Why Does The Va Care About Residual Income

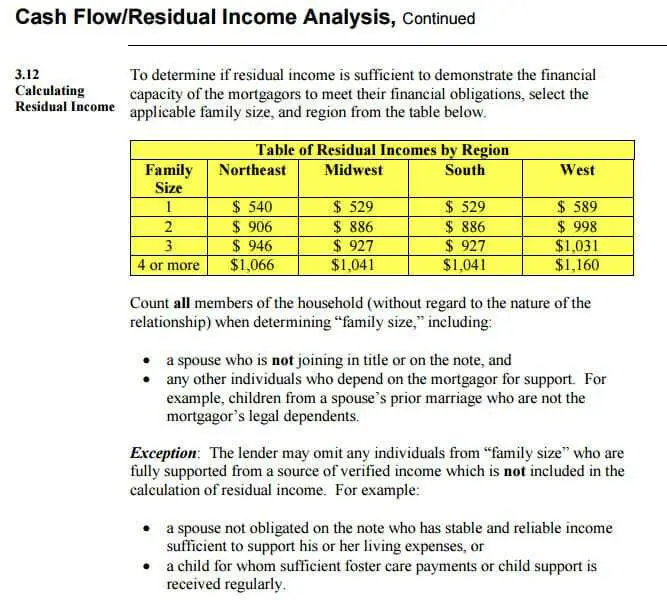

The VA actually has a minimum amount of residual income you must have in order to qualify for a VA loan. They require these minimums based on your family size and where you live. The larger your family size, the more money you need to cover the daily cost of living for each of them. Likewise, the more expensive the area that you live, the more money you need to cover the daily cost of living.

The VA focuses on these numbers because they feel that borrowers that have enough money to cover their daily cost of living are less likely to default on their mortgage. The VA claims that their low mortgage default rate is because of their focus on the residual income.

How Can You Make Residual Income

Some online business models offer a way to turn a residual profit. The trick is to find an area or niche you excel in and stick to it.

For example, if you teach piano in your community, you only have room for a certain number of lessons each day. Once you have enough students to fill the time slots, youve maxed out your income potential. But there is an opportunity for you to create residual income by moving online.

You might create an online course with video that takes people step-by-step through learning to play piano. You could also sell music instruction and study books, digital copies of sheet music, or set up a store to drop-ship piano accessories such as metronomes, polishing cloths, and piano benches.

Buying rental property is another option. Whether you collect money by renting the home to other people through a long-term lease or as a vacation rental on Airbnb, you have the potential to earn a passive income stream.

If being a landlord isnt your thing, another option is real estate crowdfunding. Several online platforms exist that allow you to invest your cash and earn a return from real estate investment trusts .

You may have to invest a lot of work and money upfront to generate residual income. There is no guarantee that youll make a profit from your efforts and nothing lasts forever so expect to upgrade/update on a consistent basis. Its smart to research your idea and the costs involved before you decide what business to go into.

What Va Loans Income Requirements Entail

The variety of income types VA lenders accept is diverse. However, a major requirement is that the income MUST originate from full-time employment.

This requirement does not explicitly target employees of traditional employers. Self-employed individuals also qualify as long as the income from their self-employed has a history of at least TWO years.

Lenders would look at your most recent federal income tax returns to ascertain qualified income. Furthermore, lenders mostly desire self-employment income that shows a substantial increase on a year-to-year basis.

But what happens when you dont have full-time employment with a traditional employer or self-employed full-time? A lender may use part-time income if it is consistent.

Lenders want to be sure that the part-time income has a TWO year history, and you are likely to continue earning it for at least the next THREE years.

In addition to part-time income, lenders may accept other income sources such as a pension, dividends, or interest as long as the same rules of consistency apply to them.

