional auto refinancing, borrowers can choose cash-back refinancing and lease payoff refinancing.

AUTOPAY is a marketplace that makes it easy to shop around for the best deal. It caters to individuals who are rebuilding credit or improving their credit.

You May Like: How Many Times Can You Refinance A Car Loan

How Much Would You Like To Borrow:

Please review and adjust your amounts for down payment, trade-in and cash incentive. Their current total is equal to orexceeds the vehicle purchase price.

Reminderthe minimum borrowing amount is $7,500. Therefore the total price of the vehicle less any down payment, trade-in, and cash incentive cannot be below this amount.

Interest Rate

Buying A Car Outright

The final option is to buy your car outright. Granted, this isnt a possibility for most people . However, if you have been saving your money and can afford it, there are some benefits.

- No monthly payments: This is the most obvious perk to buying a car outright. Having no monthly payments takes off the added stress of making sure you have money set aside to cover your loan or lease.

- Possible Discount: Cash is king and dealerships recognize this. If you are able to pay for your vehicle upfront in cash, then you can probably get a discount.

- No Interest: Paying in full using cash means youre not being charged any interest to purchase the car. It could potentially save you thousands of dollars.

Read Also: Need To Refinance My Car With Bad Credit

Apply For Financing At Sam Leman Automotive Group

If you need assistance with automotive financing, you can trust the experts at the Sam Leman Automotive Group. Apply for financing in advance to expedite the process. We look forward to helping you drive home to Bloomington-Normal, Peoria, or Champaign in the vehicle of your dreams. Contact us today for more information or use our car payment calculator.

Car Loan Versus Car Lease

Financing and leasing are two methods through which people can get a new car. In both cases, the car owner/lessee would have to make monthly payments. The bank/leasing company would have a stake in the vehicle as well.

There are several differences between car leasing and car purchase through a loan. Listed below are some of the differences:

- People who like to change cars every 3-4 years may find it more advantageous to lease a car as opposed to financing it. This way, the hassle of maintenance is also taken care of by the lessor.

- When the lease period expires, the lessee can return the car to the leasing company. He/she does not have to go through the process of car valuation and sale, as would be the case if he/she owned the vehicle.

- In the event of leasing a car, there is a restriction on the distance you can drive it for. This kind of restrictions are not there when you are the owner of a financed car.

- Another disadvantage of leasing a car is the fact that you will be unable to customise the vehicle based on your personal preferences.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How Do I Get Out Of A Car Loan

Assuming that your car is worth more than the remaining balance on your car loan, the easiest way to get out of a car loan is by selling that vehicle. Then immediately use the money you receive to finish paying off your loan. Remember, until you pay off the loan, you do not own the title to the car. Most lenders will allow you to sell it under the condition that the sale covers the remainder of what you owe.

How Can I Get A Car Loan With Bad Credit And No Co

Applying for a car loan with both bad credit and without a co-signer limits ones financing options. Lenders use credit history to evaluate if a lender will pay back a loan. Borrowers with no or poor credit history benefit from having a co-signer. That person helps reassure the lender that someone will pay back the loan. Without one, alternative lenders, particularly online lenders, are the best option. Unfortunately, they too will consider a borrower with bad credit and no co-signer as a risk. Expect higher interests rate and less favourable terms.

Also Check: Refinance Auto Usaa

Is 9% A Good Interest Rate For A Car Loan

I took out a car loan from a dealership a few weeks ago, and my interest rate is 9%. Iâm not sure if thatâs good or bad. My credit score is 600, if that matters. Is 9% good for a car loan?

Answer

9% is a good interest rate on a car loanabovecompare refinancing offers from

- National and local banks

- Online lenders

comparison shop for car insurance

Best For Tech Junkies: Carvana

Courtesy of Carvana

Carvana offers a completely online shopping experience, from financing to delivery with no minimum loan amounts and is our choice as the best for tech junkies.

-

Prequalify with a soft credit check

-

No minimum credit score requirement

-

End-to-end online shopping experience

-

Financing for Carvanas vehicles only

-

$4,000 minimum annual income required

-

Only used vehicles

It seems like every industry is cutting out go-betweens these days and the car industry is no exception. If you would rather skip the dealership and the bank altogether, Carvana is the site for you. Without ever leaving your home, you can apply for a car loan, choose your car and get it delivered. If you want to trade your old car in, you can do so while youre at it. Carvana will give you an offer and pick it up from your home.

Best of all, these loans aren’t just easy to get they are great deals for all kinds of borrowers. There is no minimum credit score, so anyone who is 18 years old, has no active bankruptcies and makes at least $4,000 per year is eligible.

Recommended Reading: Does Va Loan Work For Manufactured Homes

What Are The Best Banks For Car Loans

There are too many lenders to list here, but many major banks and credit unions offer car loans. Dealerships often offer financing to well-qualified borrowers. Online lenders are increasingly entering this marketplace.

Here are some popular lenders:

- BMO Harris / Bank of Montreal car loans

- Capital One car loans

- RBC/ Royal Bank of Canada car loans

- Scotiabank car loans

What Is The Average Interest Rate On A Car Loan

This handy chart shows average new and used car loan rates based on APR and credit scores.

| Average Credit Score for New Car | Annual Percentage Rate | Average Credit Score for Used Car | Annual Percentage Rate |

| 300-500 | 19.32% |

To help you better understand your place in the chart, lets look at a common example: A three-year car loan has an average interest rate of between 3% to 4.5%. However, your credit score can swing the needle in either direction. Thats why its best to compare car loans and interest rates by looking at various lenders across San Diego and Escondido.

Recommended Reading: 84 Month Auto Loan Usaa

What Is The Average Car Loan Interest Rate In Canada

Categories

If youre in the market for a new or used car, its likely that youll need to secure some financing for your purchase. When applying for a loan, youll find that the interest rate is an important factor in determining exactly how much the loan will cost you. The interest rate identifies how much extra money you will be paying back in addition to the principal. Interest rates vary, and to get a competitive rate, you will need to have a strong financial status capital, income, and credit rating. Lets take a look at car loan interest rates in Canada.

Auto Loans For Good And Bad Credit

Compare car loans from multiple lenders to find your best rate and learn what you need to know before you apply.

Shopping for the lowest interest rate on your auto loan before you buy your next car puts you in a stronger negotiating position and saves you money over the life of your loan. If you already have a loan, you may be able to lower your monthly payment and save money by refinancing your car loan.

You can compare multiple offers below for auto purchase loans, auto loan refinancing, even online car dealers with financing. Bookmark our auto loans calculator to estimate your monthly payment.

Shopping for the lowest interest rate on your auto loan before you buy your next car puts you in a stronger negotiating position and saves you money over the life of your loan. If you already have a loan, you may be able to lower your monthly payment and save money by refinancing your car loan.

You can compare multiple offers below for auto purchase loans, auto loan refinancing, even online car dealers with financing. Bookmark our auto loans calculator to estimate your monthly payment.

Read Also: Va Loan And Manufactured Homes