Housing Help For Older Veterans

Find programs to help older veterans with a wide range of housing needs. This includes in-home care, assisted living, and retirement homes for veterans.

-

Get help finding housing and care in a variety of residential settings. This includes nursing homes, assisted living, and medical foster homes.

-

If you need in-home care so you can remain at home, the VA may be able to help. Call the VA Health Care Benefits number at . Or, contact the VA medical center nearest you.

Another option for some military retirees and other veterans is the Armed Forces Retirement Home . The AFRH has two locations: Washington, DC, and Gulfport, MS. Both offer recreation and wellness services including assisted living and skilled care.

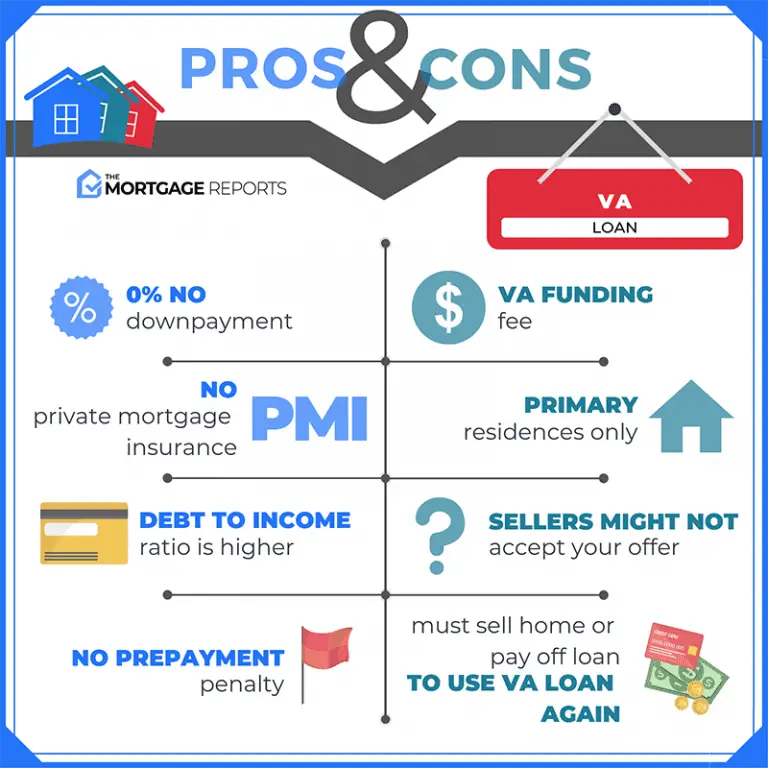

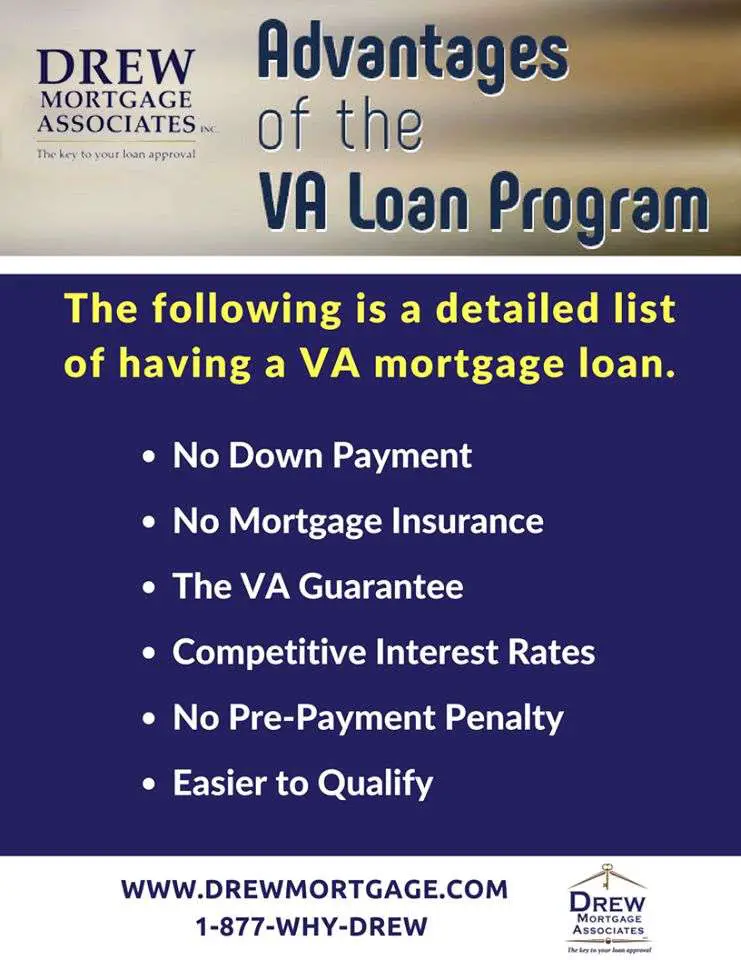

Benefits Of A Va Home Loan

- Equal opportunity.

- No down payment .

- Buyer informed of reasonable value.

- Negotiable interest rate.

- Ability to finance the VA funding fee .

- Closing costs are comparable with other financing types .

- No mortgage insurance premiums.

- An assumable mortgage.

- Right to prepay without penalty.

- For homes inspected by VA during construction, a warranty from builder and assistance from VA to obtain cooperation of builder.

- VA assistance to veteran borrowers in default due to temporary financial difficulty.

Access To Specially Adapted Housing Grants

Do you have a disability that affects your mobility or sight? You may qualify for a SAH grant.

SAH grants can go toward constructing a special home designed to fit the needs of the disabled individual. Or they allow you to modify an existing home to make it more accessible. SAH grants can also pay the unpaid balance of an adapted home already purchased without VA grant assistance.

