Properties Not Eligible For Fha

1. Homes With Encroachment IssuesIf the property has a garage, shed, utility easement, dwelling, or other type of physical structure that is owned by a neighbor or a third party, but breaches the property of the homeowner, then it is not eligible for an FHA loan.

2. Unfinished HomesThe home has to have or be able to obtain a certificate of occupancy, which is a certification by the county inspector saying the home is habitable. A habitable home has finished walls, covered floors , working faucets in the kitchen and bathrooms, flushing toilets, and hot water. No gaping holes in the roof or walls, or any other factor that makes the home uninhabitable, are permitted for FHA financing.

3. Investment & Rental PropertiesThe FHA only finances owner-occupied homes and vacation homes. If you currently have a rental unit on your property, theres a good chance it wont qualify for FHA financing.

Fha Minimum Credit Score: 500

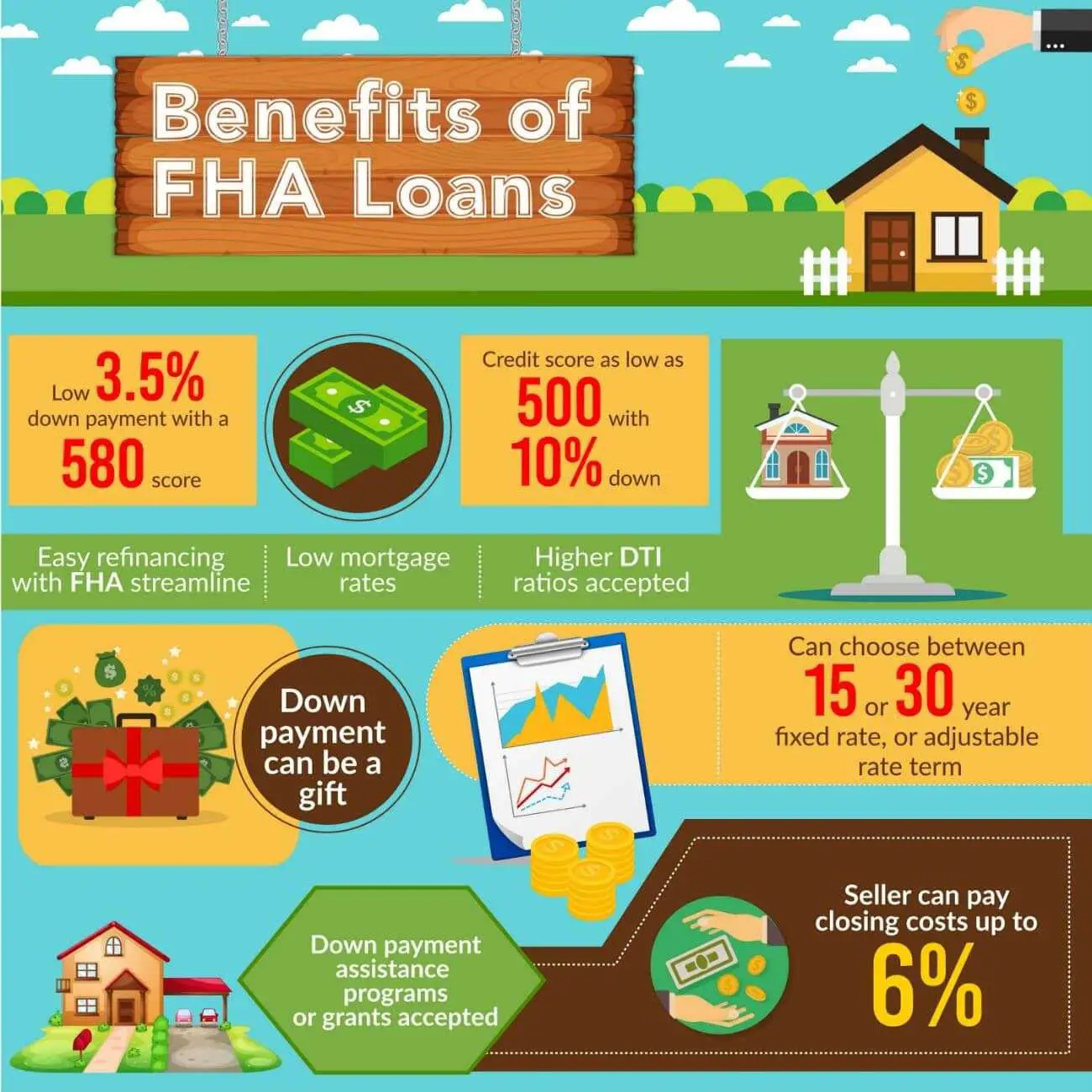

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, it’s important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans don’t come directly from the government; the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why it’s smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders’ rates and fees.

