Are There Penalties For Paying Off My Loan Early

It depends. Some lenders will penalize you for paying off your loan early as a way to make back a portion of the interest you would have paid if your loan had gone to term.

Prepayment penalties

Prepayment penalties or exit fees are usually included in the loan contract before you sign, so if you know youre going to be paying early,;avoid lenders that charge these.

Typically, a prepayment penalty is a percentage of the loan balance youre paying off. So the sooner you pay off your loan early, the larger the penalty you pay. Lenders apply this so they dont lose on the lost interest payments.

Precomputed or add-on interest

Since there are plenty of lenders that dont have prepayment penalties, its in your best interest to also research ones that dont precompute your interest. Also known as add-on interest, this is where lenders calculate the amount of interest youll pay over the life of your loan and add it to the principal.

It might seem convenient, but it will cost you more if you decide to pay your loan early. An interest refund will be given to you, although this still wont be as cheap as finding a loan that accrues interest daily rather than including it all as one lump sum.

Hdfc Personal Loan Pre

HDFC Bank enables a personal loan borrower to make a pre-closure or a pre-payment of loan. However, you will be able to prepay your HDFC personal loan only after 12 months after you have procured your loan and after paying 12 EMIs plus the foreclosure charges that may be applicable. If you meet this requirement, you can repay your personal loan before the original due date and close your loan early.

Round Up Your Monthly Payments

Round up your monthly payments to the nearest $50 for an effortless way to shorten your loan. For example, if your auto loan costs you $220 each month, bring that number up to $250. The difference is too small to make a tangible dent in your budget, but large enough to knock a few months off the life of your loan and save you a significant amount in interest.

For a potentially even bigger impact, consider bumping up your payments to the nearest $100.

Recommended Reading: How Much Is Va Loan Entitlement

The Benefits Of Paying Off Your 401k Loan Early

The bottom line is that clearing off your loan quick will save you money from interest and lower the overall term of the loan. Just think what you could do with your excess money: save for home improvements, retirement, buy new things or pay off your other debts.

Dont let the financial media frighten you from a valuable liquidity option included in your 401 plan.

When you loan yourself proper amounts of money for the right short-term causes, these transactions can be the best, most comfortable and cheapest cost source of cash.

There are lots of benefits in paying off your loan early, but one of the most important is it gives you less stress and less risk because you wont be a slave to the lender anymore.

Overpayments And Repaying Your Loan Early

Don’t Miss: Are Va Loan Interest Rates Lower

How To Save Up To Pay Off Your Loan Early

There are literally dozens of ways to save up money to pay off a loan early. Here are just a few suggestions:

- Cut down on spending

- Put a certain percentage or amount of money away each paycheck and deposit into a savings account

- Automate your savings

- Pay down your higher-rate loans first to free up more money

- Reduce waste of energy in the home

- Use your credit cards wisely

- Take a grocery list with you when you go shopping and stick to it

- Sell items you havent used in at least 6 months

- Move bank accounts around to benefit from perks to earn more interest

- Dont eat out

- Negotiate interest rates with your credit card provider

- Cancel any little-used club memberships

How To Do It

Now that you know more about paying off those loans, you may be eager to move forward. In many cases, its as simple as sending extra money, whether you wipe out the debt with one payment or just pay a little extra each month. Call or email your lender and explain what your goals are. Ask;how to proceed so that your payments are properly applied to paying down your loan’s principal and so that you know exactly how much to send.

Read Also: How Much Do I Pay For Student Loan

Do You Have An Emergency Fund

There are other times when its better to skip paying your personal loan early. For instance, if you dont have an emergency fund its better to take your extra cash to build one.

An emergency fund, as its name suggests, is a pool of money that you only dip into to cover the costs of unexpected emergencies. This way, you wont have to run up debt on your credit cards if your water heater bursts or cars transmission fails.

Experts say you should have from 6 to 12 months of daily living expenses saved in your emergency fund. If you dont have this, it might be better to build that fund than it is to pay off your personal loan.