Read Also: Do Private Student Loans Accrue Interest While In School

Northeast Region Va Residual Income Tables

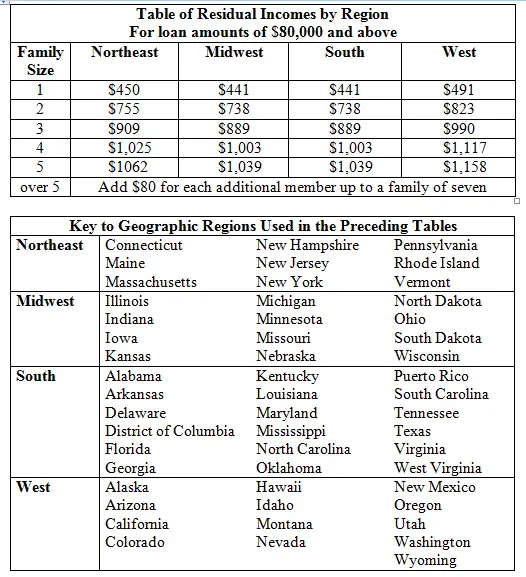

For Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont, the VA residual income tables are as follows :

- Family size of 1 : $450

- Family size of 2 : $755

- Family size of 3 : $909

- Family size of 4 : $1,025

- Family size of 5 : $1,062

- For each additional family member, add $80 up to a family of 7

Dti Ratio & Residual Income

All VA loans require a certain amount of residual income or discretionary income thats left over after covering your monthly debts and mortgage payment. The exact amount youll need varies, but your loan amount, household size, and location all play a role.

Your DTI can impact your residual income requirement, too. If your DTI is over the 41% threshold, for example, youll need significantly more in residual income 20% more, to be exact in order to qualify for the loan.

Heres an example: Say the typical residual income requirement for a VA loan in your area is $1,500, meaning you need $1,500 on top of whats required for your mortgage and other monthly expenses.

If your DTI were to come in over 41%, that residual income requirement would jump to $1,800 20% more. If you dont have that $1,800 in discretionary income, youd need to lower your DTI or increase your income before you could qualify for the mortgage.

Don’t Miss: Can You Buy An Auction Home With A Fha Loan

Residual Income In Equity Valuation

When it comes to equity, residual income is used to approximate the intrinsic value of a companys shares.

In such a case, the company is assessed based on the sum of its book value, as well as the present value of anticipated residual incomes. The RI helps company owners measure economic profit, which is the net profit after subtracting opportunity costs incurred in all sources of capital.

RI = Net Income Equity Charge

Simply put, the residual income is the net profit thats been altered depending on the cost of equityCost of EquityCost of Equity is the rate of return a shareholder requires for investing in a business. The rate of return required is based on the level of risk associated with the investment. The equity charge is computed by multiplying the cost of equity and the companys equity capital.

How Do You Calculate Residual Income

Residual income is simply whats left over after all your expenses are paid. To calculate that number, you simply subtract all the bills mentioned above that make up your DTI ratio.

The VAs minimum residual income is considered a guide and should not trigger an approval or rejection of a VA loan on its own.

You May Like: Can You Buy Land With A Va Loan

What If You Have A High Dti Ratio

If your DTI is higher than 41%, the above residual income rule may be able to help you. With 20% more in residual income per month, you can qualify for a VA loan even with a higher-than-allowable debt-to-income ratio.

However, if coming up with that extra residual income is not possible, you can also work on improving your DTI instead.

To do this, you would need to either reduce your debts or increase your income. This might entail getting a side gig, having your spouse seek employment, or, if theyre already employed, asking for a raise or more hours.

Searching for a lower-priced home or making a larger down payment can help, too. The less you need to borrow, the smaller your mortgage payment will be. Since your mortgage payment is a big part of your back-end DTI, buying a more affordable home can help lower it, improving your chances of qualifying for the loan.

What Is The Residual Income Requirement

When your lender reviews your qualification for a VA loan, they consider overall debts . They also go one step further to look at additional every day expenses in order to ensure you have enough funds each month to cover basic living expenses, as well as the mortgage. This is known as the Residual Income Requirement. It is a realistic way of evaluating affordability to verify that the household can stay afloat with the added mortgage expense.

Don’t Miss: What Credit Bureau Does Usaa Use For Auto Loans

What Is A Good Debt

Your debt-to-income ratio plays a big role in the VA loan process. It will determine whether you qualify, the size of the loan you can get, and the amount of residual income youll need.

