Upgrade: Best For Fast Funding

Overview: Upgrade offers personal loans for those with fair credit or better. The funds can be used for debt consolidation, credit card refinancing, home improvements or major purchases. APRs available from Upgrade range from 5.94 percent to 35.97 percent. Loan amounts range from $1,000 to $50,000, and terms are two to seven years.

Why Upgrade is the best for fast funding: Upgrade offers a quick application process and provides loan decisions within a few minutes. Additionally, money is available within as little as one day of completing the verification process.

Perks: Theres no prepayment penalty. Also, if you use one of its personal loans for debt consolidation, Upgrade gives you the option of having the loan funds sent right to your creditor.

What to watch out for: All Upgrade personal loans come with an origination fee of 2.9 percent to 8 percent. The fee is deducted from your loan funds.

Impact on borrowers looking for low interest rates: Borrowers with fair credit may find Upgrade a better alternative to payday lenders, which offer fast loans without a credit check. Upgrade also offers incredibly fast funding.

What Is A Low Interest Personal Loan

A low interest rate personal loan will generally offer interest rates of around 4-6% p.a.

From a lender’s perspective, there are a few reasons why one loan may be more competitively priced than another.

The first is only good news for the borrower, in that the lender is competing for your business by offering better rates than its competitors.

The second reason is that the lender may be making up for the lost revenue from interest rates through extra fees and charges. This is why lenders must advertise a comparison rate – an estimate of the interest rate after fees – alongside their standard rates. Comparison rates are based on loan terms that could differ significantly from what you are borrowing, so it’s best to use a personal loan calculator to truly understand what you will be paying.

