Comparing Fha Versus Conventional Loans Limitations

There are a few major takeaways when comparing conventional loans versus FHA loans uses and restrictions.

- Owner Occupation: Conventional loans do not require the borrower to live in the property. FHA mortgages do.

- Refinancing: Refinancing is available for both FHA and conventional loans. However, conventional loans refinancing is more detailed, requiring a credit check, home reappraisal, income verification and more.

- High-cost and low-cost areas affecting loan values: Both FHA and conventional mortgages have loan floors and ceilings, i.e., the minimum and maximum values you can receive. FHA loans are determined by the median home value in a county. Conventional loans vary by county, state and lender but will generally follow Fannie Mae and Freddy Mac protection standards.

- Debt-to-income ratios: The lower your debt-to-income ratio , the harder it will be to secure a conventional loan. Conventional loans typically accept DTIs in the 30-43 percent range FHA mortgages can go up to 50 percent.

Pros And Cons Of Conventional Loans

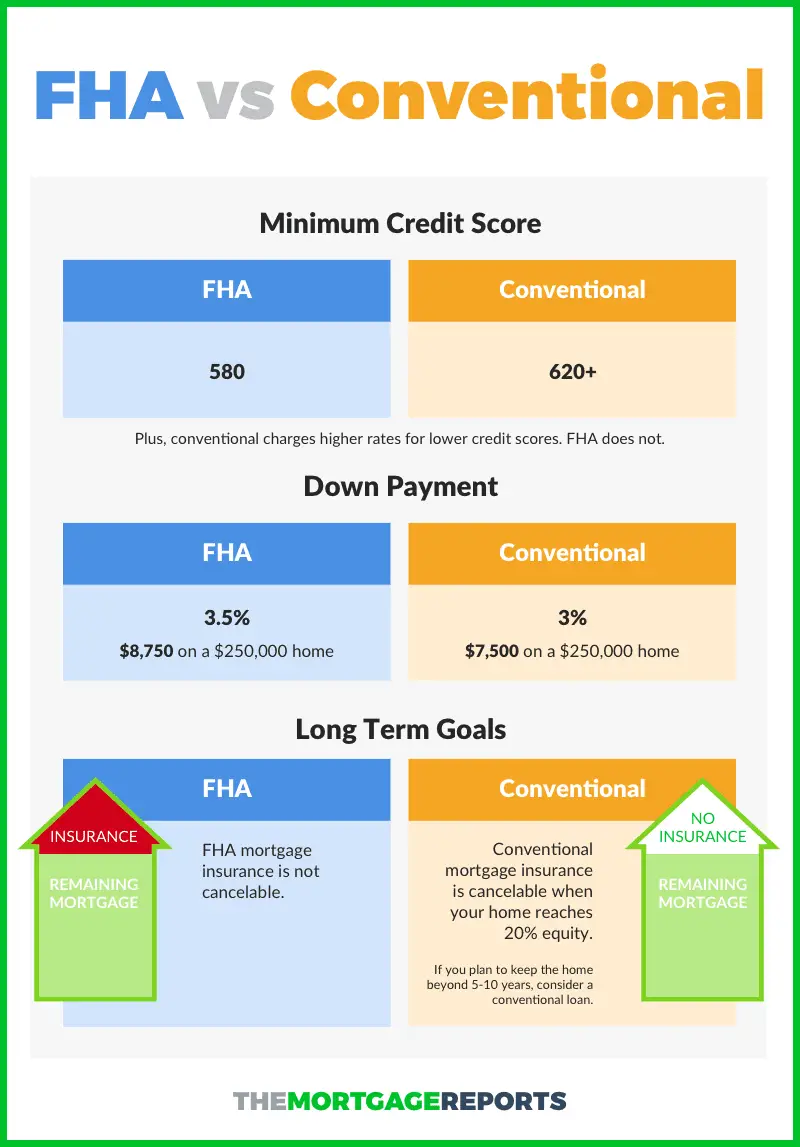

Conventional loans are not limited to purchasing a primary residence. For example, eligible borrowers can use the loan to buy a rental property or vacation home. Lenders of conventional mortgages typically only require borrowers to purchase mortgage insurance when they cant come up with a 20% down payment, but once a borrower pays down enough of the mortgages principal, insurance can be canceled.

Because conventional mortgages are not guaranteed by the government, they typically have stricter lending requirements, including a higher credit score and a lower debt-to-income ratio.

What Are Fha Loan Requirements

Every year, the Federal Housing Administration, along with a slew of assisting government agencies, publishes their 1,000-plus-page FHA loan handbook.