It’s worth noting that even with a lender who’s following FHA guidelines to the letter, you’ll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

Loan Providers Have To Stick To The Fhas Recommendations And Demands However To Be Eligible For A An Fha Loan You May Need:

Written by bette on Tuesday, September 21, 2021

Loan providers have to stick to the FHA’s recommendations and demands, however. To be eligible for a an FHA loan, you may need:

- Evidence of employment.

- A center credit rating of 580 with a 3.5% advance payment, or 500 by having a 10% advance payment.

- Generally speaking, your month-to-month debt re re payments cannot be a lot more than 43percent of the month-to-month income that is grossincome before taxes), or 31% after together with your home loan as well as other home-related expenses, such as for example property fees.

There are various other needs also. As an example, FHA loans have loan that is maximum, which differs dependent on where you are purchasing a property.

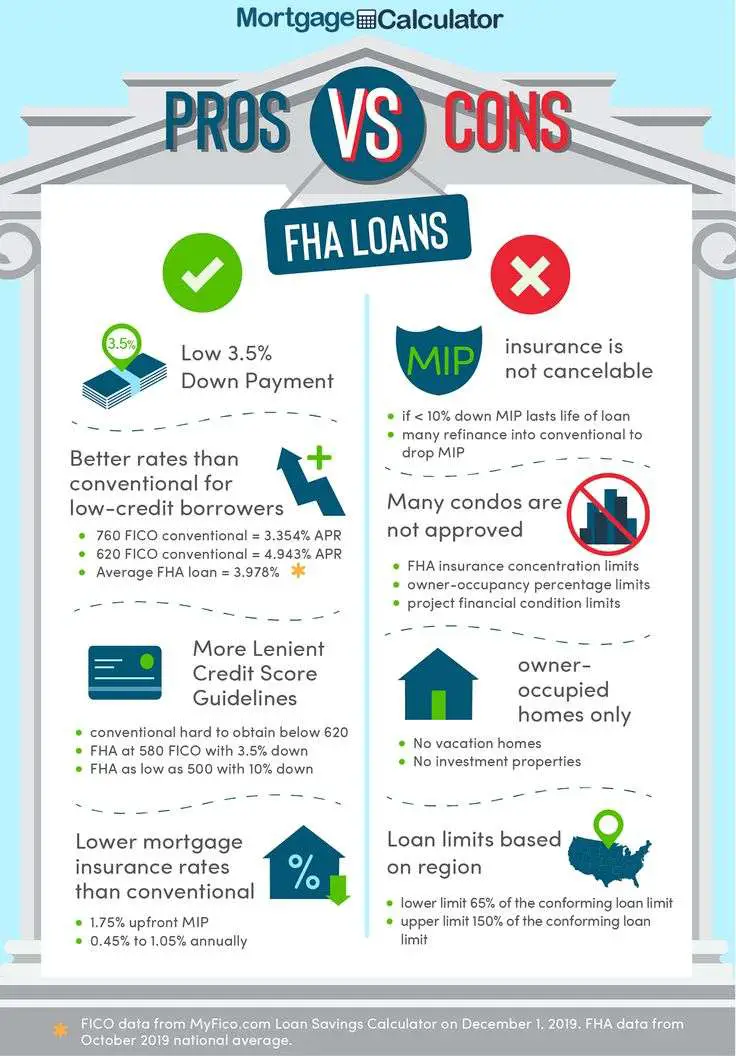

As a whole, FHA loans could be more costly than main-stream loans for purchasers with good credit or who are able to pay for at the very least a 10per cent advance payment. Nevertheless, the FHA path will be the better choice when you yourself have woeful credit or is only able to pay for a small payment that is down.

VA Loans

If you should be a site user, veteran or spouse that is surviving meet up with the eligibility needs, you might be eligible for the U.S. Department of Veteran Affairs mortgage loan system.

Needless to say, you will wish to compare the attention prices and monthly obligations on the loans to determine what choice most readily useful fits your allowance.

Don’t Miss: Is It Worth It To Refinance Car Loan

Types Of Fha 203 Loans And What They Cover

There are two primary types of FHA 203 loans: limited and standard. The FHA 203 loan you apply for will depend on your own unique needs.;

As a rule of thumb, if youre looking to make cosmetic fixes, a limited 203 loan will do the trick. Use a standard 203 loan for work thats more extensive and involved. But lets break the two types down a bit more.

Learn About Fha Closing Costs

Many first-time homebuyers are surprised that the down payment isnt the only thing theyre saving up for. There are some upfront costs required to close your mortgage, which can be significant, usually running between 2 and 5 percent of the total loan amount.