In 2020, you may qualify for a grant of up to $90,364, and you may use the grant up to three times as long as your disability qualifies. Because the SAH is a grant and not a loan, you dont need to pay it back.

Don’t Miss: Can Closing Costs Be Included In Refinance Loan

I Am A Veteran And Currently Own A Home

Even if you already own a home, there are substantial savings that Veterans and active-duty servicemembers shouldnt pass up. VA home loan benefits vary depending on your home purchase history, check the benefits below based on your mortgage history:

1. I already have a VA mortgage.

With a current VA mortgage, you have access to one of the greatest benefits of a VA home loan the ability to reduce your existing rate by refinancing easily and with little or no out-of-pocket expenses. A VA streamline refinance can be completed with minimal documentation requirements and often within 30 days. This can be especially helpful for Veterans who may have experienced a significant change in circumstances such as the loss of a job, bankruptcy, or a significant decrease in home value.

2. I own a home but did NOT use my VA benefits.

1 MGIC Rate Finder | Average savings calculated on a $250,000 mortgage and is based on elimination of a $198/month PMI premium for 12 years and an interest rate reduction of 0.25% . This equals a total savings of $41,112 compared to conventional loans.

2 . | It takes an average of 12.5 years to save up a 20% down payment on a median $259,000 home with a current personal savings rate of 5.6%.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791

What Are The Service Requirements For A Va Loan

The service requirements vary depending on when you served, when you separated from service, and whether you were discharged with a service-connected disability. In general, for active-duty service members and veterans, the service requirements vary from 90 days to 24 continuous months. For National Guard and Reserve members, it’s a minimum of 90 days of active duty service.