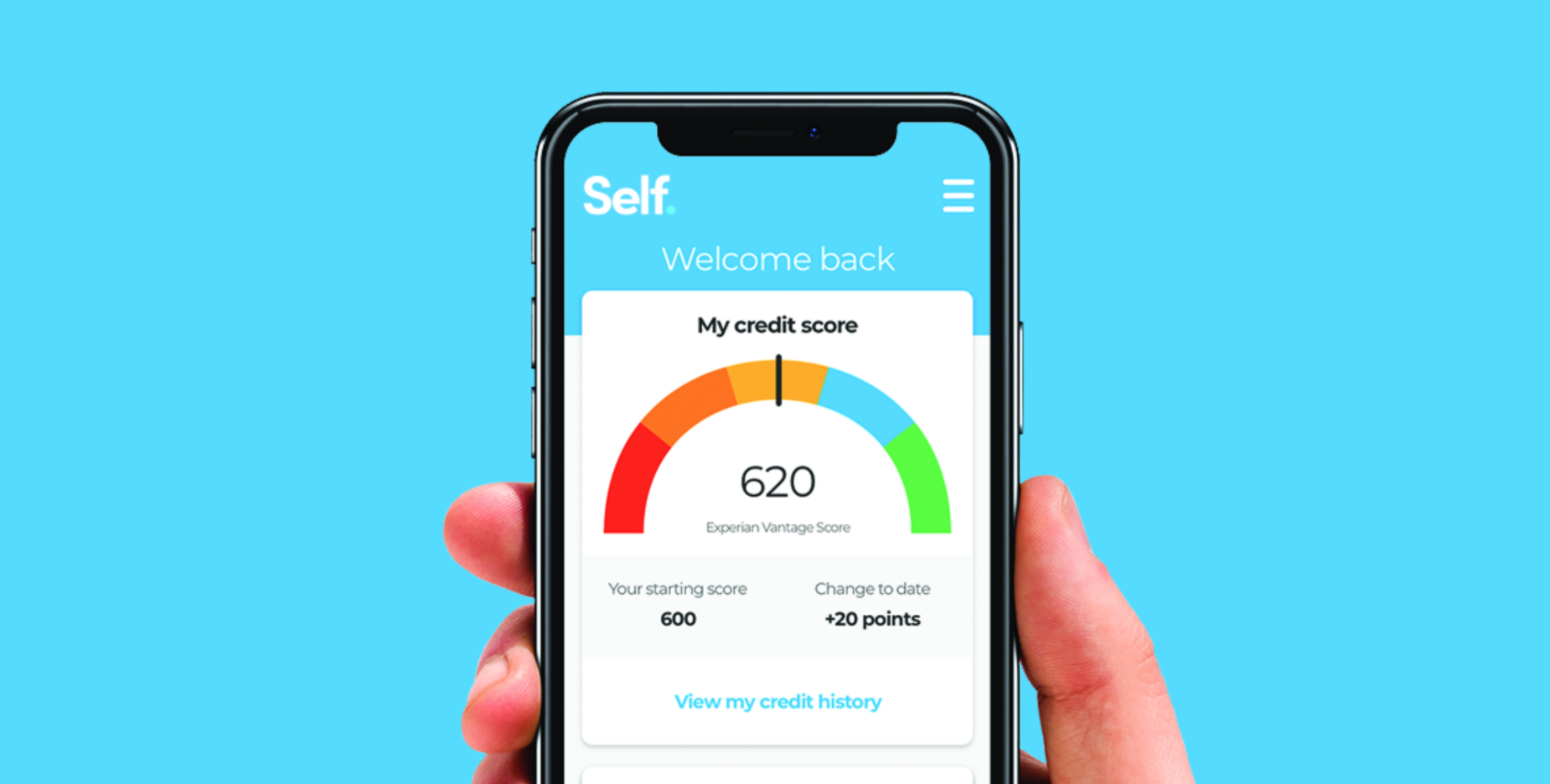

How Does Paying Off A Personal Loan Early Affect Your Credit Score

When you pay down your credit card balance, you lower the amount of credit card debt you have in relation to your total credit limit. This means your utilization rate, which makes up 30% of your credit score, is lowered and it can help you give your credit score a little boost. So shouldn’t the same be true when paying off your personal loan?

According to Experian, personal loans don’t operate the same way because they are installment debt. Credit card debt, on the other hand, is revolving debt, which means there’s no set repayment period and you can borrow more money up to your credit limit as you make payments. Installment debt is a form of credit that requires you to repay the amount in regular, equal amounts within a fixed period of time. When you’re done repaying the loan, the account is closed.