If federal loan manuals dont make your reading list cut, no problem. Weve summed up the top FHA loan requirements applicable to todays prospective home buyers:

Note: FHAs mandatory mortgage insurance requires borrowers to pay not one but two mortgage insurance premiums: Upfront premiums and annual premiums.

- Upfront mortgage insurance premium: Currently, upfront insurance premiums for FHA loans are a small percentage of the total loan amount. It is paid as soon as the borrower receives their loan.

- Annual mortgage insurance premium: Like upfront mortgage insurance premiums, annual mortgage insurance premiums are calculated based off of a small percentage of the total loan amount.However, variables like loan terms also influence rates. This premium is paid monthly, with installments calculated by taking the premium rate and dividing it by 12 months.

Recommended Reading: What Kind Of Loan For Land

Whats The Difference Between Fha And Conventional Loans

Home loans fall into two broad categories: government and conventional. A conventional loan is any mortgage that is not insured by a federal entity. Because private lenders assume all the risk in funding conventional loans, the requirements to qualify for these loans are more strict. Generally speaking, FHA loans might be a good fit if you have less money set aside to fund your down payment and/or you have a below-average credit score. While low down payment minimums and competitive interest rates are still possible with a conventional loan, youll need to show a strong credit score to qualify for those advantages.

Each loan type has advantages and disadvantagesincluding different mortgage insurance requirements, loan limits, and property appraisal guidelinesso choosing the one that works best for you really depends on your financial profile and your homebuying priorities.

Listing In The Dutch National Credit Register

If you take out a loan of 250 or more, youre assigned a positive credit listing. If you make your repayments as required, this listing wont have any consequences for your credit rating. If you fell behind on your payment obligations at any time during the past five years, youll be assigned a negative listing, which makes it more difficult for you to borrow money.

Recommended Reading: Drb Student Loan Review

Which Is Better: Conventional Fha Or Va

Consider your finances, needs, preferences and what you can qualify for when youre weighing the pros and cons between a conventional vs. FHA vs. VA loan. If you qualify, conventional mortgages generally pose fewer hurdles than FHA or VA mortgages, which might take longer to process.

Remember that conventional loans are usually better suited for borrowers with a higher credit score, while FHA and VA loans can be ideal for those with a lower score.

Like an FHA loan, a conventional loan requires mortgage insurance payments, but only if youre putting less than 20 percent down. Additionally, the payments can be removed when you hit a certain equity level. With an FHA loan, you cant remove MIP unless you refinance or pay off the mortgage. With a VA loan, there is no mortgage insurance requirement, but youll have to pay a funding fee based on the amount of the loan.

Its also important to note that refinancing an FHA or VA loan can be easier than refinancing a conventional mortgage. Both FHA and VA offer streamlined refinancing, which allows you to bypass some steps in the process, like submitting some financial documentation or waiting on an appraisal.

How Fha And Conventional Loans Are Different

Loan insurers

The first major difference is who insures the loan. FHA loans are insured by the Federal Housing Administration , meaning that the government will step in and reimburse the lender in the event a borrower defaults on the loan. Conventional loans have no such guarantee from the government.

As a result, qualifications for FHA loans tend to be more open than Conventional loans, because lenders know the government stands behind the loan. However, FHA loans tend to carry slightly higher mortgage insurance costs for the borrower. These insurance premiums help to ensure the government is able to continue to provide backing for the loans without drawing too heavily on taxpayer dollars.

Availability

The second differentiator has to do with what lenders are able to issue which types of loans. Most lenders are happy to issue Conventional loans, which are the most straightforward and are considered the safest type of loan from the lenders point of view. Not all lenders, however, offer FHA loans, which require a bit more due diligence and proven track record on the part of the lender. .

Property type

A major consideration when choosing between FHA and Conventional is whether or not the property youre buying is going to be your primary residence. FHA loans are only available for primary residence properties, whereas Conventional loans are available for secondary homes and investment properties .

Qualifications

Mortgage insurance

Read Also: Usaa Car Loan Requirements

When An Fha Loan Is Better

Federal Housing Authority loans are backed by the federal government. Because they are guaranteed, lenders can afford to take a risk with those who have bad or slow credit a credit score of 580 is the standard. The advantages of FHA Loans include lower down payment requirements of as little as 3% in addition to lower interest rates. Buyers can even borrow the down payment from a relative, which you cant do with a conventional loan.