Read Also: Is It Easy To Get Loan From Credit Union

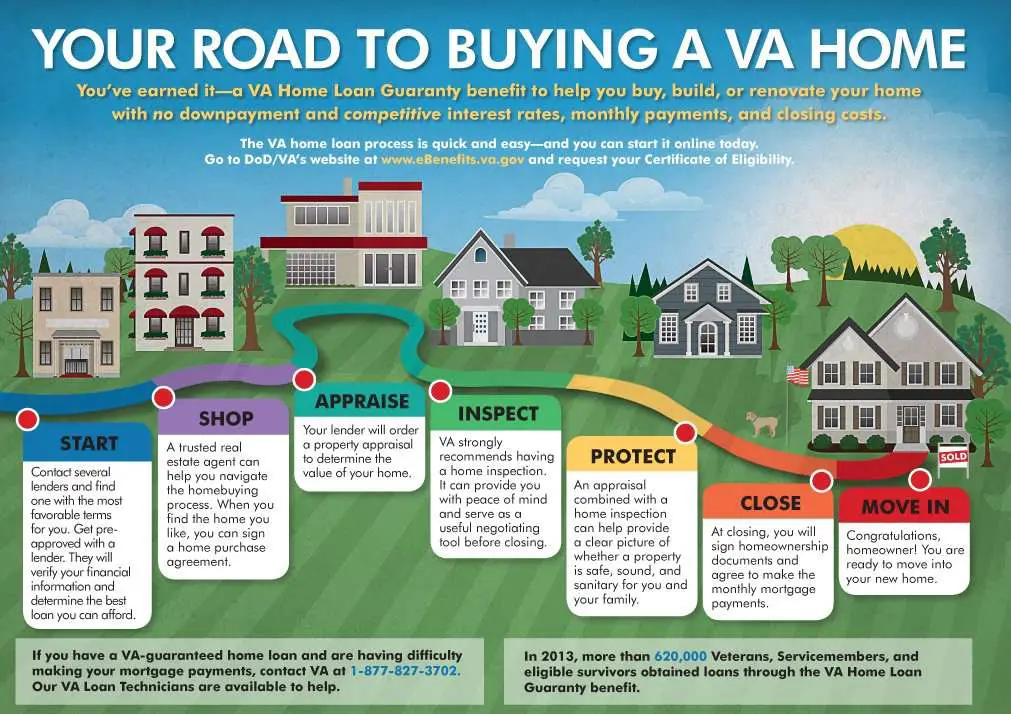

Us Department Of Veterans Affairs Home Loan Guaranty

The U.S. Department of Veterans Affairs helps service members, Veterans, and eligible surviving spouses become homeowners. As part of VAs mission, it provides a home loan guaranty benefit and other housing-related programs to help buy, build, repair, retain, or adapt a home for personal occupancy. VA Home Loans are provided by private lenders, such as banks and mortgage companies, and VA guarantees a portion of the loan, enabling the lender to provide more favorable terms.

Some specific programs include:

- Interest Rate Reduction Refinance Loan :

- Native American Direct Loan Program

- Adapted Housing Grants

Exemption From Funding Fees

Disabled veterans are exempted from the VA funding fee, so they dont have to pay the VA funding fee during closing. To qualify for the exemption, you must currently receive some form of disability benefits. Your level of disability is irrelevant.

This this exemption can save veterans or their surviving spouse thousands. For example, if you buy a home worth $200,000, you might pay as much as $2,500 $6,600 in VA funding fees when you close. Disabled veterans can avoid this fee.

You May Like: What’s Better Refinance Or Home Equity Loan

Determining Who Can Get A Va Home Loan

Here are the criteria for who is eligible to get VA Mortgage financing to purchase a home. The Veterans Administration offers this kind of mortgage to four different types of veterans under the following circumstances:

- Active-duty servicemen and women to get a VA home loan, you must have served at least 90 days in the military during a time when the country is at war.

- Active duty during peace in order to get a VA loan you must have served at least 181 days as full-time military personnel during a time the country was at peace.

- National Guard or Reserves service you must have served at least six years in either the Reserves or the National Guard in order to get a VA loan.

- Surviving spouse you can also be a surviving spouse of a person that either perished while serving in the line of duty or died due to a disability-related to their service.

Understanding The Va Loan

Did you know that there are millions of veterans eligible to explore their VA home loan benefits? Sadly only a very small percentage actually take advantage of this outstanding benefit.

The United States government established the Home Loan Guarantee Program back in 1944. The goal was to minimize economic challenges faced by service members during post-war readjustment to civilian life. The Government felt that Veterans had missed out on the chance to establish a credit rating that could be used to borrow money to buy a home. The basic fundamentals of the present-day VA loan program are fairly easy to understand. You apply for a mortgage through a private lender, or bank, and the Veterans Administration guarantees 25% of the loan on your behalf. That means the VA will pay the lender 25% of the loan balance if you happen to default on your mortgage. Its because of this guarantee that lenders are able to relax traditional requirements and make VA home loans much easier to obtain

The bottom line is that lenders know the VA has your back. And because of that, they are much more confidant when it comes to approving loans.