Typically, youll need a DTI of 41% or lower to be eligible for a VA loan. But some mortgage lenders are more flexible so its possible to qualify even if your DTI isnt perfect.

What Is Dti And Why Is It Important

Another basic, but still important, part of getting a home loan is understanding your debt-to-income ratio, which is also referred to as your DTI.

In this article, we’ll explain exactly what your DTI is, how it’s calculated, how to improve it, and how it relates to residual income, another aspect of your finances.

Recommended Reading: Usaa Current Used Car Loan Rates

What If Income Comes Up Short

What happens if the income comes up short because of high debt or low income? Its still possible to qualify, but the applicant will need to document one or more compensating factors. Such factors can include income from other sources, unused proceeds available in the reverse mortgage after closing, available cash in retirement accounts or savings, etc.

If the RI is still short after compensating factors are applied, the lender may require a LESA or the applicant may not qualify at all.

Why Va Income Checks Are Necessary

The short answer is for lenders to get a full picture of the ability of a borrower to handle mortgage payments.

It is as much a protection for lenders against high default rates thatd negatively impact their business, as much as it is a protection for borrowers against expensive mortgages that they cant afford to pay off in the long run, which would otherwise set them up for the heartaches of foreclosure and a heavy hit on their credit.

A thorough income check is effectively a win-win guideline.

Read Also: How Far Back Do Underwriters Look At Bank Statements

Residual Income As Net Operating Profit

Similar to how residual income can represent income after paying obligations for an individual, it can also reflect a companys profit after the cost of capital.

Just as disposable income helps determine the health of an individuals finances, a measure of economic profit reveals how well a company is performing.

Using Va Residual Income As A Compensating Factor For Loan Approval

There are all kinds of factors that contribute to mortgage loan approvals. Whether it is a software program or a human underwriter, some serious calculations are going on. These are weighing the risks versus benefits of giving the loan. For instance, higher debt to income ratios, low credit scores, no assets, and prior foreclosures are considered risks. Although high credit scores, low debt ratios, low payment shock, and high residual income are all compensating factors, this is especially true when it comes to a VA loan manual underwrite.

Manually underwritten VA loans are required when an automated approval is not available. These guidelines are traditionally more conservative than automated guidelines. While underwriters are considering qualification, having as many benefits or compensating factors possible could sway the reviewer to an approval. One of the key factors, actually requirement, is that the borrower meet the VA residual income chart. Better yet, exceeding the minimum VA residual income by 120% is considered a major compensating factor. In the end, it could turn a denial into a VA loan approval.

Do you want to learn more about qualifying for a VA loan? Check with an OVM Financial loan officer today! See the difference we make in your purchase, building, or refinancing experience.

GET OUR FREE ULTIMATE GUIDE TO VA LOANS

Discover the benefits of a VA Loan, what documents are needed, the VA Loan process, and more

You May Like: Usaa Student Loans Review

What Are The Requirements For Residual Income

Residual income requirements are calculated on a sliding scale based on the loan amount, the location of the home and the size of the family. Below is an example of a residual income requirement chart for loan amounts over $80,000.

If you are eligible for a VA loan it may be a favorable option for you to consider. Talk to a loan advisor to review your eligibility and discuss your specific loan needs.

Gustan Cho Associates Has A National Reputation Of Approving Loans Other Lenders Cannot

Over 75% of our borrowers at Gustan Cho Associates are folks who either got a last-minute mortgage denial and/or could not qualify for a VA loan due to the lenderâs lender overlays. As long as borrowers get an approve/eligible per automated underwriting system , we are ready to approve and close the loan. We do not just close your VA Loans but rest assured that we will close them on time.

You May Like: Usaa Personal Loan Approval Odds

What Is The Required Residual Income Calculation When Dti Exceeds 41% For A Va Loan

All VA loans require residual income, which is the income left over after youve met all your monthly debt obligations . The exact amount varies by location, household size, and loan amount.

If your DTI exceeds the recommended 41% maximum, then youll be required to have 20% more in residual income to qualify. So if you were initially required to have $1,000 in residual income, but your DTI comes out to 45%, youd need to have $1,200 in residual income instead. Only then could you qualify for the loan.