On the downside, theres a cap on FHA loans that averages about $271,000 depending on your location. That means you may be priced out of certain neighborhoods. Youre also required to carry mortgage insurance for the first five years of the loan period, which might temporarily cancel out the lower payments and interest rate.

FHA loans are a great option for buyers with low incomes or bad credit.

So, which type of loan is better? In the end, it depends on your financial situation and how much risk you and the lender are willing to take. When youre ready for the next step, find out if you qualify for an FHA loan.

What Is An Fha Loan

An FHA loan is backed by the Federal Housing Administration and protects the lender if the borrower defaults. An FHA loan also:

- Requires a credit score of at least 500

- Requires mortgage insurance premiums , regardless of your credit score or down payment amount

- Helps people who otherwise wouldnt qualify for home financing

You May Like: Can I Use Va Loan For Investment Property

About The Fha 35% Down Payment Program

The Federal Housing Administration is not a lender. Rather, its a loan insurer. The federal agency was established in 1934 and exists to support homeownership within communities.

Promising affordable and stable financing, the FHA established a program by which it would insure U.S. lenders against losses on a loan and provide more favorable loan terms for U.S. borrowers.

More than 80 years later, the FHA continues to fulfill its role.

Todays FHA homeowners get access to loans of up to 30 years minimum down payment requirements are as low as 3.5% and, FHA mortgage rates routinely beat the market average often by a quarterpercentage point or more.

In order to get the FHAs backing, banks must only verify that loans meet minimum FHA lending standards, a collection of rules which are more commonly known as the FHA mortgage guidelines.

FHA mortgage guidelines state that eligible home buyers must have documented, verifiable income, for example and require home buyers to live in the home being purchased.

The FHA also requires home buyers to pay mortgage insurance premiums as part of their monthly payments.

FHA MIP varies by loan type and downpayment, with the most common scenario being a home buyer using a 30year fixed rate FHA loan with the minimum allowable 3.5% downpayment and paying 0.85 percent against the borrowed amount in mortgage insurance premiums annually, or $71 per month per $100,000 borrowed.

Conventional Loans Vs Fha Faqs

Which is a better loan: FHA loan or conventional?

It depends on your homebuying goals and financial situation. Homebuyers with high credit scores may benefit from a conventional loan because they may receive low rates and non-permanent mortgage insurance.FHA loans can be great options for borrowers who have the income to afford a home but have lower credit scores or a high DTI. An FHA loan can provide an affordable path to homeownership even for folks whose credit has taken a hit in the past.

Whats the difference between an FHA Loan and a conventional loan?

FHA loans are backed by the federal government, which means they can offer more flexibility in borrower qualifications. It can be easier to qualify for an FHA loan because the minimum credit score requirement is 580 to buy with a 3.5% down payment. FHA lenders can also sometimes approve borrowers with debt-to-income ratios above 50%.Conventional loans are insured not by the federal government, but by the government-sponsored enterprises Fannie Mae and Freddie Mac. The minimum credit score requirement is 620.

Why do sellers prefer conventional over FHA?

Recommended Reading: Can You Refinance Fha Loan

Conventional Loans And Mortgage Insurance

Private mortgage insurance is a type of mortgage insurance unique to conventional loans. Like mortgage insurance premiums do for FHA loans, PMI protects the lender if the borrower defaults on the loan

Youll have to pay PMI as part of your mortgage payment if your down payment was less than 20% of the homes value. However, you can request to remove PMI when you have 20% equity in the home. Once youve reached 22% home equity, PMI is often removed from your mortgage payment automatically.

Unlike mortgage insurance for FHA loans, PMI offers different payment options. Borrower-paid PMI, or BPMI, does not require an upfront cost. Depending on the lender, you can request to have it canceled once youve reached 20% equity in your home. In most cases, its automatically removed once you reach 22% equity.

Lender-paid PMI, or LPMI, is paid for you by your lender. The lender will raise your mortgage interest rate to incorporate the insurance payment they make on your behalf. This option may result in lower payments, but its typically not cheaper over the life of the loan. LPMI cant be canceled because its built into your interest rate.

When Is An Fha Loan The Right Choice

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”>

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”> At first glance, the Conventional 97 loan seems like the clear winner for borrowers with sparse cash to spare. But thats only when all things are equal.

Once you introduce a lower credit score, all of the variables start to change. Heres why: The lower your credit score, the higher your interest rate is likely to be for a conventional loan. Once your credit score falls below 620, you no longer qualify for the Conventional 97 loan.

Private mortgage insurance generally costs more than FHA mortgage insurance payments for borrowers with credit scores under 720.