When shopping for a home loan, remember to compare prices for certain closing expenses, such as homeowners insurance, home inspections and title searches. In some cases, you may even be able to cut down on closing costs by asking the seller to pay for a portion of them or negotiating your real estate agent’s commission. Some of the common closing costs that go into an FHA mortgage include:

- Lender’s origination fee

Don’t Miss: How To Get Pmi Off Fha Loan

Refinancing With Fha Loans

Current homeowners can use the FHA to refinance their homes as long as the loan value does not exceed the FHA caps for their type of property. Since the interest rates on an FHA loan are generally lower than market rates, people who would like to refinance their homes can do so with FHA loans only if they reside in the home. The FHA will not refinance a home not occupied by the homeowner.

References

What Is An Fha 203 Rehab Loan

You get an FHA 203 rehab loan through a conventional lender, but its secured through a government loan program. The program lets borrowers renovate fixer-uppers without having to get separate mortgage and home improvement loans.

With an FHA 203 loan, the cost of repairs is baked into the mortgage. This means you can pay off the cost of your home improvements in small amounts over the life of your loan.

Because these loans are government-backed, lenders are often more flexible with lending terms. This gives first-time home buyers and buyers with low credit, no credit, high debt or a bankruptcy on their credit report a chance at securing financing.

And this is not a drill! Credit scores as low as 580 and down payments as low as 3.5% dont disqualify you.;

While thats welcome news for a lot of potential home buyers, getting an FHA 203 loan is no free-for-all. There are some rules.

Recommended Reading: Does Home Loan Include Furniture

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE:;Facts about FHA home loans

Income And Proof Of Employment

You will need to be able to verify your employment history to qualify for an FHA loan. You should be able to provide proof of income through pay stubs, W-2sand tax returns. There are technically no income limits, but you will need enough income to have an acceptable DTI ratio. Having a higher income will not disqualify you from receiving a loan.

Recommended Reading: How To Get An Aer Loan

Reach Your Home Dreams That Are Owning Big Lifestyle Mortgage Loan Group

Purchasing a house may be the quintessential United states dream; your own personal little bit of utopia, your own personal home to do as to what you want. No more signing leases, you can forget landlords, with no more throwing leasing re payments away on a monthly basis having a property enables you to build equity, securing the long run for you personally along with your family members.

Big lifetime mortgage Group focuses primarily on assisting first-time purchasers installment loans South Dakota and buyers with bad credit obtain affordable, competitive mortgage loans in Austin, Texas while the surrounding areas. Just take the step that is next attaining your property getting desires contact a part for the Big lifestyle mortgage Group team today and discover why we are ranked given that favored mortgage loan loan provider in the united states!

Save At Least A 35% Down Payment

The minimum required down payment for an FHA loan is 3.5%. In reality, youll need to save closer to 6% of the homes purchase price to account for closing costs- which include an upfront mortgage insurance premium equal to 1.75% of the homes value. You can reduce this premium to 1.25% by undergoing an FHA-approved credit counseling program prior to closing.

Recommended Reading: How To Get Car Loan When Self Employed

Fha Energy Efficient Mortgage

This program is a similar concept to the FHA 203 Improvement Loan program, but its aimed at upgrades that can lower your utility bills, such as new insulation or the installation of new solar or wind energy systems. The idea is that energy-efficient homes have lower operating costs, which lower bills and make more income available for mortgage payments.

How Much Can I Borrow

Use our FHA mortgage calculator to determine the highest monthly payment and the maximum loan amount you can qualify for. We can help you understand how a lender looks at your ability to make payments.

How much you can borrow depends on circumstances. The interest rate, for example, is determined in part by your credit history and FICO® scores. The better your FICO® scores are, the better the interest rates. Your current debts will also factor into things. Use our FHA Loan Calculator to learn more.

Also Check: How Much Can We Borrow Home Loan

Understand The Costs Of An Fha Loan

The drawback of an FHA loan is the mandatory private mortgage insurance . PMI is insurance you must pay as the borrower both upfront and monthly that protects the lender in the event you default. PMI is required for anybody who puts less than 20% down on a home. Learn more about the fees associated with FHA loans.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Check Credit Score For Home Loan

Fixing Up Your Current Home

Did you know that you could use the 203K program as your refinance program? Lets say you want to add a room to your home or you want to do some simple remodeling on the bathroom, you can take the money out with the FHA loan program.

If the improvements are less than $15,000, you can use the streamlined version. You wont need a loan consultant, but you will have to meet the value requirements. The appraiser will need to make sure that the changes you will make will improve the homes value enough that you borrow no more than 110% of the improved value.