Compare Low Interest Personal Loansjanuary 2022

| Lender | |

|---|---|

| LightStreamBest for Good Credit | 2.49%19.99% with autopay |

| Best for Debt Consolidation | 6.99%19.99% |

| Alliant Credit UnionBest for Hardship Protection | 6.24%10.24% |

| American ExpressBest for Debt Consolidation | 5.91%19.95% |

| PayoffBest for Fair Credit | 5.99%24.99% |

| 5.74%19.99% with relationship discount | $3,000 |

| PenFed Credit UnionBest Loan for Veterans | 5.99%17.99% |

Also Check: Specialized Loan Servicing Settlement

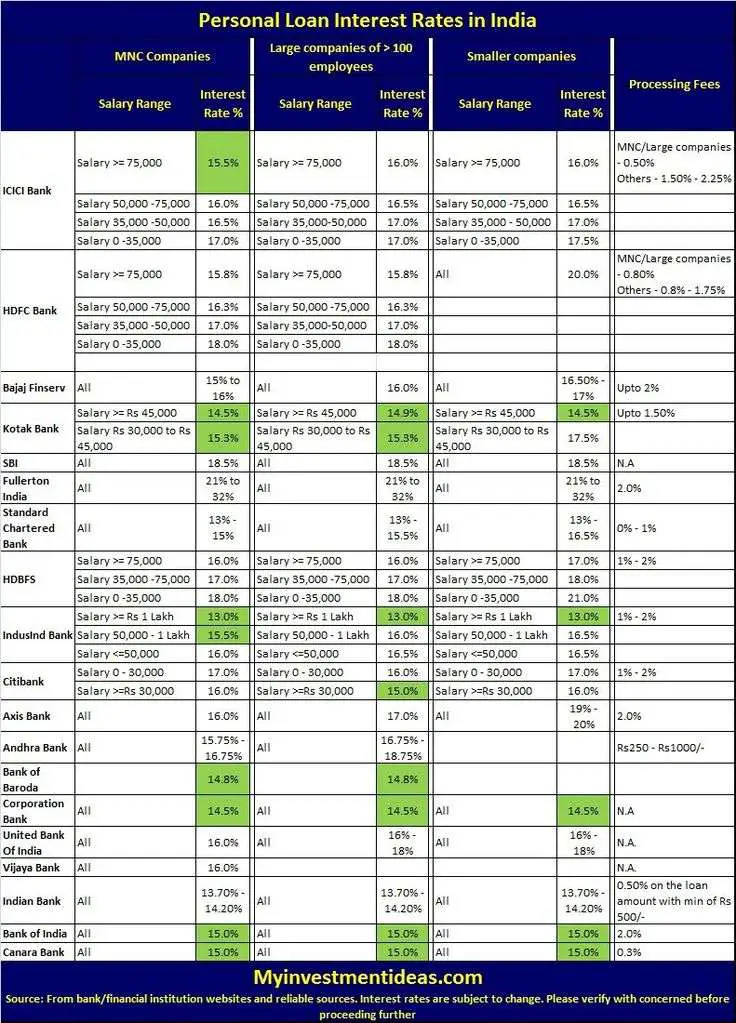

Faqs On Personal Loan Interest Rates

The interest rate that applies on your personal loan is an important factor. In this page, weve put together some of the questions borrowers usually ask regarding their personal loan interest rates.

PNB offer personal loans at attractive rates starting from 6.90% p.a. However, the interest rate may vary from customer to customer depending on certain factors, customers including credit profile and relationship with the bank, to name a few.

Your income denotes your capacity to repay a loan. A higher income shows that you have a better financial bandwidth to repay the loan on time. This means that your risk level is low. Lenders prefer individuals with low risk profiles and may hence offer you a lower interest rate.

Working with reputed companies means that you are more likely to have a stable job and income. Your work experience shows work stability as well. This reflects on your loan rate.

A good credit score indicates that you are responsible in handling your finances. This keeps your risk rating low. If your credit score is 750 and above, most likely you will be offered preferential rates.

How Can I Apply For A Low Interest Personal Loan

Before you apply for a loan, you should compare your options using the table above. You can find a range of competitive options when you compare low interest rate personal loans. Make sure you consider a range of lenders to find the right loan for your needs and situation. Once you’ve found a loan you’d like to apply for, click “go to site” to apply.

Read Also: Penfed Credit Score Requirement Auto Loan

Why Banks Charge Interest On Personal Loans

Money lending is a risky business because there is no guarantee you can get the money back on time and in full.

Banks will usually charge interest as a fee for doing business with you and assuming the risk of default.

A personal loan interest rate can be high or low depending on the risk profile of a borrower.

If you have a poor credit history, you may be charged a higher interest rate compared to those with a good credit rating because you are considered as high-risk borrowers.

Personal Loan Foreclosure Charges

Summarized below are the personal loan foreclosure charges applicable, if you wish to close your personal loan account before the end of the loan tenure..

| Foreclosure Charges | |

|---|---|

| 0 to 6 EMIs fully paid | Not Allowed |

| 7 to 17 EMIs fully paid | 7% |

| 18 to 23 EMIs fully paid | 5% |

| 24 to 35 EMIs fully paid | 3% |

| 36 or more EMIs fully paid | 0% |

Read Also: Capitalone Autoloans.com

How We Chose The Best Low Interest Personal Loans

Investopedia is dedicated to providing consumers with unbiased, comprehensive reviews of personal loan lenders for all borrowing needs. We collected over 25 data points across more than 50 lendersincluding interest rates, fees, loan amounts, and repayment termsto ensure that our content helps users make the right borrowing decision for their needs.

Points For A Successful Application

- Your mobile number must be updated in your Aadhaar and bank account.

- You must have an active net banking facility on your main savings bank account in which you receive your monthly salary gets credited and the mobile number updated with the bank must match the one you are applying for the loan with which is also the one associated with your Aadhaar.

- Your latest current address must be updated in your Aadhaar and savings bank account.

- You must be able to both receive and send emails from your official email address, in case you have one.

- You must have physical original copies of your main KYC documents, primarily your PAN card, Aadhaar card with correct current address, to be able to complete video KYC.

What are the charges involved in a personal loan?