You May Like: Where To Apply For Small Business Loan

Enjoy Flexible Credit Requirements

As with any loan program, your credit history determines whether you qualify. The good news is that the U.S. Department of Veterans Affairs doesnt set a minimum credit score for approval. Instead, each mortgage lender decides its own minimum credit score. On average, lenders set their minimum between ;600 and 660.

Veteran Mortgage Relief With The Va Loan

The U.S. Department of VeteransAffairs, or VA, provides home retention assistance. The VA intervenes whena veteran is having trouble making home loan payments.

The VA works with loan servicersto offer options to the veteran other than foreclosure.

In fiscal year 2019, the VA madeover400,000 contact actions to reach borrowers andloan servicers. The intent was to work out a mutually agreeable repaymentoption for both parties.

More than 100,000 veteranhomeowners avoided foreclosure in 2019 alone thanks to this effort.

The initiative has saved thetaxpayer an estimated $2.6 billion. More importantly, vastnumbers of veterans got another chance at homeownership.

Don’t Miss: Is It Easy To Get Approved For Fha Loan

What Are Va Loan Entitlements

The VA typically will guarantee;25% of your loan amount if youre not making a down payment.;This is called your VA loan entitlement. In most parts of the country, your entitlement is $113,275, which means you can borrow up to $453,100 without a down payment. If you want to borrow more than $453,100, you will need to make a down payment.

If you havent used a VA loan before, youll receive whats called full entitlement. A VA loan entitlement is the maximum loan amount the Veterans Administration will pay your lender if you default on your mortgage loan. This guarantee reduces the lenders risk of approving a loan for a borrower who may have no down payment and a below-average credit score.

Your entitlement can be higher in high-cost areas like California and Hawaii. You may have less than a full entitlement if you already have a VA home loan or if you have gone into foreclosure on a previous VA loan. Not having a full entitlement limits the amount you can borrow without a down payment.

Five Benefits Of Va Loans #: Zero Down Va Home Loans

VA mortgages require no money down in most cases. Zero down for a home loan is a huge advantage, especially for lower-ranking junior enlisted personnel.

There are some situations where a down payment IS required; your FICO scores and credit history may affect whether a lender is willing to offer you a no-money-down loan .

There are also situations where money up front is required because the asking price of the home is higher than the appraised value. In such cases, the borrower is required to pay the difference in cash.

Also Check: Can I Roll My Closing Costs Into My Va Loan

Your Va Home Loan Benefit The Latest Changes And Tips To Make The Most Of It

When Bryan Bergjans and his wife bought their first house in the early 2000s, he didnt use his VA home loan benefit, because he didnt know about it.

And no one involved in the purchase including his realtor, his builder or his lender suggested that he use the benefit. He even showed up to some meetings in uniform.

You dont know what you dont know, he said.

The VA home loan program, which is more than 75 years old, can be used, in general, to buy, build or refinance a home. Its available to nearly every service member and veteran. And it can save you tens of thousands of dollars.

Bergjans, a Navy reservist, is now senior vice president and national director of military lending for Caliber Home Loans, which does business in all 50 states. The company ranked 13th in volume of VA loans in fiscal 2019, with 7,795 loans.

When he looks back at his own experience buying a home, there werent any malicious reasons behind the fact that he wasnt offered the VA loan benefit, Bergjans said. It simply wasnt on their list of options. I had a straight lack of knowledge, no understanding.

But hes used his benefit since then. And that experience is part of the passion behind his effort to educate realtors. He speaks to thousands of realtors around the country every year, working to dispel some of their myths about VA loans.

Bigger benefit now

As a result, more veterans will be able to buy homes in high-cost areas.

RELATED

The funding fee

Service During Peace Time

Anyone serving from July 26, 1947 June 26, 1950 and February 1, 1955 August 4, 1964, those enlisted from May 8, 1975 September 7, 1980, and Officers from May 8, 1975 October 16, 1981 need to have served at least 181 days of continuous active duty without a dishonorable discharge, or less than the 181 days if due to a service-connected disability.