Earning Money For Work You Did Years Ago Doesnt Have To Be A Pipe Dream Here Are A Few Realistic Ways To Get There

Doing something once and getting paid for it for the rest of your life? It almost sounds too good to be true. Thats the general idea behind residual income.

Study up on the concept of residual income by learning a few definitions, understanding why you should care about residual income and finding out how to get started yourself.

You May Like: Is Usaa Good For Auto Loans

The Role Of Dti To Residual Income For Va Loans

Residual income and debt-to-income ratio are interconnected for VA loans, and are most often considered in conjunction with other credit factors. DTI and residual income are decidedly different, but they affect each other.

While its possible to qualify with a DTI thats more than 41%, you must exceed the regional residual income requirement by at least 20%. So, if you have a family of four and live in Michigan, your regional residual requirement is $1,003. If your DTI is at 43%, you now must have a residual income of $1,203 to be approved for a VA loan.

Understanding your debt-to-income ratio and residual income balance can be difficult. Thats why its important to work with a mortgage lender who is experienced in dealing with VA loans.

South Region Va Residual Income Tables

For Alabama, Arkansas, Delaware, District of Columbia, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, Puerto Rico, South Carolina, Tennessee, Texas, Virginia, and West Virginia, the VA residual income tables are as follows:

- Family size of 1 : $441

- Family size of 2 : $738

- Family size of 3 : $889

- Family size of 4 : $1,003

- Family size of 5 : $1,039

- For each additional family member, add $80 up to a family of 7

Recommended Reading: Mountain America Mortgage Rates

How Dti Ratios Are Calculated For A Va Loan

Since VA lenders use your back-end debt-to-income ratio, the first step to calculating your DTI is to add up all your monthly debt payments. This will include the minimum payments on all credit cards, student loans, car loans, personal loans, and more. VA lenders may also take into account other bills, like monthly childcare or transportation costs.

Then, the lender will add in your projected monthly mortgage payment which includes the interest, taxes, and insurance as well as your estimated utility bills. This is calculated by multiplying the propertys square footage by 0.14.

Finally, theyll divide that total number by your gross income the pre-tax earnings your household brings in on a monthly basis. Heres an example:

| Min. Credit Card Payments | |

| DTI: | 41% |

In this case, your DTI would be right at 41%, meaning you can likely qualify for a VA loan.

No Income Threshold Requirements

Designed to be a well-deserved safety net for the men and women of our armed forces, homebuyers using VA Loans arent required to reach any kind of income threshold to use the loan benefits.

However, in order for the agreement to make sense to the lender, the borrower is expected to have a stable, reliable income that is sufficient to cover foreseen monthly expenses, like mortgage payments.

You May Like: Auto Loan Self Employed

What Is A Debt

Your debt-to-income ratio is commonly referred to as your DTI, and it’s the percentage mentioned above. If your DTI is within an acceptable range, youâve successfully checked one of the many boxes needed to obtain a VA loan.

DTI is your monthly debt payments, including your new house payment of principal, interest, taxes, and homeowners insurance, and homeowner association dues divided by your GROSS monthly income. Debt is typically defined as money you have borrowed and on which you are making monthly payments over time. Credit card payments, autos and other motor vehicles, student loans, mortgages, including property taxes and homeowners insurance, and personal loans are the most common examples and are all included in your DTI.

While there isnât necessarily a set-in-stone DTI standard, maintaining a debt-to-income ratio at or below 40% is often advised. The lower your DTI the better. However, when qualifying for a VA loan, a low, traditionally calculated DTI may not be enough.

Va Qualifying Income Types

- Salary/W-2 Income

- LES stipulated military income

- Self-employed Income defined as income from ventures in which the borrower has at least 25% ownership interest. Used only when it follows the stated rule of consistency. Borrower MUST provide:

- Personal tax returns going back TWO years

- K-1, 1120, or 1120S when applicable

- Balance sheet and year-to-date profit/loss statement

- Signed 8821 or 4506 forms to aid the lender in requesting copies of your income tax returns from the IRS.

Rental Income subject to the following guidelines

Also Check: Usaa Refinancing Car Loan