You May Like: Usaa Car Refinance Calculator

How To Get A Low Interest Personal Loan

As you know that there are a variety of low interest personal loans in the market, it is important that you shop around for the benefits and features that you want.

You must also watch out for the product fine prints before agreeing on anything.

Another way to secure for low interest personal loans is by pledging an asset to your loan.

This collateral will be used to cover for the remaining loan outstanding in case you are no longer able to meet your repayment.

If you dont have collateral, you can get a guarantor to co-sign your loan agreement, who will then be responsible for the repayment.

Personal loans with low interest will not be given to borrowers with poor credit ratings.

Therefore, take your time to improve your credit score by building a solid financial standing.

How To Avoid Rejection Of Personal Loan Application

The approval of a personal loan application depends on a number of factors. When you apply for a loan, you should make sure that you are fulfilling all the factors to ensure the approval of your loan application. The eligibility criteria for personal loans may vary from lender to lender. However, there are number of common criteria which include the age of the applicant, his or her income, credit score, status of employment, and so on. Before you apply for a loan, make sure that all the eligibility criteria are being fulfilled. This will help you avoid rejection of your loan application. Although there are other options which you can resort to in case your loan application gets rejected, it is recommended to double check before applying to avoid the chances of rejection of application.

Read Also: Upstart Early Payoff Penalty

How Does My Credit Score Affect My Offer

Lenders prefer credit scores in the good-to-excellent range. A high credit score tells a lender that the borrower can be trusted to handle credit and debt responsibly, so higher credit scores tend to merit a higher chance of loan approval and lower interest rates. A fair or poor credit score wont disqualify you from getting a personal loan , but it may be more difficult to get a low interest rate thats competitive with credit card interest rates.

Personal Loan Fees & Charges

Here are Fullerton India personal loan fees and charges to help you understand the same in detail,

There are a few personal loan charges to keep in mind. These, along with interest rates influence the total cost of the loan. Below enlisted is information on the applicable fees and charges.

All charges mentioned in the below table are in INR

| Fee Type | |

|---|---|

| As stated under additional interest charge** | |

| Collection of Cheque/Cash | |

| 300 | |

| Swap Charges- for replacement of Post-dated cheques to ECS | |

| Swap Charges- for replacement of ECS to ECS | |

| 5,000 | |

| Processing Fees | Between 0% – 6% of the Loan Amount |

| *Foreclosure charges/ pre-payment penalties shall not be charged on all floating rate term loans sanctioned to individual borrowers |

Read Also: When Should I Refinance My Fha Mortgage

What Credit Score Is Needed For A Personal Loan

Youll generally need a good to excellent credit score to qualify for a personal loan a good credit score is usually considered to be 700 or higher. Your credit score also plays a major role in determining what interest rates you qualify for. In general, the better your credit score, the lower the interest rates youll likely get.

Here are the credit score ranges you can typically expect to see as well as how they can affect the interest rates youre offered:

Poor :

Fair :

While there are several lenders that offer fair credit personal loans, you can generally expect to pay a higher interest rate. Having a cosigner might get you a better rate, even if you dont need one to qualify.

Good :

A good score greatly increases your chances of qualifying with several personal loan lenders. Youre also more likely to receive more favorable rates. While you likely wont need a cosigner to get approved for a loan, having one might help you get the best interest rates.

Fair :

Scores above 750 will qualify you for the vast majority of personal loans as well as help you get the lowest interest rates advertised by lenders.