If you were separated from service after September 7, 1980 :

1. 24 months of continuous active duty with other than dishonorable discharge

2. At least 181 days or completed full term of active duty with other than dishonorable discharge

3. At least 181 days of active duty and discharged for hardship, convenience of the Government, early out, a RIF , or compensable service-connected disability

4. Less than 181 days active duty is allowable if discharged for a service-connected disability

5. If you meet the service minimums, you are entitled to the VA loan benefit.

You May Like: What Is The Lowest Auto Loan Interest Rate

You Dont Need Perfect Credit

Theres no minimum credit score for a VA loan. However, lenders still have to verify you can repay your loan and will pull a credit report to see how well youve managed other credit accounts. VA-approved lenders typically set their minimum at 620 or higher.

VA lenders view your recent rental payment history as a

benchmark for how timely youll make mortgage payments.

Additionally, VA loans have a shorter waiting period after a major credit problem like a foreclosure or bankruptcy. For example, you might have to wait three to seven years after a foreclosure to apply for an FHA or conventional loan, versus two years for a VA loan.

What Are Veterans Uniteds Benefits

Veterans United has been the nations Top VA Purchase Lender for five consecutive years. Mortgages backed by the U.S. Department of Veterans Affairs are among the most valuable benefits provided to active duty service members, Veterans and their families.

Check out our 250,000 unfiltered reviews to see for yourself.

Also Check: How To Get Pmi Off Fha Loan

You Can Borrow More Than Other Mortgage Programs With No Down Payment

Military borrowers searching for more expensive homes have an advantage over FHA and conventional borrowers: There are no VA loan limits. Conventional loan amounts are currently capped at $510,400 in most areas, while the majority of counties are limited to FHA loan amounts of $331,760.

VA buyers may also be able to buy a second home with no down payment, based on their VA home loan bonus entitlement. This allows military families to move from base to base and use their VA home loan benefits to buy a new home while theyre waiting to sell or rent their current home.

What Are The Eligibility Requirements For A Va Loan

There are a few different qualifications for a VA loan, but the main one is you must be a current or former member of the military or a surviving spouse of someone who served. Active duty members can qualify for a VA loan after 90 days. Conditions for former military personnel depend on the years you were on active duty; wartime veterans generally have shorter minimum service requirements. If youre unsure whether you qualify, you can refer to the VA home loan eligibility list.

While the VA does not publish official credit score guidelines and leaves these requirements up to each lender, the consensus among experts is that its easier to get approved for VA loans compared to a traditional mortgage. Credit score requirements can vary by lender and other factors, but the minimum score veterans need for a VA loan is often lower than conventional benchmarks, says Birk. VA loans also allow veterans to bounce back faster after derogatory credit events like a bankruptcy or foreclosure.

All things considered, VA home loan eligibility has remained relatively stable as mortgage availability plummeted in 2020 in response to the pandemic. Credit score minimums went up slightly, but they still remained a very flexible option for individuals who might not qualify for conventional loans, says Crooks, Jr. The VA also helped facilitate transactions in several ways, including allowing exterior-only appraisals and waiving termite inspections in moderate to heavy areas.

You May Like: Is It Worth It To Refinance Car Loan

Facts About Va Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with;no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Veterans Home Loans Provide Help With The Appraisal Process

VA appraisers are more flexible than the typical appraiser and will often work with buyers, sellers, and agents to ensure that the final valuation is accurate. This can be extremely helpful when the home is not reaching the price needed for purchase initially.

Without an appraisal value that meets the lenders appropriate value, you cannot get the loan. The appraiser will consider additional information after the initial appraisal, which helps streamline the purchasing process for everyone involved.

In a VA loan appraisal, the appraiser will notify the lender that the appraisal value is probably going to come in too low. When this happens, the lender can inform the buyer and agents of the issue and give them an opportunity typically 48 hours to submit more information about the home to increase the appraisal value.

There may be improvements, renovations, and upgrades made in recent years that the appraiser is not aware of. If the agent is prepared with all the information the appraiser may need, they can communicate that information in the 48 hour grace period so that the appraiser can make adjustments.

In other words, disputing a low home appraisal might not be as difficult to win when compared to conventional financing.

If things go right, you can still wind up living in the home you want and get the loan that you need.

Also Check: How To Stop Loan Payments