When you take on a personal loan, you add to the number of open accounts on your credit report. The loan can also improve your , which makes up 10% of your FICO score. But when you pay off an installment loan, it appears as a closed account on your credit report. Closed accounts aren’t weighted as heavily as open accounts when calculating your FICO score, so once you pay off your personal loan, you’ll have fewer open accounts on your credit report.

Also Check: Is Jumbo Loan Rates Higher

Make Sure You Tell Your Lender First

However, unless the lender specifically allows it in the contract, you cant simply overpay without warning.

You must give them notice youre making an overpayment and make the payment within 28 days. You can send the payment with the notice if you prefer.

If you do send payment without notice, the lender can treat the payment as having been received 28 days later and you’ll be charged interest during this time.

Can I Repay My Loan Debt Early

Loan providers must allow you to pay back a personal loan in full, but this can come with an early repayment charge of around one to two months interest. Any fees and how theyre calculated should be set out in your loan information and agreement, so you know what to expect if you repay early.

Other fees may apply if your loan is for more than £8,000 but these fees must be fair. They could be:

- the remaining interest OR

- 1% of the amount repaid early if the agreement has more than a year to run OR

- 0.5% of the amount repaid early if the agreement has a year or less to run.

Read Also: Is My Home Loan Secured

Do I Need To Pay Stamp Duty

You dont have to pay stamp duty on any of our personal loans.

But if youre buying a car, you may need to pay stamp duty to the state or territory government to register it and to transfer its registration. The amount of stamp duty varies between states and territories, and also depending on the type of vehicle.

Remember that this money doesnt go to us, but to the relevant state or territory government.

If youre struggling to make your loan repayments, read on to see how we may be able to help. You can also find out more at our dedicated;financial hardship;site.

What do I do if I cant make a payment?

If you cant make a personal loan repayment, please call;us immediately to discuss the matter and see if we can come to a financial arrangement. We may be able to look at temporary payment options to help you manage your loan.

What happens if I get sick, have an accident or lose my job?

You can call us to discuss an arrangement if something has happened that could affect your financial situation.

For Personal Loans repayments please call;

For Secured Car Loans repayments please call;

Faqs About Early Loan Payment

Will paying off a loan affect my credit score?

Paying off a loan wont harm your credit score, but keeping it open for the full term and being responsible with all payments can actually be a good thing for your credit score. As such, sometimes it pays to leave these accounts open.

Will my lender let me pay off my loan after a month?

Again, this will depend on the specifics of your particular loan and what the exact rules are. If a prepayment penalty exists, your lender may allow you to pay off the loan early, but not without some form of prepayment penalty being charged and paid first.

How do I pay off my loan early?

In order to pay off your loan early, its not as simple as dumping extra money into your loan account. Instead, youll need to discuss your desires with your lender in order to arrange for early loan repayment.;

Don’t Miss: Does Refinancing Car Loan Hurt Credit

Should You Consolidate Your Debts

Some loans are specifically advertised as debt consolidation loans these allow you to merge several credit commitments into one.

Consolidation loans are now much harder to get. Its important to only consider taking one out when youve explored all your other options, especially if the loan is secured against your home.

While they can seem an attractive option because of lower interest rates and repayments, consolidation loans can often cost you a lot more than sticking with your current loans.

This is because they usually have a much longer repayment term than unsecured loans. You might also risk losing your home if the loan is secured and you cant keep up with the repayments.

When youre consolidating your debts, also try to avoid building up more debt elsewhere.

Your Credit Score Could Be Affected

When you pay off a personal loan, your credit mix and credit history changes and the results may affect your credit goals.A personal loan appears on your credit report as an installment loan account, which includes the specific loan amount and repayment schedule. Because payment history is the biggest factor in determining your credit score, a solid record of on-time, monthly payments can be beneficial for your finances in the long term. When you pay off your personal loans early, youre potentially losing out on months of a positive payment history. At the same time, the credit age of all your accounts and maintaining a well-managed mix of creditlike credit cards, student loans, or auto loan accounts, to name a fewalso affects your score. Considering those key measures, paying off a personal loan early may actually cause a temporary dip in your credit score.