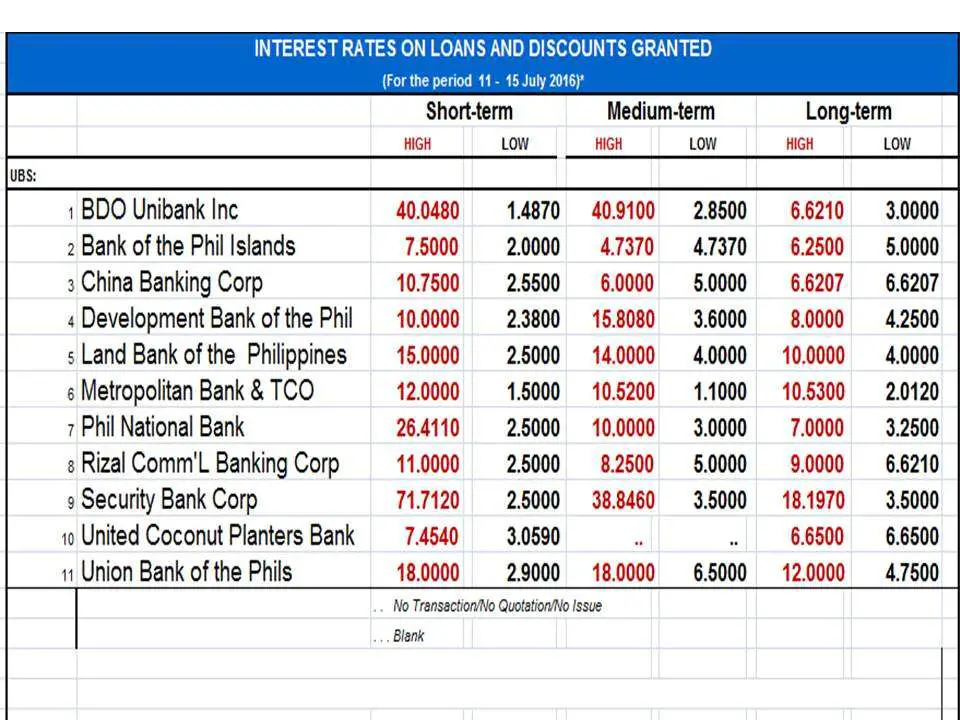

Bank Of The Philippine Islands

BPIs personal loan has a fixed add-on rate of 1.20 per month with a minimum monthly requirement of Php25,000 gross income for locally-employed borrowers. Overseas Filipino Workers should have at least a Php30,000 monthly salary and self-employed individuals should be earning a minimum of Php50,000. BPI does not charge for any disbursement or miscellaneous fees but imposes 5% of the outstanding balance for late payments.

Self-employed borrowers will be required to submit proofs of business operation for three years, audited financial statements, and the latest income tax return.

Personal loans are helpful financial tools that can save you from stressful situations. Most banks, however, get you pre-approved for the lowest interest rates if you are an existing credit card holder. Pay off your balances on-time and ensure that you only used up about 30% of your credit limit to boost your credit score and your chances of getting approved. Maintaining a healthy credit record can increase your chances to avail of the best financial product out there, just when you need them most.

Debt consolidation is one of the most common reasons why Filipinos apply for personal loan

Check out personal loans offers with GoBear and see which bank offers the best one with the lowest rate. Use GoBears comparison tool for unbiased results. You can also call your credit card provider and see if you are eligible for their low-interest multi-purpose loans.

People also read:

Recommended Reading: Rv Loan Calculator Usaa

Personal Loan Interest Rate Axis Bank

Be it any personal or professional need, Personal loan Axis Bank can be taken for any unforeseen financial need. Axis Bank personal loan interest rates range between 10.25% – 21.00% per annum. The loan can be taken by any salaried individual with a wide range of loan amount option facility. The simple loan application procedure and easy documentation make Axis Bank personal loan an attractive one.

Cimb Bank Personal Loan

- Monthly add-on interest rate: 1.12% to 1.95%

- Annual contractual rate: 24%, 30%, or 36%

- Loan amount: PHP 30,000 to PHP 1,000,000

- Loan terms: 12 to 60 months

- Processing duration: Loan application in just 10 minutes, approval in 24 hours

- Loan fees:

- Documentary stamp PHP 1.50 per PHP 200 of the loan amount

- Late payment fee of 5% of unpaid installment due or PHP 300. whichever is higher

CIMB also offers competitive bank loan interest rates in the Philippines. And if you do everything on your phone, youll be glad to know that CIMB offers an all-digital personal loan application. Just launch your CIMB app, tap I need a personal loan and Apply now. Supply the required information and upload all your requirements. There will be a Virtual Verification process. If approved, youll receive an email with the loan contract.