All of this means that if your credit has been negatively impacted, the FHA loan may not only be your better option from the standpoint of your interest rate, it may also be the only one of the two options for which you are eligible.

Don’t Miss: How Long Does Sba Loan Take To Process

Understanding Fha Loan Mortgage Insurance

FHA borrowers have to pay two types of FHA mortgage insurance to protect FHA-approved lenders from the financial risk of defaults. The first is an upfront mortgage insurance premium of 1.75% of your loan amount, which is charged at closing and typically added to your mortgage balance.

The second is an ongoing annual mortgage insurance premium that ranges from 0.45% to 1.05%, depending on your down payment and loan term. Its charged annually, divided by 12 and then added to your monthly payment. Heres an example of how much FHA mortgage insurance youd pay on a $300,000 loan amount assuming you make a 3.5% with an annual MIP charge of 0.85%.

FHA UFMIP calculation:

- Convert 1.75% to the decimal

- Multiply by the loan amount: 0.0175% x $300,000 = $5,250 FHA UFMIP premium added to your loan amount

- Convert 0.85% to a decimal

- Multiply by the loan amount 0.0085% x $300,000 = $2,550

- $2,550 divided by 12 = $212.50 monthly MIP charge added to your monthly payment

There are some important differences between FHA mortgage insurance and conventional private mortgage insurance :

Youll typically pay FHA MIP for the life of your loan. This is true if you make a minimum FHA 3.5% down payment. However, if you can make at least a 10% down payment, MIP drops off after 11 years. You can get rid of conventional PMI once you can prove you have 20% equity.

Who Should Not Get An Fha Loan

Borrowers turned off by the loan limit may find FHA mortgages too restrictive.

Likewise, most lenders recommend your monthly mortgage payments should not exceed 31 percent of your gross monthly income. Some private lenders offering FHA loans may allow up to 40 percent. If either of those rates proves to siphon too much of your monthly income, an FHA loan still may not be right for you.

Don’t Miss: How Long Does It Take Sba To Approve Ppp

Fha Vs Conventional Loan: These Charts Can Help You Determine Which Is Cheaper

Its time for another edition of mortgage match-ups: FHA vs. conventional loan.

Our latest bout pits FHA loans against conventional loans, both of which are extremely popular loan options for home buyers these days.

In short, conventional loans are non-government mortgages, typically backed by Fannie Mae or Freddie Mac.

Whereas FHA loans are government-backed mortgages that are insured by the Federal Housing Administration .

Both can be a good choice depending on your credit profile and homeownership goals, but there are key differences.

Lets discuss the pros and cons of both loan programs to determine if and when one might be the better choice.

Fha Loans: What You Need To Know In 2021

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

The Federal Housing Administration backs home loans with flexible borrowing guidelines for homebuyers who might not qualify for conventional loans with more stringent requirements. FHA loans are popular with first-time buyers who may have little savings and credit issues, and the government backing allows many lenders to offer lower average rates than conventional mortgages.

You May Like: Apply For Capital One Auto Loan

How Do Fha Loans Work

FHA loans essentially work the same as other home loan programs. Youll need to qualify based on your income, credit history, employment history and verify you have or can get a gift for the down payment and closing costs.

However, the flexibility of FHA loans may work best if:

- Your credit score is between 500 and 619.

- Your total debt-to-income ratio is higher than the 50% conventional DTI ratio maximum.

- You need a loan amount at or below the current FHA loan limit in the county youre buying in.

- You want to buy and live in a two-to-four unit, multifamily home with a 3.5% down payment, and use rental income to help you qualify.

- You want to buy a fixer-upper home with a 3.5% down payment and roll the renovation costs into your loan amount.

- You need to qualify for a mortgage with the income of a co-borrower who wont live in the home.

- Youve had a bankruptcy in the past two or more years.

- Youve had a foreclosure in the past three or more years.

- You cant qualify for a conventional loan.

Summary Fha Vs Conventional Loan

The difference between an FHA vs conventional loan is fairly significant and every home buyer must make his or her own educated decision on which option is best for you. You may want to qualify for one of these program but will find that your credit score, or your down payment is not optimal. This is why your first step should be to discuss your personal scenario with a lender far in advance.

Having a discussion with a lender early will allow you some time to repair your credit or to make other preparations to help you to either qualify or to get a better interest rate. We suggest speaking to one of our national FHA lenders who can answer your questions about FHA vs conventional loans and provide rate quotes regardless as to which program you are interested in.

You May Like: Capital One Preapproved Auto Financing