Recommended Reading: What Type Of Loan Is Needed To Buy Land

S For The Hdfc Personal Loan Pre

- You will first have to get in touch with a bank representative from HDFC Bank and express your interest in pre-paying your HDFC Personal Loan.

- Next, you can make the pre-payment by releasing a cheque or a demand draft at any HDFC Bank branch.

- You can take note that the bank does not accept cash above Rs.49,000 for repaying your loan against pre-payment or matured loan closure payment. If you need to make any payment above Rs.49,000, you will need to make sure that you pay via pay order or account payee cheque or demand draft.

You can pre-close or pre-pay your HDFC personal loan at a nominal price by informing the bank beforehand. You will have to keep in mind that this needs to be done only after careful evaluation of your financial condition.

Can I Apply For An Anz Personal Loan If I Already Have An Existing Personal Loan With Another Lender

Yes, you can apply but your application for an ANZ Personal Loan will be subject to ANZs credit assessment criteria.

Your liabilities and other financial commitments, such as an existing personal loan with another lender, will be taken into account when we assess your application for an ANZ Personal Loan.

You’ll need to provide information on:

- your income amount and frequency

- your assets

- what existing financial commitments you have with ANZ and other financial institutions, such as personal loans, home loans or credit cards

- your expenses, such as how;much you spend on gas, electricity, insurances, food, transport and lifestyle expenses

We ask for this information so that we can verify your financial circumstances and assess your ability to repay an ANZ Personal Loan without substantial hardship. You can explore which ANZ Personal Loan may suit your needs by using our tools and calculators.;

- Calculate;how much you could borrow;with an ANZ Personal Loan

- Get an estimate of your;potential loan repayments;for an ANZ Personal Loan

- Compare key features;of the different types of ANZ Personal Loans.

Don’t Miss: Can You Use Fha Loan If You Already Own House

Can I Cancel A Loan Once Ive Borrowed The Money

With some loan applications taking only 24 hours to process, it can be all too easy to jump in and sign up, then change your mind afterwards. Luckily, when you take out a loan, you have a 14 day cooling off period in which you can cancel the agreement.

If the moneys already been transferred into your account, youll need to pay it back in full within 30 days. Try to repay this as soon as possible, as the lender is legally allowed to charge you interest until they get the full amount back.

How Long Will It Take Me To Pay Off My Student Loan: Usa

In the US, a student loan is treated more like a traditional bank loan. It requires regular repayments, whatever the circumstances. It will not be written off after a certain amount of time, so small repayments can feel stressful for the borrower, who is aware that the interest is constantly growing.

You May Like: What Kind Of Loan Do I Need To Buy Land

Do You Need Your Very Best Credit Score Now

Damage to your credit score from paying off a personal loan early likely won’t be catastrophic or long-lasting. But sometimes, such as when you’re applying for a mortgage, you’re counting on every point of your credit score to help you get a great rate. In this situation, you might want to hold off on repaying your personal loan in full until after your mortgage is approved.

What Is A Personal Loan Agreement

Simply put, a personal loan agreement is the contract between the borrower and the lender. It lays out the details of the loan, including the interest rate, the length of the loan and any fees or penalties that could be assessed. The loan agreement could also contain loan repayment details things like whether your bank account can be automatically drafted for payments as well as personal privacy information. When you sign this agreement, you accept these terms. Thats why reading it, and understanding the terminology, is important.

Depending on the lender, the loan agreement may not include your specific details, e.g., the loan amount you are agreeing upon with its APR, monthly payment and personalized term. Look for these details in your loan letter or other disclosures.

Also Check: How To Get 150k Business Loan

Factors That Determine How Much Interest You Will Have To Pay:

Principal: This is the amount you are going to borrow .

Loan Term: This is the duration in which the loan amount, including interest, has to be paid back. Depending on the budgeting style, it can be weekly, monthly, fortnightly or yearly.

Repayment Amount: For a borrower, it is always good to be aware of the calculations of the amount that will go into repayments. This is because a certain amount goes in paying off the interest first and then the repayment of the principal starts. Again the interest amount is calculated on the principal you are going to borrow.

Rate of interest: The actual amount to be repaid largely depends on the rate of interest. The breakdown of your monthly interest payments are affected by how high or low your annual rate of interest is.