Read Also: Bayview Loan Servicing Payments

Can I Get A Personal Loan With Bad Credit

Yes, there are several lenders that offer personal loans for bad credit for example, you might be able to geta personal loan with a 600 credit score or lower from certain lenders. However, keep in mind that these loans generally come with higher interest rates compared to good credit loans.

If you have bad credit and are struggling to get approved, consider applying with a cosigner. Not all personal loan lenders allow cosigners on personal loans, but some do. Having a cosigner could also help you qualify for a lower interest rate than youd get on your own.

Another option is working to improve your credit so you can qualify more easily in the future as well as get approved for more favorable rates and terms. A few potential ways to do this include:

Making on-time payments on all of your bills:

Paying down your credit card balances:

Your credit utilization ratio refers to how much you owe on revolving credit accounts like credit cards compared to your available credit limits. This ratio is also a big factor in your credit score, so if you can pay down your balances, you might see your score go up.

Taking out a credit-builder loan:

This type of loan is specifically designed to help borrowers build credit by building a positive payment history over a period of time. But unlike other loans, the payments you make on are put into a dedicated savings account, and the money is returned to you at the end of your repayment term minus any interest or fees.

Pros And Cons Of Low Interest Loans

If youre thinking of taking out a low interest personal loan, heres a look at some of the pros:

- Save money. Youll save money on interest payments with a lower rate, which means youll have more money to pay off your loan or buy whatever you want.

- Faster repayments. More of the money you put onto your loan will go towards your principal, so youll be able to pay it back faster.

- Easy process. With the advent of online loans, it can take under 10 minutes to apply for a low personal loan from start to finish. You can start by applying online, and then you can keep track of the loan online as well. If you prefer to apply in person at a store, find a lender that has a physical branch location near you.

- Repayment flexibility. A number of lenders allow you to make repayments according to how frequently you get paid. If you can repay your loan ahead of time without being subject to an early payout penalty, you can save on fees and interest.

- Rebuild your credit. If you have less-than-perfect credit, a personal loan may be a great opportunity to rebuild your credit score as long as you stay committed to making your repayments on time.

Low interest personal loans also come with some downsides to be wary of:

You May Like: Do Mortgage Loan Officers Get Commission

Personal Loan Rates At Credit Unions

The average rate charged by credit unions in March 2021 for a fixed-rate, three-year loan was 8.86%, according to the National Credit Union Administration. Federal credit unions cap the APR on personal loans at 18%.

You have to become a member of a credit union to apply for a loan, which may mean paying fees or meeting certain eligibility requirements.

» MORE:

Standard Chartered Bank Personal Loan

Standard Chartered Bank charges interest rates from 11.99% for personal loans offered up to Rs. 50 Lakhs. That is one of the highest amounts of personal loans offered by any bank.

Standard Chartered Bank Personal Loan Interest Rates

11.99% onwards

| up to 2.25% of the loan amount |

| Late Fee |

| Foreclosed between 0 to 12 EMI 5%Foreclosed between 12 to 24 EMI 4%Foreclosed between 25 to 36 EMI- 2%> 36 EMI 1% |

- You can take loan of up to Rs. 50 Lakh

- No securities, collaterals, or guarantors required

- 50% discount in processing charges for online application

- up to 2.25% processing charges

- Bank branches are not available everywhere

Eligibility Criteria

The bank provides EMI Calculator for eligibility. The Loan Amount is sanctioned depending on the borrowers repayment capacity, income, location and age.

| Eligibility |

- Latest ITR or Form 16 for salaried and Income report for self-employed/ business persons.

Don’t Miss: When Can You Refinance An Fha Loan