The FHA 203K loan is available for almost any type of home that you could use the standard FHA loan on. The difference is that the appraiser has the final say depending on how the improvements will affect the homes value. Talking with a knowledgeable FHA lender will help you determine if the loan will work for what you intended.

Fha 203 Loan Requirements

Ready to take the plunge into homeownership with an FHA 203 loan? You need to meet these requirements to be eligible:

- Purchase the home as a primary residence and plan to occupy the property within 60 days of closing.

- Get your future home appraised by an FHA-approved appraiser who can provide inspection reports verifying that the property meets the FHAs minimum health and safety standards.

Don’t Miss: Is There Any Loan For Buying Land

How Many Homes Can I Buy With An Fha Loan

The FHA single family home loan program generally permit FHA loans only for owner-occupiers, so the short answer is just one in most cases. The rules for;

According to the FHA loan rulebook, To prevent circumvention of the restrictions on FHA insured mortgages to investors, FHA generally will not insure more than;

You will be able to use an FHA home loan more than once. If the previous FHA home loan is paid off, whether it is while you are occupying the home or you sell;

Know Your Credit Score

One of the biggest surprises that many first-time homebuyers face is a low credit score. This can happen for a lot of reasons. You may have forgotten to pay your credit card bill for a while. Maybe you never signed up for a credit card, which could mean you dont have an established credit history. Theres also the rare chance that you suffered from identity theft that drastically lowered your credit score.

Regardless of the reason, a low credit score can mean a larger down payment requirement or a higher interest rate for a homebuyer. Thats why its best to stay in the know, and monitor your FICO score so youre not faced with any unpleasant surprises. If youre concerned about your credit ranking, here are a few steps you can take:

- Review your credit report. If you know whats in it, you dont have to waste time and energy with guess work. Check to see if there are any errors, and if so, dispute them.

- Pay your bills with a credit card. Set up utility bill payments through a credit card account in your name to help establish credit.

- Pay on time! Missed or late payments can stay on your record for years, making lenders feel that granting you a mortgage could be a risk.

Also Check: Does Applying For Personal Loan Hurt Credit

Fha Loans : You Might Actually Be Able To Buy A House

Dec 21, 2017 The upsides, the catches, and how to decide if an FHA loan is right for as long as you have it, no matter how much equity you build up.

Frequently Asked Questions If you meet the credit score requirement but have negative information such as late payments or collection accounts, your loan;

The FHA limits the size of the loan you can obtain based on where youre purchasing and the type of property. In much of the country, the limit for a;

6 days ago Comparison shopping often leads to lower interest rates, so be sure to collect as much information as you can. You can use a loan estimate from;

Learn how long youll have to wait to get a FHA loan after a foreclosure or If you fit into this category and can show that filing for bankruptcy was;

Can I Have a Co-Borrower for an FHA Loan? Yes, the FHA allows a co-borrower or cosigner to also apply alongside you. How Long Does It Take for FHA Loan;

FHA loans can expand homeownership opportunities to those who might not all FHA mortgages to have MIP regardless of how much money the borrower puts;

An FHA Mortgage Loan can help you purchase the home youve always wanted. This government-insured loan often requires a lower down

You can buy and refinance homes with FHA loans. Low minimum down payments; Minimum credit score often 600; Mortgage insurance premiums required.

Fha Vs Conventional Loans

Unlike FHA loans, conventional loans are not insured by the government. Qualifying for a conventional mortgage requires a higher credit score, solid income and a down payment of at least 3 percent for certain loan programs. Heres a side-by-side comparison of the two types of loans.

FHA loans vs. conventional mortgages| Conventional loan |

|---|

Read Also: Can I Roll Closing Costs Into Loan

How To Decide If An Fha Loan Is The Right Choice

An FHA loan does offer significant benefits, but it’s not the right choice for every would-be homebuyer. An FHA loan could make sense for you if:

- Your credit needs improvement. Conventional mortgage loans usually require a , while FHA loans allow for lower credit scores. Even if you’ve had more significant credit problems, such as a bankruptcy, you could still qualify for an FHA loan.

- You don’t have much saved for a down payment. Since FHA loans allow you to put down as little as 3.5%, they’re an option for homebuyers who haven’t been able to set aside a significant sum.

- You need help with closing costs. Conventional mortgages require borrowers to pay hefty upfront costs in addition to the down payment, which can easily total in the thousands. To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time.

FHA loans have their advantages, but there’s a trade-off in the form of the mortgage insurance. Homebuyers who take out an FHA loan must pay an upfront premium that’s usually 1.75% of the base loan amount. There’s also an ongoing annual mortgage insurance premium that usually costs 0.45% to 1.05% of the loan amount. This annual premium lasts for the life of the loan unless you refinance later on or put down 10% or more, in which case it falls off after 11 years.